US services PMI misses, adding to worries

The US dollar held steady overnight even as US data extended a recent poor run with the ISM services PMI unexpectedly dropping.

The Institute of Supply Managers’ activity data is seen as one of the most up-to-date readings of the US’s services sector and the large miss – at 50.1 versus the 51.5 expected – was a shock that compounded after last week’s large fall and sharp revisions in the benchmark US non-farm employment report.

US shares fell on the news with the S&P 50 down 0.5% and the tech-heavy Nasdaq losing 0.7%.

The AUD/USD inched higher, up 0.1%, while the NZD/USD was flat.

The USD/CNH gained 0.1% while the USD/SGD was unchanged.

Fed official hints at deeper rate cuts

Mary Daly, head of the San Francisco Fed, says interest rates may need to fall more than twice this year. She also pushed back on claims that tariffs are fuelling inflation. Daly won’t be a voter this year or next.

Over in Asia-Pacific, the Aussie was broadly steady despite its usual sensitivity to market mood.

Next key resistance lies at 50-day EMA of 0.6496, followed by 21-day EMA of 0.6505, marking key short-term resistance levels.

China’s services sector shows surprise strength

China’s Caixin Services PMI rose to 52.6 in July, outpacing the official reading of 50.1 and previous prints near 50. Stronger tourism and steadier trade helped push new business to its fastest growth in a year, while export demand bounced back after a three-month lull.

Still, the overall picture dimmed slightly. The composite PMI dipped from 51.3 to 50.8, dragged down by factory contraction and hinting at underlying economic pressure.

USD/CNH pulled back over the last four sessions and now hovers near key support at 21-day EMA 7.1819. The pair has stayed in a tight range since May 2025.

Conversely, the next key resistance list at 100-day EMA of 7.2060.

Aussie remains under pressure

Table: seven-day rolling currency trends and trading ranges

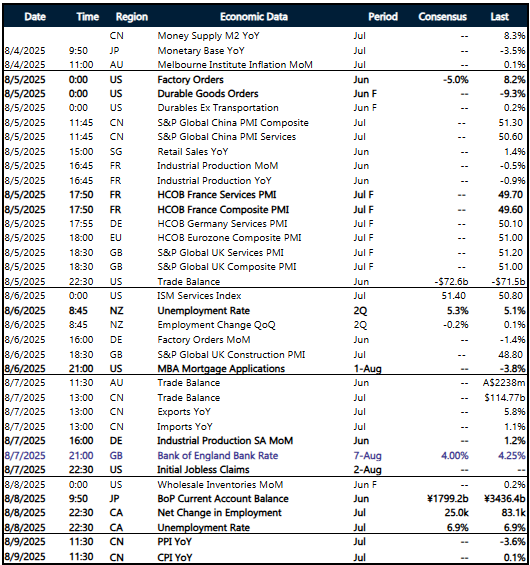

Key global risk events

Calendar: 4 – 9 August

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.