USD steady despite drop in short-term yields

The US dollar finished last week broadly flat after a hotter-than-expected US consumer inflation report (CPI) was balanced by a lower-than-expected producer inflation reading (PPI).

In bond markets, the PPI number clearly took precedence, with the two-year bond yield tumbling from 4.26% to 4.14% on Friday. The market now sees 166bps of cuts from the Federal Reserve this year – more than six 25bps cuts.

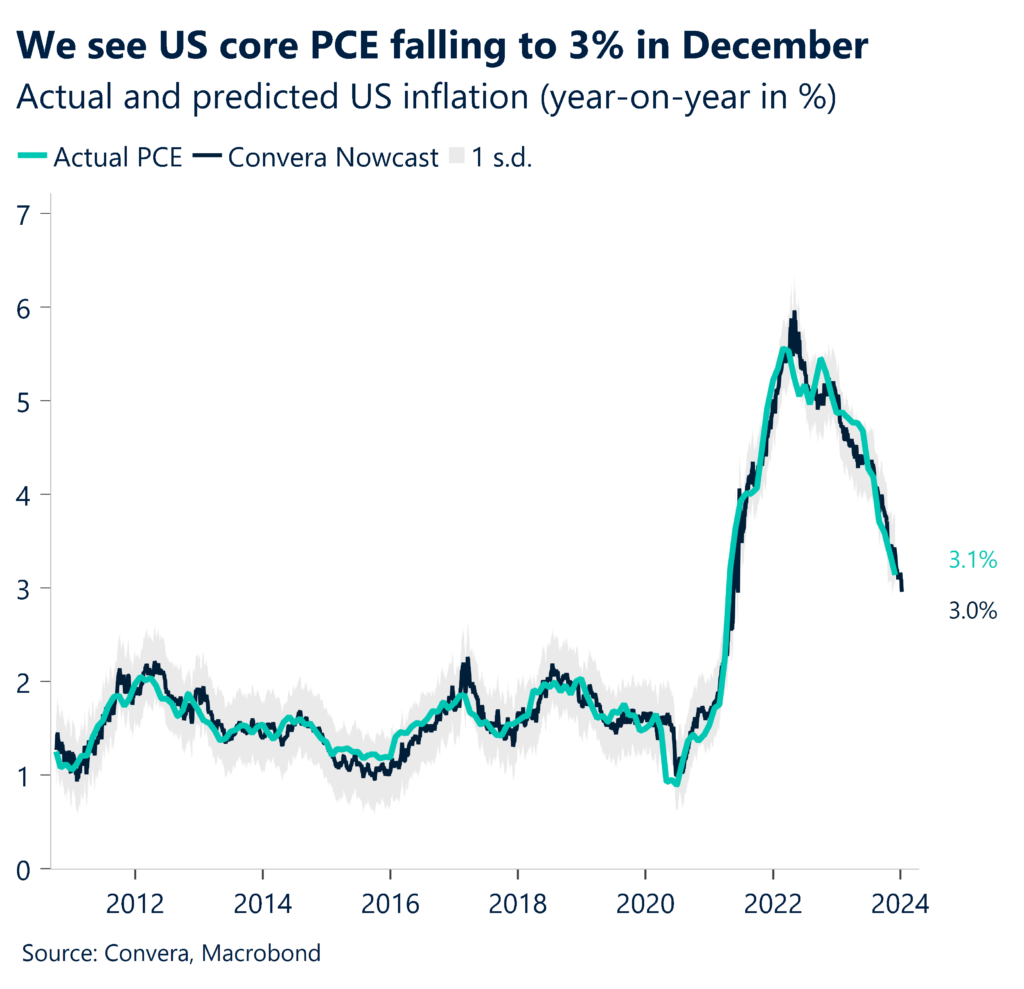

The weaker PPI number sets up a core December PCE (personal consumption and expenditure) at 3.0% — allowing the Federal Reserve to cut rates as soon as March.

Other markets, however, were less moved, with US shares broadly flat and the US dollar index up 0.1% on Friday.

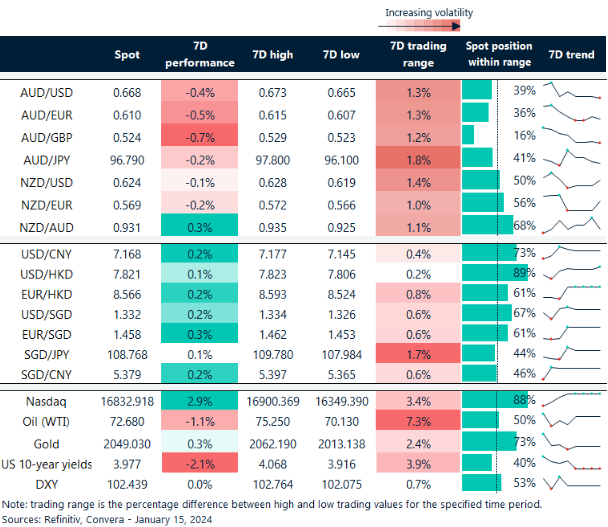

For the week, the AUD/USD was lower, down 0.4%, while the NZD/USD was flat.

