Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

The Daily Market Update will take a break over the holiday period – our final edition is on 20 December 2024. The report will return on 6 January 2025. Our offices will be open as usual but will observe local public holidays. Speak to your account representative for more information.

Fed’s hawkish roar rattles markets

The Federal Reserve delivered a hawkish surprise overnight, shaking global markets. A 25bp rate cut was accompanied by upward revisions to the long-run Fed funds rate (3.0% from 2.9%) and core PCE forecasts for 2024–2027. Chair Powell emphasized caution, signaling the Fed is nearing neutral rates.

US equities tumbled, with the S&P 500 down 2.95% and the Nasdaq Composite falling 3.56%. US Treasury yields climbed 8–11bps across the curve, pushing 10-year yields above 4.50%.

Thursday’s BoJ policy decision could influence USD/JPY, with markets bracing for potential surprises. USD/JPY now hovered near 154.6, supported by higher US yields.

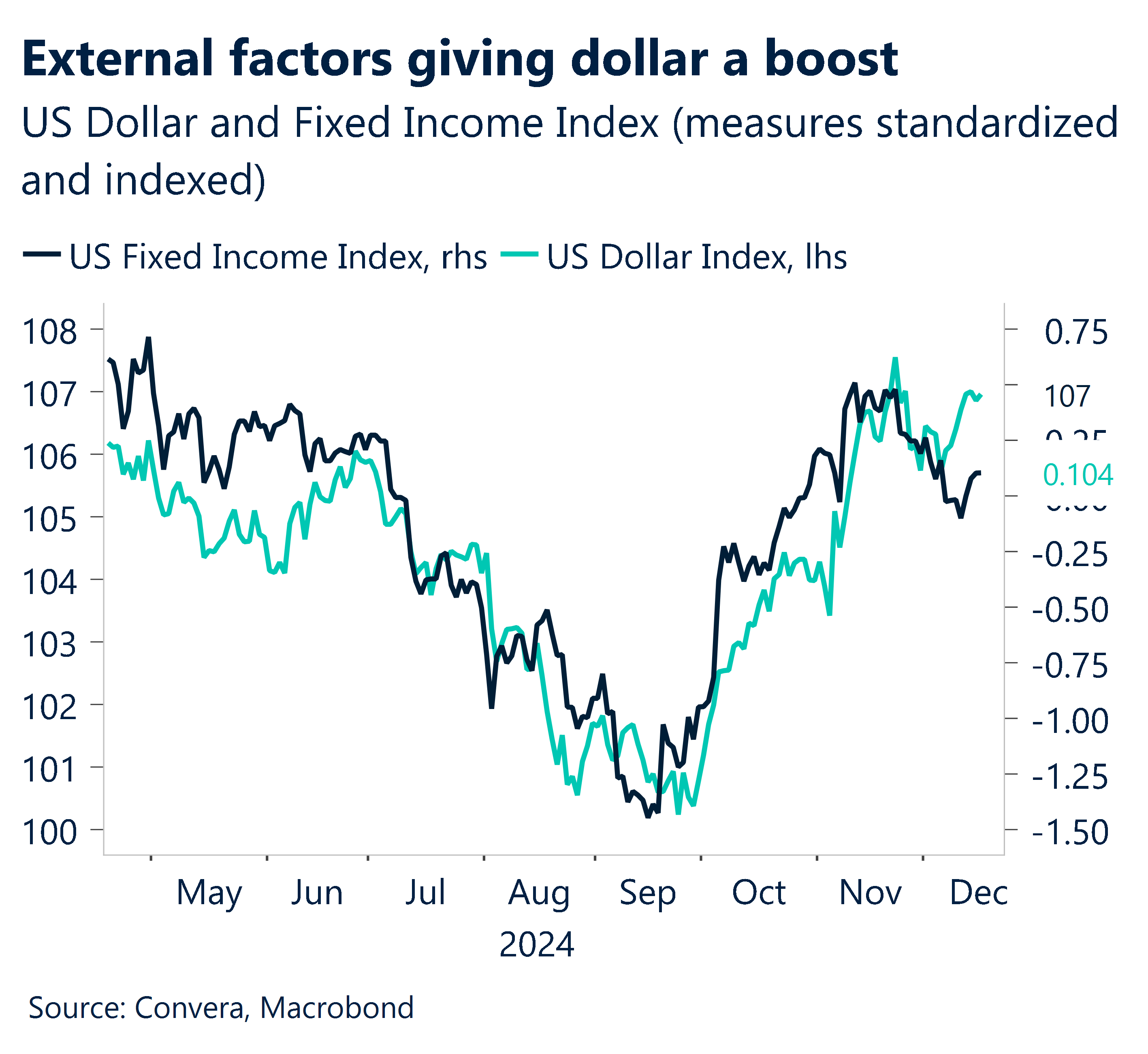

The US dollar extended its rally, with broad strength across G10 currencies.

