Written by Convera’s Market Insights team

The Daily Market Update will take a break over the holiday period – our final edition is on 20 December 2024. The report will return on 6 January 2025. Our offices will be open as usual but will observe local public holidays. Speak to your account representative for more information.

Risk-off on US funding bill drama

George Vessey – FX Strategist

Sentiment across financial markets has turned sour at the end of the week, as a bill to extend US government spending to March 14 fell far short of the two-thirds majority needed to pass. US Congress needs to find a deal today to keep the government open. Equities futures are in the red and the safe haven and high yielding US dollar is modestly stronger against peers.

It was the House of Representatives that rejected the Trump-backed package, with critics describing the breakdown as an early glimpse of the chaos to come when Trump returns to the White House. The risk off mood has seen the US dollar index remain around the 108.5 level, near its highest since November 2022, as investors also await the latest PCE price index report, the Federal Reserve’s (Fed) preferred measure of inflation. The 12-month inflation rate is expected to remain above the central bank’s 2% target. The Fed’s widely anticipated quarter-point rate cut this week was accompanied with hawkish guidance, as the central bank signalled fewer cuts in 2025 due to persistent inflation. The Fed now projects only two more rate reductions next year, a significant shift from the four cuts previously expected in its September forecast.

Coinciding with the US inflation data and funding bill drama, is a record $6.6 trillion in options due to expire in Friday’s ‘triple witching’. The quarterly event is always closely watched by traders, but the stakes are especially high following Wednesday’s Fed-inspired selloff. Amidst all these concerns, traders are bracing for volatility as witnessed by the second biggest one-day spike in the Wall Street’s so-called fear gauge, in the last three years.

Sterling drops to 6-month low after BoE

George Vessey – FX Strategist

The pound in under pressure after the Bank of England (BoE) left its Bank Rate unchanged at 4.75%, in line with expectations. The greater impulse for markets came from the fact that three officials voted for a cut, as opposed to the previous 8-1 split in favour of a hold. This sent a moderately dovish signal to markets, weighing on short-dated gilt yields and sterling.

The dovish dissent was greater than many had anticipated, but was backed-up by the committee downplaying the importance of this week’s stronger pay data stating it “has tended to be more volatile than other wage indicators”. Moreover, it seems recent soft data for activity and employment appear to have tipped the balance. It therefore looks likely that the BoE will cut its key interest rate by 25 basis points in February, maintaining the ‘cut-hold’ tempo. Indeed, markets have boosted bets on such a scenario, from around a 50% probability to over 70%. However, still only 57 basis points of cuts are priced in for 2025 versus the 100 basis points indicated by BoE Governor Bailey. Should market pricing fall more in line with the BoE’s expectations, the pound is at risk of weakening further in 2025.

GBP/USD has fallen to its lowest in six months, back below its 100-week moving average and the $1.25 support level. More downside is possible given the relative strength index is yet to move into oversold territory on the weekly and daily timeframes. GBP/EUR, meanwhile, has held up better over the past few months due to favouring rate differentials and the euro’s domestic bearish factors.

A historic year for the euro

Boris Kovacevic – Global Macro Strategist

The euro seems to be establishing a short-term bottom around the $1.0350 mark as the currency continues to struggle with the growing divergence between the Fed and ECB and weak domestic macro data. A close below $1.0410 today would be the lowest level EUR/USD ended any week so far this year. The last risk event euro bulls can hope for before going into the weekend is the release of the US PCE inflation number. The consensus expects a downshift in core price pressures from 0.3% in October to 0.2% in November. However, personal spending is expected to have accelerated from 0.4% to 0.5%.

We tend to think that the room for surprises lies to the upside when it comes to consumption data. This will make it difficult for the euro to recover enough to end the week in positive territory, which means that EUR/USD will have fallen in six out of the last seven weeks. Given that we lack any meaningful data until year end, the currency pair is likely to end 2024 overall with a loss. Furthermore, if the euro does not recover beyond $1.05 in the next 11 days, it will record the lowest yearly close since 2002.

