Written by Convera’s Market Insights team

The Daily Market Update will take a break over the holiday period – our final edition is on 20 December 2024. The report will return on 6 January 2025. Our offices will be open as usual but will observe local public holidays. Speak to your account representative for more information.

Hawkish as a rate cut can be

Boris Kovacevic – Global Macro Strategist

The Federal Reserve cut interest rates by 25 basis points as expected. Policy makers have ended the year with three rate cuts worth 1% of easing, bringing the fed funds rate to 4.25%. The Summary of Economic Projections shows a median of two cuts for next year as officials revised up their year-end inflation projection for 2025 to 2.5%.

US policy makers had gotten ahead of themselves when it comes to their lenient inflation assessment. Ever since prices started rising at the beginning of 2021, the FOMC’s inflation risk perception tracked its preferred price measure, the core PCE figure. Since 2022, policy makers have been even more cautious than inflation would have suggested or justified. This cautiousness turned in September, when only three FOMC members saw upside risks to core PCE.

As we expected, concerns over inflation are back on the rise within the FOMC. The number of members seeing upside risks to core PCE rose from 3 to 15. This was the largest meeting-by-meeting increase since at least 2017. The median inflation forecast for next year rose from 2.1% to 2.5%. The upside revision, the dissent from Cleveland Fed President Beth Hammack and the rise in inflation risk perception have laid the foundation for a pause in January. This meeting was seen by investors as hawkish as a cut can be.

Equity markets recorded their largest single-day drop in about a month as investors adjust to a shallower easing cycle. The S&P 500 dropped below the 6,000 threshold and recorded its worst Fed day since 2001. The US dollar rose to its highest level so far this year and has extended its 2024 advance to 6%. If the Greenback can hold on to these gains, the currency would leave behind the second-best year since 2015. The US Dollar Index is still 6% away from its 2022 high. However, the Fed’s broad dollar index is approaching record highs, having risen from the 85 mark after the Global Financial Crisis to 125 right now.

Euro feeling the brunt of it

Boris Kovacevic – Global Macro Strategist

The euro broke through the key $1.04 support level for just the second time this year as the Fed delivered a hawkish cut yesterday evening. Global equity markets got rattled by the prospects of a more cautious US central bank going forward, leading to losses across the world.

The implied stock market volatility gauge (VIX) doubled following the Fed meeting and is on track to record its largest weekly rise since the pandemic. Markets are now zooming in on central bank announcements across the world. Rate decisions in Norway, Sweden, the UK, Mexico, Taiwan, and the Philippines will be closely watched for any spillover effects from the Fed.

As we rightly pointed out going into the week, the euro remains purely a function of developments in the US. Following the Fed decision, the focus is shifting onto the US inflation print tomorrow. Today’s GfK consumer survey from Germany did little to spark any optimism. Consumer confidence has not budged in December, ending the week in negative territory. The figure has been negative since the end of 2021.

BoE up next, guidance is key

George Vessey – FX Strategist

We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 4.75% today, in line with consensus and market pricing. All eyes will be on the vote split and on the forward guidance – whether they prepare the ground for a cut at the February meeting or signal a more cautious approach (like the Fed) following the wage surprise.

The Monetary Policy Committee has consistently signalled a gradual approach to policy easing (largely interpreted as quarterly cuts) and given data has broadly been in line with their expectations, it’s likely this tempo of rate cuts will hold into 2025. That being said, following the hot UK wage numbers, and sticky inflation figures from the UK this week, money markets have reduced their expectations of BoE rate cuts next year to less than two 25 basis point cuts. UK gilt yields are closing in on fresh 1-month highs, with the UK-German 10-year spread widening to its highest since the 1990s, allowing GBP/EUR to grind north of the €1.21 handle again.

GBP/USD is drifting towards the $1.26 threshold after the hawkish Fed decision last night. The currency pair suffered its worst day in over a month and is still caught in this downtrend since late September’s peak of $1.34. A hawkish BoE meeting today might offer some much-needed support, though the very short-term bias doesn’t look promising for GBP/USD.

