Global overview

The U.S. dollar bounced higher Friday after a dovish Bank of Japan maintained rock bottom interest rates while data from Europe underwhelmed and weighed on the euro. The dollar exploded to seven-week highs against the yen after the new governor of the BOJ, Kazuo Ueda, maintained his predecessor’s ultra-lax lending rates of minus 0.1%. Japan continues to go against the grain of surging global borrowing rates as officials worry that a U.S.-led economic slowdown could undermine the world’s third-largest economy. Sterling fell Friday but was on course for weekly and monthly gains against its U.S. rival. Another bout of market risk aversion weighed on commodity-linked currencies like the Canadian dollar which slipped to one-month lows against the U.S. dollar. The dollar index could eke out a second straight weekly gain if U.S. data today on consumer spending and inflation buttress the Fed’s higher for longer interest rate outlook.

Euro’s rally dampened by data

The euro pared some of its monthly gains against the greenback after underwhelming data from Europe dampened budding optimism toward the continent. Growth in Europe’s biggest economy, Germany, unexpectedly flatlined during the first quarter, compared to forecasts of a 0.2% quarterly rise. The wider euro zone eked out growth of just 0.1% last quarter which was half the consensus forecast of 0.2%. The euro lost altitude as weaker than expected growth suggested a lower risk of the ECB opting for a larger 50 basis point rate hike on May 4.

GBP/USD poised for 1% monthly advance

The UK pound was poised for smaller weekly and monthly advances against a stronger U.S. dollar Friday. World markets in risk-off mode added traction to the pound’s move below recent 10-month peaks. Still, underlying sentiment toward the pound remains bullish as double-digit UK inflation is seen extending the Bank of England’s tightening cycle, policy that diverges with the Fed whose borrowing rates could soon peak. Sterling’s elevated altitude will be tested next week by central bank decisions in the U.S. and euro zone. A Fed that should come across more hawkish than expected could leave some of the pound’s gains at risk.

