Written by Convera’s Market Insights team

Opposing forces still in motion

George Vessey – Lead FX Strategist

Two opposing forces (fiscal- and monetary policy) are still keeping FX and fixed income traders on their feet. Politics continues to put upward pressure on yields and the US dollar, while the expected easing cycle by the Federal Reserve (Fed) might do the opposite. US macro data this week is, as ever, eagerly awaited, but we think risks are quite balanced for the dollar given the political backdrop.

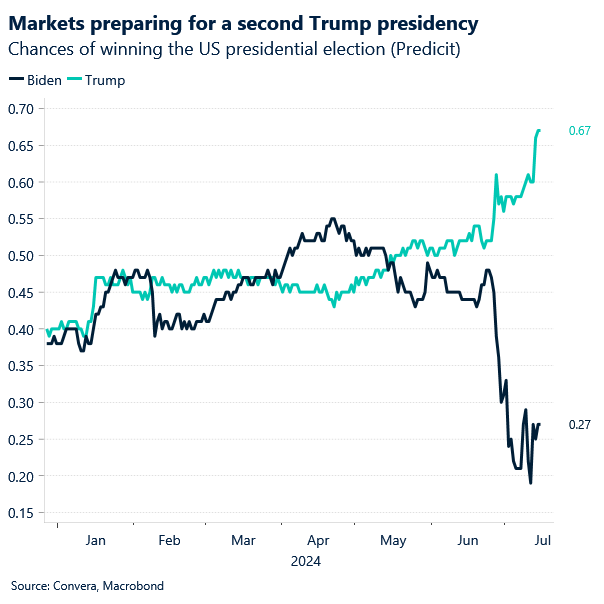

PredictIt odds that Donald Trump wins a second term as president have risen to about 67%, from 60% beforehand, after the assassination attempt on the former president over the weekend. So far the market reaction has been fairly muted, but the yield on 30-year Treasuries surpassed the rate on two-year notes for the first time since January on bets Trump’s policies will spur growth. Markets are grappling with the concept of the “Trump Trade,” which reflects the expectation of a pro-business environment and a significant boost to the US economy through fiscal stimulus, which might limit the scale of rate cuts by the Fed, helping the dollar maintain its high growth and high yield advantage. Nevertheless, we suspect US macro could be a bigger driver of the FX market through the summer. With recent data pointing to easing inflation, a cooling labour market and moderating consumer spending, concerns about an abrupt US slowdown and a more dovish Fed may weigh heavier on the dollar.

Indeed, softer data in recent weeks, including broad-based weakness in the June CPI, have raised the probability of two Fed rate cuts this year. Moreover, yesterday’s modest decline in manufacturing conditions in the New York Fed’s Empire State Manufacturing Survey suggests the ISM Manufacturing PMI for July could soften modestly as well. Today, US retail sales are in focus and will likely show a third straight month of weak spending amid high borrowing costs and a cooling labour market.

Sterling takes a breather before data dump

George Vessey – Lead FX Strategist

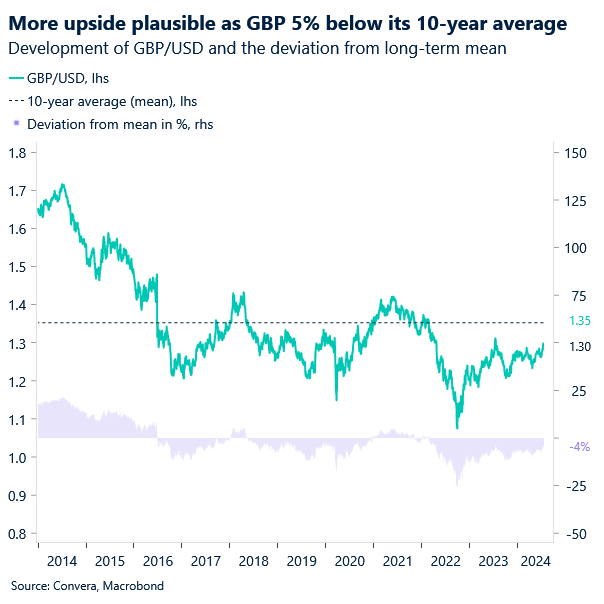

The British pound has pulled back modestly from its highest in a year against the US dollar, still unable to reclaim the psychologically important $1.30 handle. Meanwhile, GBP/EUR is flirting with the €1.19 threshold after hitting an almost 2-year high yesterday. Crucial macro data awaits over the next three days, which could make or break the pound’s positive run of late.