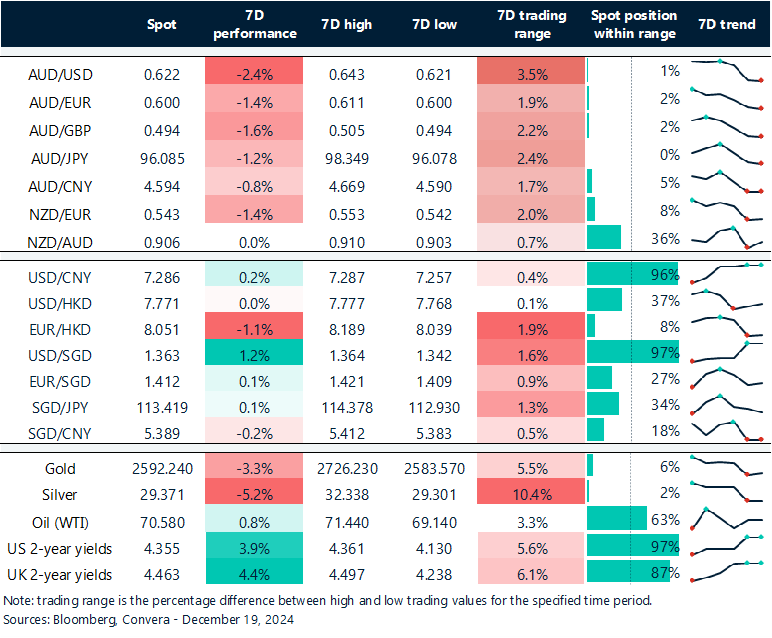

The AUD/USD fell 1.9% as it hit new yearly lows with the Aussie under pressure from USD strength.

The kiwi was also weaker, down 2.3% after a disappointing Q3 GDP report.

