Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

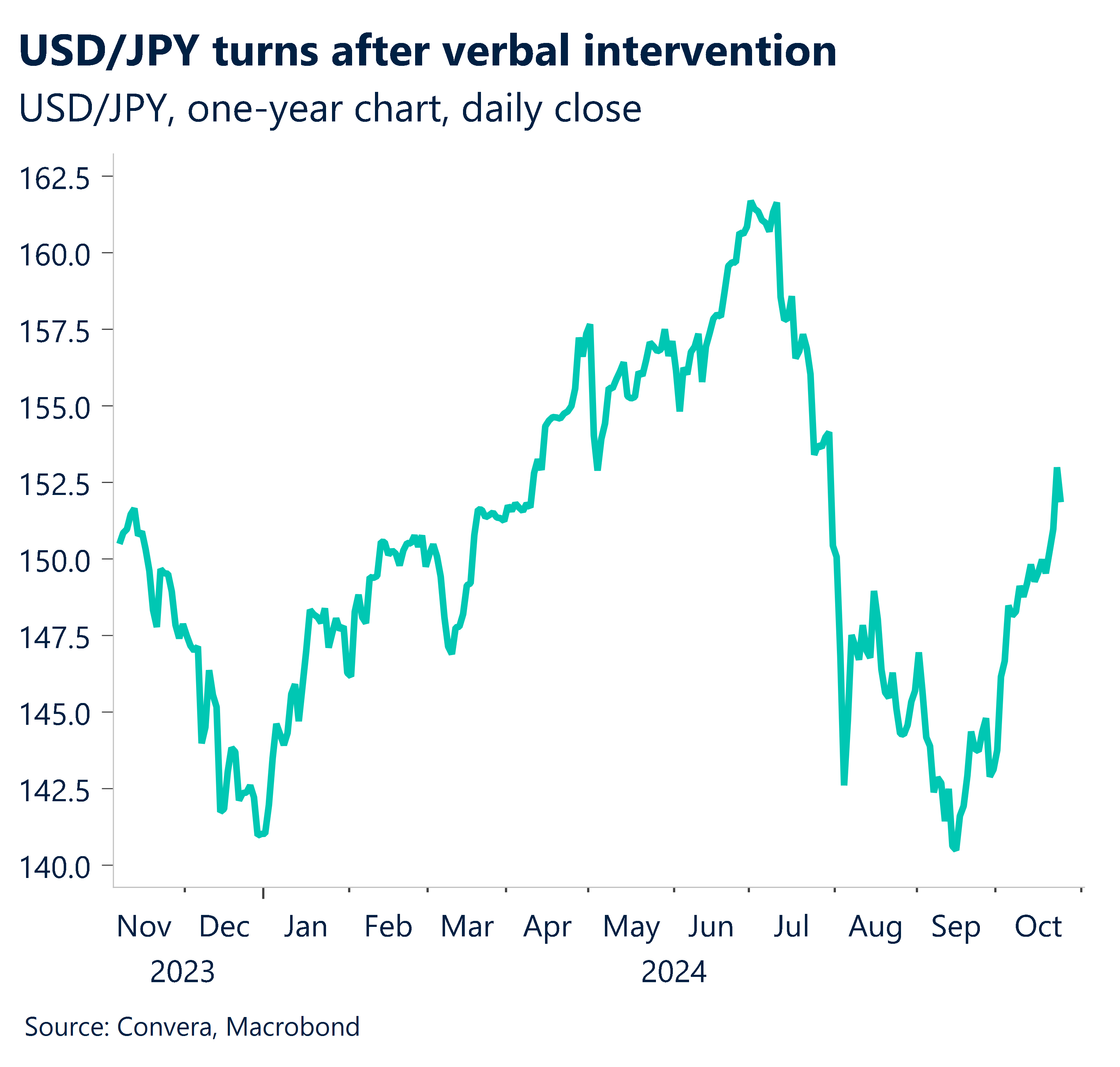

Greenback hit after Japan comments.

The greenback turned sharply lower overnight after a monster rally so far in October that has seen the USD index gain as much as 3.8% over the month so far.

The USD has been boosted by stronger data – most notably the 254k new jobs in the September labour report – and the increasing probability of a Trump win in next month’s US presidential election.

However, the greenback eased on Thursday, with the most notable driver seen in the USD/JPY after Japan’s deputy chief cabinet secretary Kazuhiko Aoki said Japanese authorities were “closely watching” FX moves. The USD/JPY fell 0.6% overnight.

In other markets, the moves were less spectacular, with AUD/USD up 0.1% and NZD/USD up 0.2%.

In Asia, the USD/SGD fell 0.4% while USD/CNH fell 0.2% as it again found resistance at the 7.15 level.

