Written by Convera’s Market Insights team

Geopolitics returns to the fore

George Vessey – Lead FX Strategist

Renewed tensions involving Russia and the US reignited volatility from risk assets to safe havens yesterday. Treasury bonds, gold, the US dollar, Swiss franc and Japanese yen all advanced whilst the Polish zloty was worst hit due to its close proximity to the conflict. Equities stumbled and the VIX index, a barometer for market uncertainty, staged its second biggest daily advance in two months, though still below its historical average of 19.5.

Geopolitics has returned to the fore after updates to Russia’s nuclear doctrine were followed up by news of a Ukrainian missile strike inside Russian territory. Russia has suggested the use of Western non-nuclear missiles by Ukraine against Russia may cause a nuclear response. Despite risk-off sentiment, the limited reaction in oil prices implies moves elsewhere in financial markets may be overdone and could unwind. The yen, for example, often a sought after safe haven in times of heightened geopolitical risks, was the best-performing G10 currency on Tuesday, but with deeply negative real rates and the carry trade yielding strong returns for dollar-yen investors, the bearish narrative remains intact and USD/JPY has indeed rebounded this morning.

Yen strength seems to depend more on either faster Bank of Japan rate hikes or a sharp US economic downturn. Options traders have turned more positive on the yen though with one-month risk reversals now in favour of puts and at a level last seen in mid-September – an indication that traders are becoming more bullish on the yen before end-2024.

Traders trim BoE rate cut bets

George Vessey – Lead FX Strategist

Sterling has spiked back above $1.27 versus the US dollar and €1.20 versus the euro this morning following higher-than-expected UK inflation data. This heaps the pressure on the Bank of England (BoE) to delay further interest rate cuts until next year, providing the pound a bigger yield appeal.

Annual headline CPI rose to 2.3% in October versus a forecast of 2.2% and 1.7% in September, pushed higher from housing and household services, particularly electricity and gas prices increasing. This was expected given the 10% increase in the UK’s energy price cap for households in October. Still, it was the largest monthly increase in headline inflation since October 2022. Core inflation also rose more than expected to 3.3%, whist services inflation nudged back to 5%, although this was still in line with the BoE’s forecasts. Policymakers at the Bank have cut interest rates twice to 4.75%, but a further reduction at a meeting in December is likely to be put off until at least February. Indeed, investors have trimmed rate cutting bets slightly as a result. The next 25 basis-point cut to be fully priced in is in March, with around 59 points of easing priced through to the end of 2025 versus almost 67 as of yesterday’s close.

It could be argued that risks to sterling lean asymmetrically to the downside given stretched speculative bullish positioning. However, today’s inflation figures could see the pound’s move higher gather pace in the short term.

Euro’s rebound likely fleeting

George Vessey – Lead FX Strategist

Despite the euro’s much needed respite from selling pressure, there lacks a compelling case for EUR/USD to correct much higher. The weak Euro-area economic backdrop, political uncertainties, trade tariff risks and rate differentials are all pointing to sustained euro weakness in the medium term.

EUR/USD has dropped over 3% since Trump was re-elected and over 6% since the end of September. The $1.05 handle remains a key psychological barrier for now, offering firm support, and it’s doubtful whether markets can front-run the full effects of a second Trump presidency without concrete policy steps from the new administration. Nevertheless, this suggests room for further dollar upside potential well into the new year. Two-year rate differentials between Europe and the US are around 210 basis points, but a chunk of this is down to US economic outperformance triggering a hawkish repricing of the Fed, whilst weak data from Europe has led to a more dovish ECB. Back in 2018, when the trade war dominated, the rate differential reached 350 basis points and EUR/USD fell 15% from peak to trough during Trump’s first term.

Given the plethora of reasons aforementioned, particularly trade tariffs risks, we see the risk for rate divergence to extend and therefore EUR/USD to continue trending lower. Stimulus out of China could support the euro if it is effective enough; however, policy announcements so far have been disappointing.