In Asia, the USD/SGD gained 0.1% last week, while the USD/CNH climbed 0.3%.

The Chinese economy is likely dominate news flow this week, with its key medium-term lending decision due on Monday and the December-quarter and full-year GDP numbers due on Wednesday.

Elevated equities to be tested

More broadly, despite the recent gains in US sharemarkets, we might see a more difficult macro environment for equities barring swift Fed relaxation of policy. The current state of the equity market is one of out-and-out positivity with volatility close to historical lows despite increasing political and geopolitical threats.

We anticipate reductions to unrealistic consensus growth expectations and another year of flat to low-single-digit profit growth in developed countries. In the backdrop of sticky and lagging wage patterns, the recent disinflationary trend should constitute a significant headwind for corporate profits after a period of unprecedented pricing power.

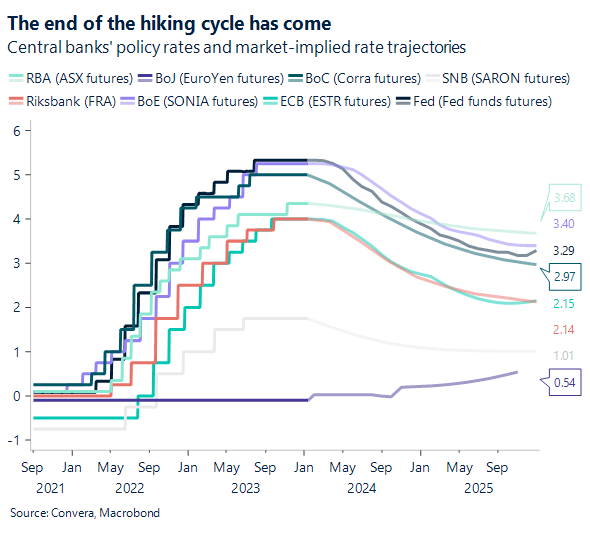

We anticipate little increase in profitability, slower sequential sales growth, and fewer buyback executions. In terms of trends, we believe equities that had outsized margin increases will be at danger. Additionally, we believe that if interest rates stay high (see above select G10 policy rates), firms with poor balance sheets and immediate refinancing requirements may trade lower.

In FX, any fall in equity markets might support the US dollar and see risk sensitive currencies like the Australian dollar and Chinese yuan weaken.

Volatility set to rise as geopolitical risks grow

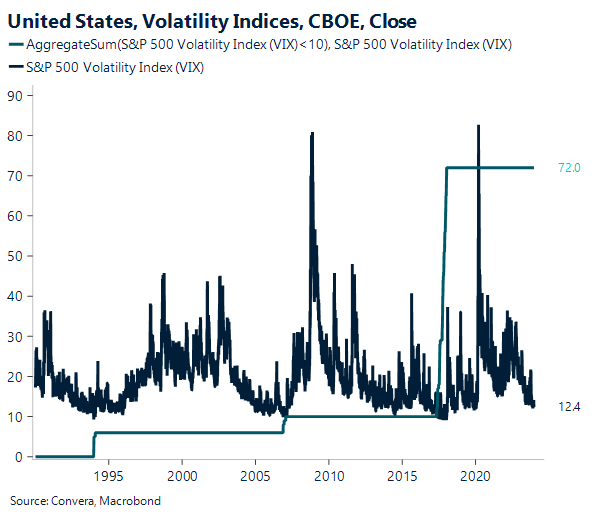

We might also see a pick-up from the low levels of volatility seen in 2023. Technical considerations and longer than typical lags in the transmission of monetary policy contributed to 2023’s relatively low volatility.

The VIX – the Chicago Board Options Exchange’s volatility index sometimes called the “fear index” – could generally trade higher in 2024 given high rates, slowing growth, a challenging backdrop for stocks, and elevated geopolitical risks. The extent of the VIX’s increase depends on the timing and severity of an eventual recession – which remains a real risk – and the timing of a potential volatility surge that could alleviate the structural short-dated volatility selling flows.

As such, we expect to see more rising volatility as a theme for 2024.

USD steady despite PPI drop

Table: seven-day rolling currency trends and trading ranges

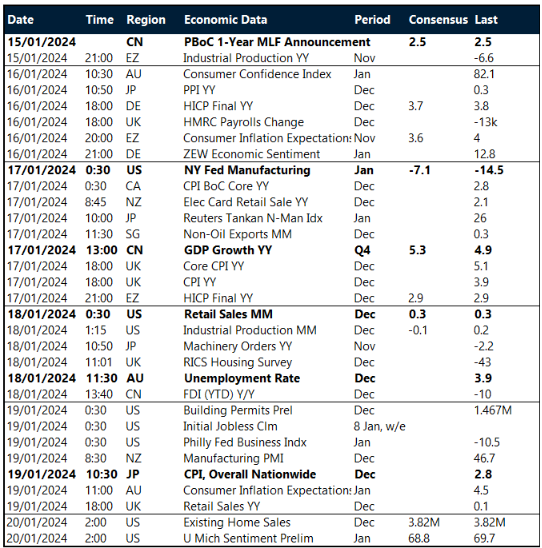

Key global risk events

Calendar: 15 – 20 January

All times AEDT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.