Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Safe-haven assets shine brightly, with DXY index at YTD highs

USD/JPY fell 0.58% as investors sought safety, with the Japanese currency benefiting from its traditional safe-haven status amid ongoing geopolitical tensions.

The USD index advanced modestly (DXY Index +0.27%) at YTD highs 106.972 as concerns over Russia/Ukraine geopolitical risks dominated market sentiment, though these fears partially eased during the NY session.

USD/THB declined 0.23% and USD/KRW dropped 0.13%, leading gains in Asian currencies despite the broader USD strength.

EUR/USD fell 0.66%, breaking below the key 1.0500 level to end at 1.0480, as weak PMI expectations weighed on sentiment. The pair faces crucial tests today with EU PMIs.

GBP/USD dropped 0.50%, breaking below 1.2600 amid broad USD strength, with UK retail sales and PMI data due later today potentially determining whether the break lower sustains.

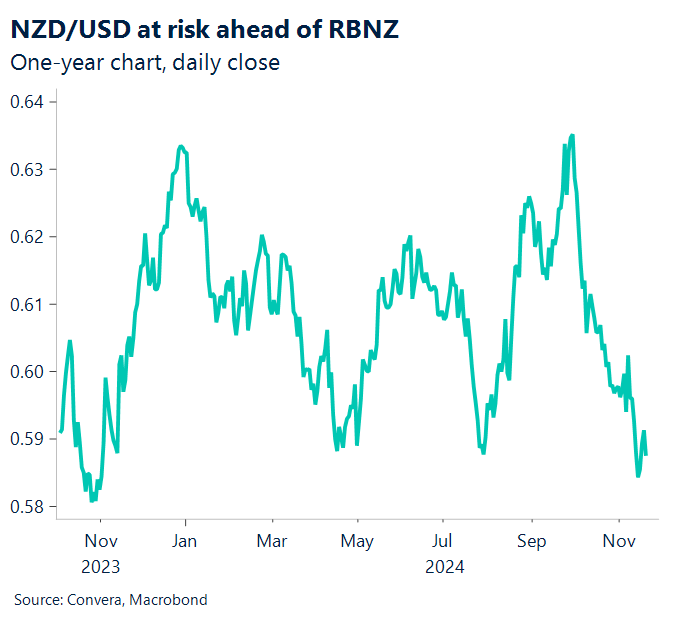

Kiwi at risk as RBNZ looms

The NZ dollar faces the risk of another step lower ahead of next week’s Reserve Bank of New Zealand decision.

The RBNZ has a long-established tradition of acting aggressively when necessary and slowing economic growth means that further deep cuts might be required.

Currently, financial markets see a 50bps cut as a certainty with 54bps of cuts priced in.

The NZD/USD remains at risk of further losses with a break of 0.5770 setting up a move to long-term support at 0.5500.

