Written by Convera’s Market Insights team. We’re producing a single, global edition of the Daily Market Update this week with the Market Insights team on conference. We’ll resume our usual publication schedule next week.

Dollar shrugs off weak jobs data

US jobs openings fell by 418,000 to 7.443 million in September, below market expectations and the lowest level since January 2021, indicating the labour market is cooling. The US dollar hovers close to 3-month highs still though as investors await the plethora of risk events looming. Stocks in the US were mixed, propelled by gains in tech shares ahead of important earnings and economic data releases.

With just about a week away from the Federal Reserve’s (Fed) decision, the job openings figures contrast with the September employment report that pointed to a still-strong labour market, which prompted traders to trim bets on another big rate cut. This Friday we’ll get a the latest data, which could prove meaningful for the Fed with the odds for a 25bps rate reduction currently at around 95%. Meanwhile, bets for a Donald Trump victory have also been pressuring the dollar higher as his policies on tariffs, taxes and immigration are seen as inflationary. But the polls are still close and uncertainty about the market response to the elections remains high.

According to FX options, the market expects the bulk of the FX reaction to materialize in the week around the election. Perhaps because the result might still be uncertain on the day after the election, and also because the Fed is scheduled to meet the same week. Indeed, the two-week implied-realised volatility spread for EUR/USD, hasn’t been this high since the turbulent 2017 French elections.

Sterling strengthens going into Budget

The British pound is flirting with $1.30 versus the US dollar again, buoyed by a rise in risk appetite which has seen equities stretch higher and Bitcoin nearing fresh all-time highs.

Against the euro, the pound is also pushing higher, appearing to form a strong base around €1.20 as we head into a key domestic risk event – the UK government’s Budget announcement. If the market thinks the new tax rises will lower the UK’s growth potential, the pound could come under selling pressure. However, we think the budget will be expansionary as the Chancellor has changed the UK’s fiscal rules to allow her to borrow more money in order to invest in projects that would boost the UK’s growth potential. This might be another reason why sterling has shifted higher so far this week.

If the Budget prompts rates traders to be more conversative with their pricing of Bank of England rate cuts in the future, the pound may encounter a fresh wave of demand as a result of improving rate differentials.

AUD/USD is currently at 2-month low

Technically speaking, the 200-day moving average of 0.6658 and other close levels are where the AUD/USD seeks to reverse. The retracement levels of 0.6739 and 0.6817 are short-term resistance. The next short-term support of 0.6348 looms.

The Australia CPI will be released today. The headline CPI inflation is expected to decrease from 3.8% y/y in Q2 to 2.9% y/y in Q3. As a result of a 7% quarterly drop in fuel prices and a 15% quarterly drop in electricity costs, we anticipate a small 0.3% quarterly increase in the headline CPI in Q3. The main core CPI is expected to rise more noticeably by 0.7% q/q and 3.4% y/y. The service price is expected to have increased by a still concerning 1.0% q/q and 4.5% y/y. We believe that this also probably decreased to around 2.3% y/y in September from 2.7% y/y in August, which is also indicative of reduced fuel and electricity costs, according to the most recent monthly CPI figure.

Yen still under pressure ahead of BoJ

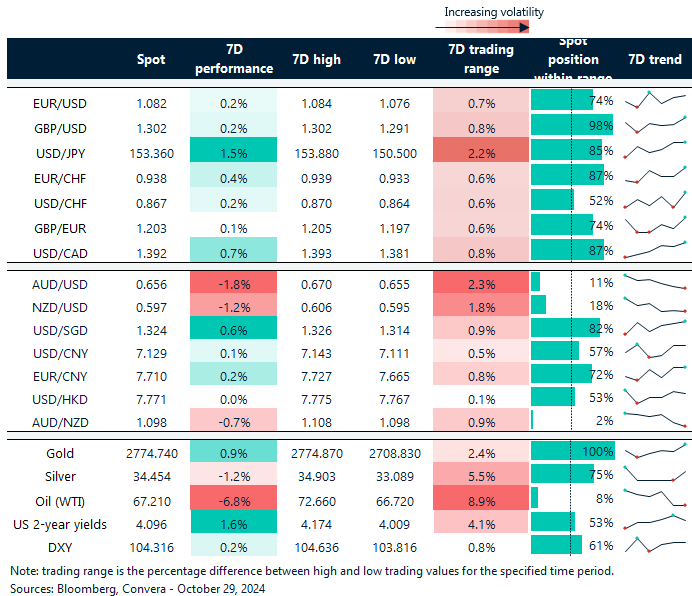

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: October 28 – November 1

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.