Markets cheer slower US inflation

The annual inflation rate in the United States fell sharply to 3% in June, continuing the disinflationary trend that started at the end of last year. Consumer price growth slowed for a 12th month in a row, falling to the lowest level since March 2021. The slowdown in core (4.8%) and services (5.7%) inflation confirms the overall improving picture, that should ease the pressure on the Fed to hike beyond or even in Q3.

All the sticky components within the CPI basket came in weaker than economists had expected with inflation of services excluding shelter falling from 5.1% to just 3.2%. The share of items rising at or below the important 2% level on a 3-month annualised rate rose to 54%, the highest share since November 2020. It will be important for US inflation to continue its below-consensus streak in July, given the fading base effects after summer. Fortunately, the regional Fed’s PMI price sub-components, which have historically been strong leading indicators for overall price growth, point to a fall of headline CPI to the mid 2% handle range next month. We’re interested to see the updates to these price indices coming up in the next 2-3 weeks.

Markets reacted strongly to the below-consensus CPI print with a sharp risk-on rally following the release. US equities advanced to a new yearly high, with the S&P500 (4470) reaching its highest level since March 2022. Two-year yields, which started falling in anticipation of a slowdown of inflation on Friday, continued their descent to the sub 4.75% level with the US dollar index recording a new 15-month low.

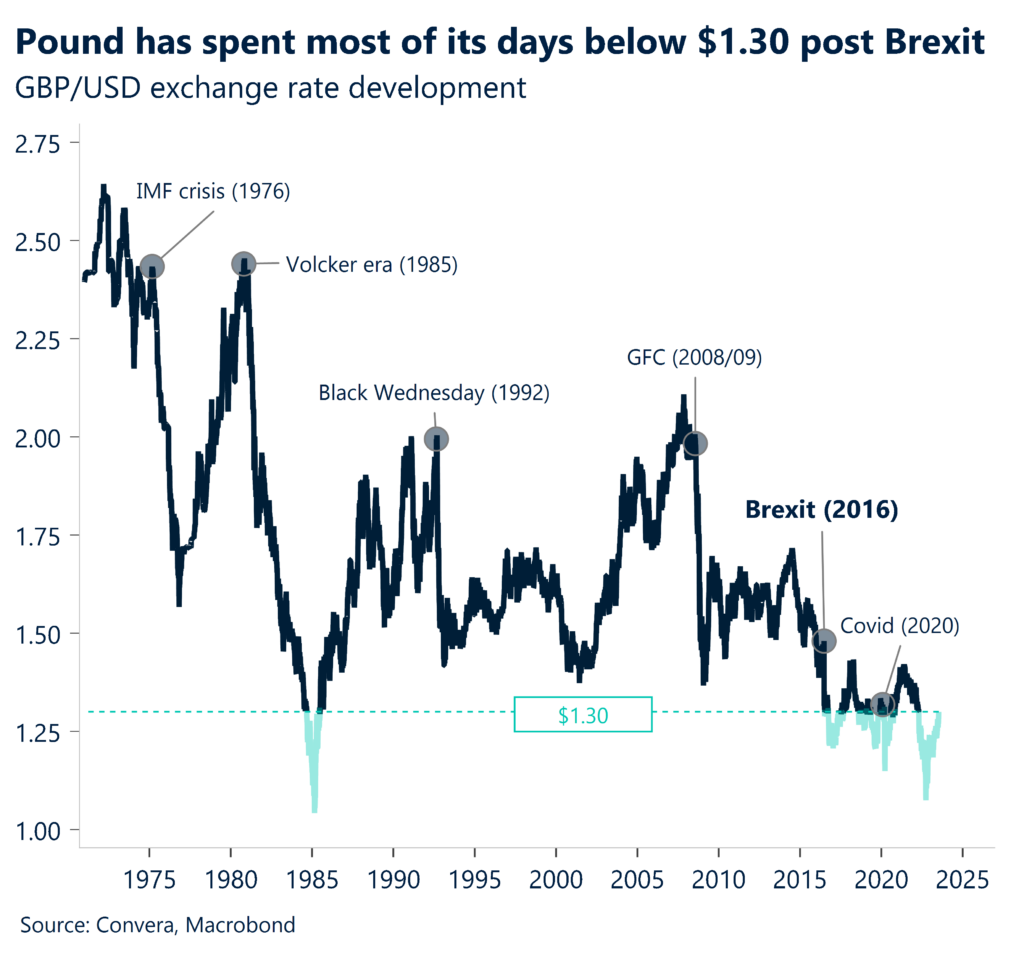

GBP/USD finally ends longest stint below $1.30

As we warned earlier this week, a softer US inflation report could allow GBP/USD to end its longest ever period below $1.30. Indeed, the currency pair changed hands at this milestone for the first time since April 2022. Sterling nursed some heavy losses elsewhere though due to improving risk sentiment, such as 2% declines against both the SEK and NOK and around 1% declines versus AUD, NZD JPY and CHF.

