FX markets turned nervous ahead of tonight’s critical US inflation report with the US dollar lower and European currencies in favour.

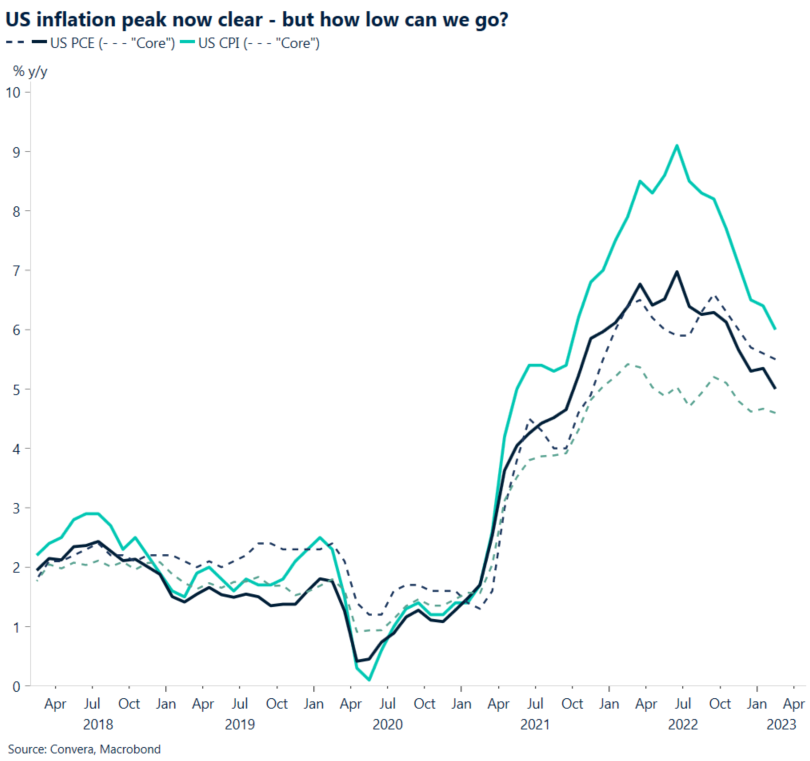

Tonight’s consumer price index result will have a major impact on the US Federal Reserve’s next move. If inflation comes in lower than expected, the Fed might have less need to hike rates, causing the US dollar to ease.

Forecasters are looking for a big fall in headline inflation – from 6.0% in February to 5.2% in March. The core number, which excludes food and energy, is forecast to climb from 5.5% to 5.6%.

US CPI is due at 10.30pm AEST.

FX focus shifts to Europe

With the US Federal Reserve potentially nearing an end to its rate-hiking cycle, the global focus has shifted to European markets.

The European Central Bank was later than most central banks to begin lifting rates, and with the inflationary impact of the Russian invasion of Ukraine, the ECB is seen as likely to continue to raise rates. The Bank of England and Swiss National Bank find themselves in similar situations.

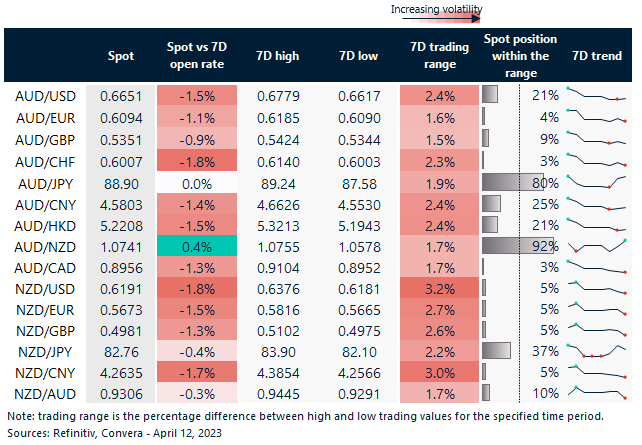

With further rate hikes looming, European currencies have outperformed, pushing the AUD/EUR to 18-month lows and the NZD/EUR to 30-month lows. The Aussie and kiwi have also seen big losses versus the British pound and Swiss franc

RBA, RBNZ seen as done

The Australian and New Zealand dollars have been mostly lower in other markets with both the Reserve Bank of Australia and Reserve Bank of New Zealand now seen as likely to be on hold.

