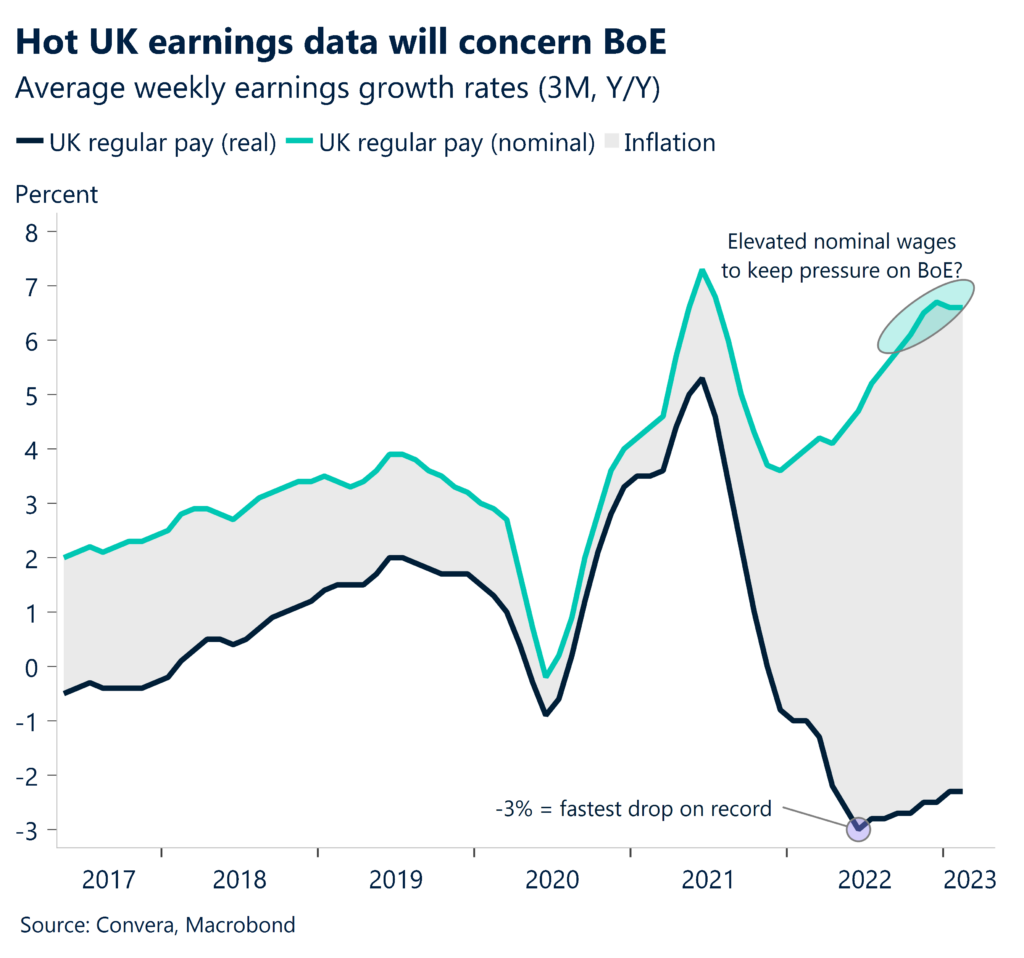

UK wage growth adds to inflation woes

The UK labour market report was published this morning and despite a slight uptick in the unemployment rate, wage growth accelerated unexpectedly, which adds to inflationary pressures and raises the odds of another Bank of England (BoE) rate hike next month. The pound has reacted positively as a result, rising across the board and hitting a new 4-month high against the Japanese yen.

