Written by Convera’s Market Insights team

Dollar’s ongoing plethora of support

George Vessey – Lead FX Strategist

The case for a resilient US dollar is gaining traction into year-end. Consistently strong US data means traders are yet again being forced to unwind some of their expectations for Fed rate cuts. The re-emergence of the Trump trade amidst rising bets of a Republican victory and ongoing tensions stemming from the Middle East, are amongst the key geopolitical risks. All of these factors provide a boost for the dollar, and with front-end US yields readjusting, there is scope for further gains from the 14-month lows reached in September.

A significant repricing of higher Fed terminal rates back to the vicinity of 3.5%, is growing, especially since the blowout US jobs report at the start of the month. Rate differentials are ultimately the main guide for the dollar and they’ve swung around aggressively in 2024, hence the dollar index is only up 1.6% year-to-date. Ultimately, though, the combination of improving growth and rate differentials, as well as the safe haven demand spurred by geopolitical risks should work in the dollar’s favour. That said, erratic data releases like last week’s jobless claims, as well as impending Chinese stimulus and a tight US election race remain a source of uncertainty, and could operate in the opposite direction for the dollar.

This week, September retail sales and another round of initial claims are in focus as the Fed’s attention has shifted to the employment side of its mandate. However, we’re also keeping a close eye on election news as the pick-up in Trump’s polling also brings tariff policy back into scope, which is another bullish factor for the dollar – highlighted in our US Election Guide.

Important week of UK data

George Vessey – Lead FX Strategist

The British pound is suffering its worst month of the year so far, appreciating against just 16% of its global peers in October. GBP/USD has fallen 2.3%, from above $1.34 to under $1.31, though losses on GBP/EUR remain contained below 0.5% – keeping the pair buoyed above €1.19.

The pound’s positive run in 2024 took a breather following dovish-perceived comments from Bank of England (BoE) Governor Bailey and a fast-approaching Budget statement at the end of October amidst conflicting fiscal policy signals. The deeper losses versus the dollar are in line with narrowing rate differentials amidst the paring back of Fed easing bets. This highlights how sensitive/vulnerable sterling is to Fed rate expectations. Furthermore, the weaker cyclical context via moderating UK economic activity is weighing on the pound in the short-term, whilst rising geopolitical uncertainty and oil prices is hurting it through the risk channel. With bullish GBP bets still overcrowded, a more dramatic sterling depreciation is plausible should we see a sharp unwinding of these positions. Having broken below its 50-day moving average last week for the first time since August, the next target to the downside could be the 100-day moving average located at $1.2941.

This week we get a number of key data points, including a labour market update (Tuesday), inflation (Wednesday) and retails sales (Friday), along with a speech from dovish MPC member Dhingra. Notably, if services inflation fell faster than expected in September, increasing the chance of two 25bps rate cuts by the BoE this year versus the total 38bps priced in, this could be the catalyst to drive GBP/USD under $1.30.

Germany to contract for a second year

Boris Kovacevic – Global Macro Strategist

The common currency struggled for direction and traded slightly lower at the European weekly open this morning. Chinese equities were able to extend their gains on Monday as investors parsed through the somewhat disappointing policy meeting on Saturday, which seemed to lack any urgency to induce significant stimulus into the economy.

EUR/USD will be largely driven by the incoming US macro data and the ECB’s rate decision later this week. The expectations of weaker US data could put a floor under the currency pair, which is currently trading in the lower $1.09 levels. However, the anticipated rate cut from European policy makers and the likely dovish shift from Christine Lagarde could set the stage for another easing in December. This would put the benchmark policy rate at 3%.

The German industry remains in doldrums and signs of a turnaround are missing. The government now expects the economy to continue the contraction from last year into 2024. This would be the first time the German economy fell for two consecutive years since 2003. At the same time, there seem to appear some cracks in the European labor market. The PMI sub-indicators for employment have turned south recently and are in negative territory for the manufacturing sector. Vacancies are coming down and the unemployment rate is expected to rise from historically low levels. All this should support the ECB’s plans to cut rates on a quarterly basis.

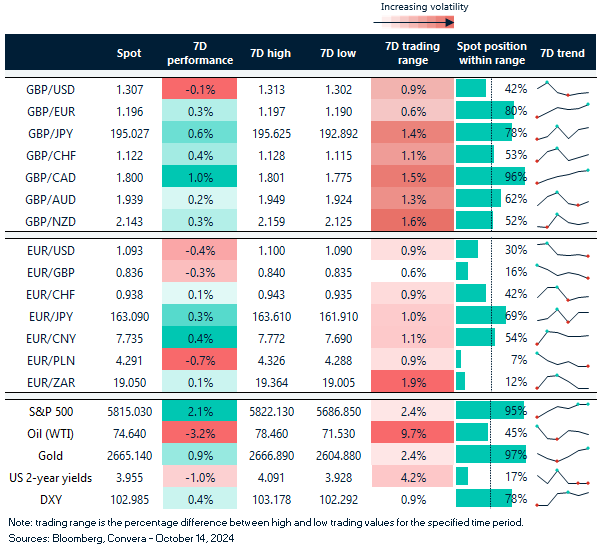

EUR/GBP in bottom quarter of 7-day range

Table: 7-day currency trends and trading ranges

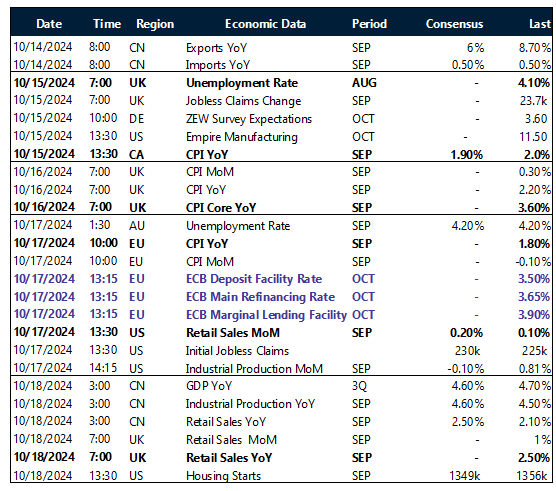

Key global risk events

Calendar: October 14-18

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.