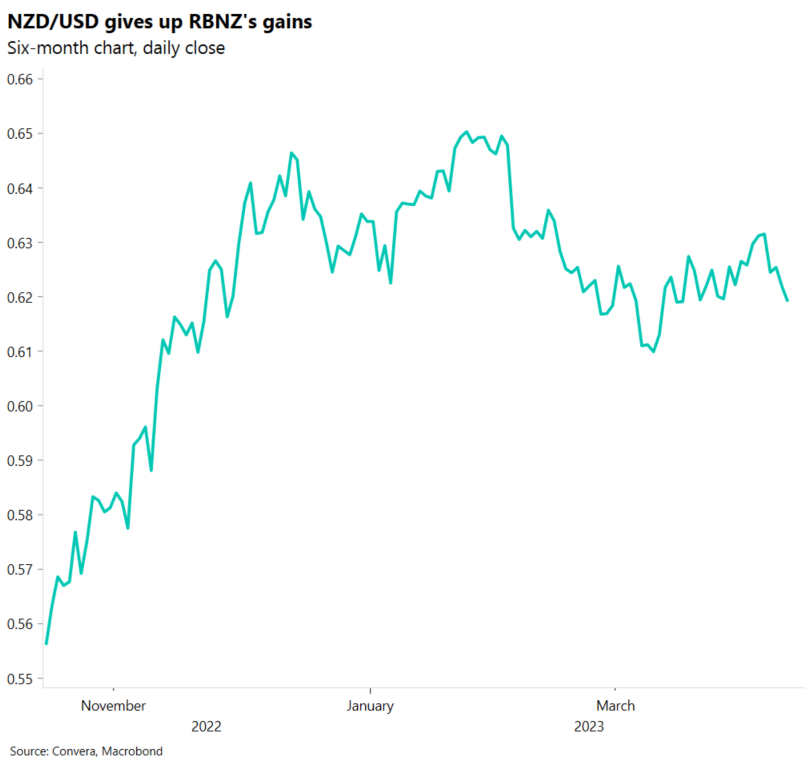

Most notably, market expectations have turned sharply in New Zealand, with last week’s 50-basis point hike to 5.25% seen as the final move from the RBNZ. The bond market has no more NZ rate hikes priced in with a 90% chance of a cut by February 2024 (source: Refinitiv, 12 April).

The kiwi has reversed sharply since last Wednesday’s hike – the NZD/USD has fallen more than 3.0% from Wednesday’s post-RBNZ high.

The Australian bond market also sees no more rate hikes in its current pricing with a 25-basis point cut forecast by April 2024.

AUD/EUR and NZD/EUR hit multi-year lows

Table: seven-day rolling currency trends and trading ranges

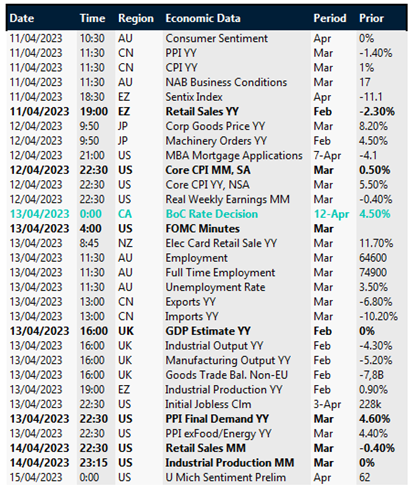

Key global risk events

Calendar: 10 – 15 April

All times AEST

Have a question? [email protected]