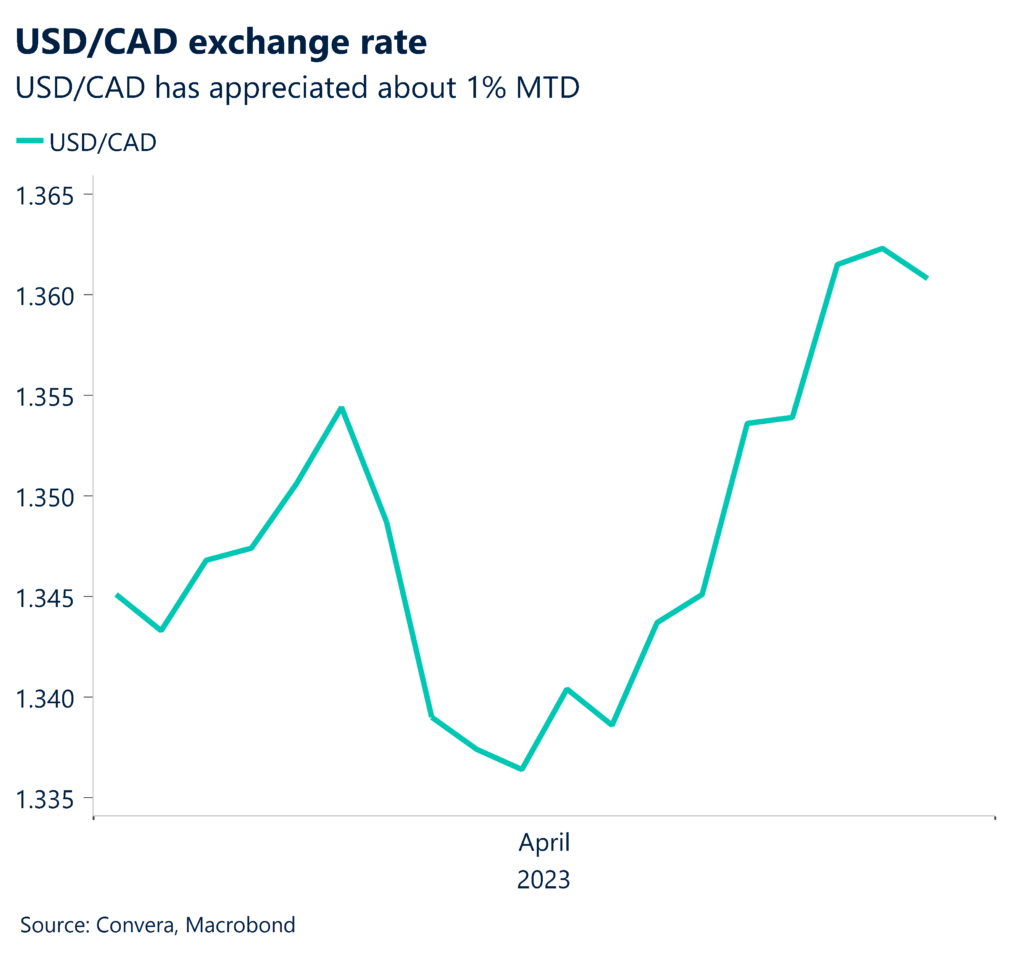

C$ hits 1-month low as growth disappoints

The Canadian dollar fell to one-month lows as signs of a weakening Canadian economy bolstered the view that area lending rates have peaked at 4.50%. Canada’s economy grew just 0.1% in February which stopped short of forecasts of 0.2%. January growth enjoyed a one-tick upgrade to 0.6%. Canada forecast that March growth would contract 0.1%. At best the data supports the view that interest rates have peaked, while at worse can revive the debate about whether the next move will be lower, a loonie-negative topic.