Momentum divergence signals consolidation phase

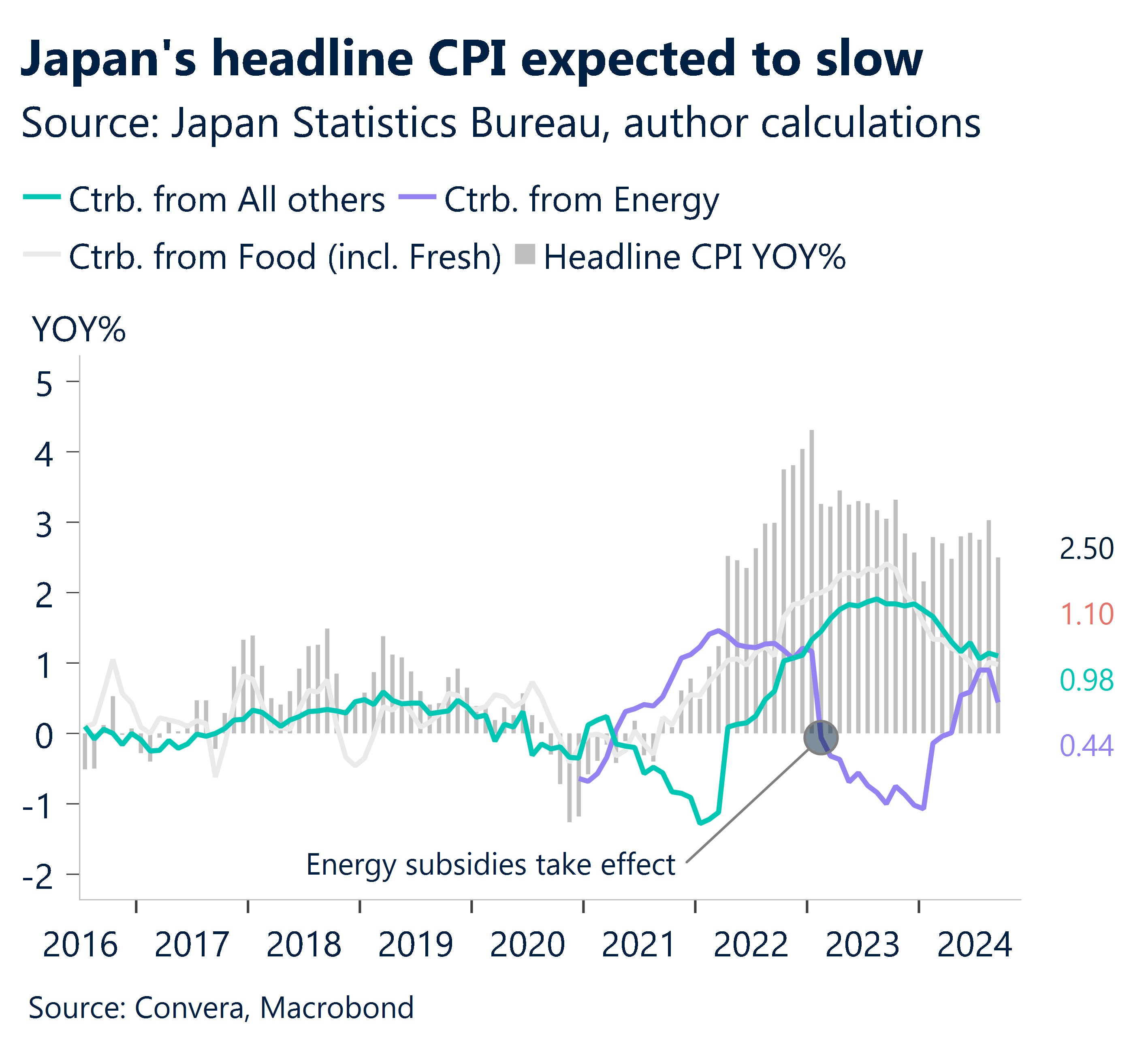

The national CPI for Japan will be announced this Friday at 10:30 AEDT.

All-Japan core CPI inflation is expected to slow from 2.4% in September to 2.3% year over year in October.

As opposed to the previous month’s 2.1%, we predict that the BOJ’s measure of core-core CPI inflation would increase by 2.3% year over year.

