Fed to weigh economic data vs. financial & political woes

The US central bank will most likely increase its benchmark interest rate for the 10th time on Wednesday, amidst signs of sticky inflation and a resilient labour market. However, markets expect the Federal Reserve (Fed) to conclude its tightening cycle with the last 25 basis point hike and are pricing in the first rate cut at the November meeting.

A string of better-than-expected economic data points and the calm on the banking front in recent weeks has strengthened the Fed’s resolve to continue tightening monetary policy. The acquisition of First Republic by JPMorgan Chase & CO, which officially marked the second-largest banking failure in US history, has brought fears about the weakness in the banking sector back to the forefront. However, it will allow the Fed to focus more on inflation than on the financial markets at least during tomorrow’s meeting as the short-term angst hast been calmed. The same cannot be said with the approaching US debt ceiling. The US could default on its debt by June 1 according to Treasury Secretary Janet Yellen. While a default is still unlikely, US 5-year credit default swaps remain at the highest level since 2011, signaling a certain fear about a worst-case scenario unfolding.

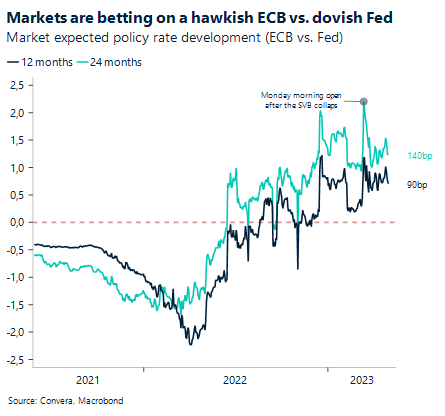

The US dollar index seems to have found a temporary bottom at the 100 mark and has started this week a bit stronger on the back of a surprising ISM manufacturing report. Economic data will continue to guide currency markets as we approach the end of the global tightening cycle. However, as long as markets expect the ECB to out-hike the Fed in the next 12 and 24 months, it will be hard for EUR/USD to weaken substantially.

Inflation in spotlight before ECB

The euro secured its sixth monthly rise in seven against the US dollar but is still struggling to hold north of $1.10 as market participants brace for a critical week of events. It’s all but certain that the European Central Bank (ECB) will continue raising interest rates at its meeting on Thursday, but with headline and core inflation falling noticeably in several European countries, the probability of a 50-basis point hike has reduced.

Germany’s inflation rate fell to an 8-month low in April but remains well above the ECB’s 2% target and food remained one of the biggest inflation drivers. Core inflation momentum across the bloc remains elevated though, amid positive news coming from the real economy. The Eurozone economy expanded 0.1% in the first quarter of 2023, driven mainly by robust services sector activity. Ahead of the ECB meeting, we see overall Eurozone inflation figures revealed today, which could sway the central bank’s decision. If the ECB opts for only a 25-basis point hike, such action could be coupled with clear communication that more will be in store, which should see US-EZ rate differentials continue to narrow (depending on the Fed’s decision of course). The common currency has been bolstered by bets of more rate hikes beyond the May meeting, so even if a 50-basis point hike is off the table, the expectation for the ECB to continue hiking rates through 2023, to a potential peak of 3.75%, should support the euro.

