Written by Convera’s Market Insights team

Tariff risks rise on Trump’s return

George Vessey – Lead FX Strategist

The so-called Trump trade was in full swing yesterday, reverberating through financial markets, as the former president clinched a second White House term. Equities rose to all-time highs – the Dow Jones notched its biggest daily jump in more than 100 years and the S&P500 is poised for the best election-year return in nine decades. Bond yields surged on worries of a swelling budget deficit and rebound in inflation, with the 30-year yield clocking its biggest daily jump since 2020.

In the FX space, the US dollar soared while the Mexican peso, Chinese yuan, Japanese yen and euro all suffered. The prospect of higher tariffs could exacerbate these moves in a further boost to the buck. As such, the world is preparing for what may become the most consequential wave of tariff hikes since at least the 1930s. Trump has pledged to impose a broad levy on all products entering the US from overseas. This would not only be trade-negative but also highly troublesome to the structure of the global economy. An increase in tariffs is likely to be dollar positive via the risk-sentiment and trade slowdown channel. If it turns out to be significantly inflationary and impacts the Fed’s bias to ease policy, it would additionally be dollar-beneficial via the monetary policy channel. Assuming Trump delivers targeted and large-scale tariffs against Europe and China, economic theory predicts that the dollar should further appreciate mid-single to low double digits to partially offset the shift in relative prices.

A key outstanding question for markets is whether Republicans end up gaining control of the House in addition to the Senate, and the White House. This so-called Red Sweep scenario is expected to further boost the reflation trade and thus yields and the dollar, but markets won’t know for sure for a few more days. In the meantime, attention shifts swiftly to the Fed’s decision today, where a 25-basis point rate cut is baked into markets.

Sterling shows resilience as BoE looms

George Vessey – Lead FX Strategist

The shift in relative interest rate expectations in favour of the US is one of the transmission mechanisms hurting G10 FX, including the pound. Aggravating this narrative is the fact traders are starting to bet on greater loosening from the Bank of England (BoE), starting today with an expected 25-basis point rate cut. GBP/USD is on track for a sixth weekly decline in a row, but short-term support is seen at the 200-day moving average nearer $1.28.

Sterling has been at the mercy of the dollar’s onslaught, but hasn’t absorbed as much of the dollar’s strength compared to the euro, yen or swissy. Perhaps given the implications of the UK government’s decision to boost spending and borrowing, there is still doubt around the pace of the BoE’s easing cycle. The UK central bank may indicate that it has less headroom to cut rates than before the budget, providing the pound a cushion. Short-term yields are at their highest in five months, capping sterling’s post-election losses. Plus, the shift in real-yield differentials, given the sharp fall in UK inflation recently, should also provide a buffer.

The bottom line today is if the BoE’s new economic forecasts, especially on inflation, prove to be surprisingly hawkish, sterling may find some extra support as traders recalibrate the BoE’s policy trajectory. This could offset a chunk of the losses endured against the dollar, but also allow GBP/EUR to extend to fresh 2-year highs. Nevertheless, despite the sharp retracement in implied volatility now the election uncertainty has faded, FX options traders still see risks skewed to the downside for GBP/USD as evidenced by the 3-month risk reversal lingering near its 10-year average, favouring puts over calls. In other words, the cost to protect against a further drop in the currency pair is greater than the cost to protect against a rise.

Euro’s woes compounded by German political risk

George Vessey – Lead FX Strategist

In the wake of the US election result, the euro slumped 1.8% on Thursday to near $1.07, its biggest drop since March 2020. It was heading for its worst day since October 2016 approaching a six-standard-deviation shift from its daily mean. This was a big warning signal from the spot market around Trump’s trade risks. When Trump was elected back in 2016, EUR/USD fell about another 4% through November and December. If history repeats, the world’s most traded currency pair could be trading below $1.03 before year-end.

Granted, the landscape is different this time round and traders also have to contend with two rate meetings from the Fed and one from the European Central Bank (ECB) before year-end. But the euro may have little to cheer about as European bonds continue to rally as traders rush to price in faster interest-rate cuts in the region, seeing potential global trade tariffs as a further headwind for the region’s fragile economy. With a Republican sweep becoming increasingly likely, the market is trading on a full-blown Trump scenario. As such, rates traders are pricing more than five further reductions from the ECB by September compared with roughly four expected from the Fed. Since mid-September, the US two-year yield advantage has widened from 135bps to 205bps.

Moreover, adding to a dramatic week for the global economy, Germany has delivered a significant political upset of its own. Chancellor Scholz has sacked his finance minister and ended the coalition. A vote of confidence to the German parliament is due on January 15 and it looks likely the federal president will have to call snap elections before the end of March next year.

EUR slides 1.4% versus GBP

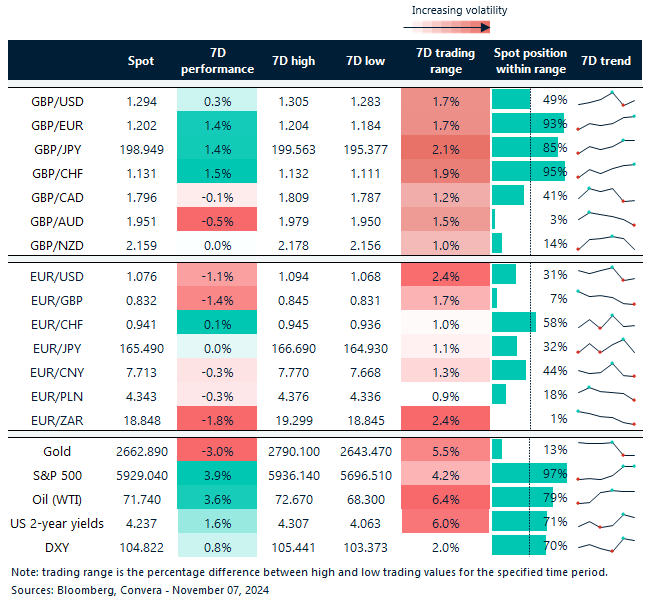

Table: 7-day currency trends and trading ranges

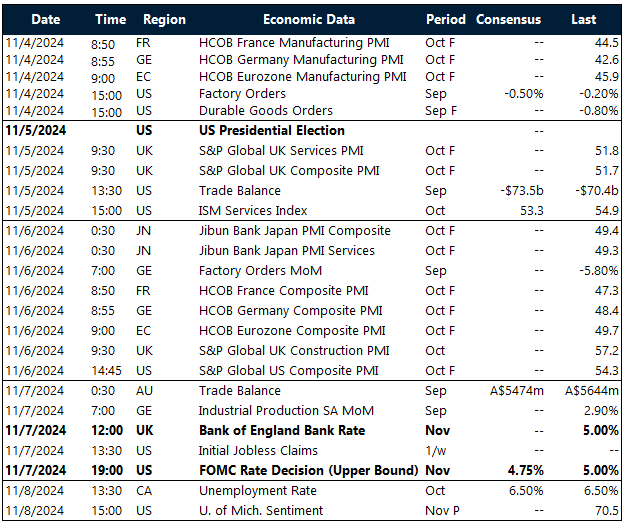

Key global risk events

Calendar: November 4-8

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.