USD gains after PCE

The US dollar remained well supported last week as a stronger PCE inflation reading and a cautious update from the Bank of Japan kept the greenback in favour.

The US’s personal consumption and expenditure reading, the Federal Reserve’s preferred measure of inflation, eased from recent highs but remains elevated.

The monthly core PCE came in at 0.3% (versus the 0.3% expected) while the annual number was reported at 4.6% (slightly above forecasts at 4.5%).

The employment cost index, an associated measure of wages, was also above expectations, at 1.2% over the March quarter versus the 1.1% expected.

Yen weaker as Ueda announces review

Earlier on Friday, the greenback was boosted after the closely-watched Bank of Japan meeting saw the Japanese central bank retreat from expectations for a potential policy tightening.

New BoJ governor Kazuo Ueda kept policy on hold and announced a policy review that might take more than a year to report.

The review was seen as making any substantial policy change unlikely in the near term and caused the Japanese yen to weaken.

The USD/JPY jumped 1.8% helping the USD to gain.

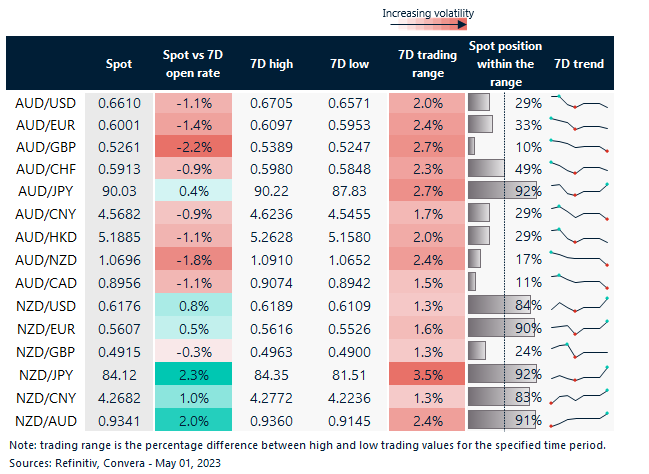

The yen weakness saw gains for the AUD/JPY, up 1.4% and the NZD/JPY, up 2.3%.

Central banks key this week

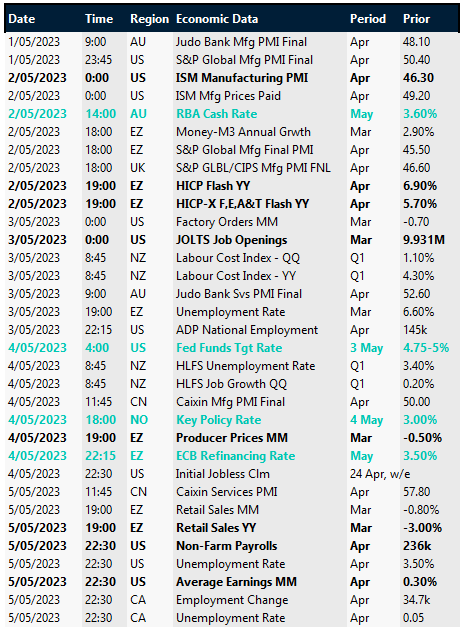

Central banks are clearly in focus this week with decisions due from the Reserve Bank of Australia, US Federal Reserve and the European Central Bank.

Importantly, these decisions might continue to drive the divergence that’s seen the AUD and NZD sharply underperform over the last month.

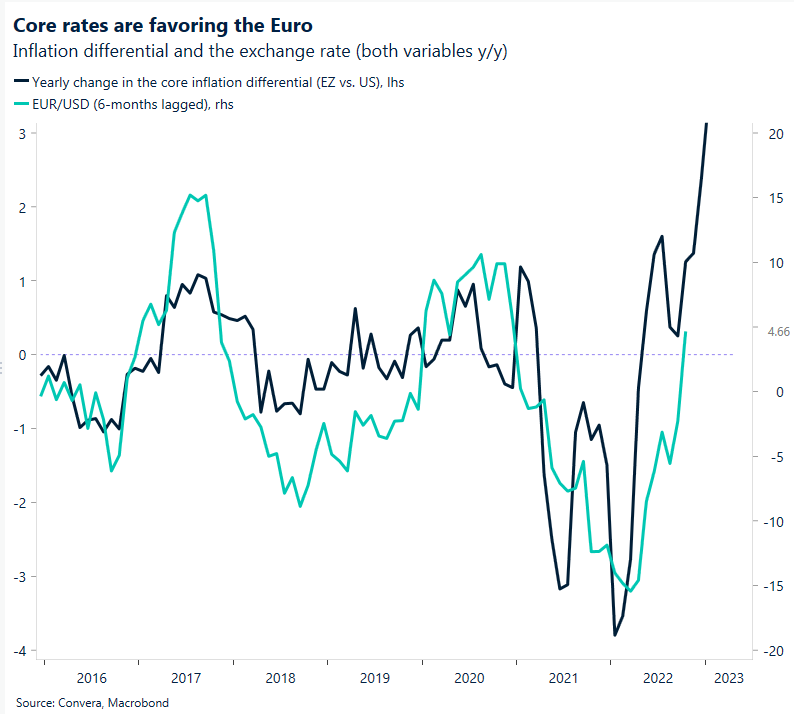

In particular, the Fed now seems near the end of its tightening cycle, while the ECB is seen as likely to hike at least three more times.

AUD/JPY, NZD/JPY jump

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 1 – 5 May

All times AEST

Have a question?[email protected]