Written by Convera’s Market Insights team

Big data dump awaits strong dollar

Boris Kovacevic – Global Macro Strategist

The US dollar is enjoying some strong buying pressure from overseas this morning after the currency comes off its first weekly loss in nine. Political instability in Europe and president-elect Donald Trump’s new tariff threats against the BRICS countries could see the Greenback claw back some of last week’s losses over the upcoming trading sessions if the macro data holds up. The US dollar index (DXY) is up around 5.7% in the last ten weeks.

However, the DXY is entering December, historically its worst month by far, with a 2% gain since the presidential election. Asset managers turned the most bullish on the dollar since the pandemic as well. Investors will therefore weigh month-end rebalancing and selling flows against rising political instability across the globe when it comes to FX markets.

The US economy continues to be powered by a resilient labor market and consumer. Personal incomes rose by 0.6% in October, the most in about seven months. Initial jobless claims remain historically depressed at 213k. The backdrop going into this labor market data heavy week is therefore a positive one.

The ISM purchasing manager indices for the manufacturing and services sector, job openings (JOLTS), the ADP private employment report, initial jobless claims, and the US non-farm payrolls report will make for an interesting week and lot of data for investors to digest. A dozen Fed speakers spread across the week with Jerome Powell speaking on Wednesday could fuel volatility in addition to the macro side.

Euro scoffs at bowl of OATs

George Vessey – Lead FX Strategist

Political stability risks continue to weigh over French bonds (OATs) and the euro as the threat of a no-confidence vote and possible toppling of the government looms. The spread between French and German bonds remains close to 12-year highs. EUR/USD is slipping back towards $1.05 having tested $1.06 last week, with a bias to the downside evident by 1-week risk reversals turning negative once again.

Last week, selling pressure on the euro eased due to a combination of hawkish pushback to a 50 basis point cut in December by European Central Bank (ECB) policymakers, combined with somewhat softer US data and positive month-end flows. Indeed, EUR/USD scored its best week since early August. However, the outlook for the euro remains dire, no matter whether the ECB cuts by 50bps or not this month or next. A more cautious approach to easing policy might heighten concerns over rising yields in France’s debt-laden economy and a feeble German economy. In contrast, lower interest rates will keep widening rate differentials as a driving force for the common currency lower.

Aside from the ECB’s outlook though, upcoming risks from potential tariffs and German elections also loom. But the very near-term risk comes from France. Marine Le Pen’s National Rally has demanded further concessions on prime minister Michel Barnier contentious 2025 budget, otherwise she is happy to support a vote of no-confidence in the government as early as Wednesday.

Pound pounces on euro weakness

George Vessey – Lead FX Strategist

The apparent deadlock in France makes a no-confidence vote highly likely. This raises the prospect of further rises in French government bonds and declines in the euro. GBP/EUR is only around one cent away from as fresh 8-year high and the next clear hurdle from here is a retest of the 2024 high at €1.21.

The currency pair has been trading above its key moving averages for several months now, which is consistent with the broader uptrend. Meanwhile, the 14-day relative strength index is still trading below overbought territory, which is a confirmatory signal that the upside is preferred at this stage. Fundamentally speaking, the UK economy is still outperforming most of Europe, and with inflation picking up again, the Bank of England (BoE) is more than likely to keep rates much higher than the ECB, providing the pound an attractive yield appeal too. In addition, the Eurozone economy is more exposed than the UK to US tariff policies too, which adds to the upside bias for the pound.

This week, focus will be on the BoE’s Decision Makers Panel, particularly on implied wage expectations, and on the reweighting of the Labour Force Survey data. Final November PMIs may receive more attention than usual as well, to see whether or not the notable decline in sentiment seen in the flash print is confirmed.