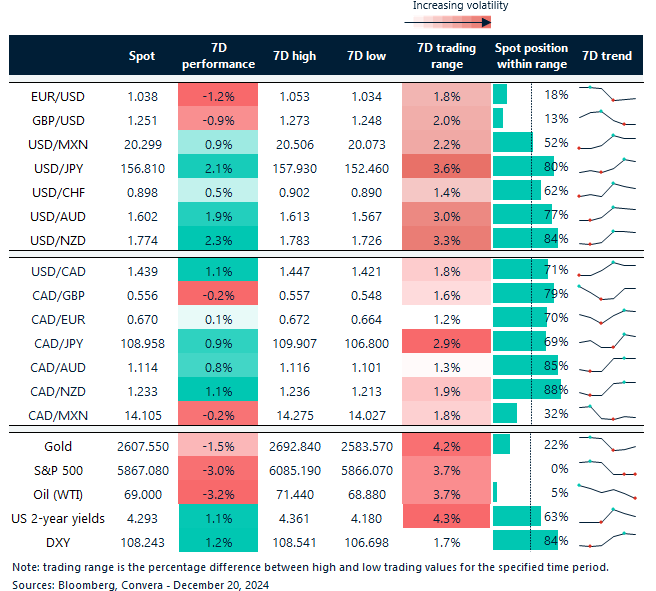

Equities plunge 3% this week; USD dominates

Table: 7-day currency trends and trading ranges

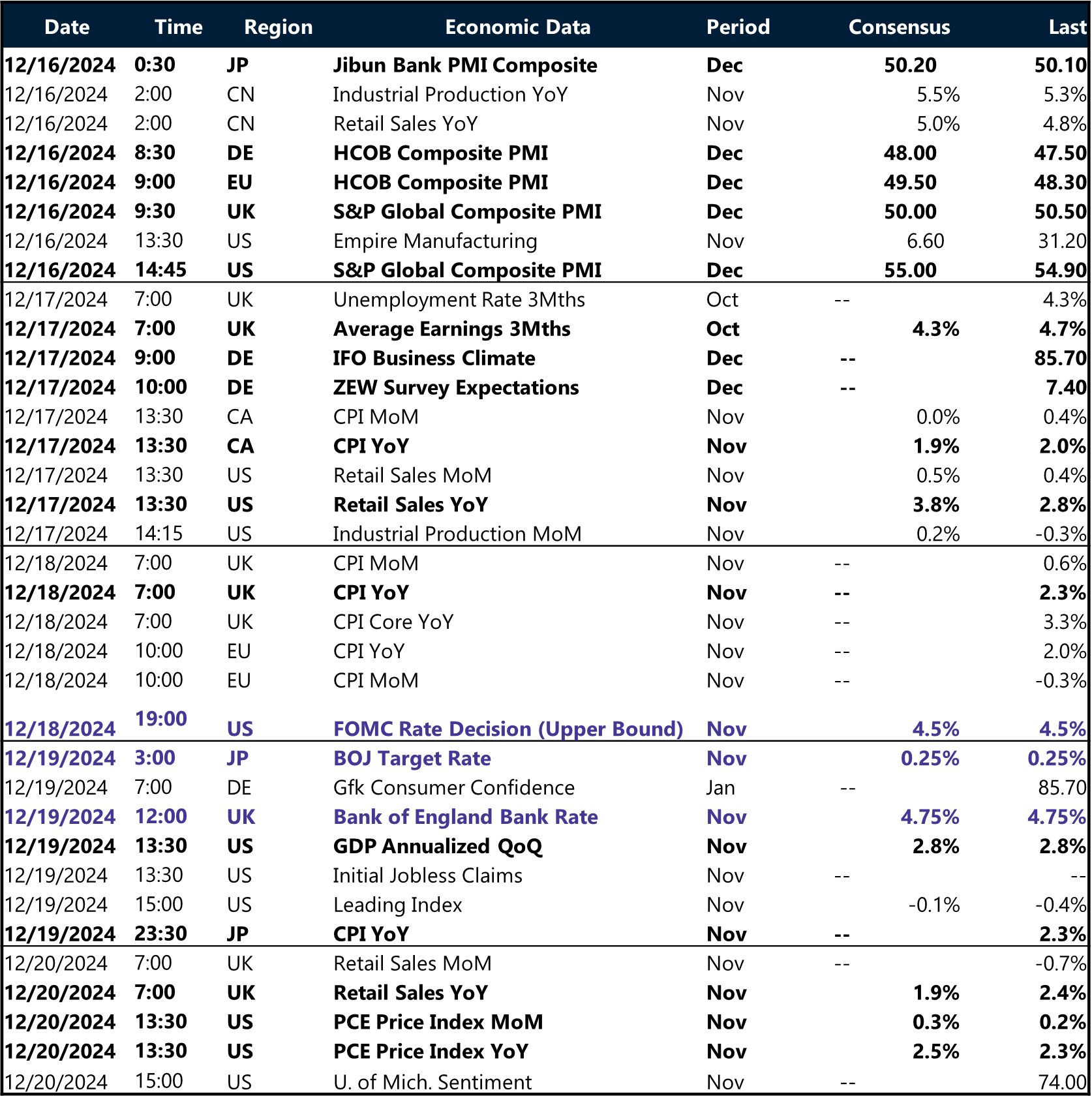

Key global risk events

Calendar: December 16-20

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.