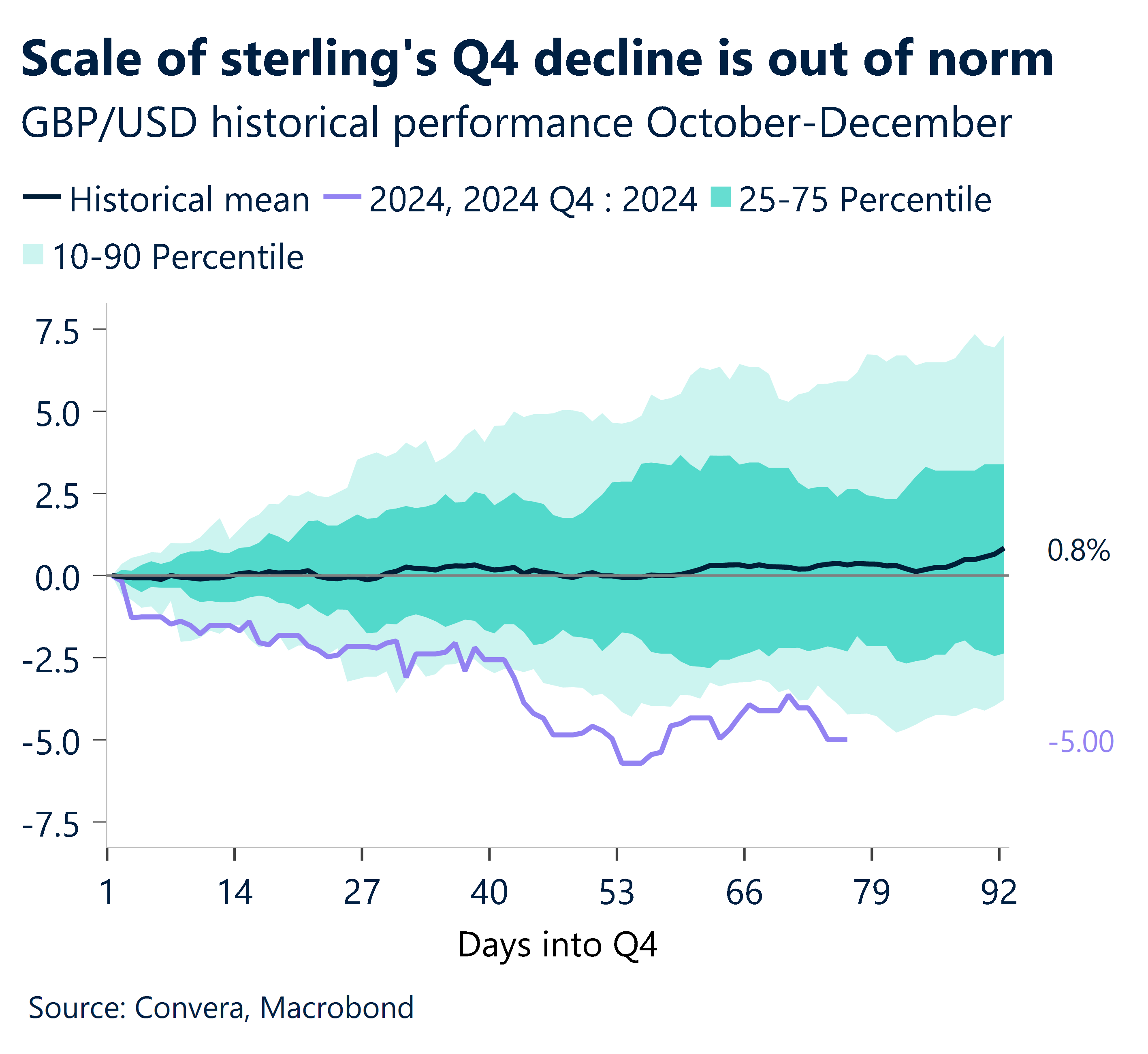

GBP likely to remain range-bound

Today at 23:00 AEDT, the Bank of England bank rate will be made public.

The BoE’s decision to conclude the year should be quite simple; we anticipate an 8-1 vote split (one member voting for a cut) and no changes to rates or guidance.

In order to attain the top end of neutral (3.50%), we anticipate further quarterly reductions through 2025 and in February 2026.

Compared to what market pricing indicates, we notice a few more cutbacks. We see policy divergence emerging between ECB, Fed and BOE.

Key short-term resistance, which includes the post-election breakdown, the September 38.2% retrace, and a cluster of moving averages, was rebuffed by the first GBP/USD recovery from the 1.2486 November low, which was located just above 1.28.