Average earnings including bonuses in the UK, rose 5.9% y/y in the three months to February, above market forecasts of 5.1%, whilst earnings excluding bonuses rose 6.6%, higher than the expected slowdown to 6.2%. With inflation still above 10%, total pay (adjusted for inflation, fell 3% – the biggest drop since 2009. The BoE was expecting wage growth to cool and ease inflation, which remains five times its 2% target, so these figures will feed into the debate about whether the central bank can pause its quickest series of rate rises in three decades. There were some signs of labour market tightness easing though, the unemployment rate rose to 3.8% from 3.7% and vacancies fell for a ninth month straight, though remained historically high at 1.1 million. Amid the ongoing cost-of-living crisis and subsequent strikes in the public sector, there were 348,000 working days lost because of labour disputes in February, meaning more than 3 million days have been lost since June.

For the pound, it’s the hot earnings data that has given a boost to hawks advocating more BoE rate hikes. GBP/USD is back above $1.24 after a corrective slump from 10-month highs last week and GBP/EUR is back above €1.13 after suffering its biggest weekly decline since early February last week. The latest UK inflation readings will be released early tomorrow, which could further sway market pricing and the BoE’s decision.

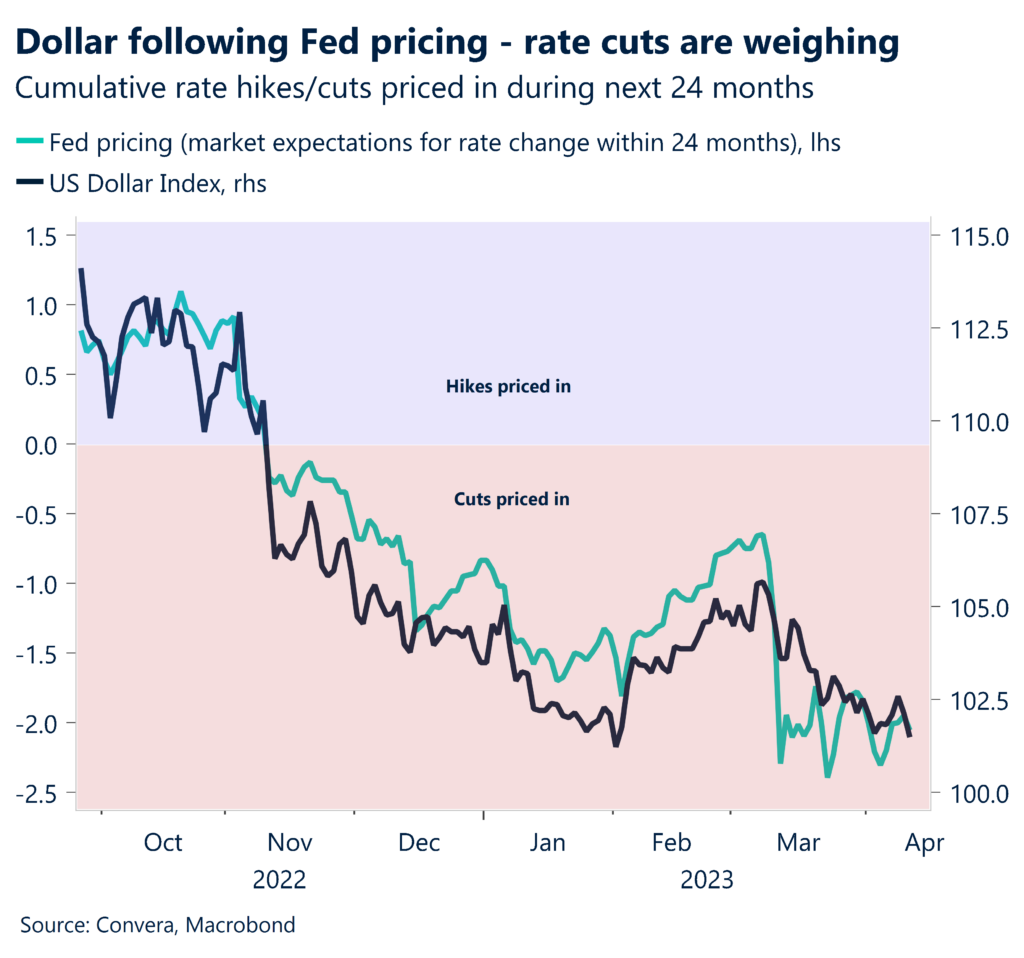

Dollar stalls as China’s economy rebounds

The tepid rebound of the US dollar came to halt on Tuesday following better-than-expected data from China. The market mood has improved somewhat as the world’s second largest economy advanced 4.5% y/y in the first quarter of 2023, the strongest pace of expansion in a year and topping estimates of 4%.