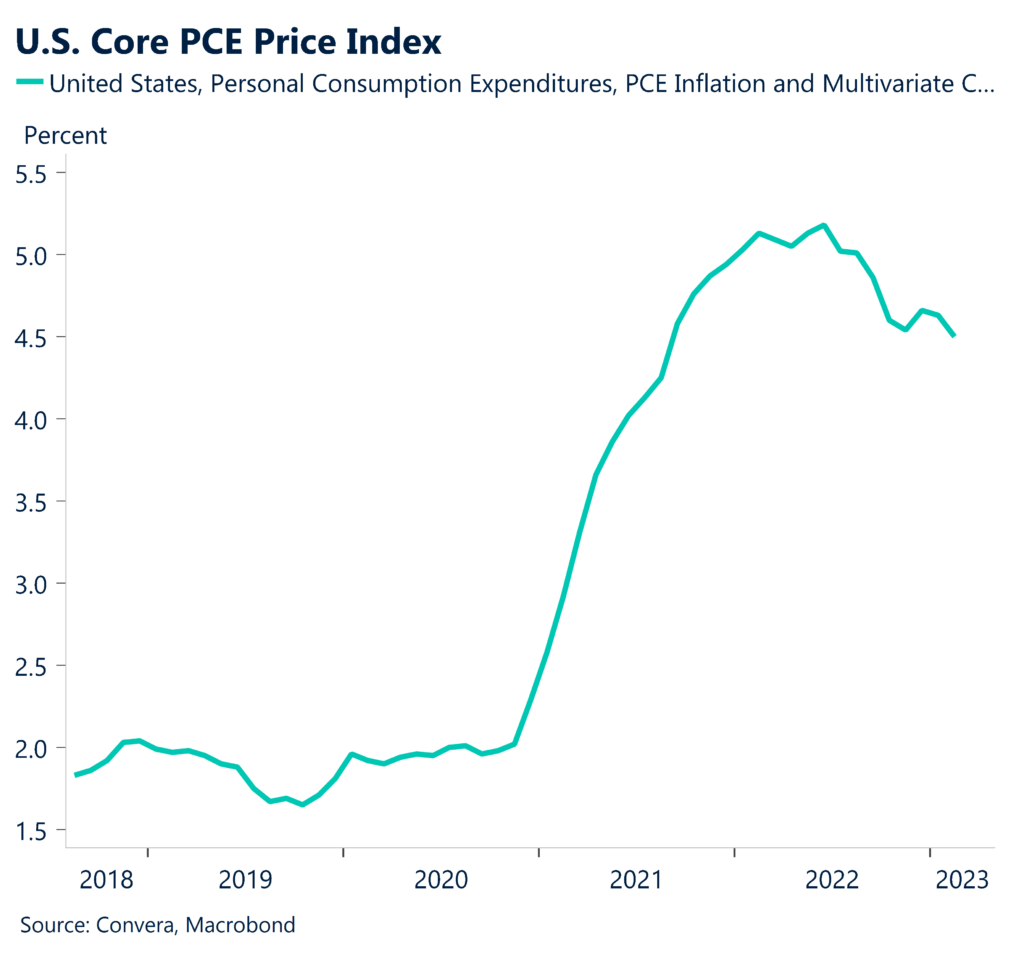

U.S. core inflation surprises to upside

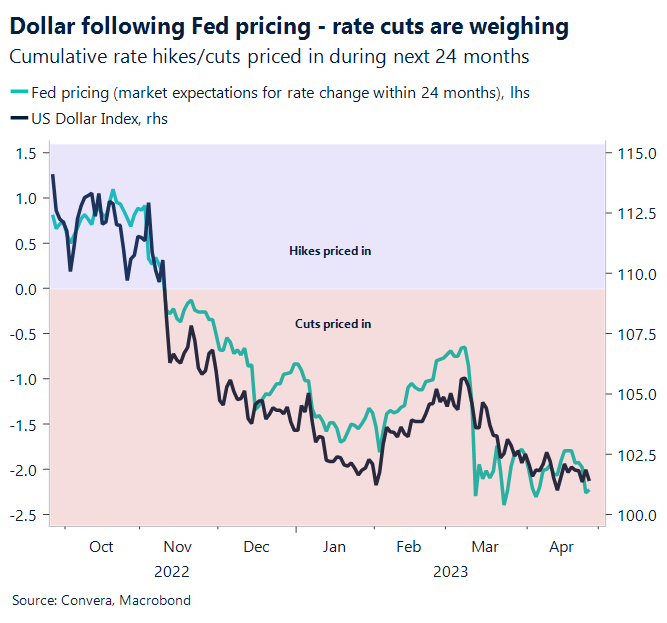

The dollar weathered another mixed bag of data as it showed core inflation making a frustratingly slow descent. Consumer spending stalled in March but incomes topped forecasts with a 0.3% rise, a good sign for future consumption. The core PCE price index topped expectations by rising at an annual rate of 4.6% which was down a tick down from 4.7% in February. While the Fed may indeed pause rate increases after an expected increase next month, core inflation remaining stubbornly high suggests the Fed’s next rate move could be higher still. The dollar stands to gain when market skepticism rises in the Fed pivoting to rate cuts by year-end.