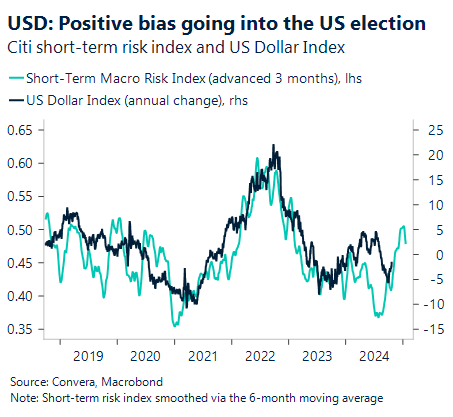

USD bias remains positive

Looking forward, there remains a positive bias for stronger USD index going into the US election.

Overnight, University of Michigan consumer sentiment will be revealed.

After an unexpected drop in the preliminary print, we anticipate that the University of Michigan consumer sentiment index final reading increased to 70.0 in October.

During the survey reference period, energy costs remained low but stock prices saw a dramatic increase. Throughout the survey reference period, the San Francisco Fed’s daily news sentiment index likewise saw a little increase.

In the last several months, buying circumstances for cars and durable items have improved, and further improvement may be forthcoming if financial conditions loosen.

SGD impacted by electronics slowdown

In Asia, all eyes today will be on Singapore industrial production in due 1.00pm SGT (4.00pm AEDT).

We expect industrial production (IP) growth to moderate to 5.5% y-o-y in September after recording a 21.0% surge in August, partly on less favorable base effects, but also on a downswing in electronics exports offsetting higher capacity of pharmaceuticals production.

This suggests a decline to -3.1% month-over-month decrease in sequential terms after robust growth of 10.2% and 6.7% in July and August, respectively.

The USD/SGD turned lower from the 1.3250 level overnight – historically a key technical level that currently aligns with the 200-day moving average.

USD turns in Asia

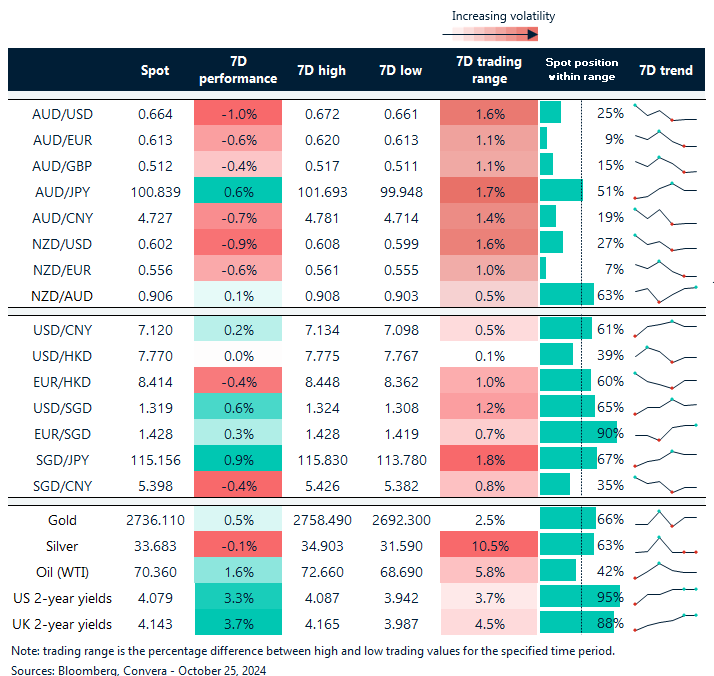

Table: seven-day rolling currency trends and trading ranges

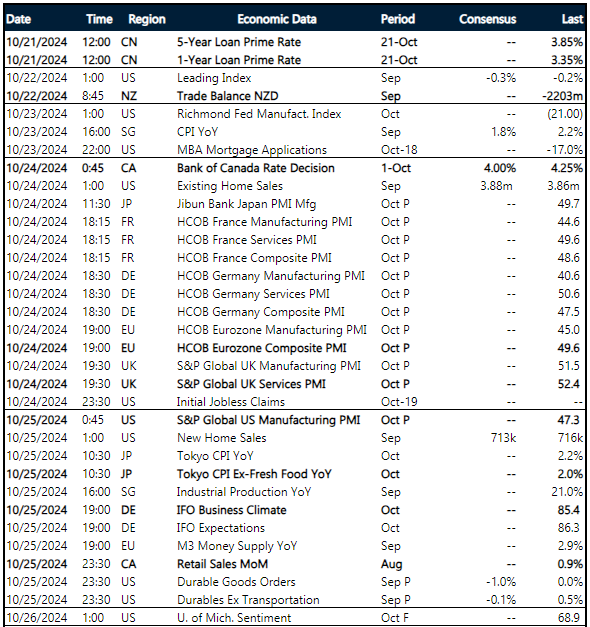

Key global risk events

Calendar: 21 – 26 October

All times AEDT

Have a question? [email protected]