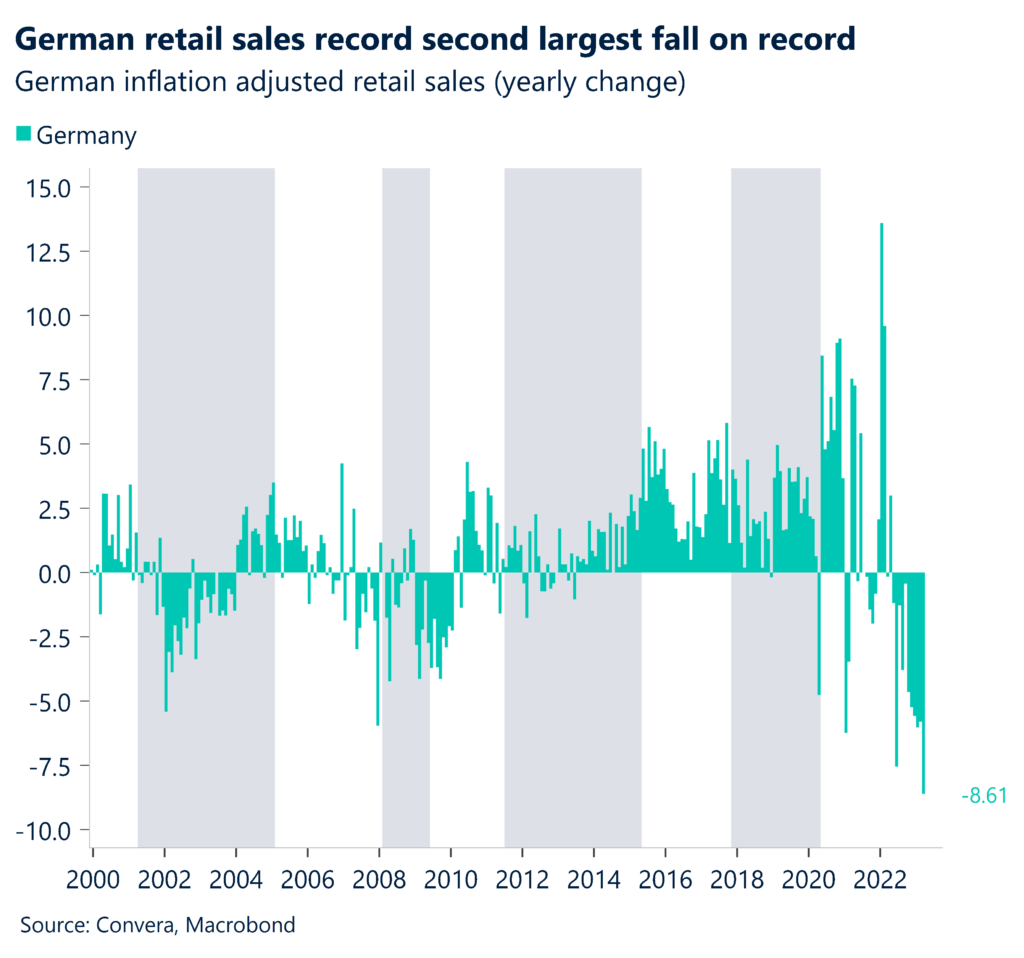

Meanwhile, data this morning showed German retail sales adjusted for inflation have fallen 8.6% on the year, recording their second-largest decline on record in March.

Pound loses grip on $1.25 again

GBP/USD rose to a fresh 1-year high last week, just shy of the $1.26 handle, before erasing most of Friday’s gains and closing below $1.25 on Monday. Against the euro, sterling remains caught in a descending channel, albeit at the top end of its 2023 trading range. Aside from final PMI prints for April, sterling will largely be driven by external factors – namely the Fed and ECB decisions.

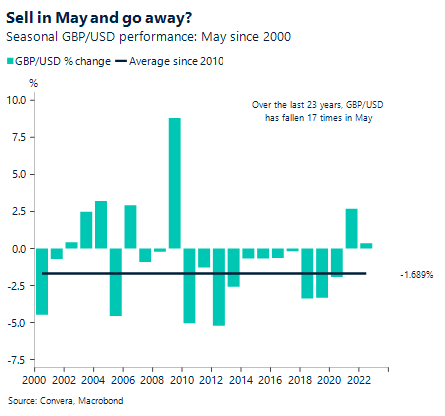

The Bank of England is likely to raise interest rates to 4.25% next week as UK inflation remains in double digits, and services inflation, which accounts for 61% of the consumer price index basket, remains stubbornly high. Although a rate rise in May looks like a done deal, markets are pricing three more hikes over the next four meetings, which would take the BoE’s terminal rate to 5%. The diverging UK-US interest rate outlook is a key catalyst behind the view that sterling will continue climbing, but seasonality trends point to a potential slump this month. Since 2010, the average performance of GBP/USD is -1.69% in May. Amidst the current low market volatility, the pound looks like its nearing a tipping point, which could be triggered by the Fed and ECB meetings this week.

Monetary policy decisions are integral for currencies as evidenced by the surge of the Australian dollar this morning, dragging GBP/AUD over 1% lower, following the surprise rate hike by the Reserve Bank of Australia.

Yen dumped, Aussie jumps

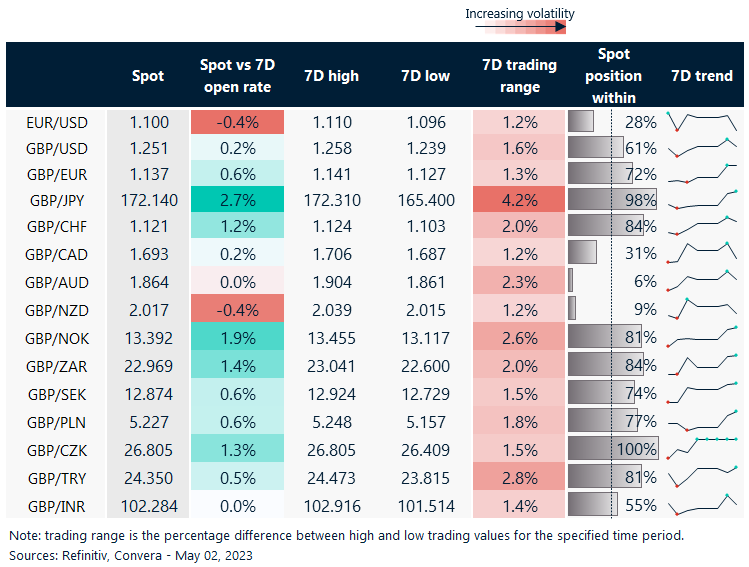

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 1-5

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.