Dollar bounces toward weekly highs

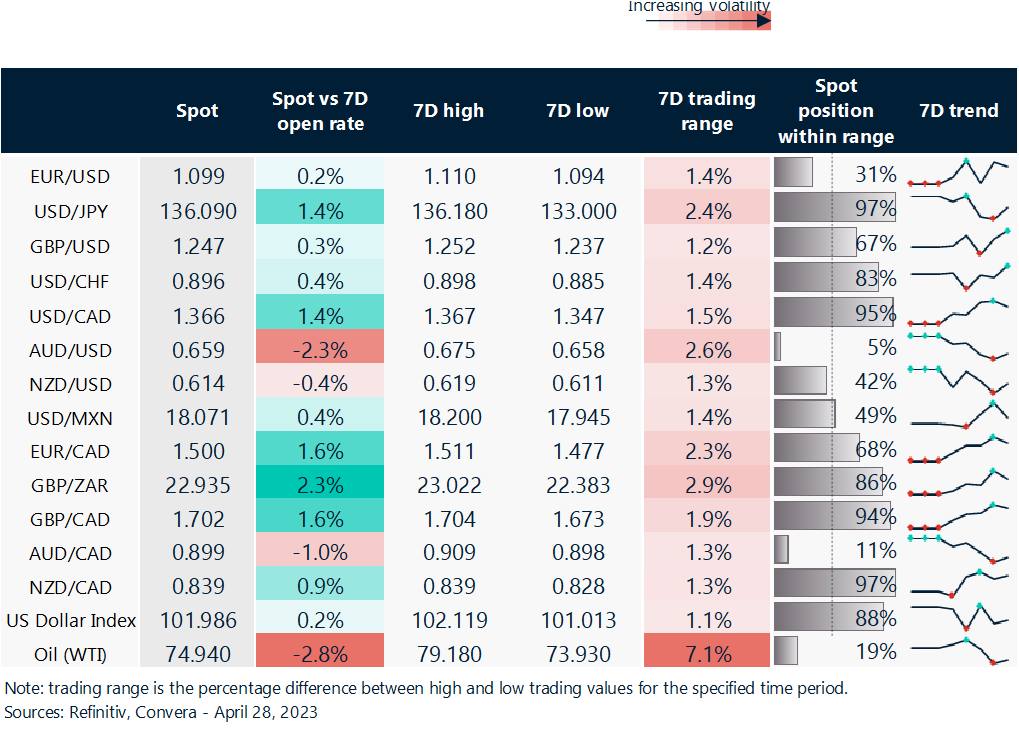

Table: rolling 7-day currency trends and trading ranges

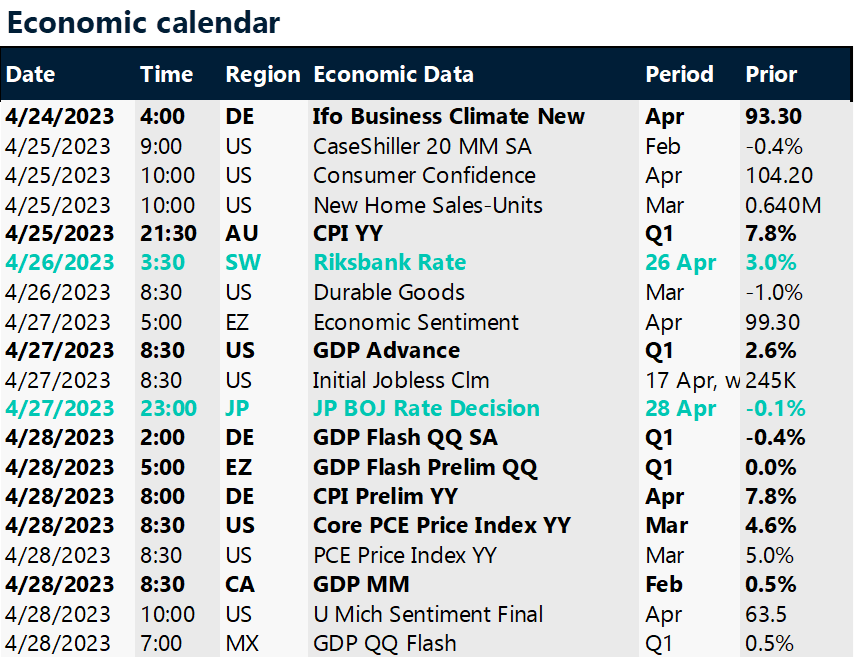

Key global risk events

Calendar: Apr 24-28

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.