Pound springs back after UK inflation

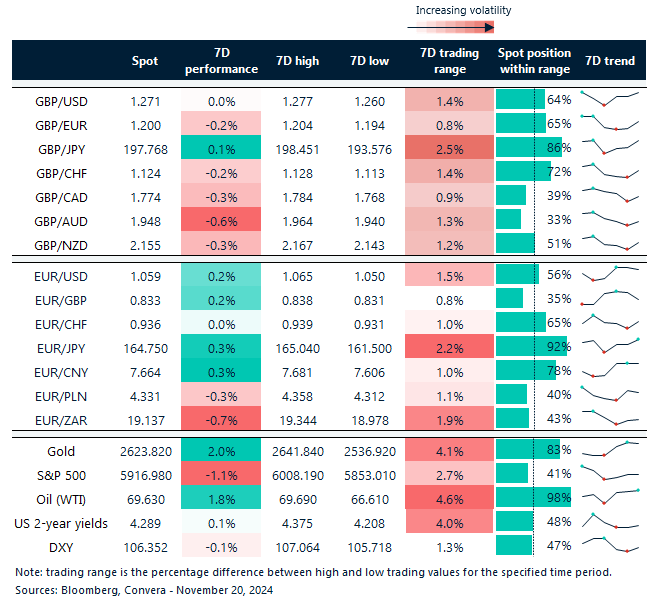

Table: 7-day currency trends and trading ranges

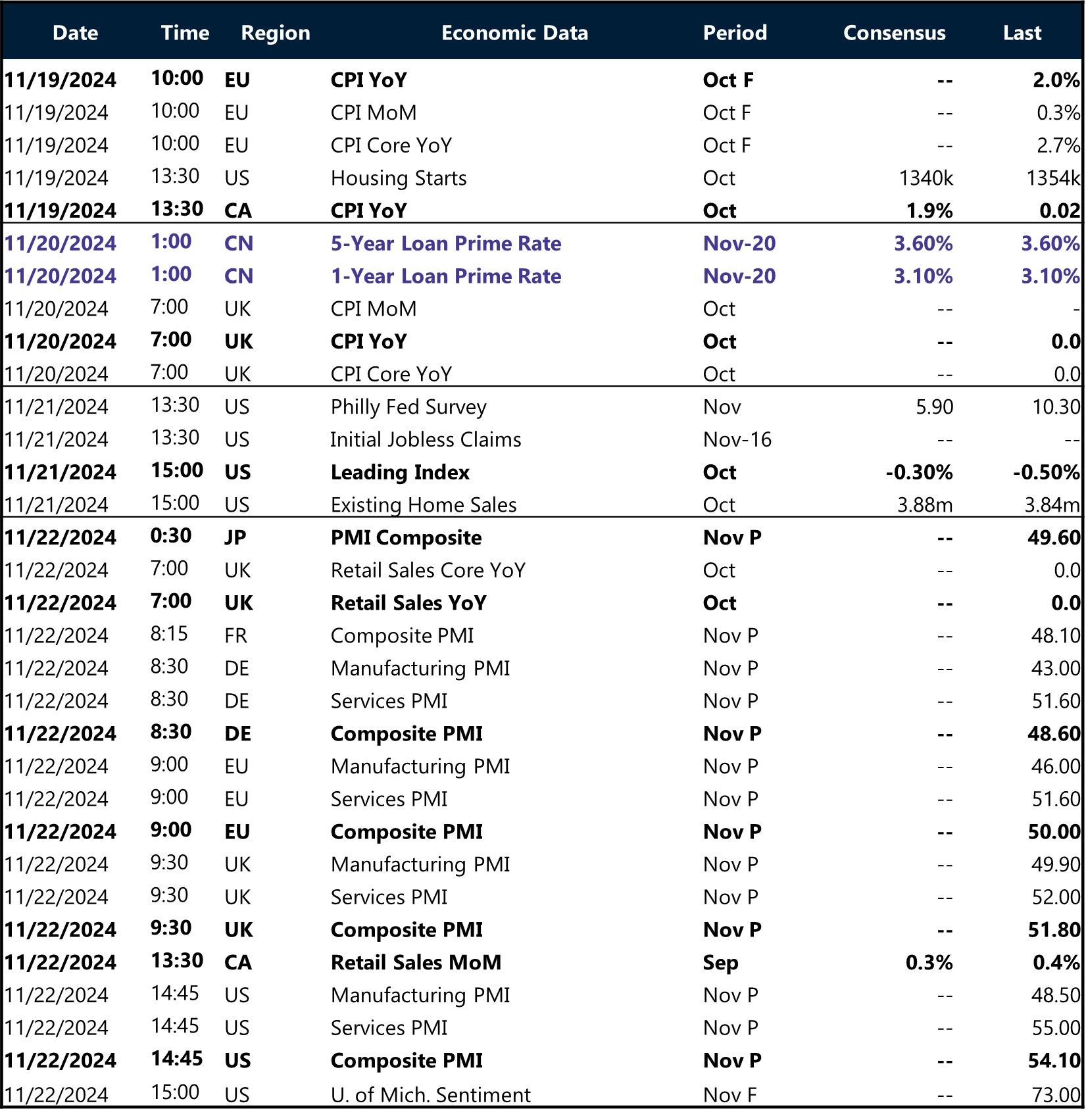

Key global risk events

Calendar: November 18-22

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.