The lifting of Covid-19 restrictions by China is finally starting to positively filter through to the real economy, led by a surge in consumer spending and a rebound in factory output. Retail sales growth was at a near 2-year high in March and industrial output rose the most in 5 months. Meanwhile, market participants remain cautious ahead of the US Federal Reserve’s (Fed) next policy decision in May. Money markets are pricing a 90% probability of a hike but are also pricing three 25 basis points of rate cuts in the second half of 2023, though the Fed continues to rule out this possibility. If the markets are wrong, a revaluation of the dollar should be expected. The US dollar index, which measures the USD against a basket of currencies, has rebounded off 1-year lows, but remains caught in descending trend channel for now. The US currency will remain sensitive to economic data and its influence on the monetary outlook.

Interestingly, volatility in equity markets has never been so low since January 2022, despite a risk of recession in the US, recent tumults observed in the banking sector and intensifying geopolitical tensions between China and the US around Taiwan. As well as the Fed possibly defying market rate cut expectations, a resurgence in equity volatility would likely be another catalyst for safe haven dollar strength over the months to come.

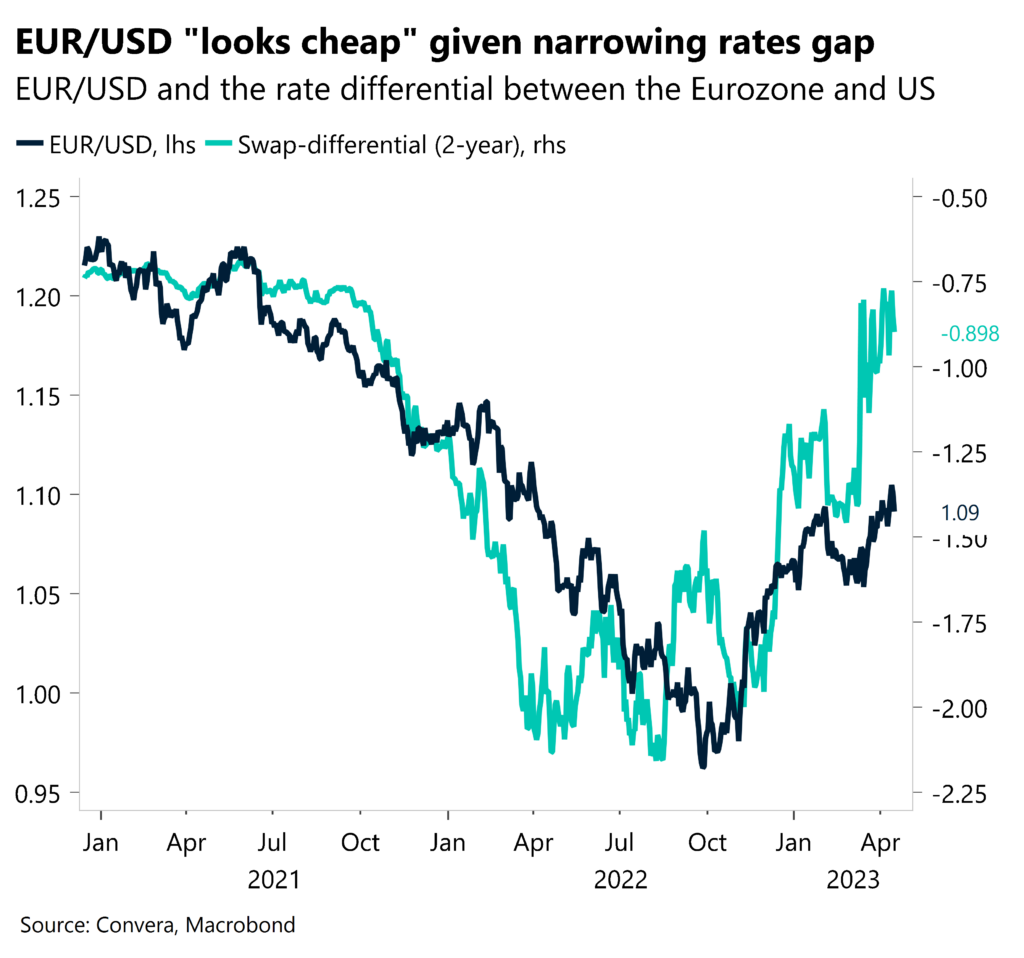

Rate differentials key for euro