GBP outperforming EUR across the board

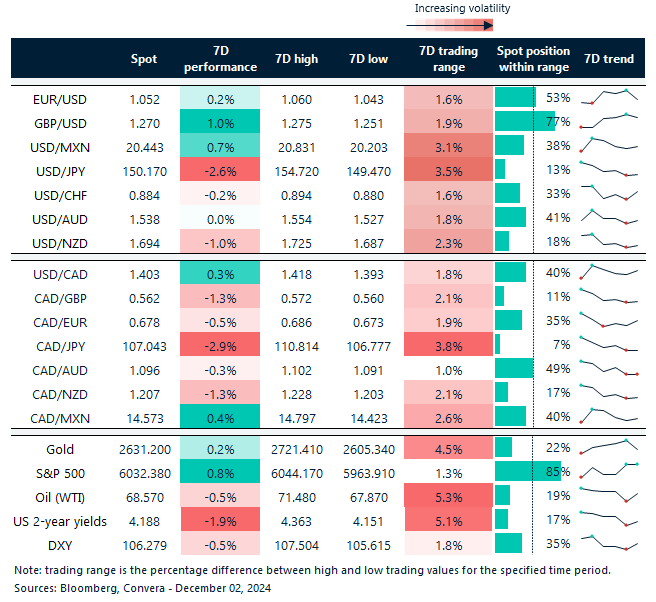

Table: 7-day currency trends and trading ranges

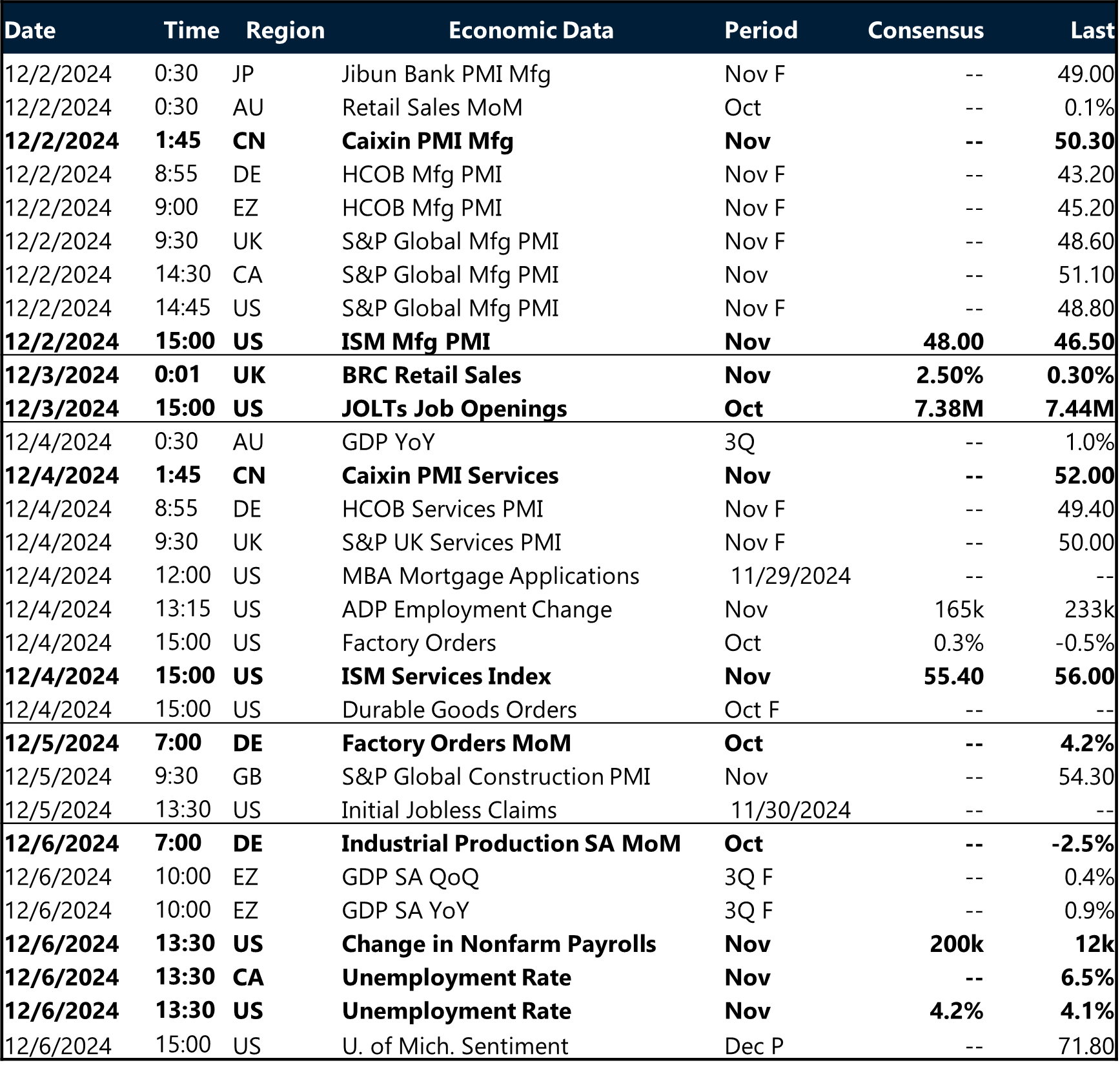

Key global risk events

Calendar: December 2-6

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.