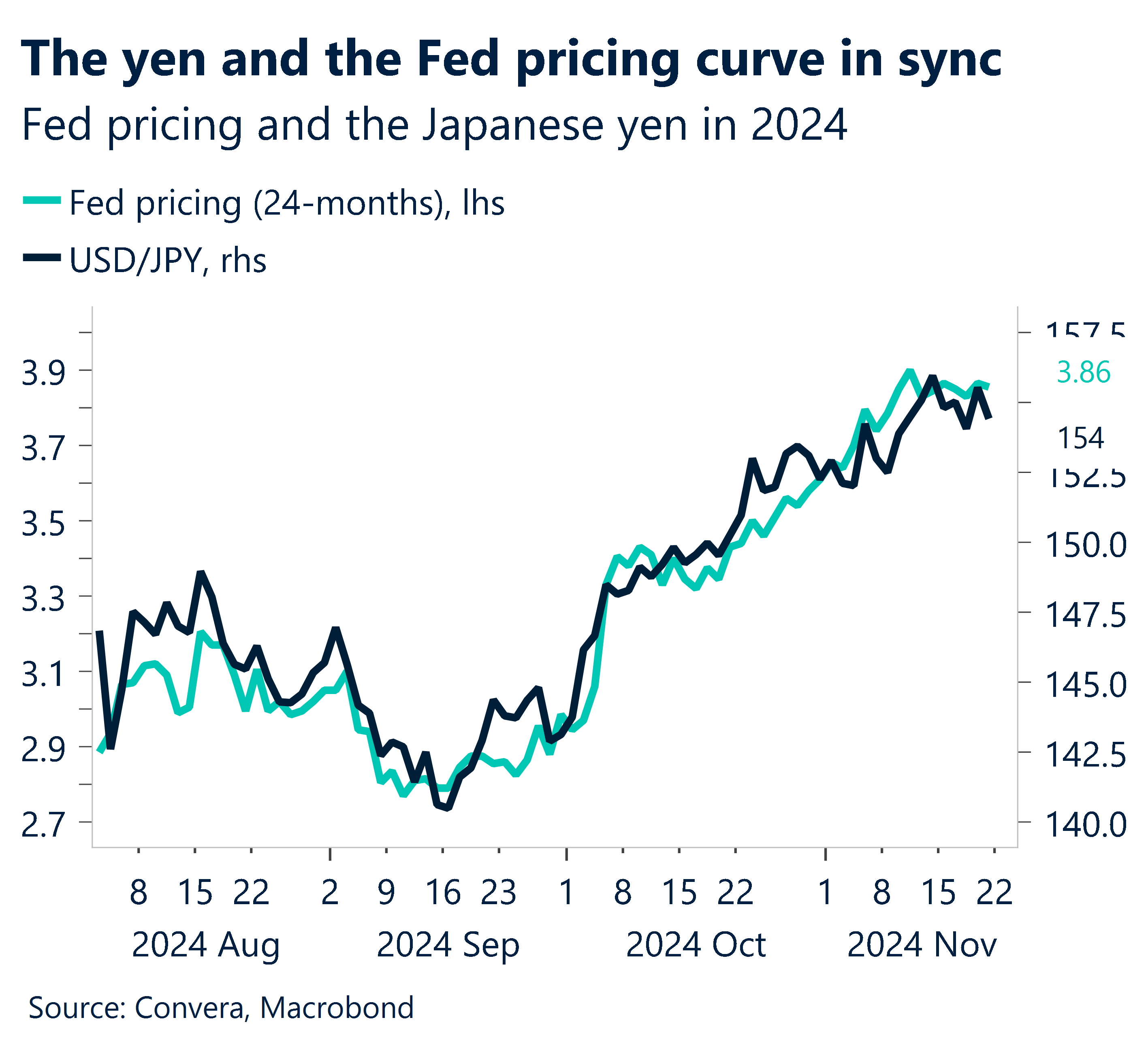

Another momentum divergence sell signal was set up by the USD/JPY whipsaw that followed the election.

We still believe that the September-November advance seems worn out and prepares the market for at least a consolidation, even though the election outcome probably restricts the extent to which USD/JPY may mean back to lower levels.

The key nearby support is located between 150.298 and 151.341 EMAs.

AUD maintains resilience amid mixed G10 performance

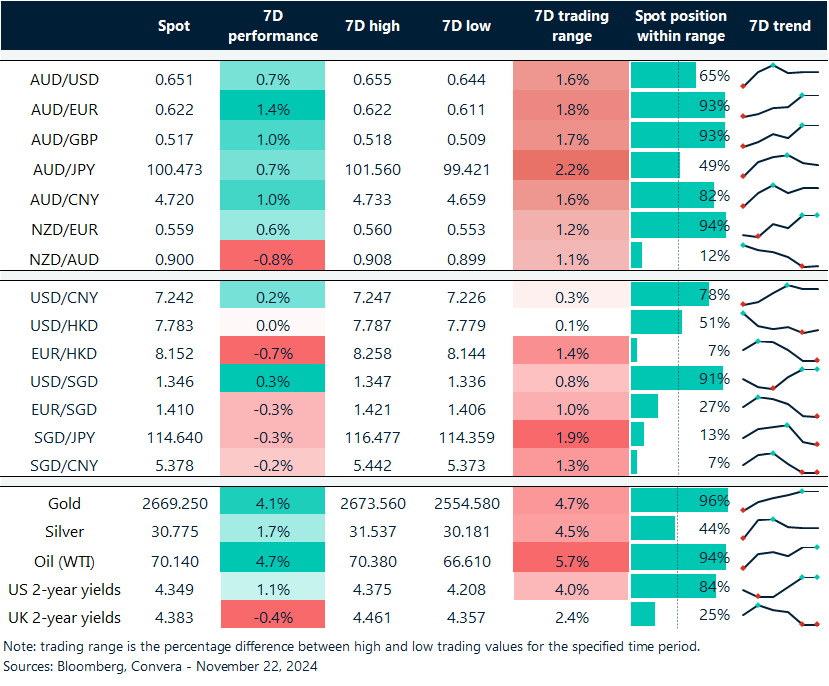

Table: seven-day rolling currency trends and trading ranges

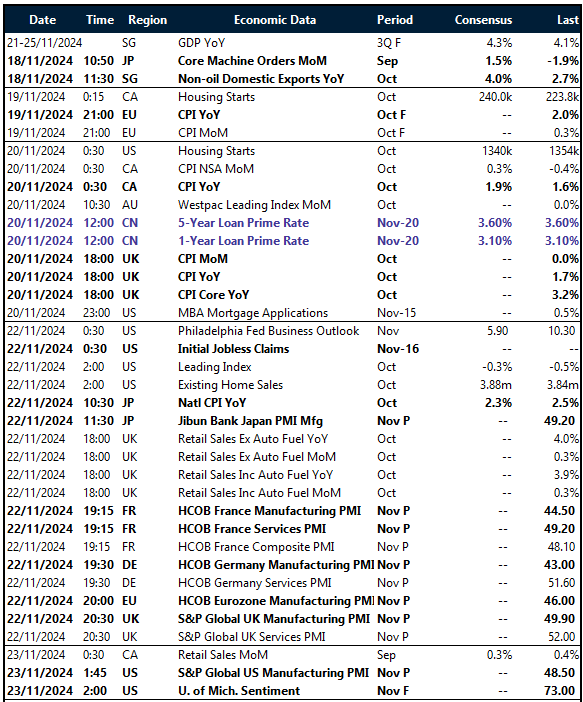

Key global risk events

Calendar: 18 – 23 November

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.