As the most traded currency pair in the world, EUR/USD is influenced by a multitude of factors such as economic (macro developments), geopolitical (war in Ukraine & energy tensions in Europe) and systemic (turmoil in US banks). Nevertheless, the main current driver of the exchange rate is monetary policy, and more particularly the rate differential, or at least rate expectations, between the US and the Eurozone.

In the past, a rate differential to the advantage of the US, and therefore the dollar, has often explained the significant downward movements of EUR/USD (as in 2014/2015 or 2021/2022). Now, it appears to be benefiting the euro. Since March and the collapse of two American banks, and amid the marked slowdown in inflation in the US relative to the Eurozone, money markets have been aggressively speculating on rate cuts in the US. On the contrary, in the Eurozone, the normalisation cycle is expected to continue for longer and rates are not expected to be cut before 2024. This dynamic differential is reflected in the evolution of the 2-year Germany/US spread, which has been gaining traction for several months, recently reaching a 17-month high.

The observation of short rate spreads is a good barometer to track the direction of the EUR/USD over the medium to long term, but today’s German ZEW survey could inject some short-term volatility. The euro recently reclaimed the $1.10 versus the dollar and has risen more than 15% since it slumped below parity at the end of summer 2022. If the monetary path differential is confirmed, then there is good reason to believe that the currency pair could push higher through 2023.

GBP/JPY hits 4-month high

Table: 7-day currency trends and trading ranges

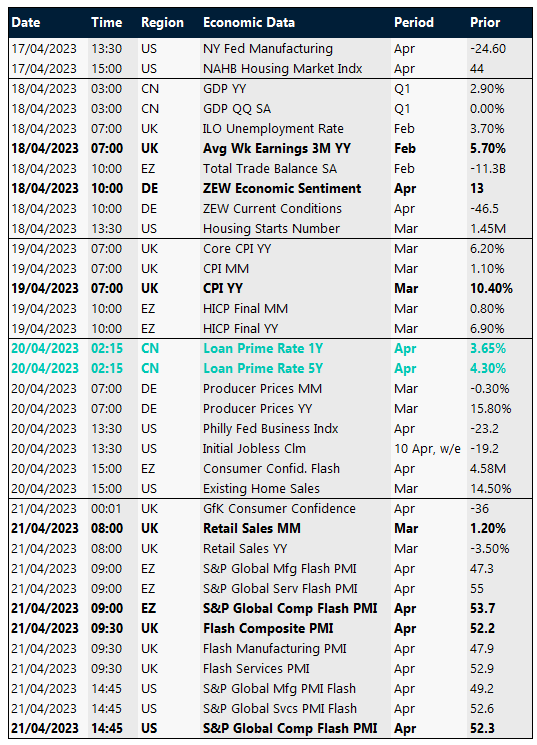

Key global risk events

Calendar: Apr 17-21

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.