Dollar dominates, yen yelps

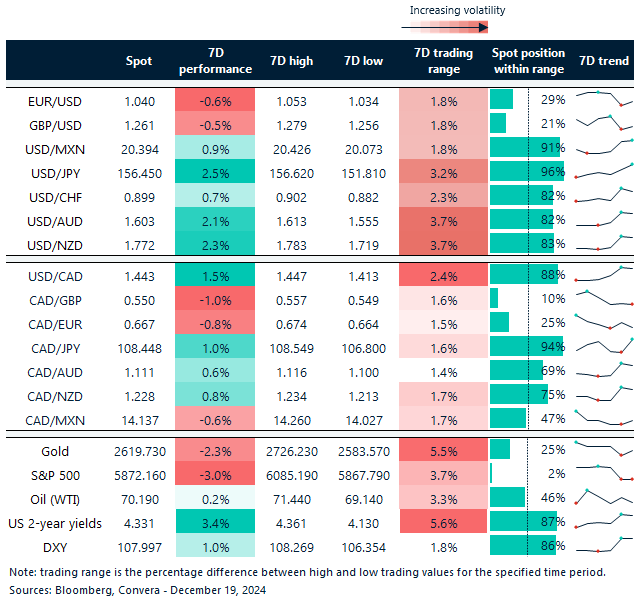

Table: 7-day currency trends and trading ranges

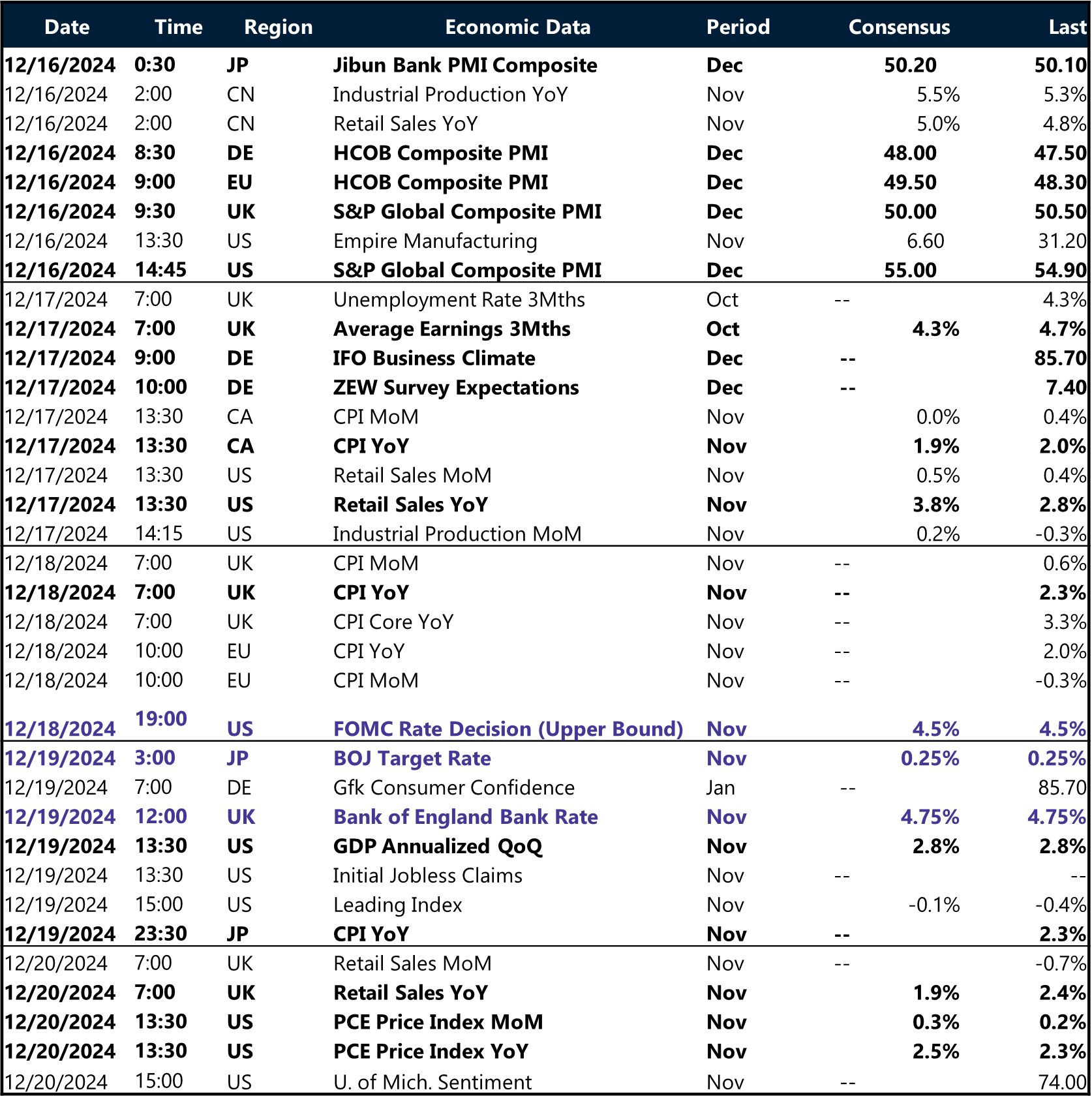

Key global risk events

Calendar: December 16-20

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.