MYR on four month lows

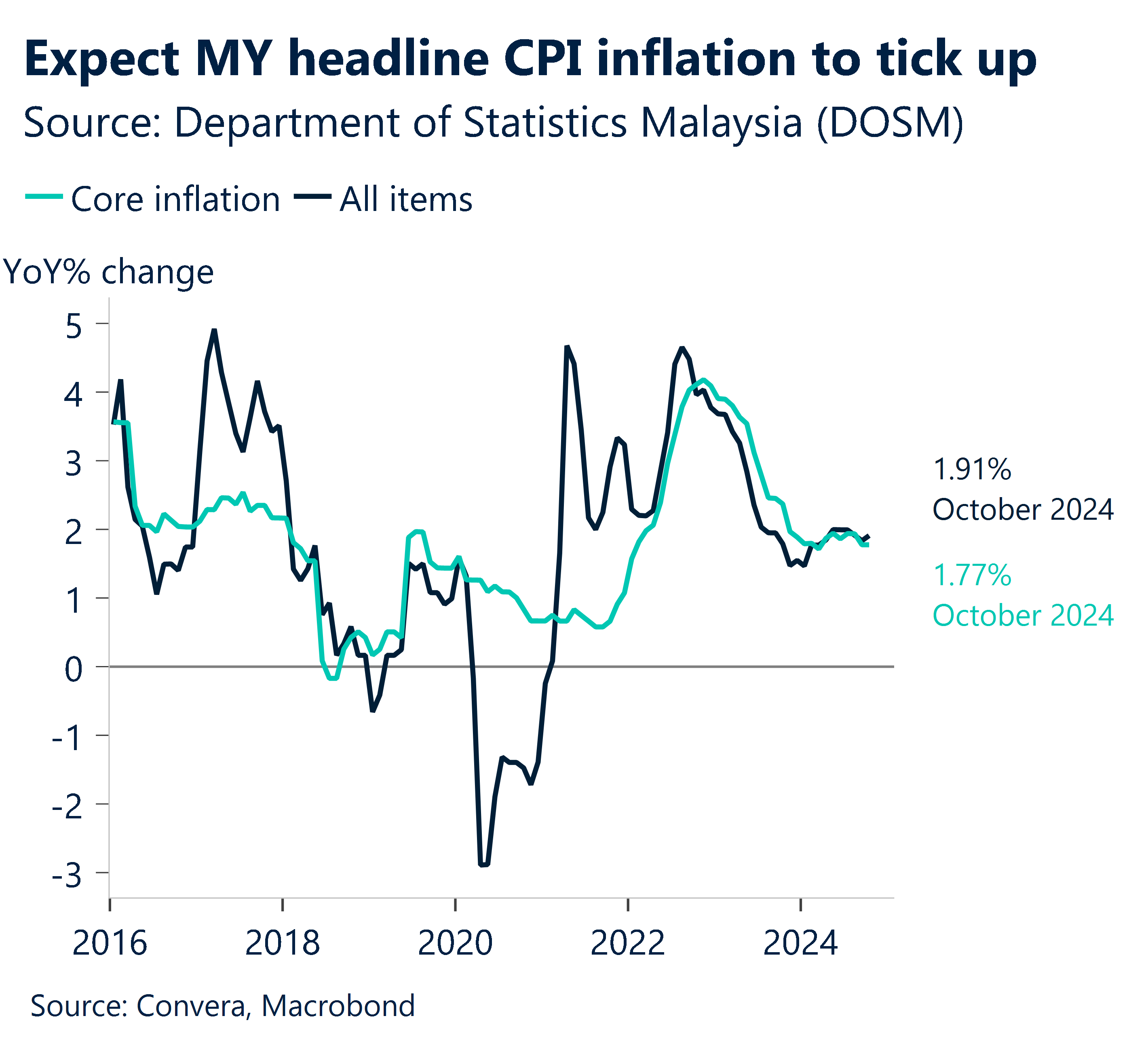

Tomorrow, the Malaysian CPI will be made public.

Due to increased food costs, particularly those of vegetables, brought on by the monsoon season’s severe rainfall and flooding, we anticipate headline CPI inflation to slightly increase from 1.9% in October to 2.0% year over year in November.

Technically, USD/MYR price momentum looks positive, with 50-day EMA of 4.4125 acting as strong key support as the pair is now on four-month highs. Next key resistance is at 4.4891.

Aussie crosses took a deep dive on hawkish Fed

Table: seven-day rolling currency trends and trading ranges

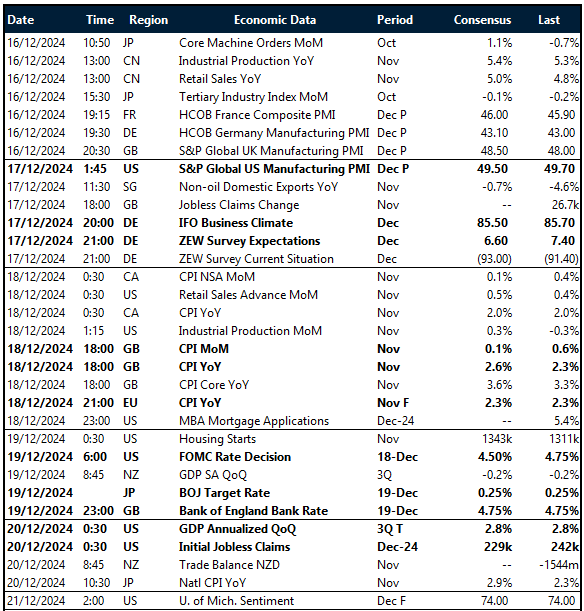

Key global risk events

Calendar: 16 – 21 December

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.