Sterling appears unusually attractive relative to the currencies of other nations at present, as optimism around the new Labour government contrasts with political uncertainty in France and the US. UK Prime Minister Keir Starmer will use the upcoming King’s Speech to showcase his new government’s efforts to spur economic growth. Improving economic growth is already curbing expectations for lower interest rates as other countries tilt toward easing. Investors currently place a 48% chance of a rate cut in August, down from odds of 60% at the start of this month. We’re now waiting on an influx of key UK data that could impact the Bank of England’s (BoE) monetary policy outlook, starting with inflation on Wednesday, labour market data on Thursday and retail sales on Friday.

Annual inflation is expected to stay at the BoE’s 2% target, with the core rate to dip to 3.4%. Unemployment should hold at 4.4%, while wages may ease to 5.7%. Retail sales are predicted to decline for the fourth time in five months. The GfK Consumer Confidence indicator is forecasted to hit its highest level since August 2021.

Euro tests a four-month high

Ruta Prieskienyte – Lead FX Strategist

A risk off sentiment succumbed the markets following disappointing economic data from China and the assassination attempt on Donald Trump. European equities and bonds were down at the start of the week, but the euro emerged victorious in an otherwise quiet session. EUR/USD claimed a fourth consecutive session of gains to rise to its highest level since the end of March.

In terms of domestic developments, the Eurozone industrial production surprised to the upside, falling 0.6% m/m in May versus the market consensus of a 1% decline. Elsewhere, France was yet again under pressure as auditor slammed its plans to fix the gaping hole in the country’s finances. President Macron’s outgoing administration pledged new spending cuts and revenue-boosting measures in April to get back on course with derailed plans to bring the budget deficit within 3% of economic output in 2027. However, the state auditors see those plans as noncredible and unrealistic given they are based on a whole host of particularly optimistic set of assumptions. The review is another red flag for the euro area’s second-largest economy, whose next government will need to find more than €15 billion in extra revenue or savings a year to meet European Union demands.

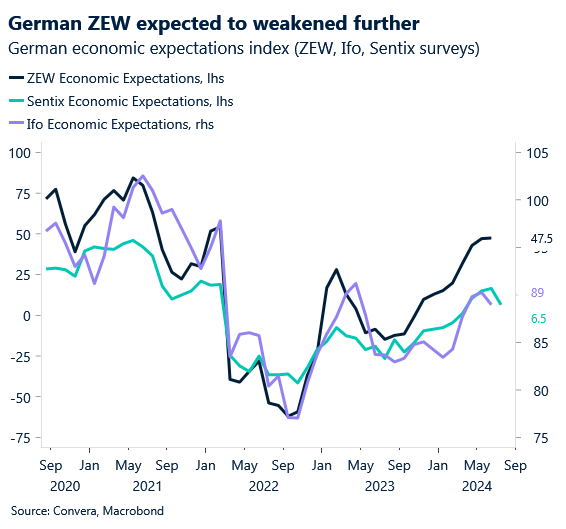

Today’s German ZEW index will be the highlight of the week from the domestic calendar and is expected to show a further loss of momentum in leading activity indicators. This may take some of the steam out of the bullish momentum, especially with the daily EUR/USD relative strength index steadily approaching overbought territory. Despite that, $1.09 could be the floor in the short term. We will also be closely monitoring the ECB’s bank lending survey due later today, which will provide an update on the tightening effect on eurozone credit supply.

US yields on holding near lows

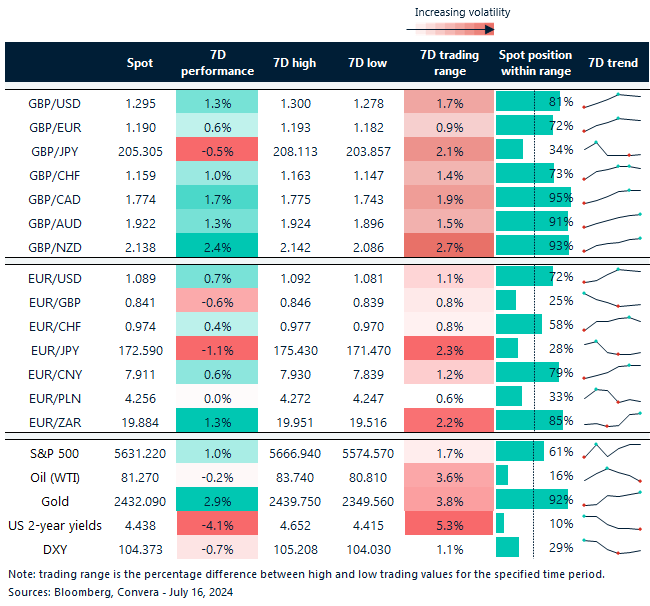

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: July 15-19

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.