This morning, UK GDP data revealed the British economy contracted 0.1% m/m in May compared to market forecasts of a bigger 0.3% decline. All the measures on services, manufacturing and construction output were slightly better than anticipated. Despite this optimism, UK GDP has shown no growth in the three months to May. The pound remains between some contrasting undercurrents. On the one hand, the pound’s outperformance is owed to troublesome inflation developments in the UK economy and the interest rate market response to them, providing UK assets with an attractive yield appeal over its developed peers in the G10. However, investors remain wary of the longer-term economic drag and increasing risks to financial stability from rate hikes, which will take time to fully materialise. Moreover, GBP/USD seems to display negative seasonality with most of its average yearly deprecation of 4% (since 2014) occurring after the second quarter.

For now, sterling remains the top performing G10 currency year-to-date and is currently averaging an over 9% gain against 57 currencies globally. Technical studies, however, reveal the pound is overbought against the US dollar at this point with the daily Relative Strength Indicator (RSI) above 70. GBP/USD will need to either enter a phase of consolidation at the current levels or retreat in the short-term.

Euro surges beyond $1.11

The US dollar has taken a beating across the board on the weaker inflation print and hopes that the Fed will be done hiking rates after the July meeting. EUR/USD has risen by 16% since finding a 20-year low in early October last year. The first leg of the rally was backed by improving European fundamentals and the energy crisis not materialising. However, the recent period of euro strength beginning in June (+4.6%) has been mostly a function of a hawkish ECB and prospects of weaker inflation and therefore lower rates in the United States. These expectations finally culminated in EUR/USD reaching a 15-month high at $1.1140 following the disappointing CPI print.

And all of this has been happening against a weak European economic backdrop. According to the German Economic Institute (IW), two third of the 2000 companies surveyed in June expect weaker business activity this year compared to 2022 with around a third expecting production to deteriorate. German industrial production unexpectedly declined in May, falling by 0.2% on the month. The manufacturing PMI meanwhile continued its descent in June, indicating the sharpest pace of deterioration since the pandemic. However, the euro has somewhat decoupled from economic data, as is shown from today’s lackluster reaction of the common currency to the weaker export numbers (-16% y/y) out of China this morning.

Today’s focus lies on Eurozone industrial production, coming up shortly. A breach of the important $1.1140 level would put $1.1170 into play with $1.12 closely following that. However, with speculative investors already positioning long on EUR/USD, today’s price action will mostly depend on US producer prices, which will confirm or refute yesterday’s CPI print.

Dollar dumped after softer inflation

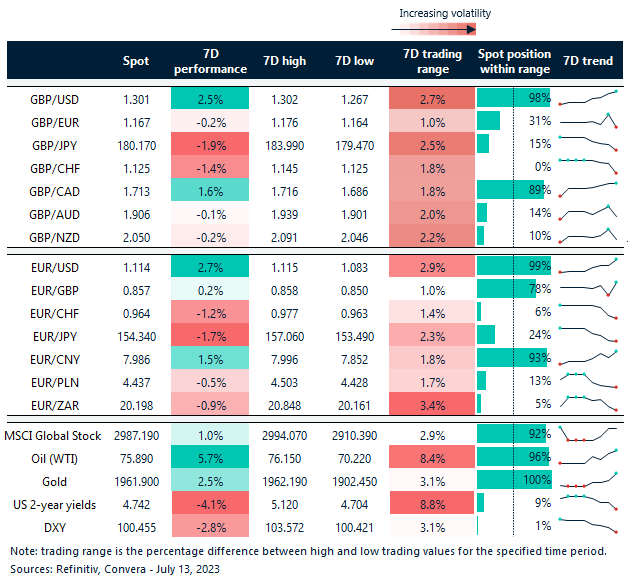

Table: 7-day currency trends and trading ranges

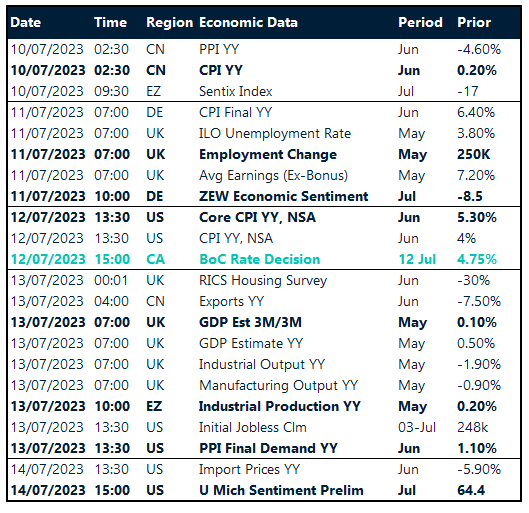

Key global risk events

Calendar: July 10-14

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.