Global overview

The U.S. dollar’s bounce higher Monday faded as markets returned to full participation following Easter holidays. Rival currencies from Europe and Canada regained the upper hand against the greenback ahead of an eventful week that could shed light on the future course for U.S. interest rates. The dollar rebounded from multimonth lows after solid U.S. jobs data suggested the Fed wasn’t done raising rates. Attention now turns to U.S. consumer prices on Wednesday and retail spending on Friday. Consumer inflation is expected to extend a moderating trend to a 5.2% annual rate in March from 6% in February. Lower inflation would show the Fed’s rapid rate hikes cooling prices. Still, inflation remaining far above the Fed’s 2% goal could pour cold water over prospects for economy-boosting rate cuts by year-end. Meanwhile, elevated inflation and higher borrowing rates are expected to weigh on retail sales, with forecasts of a second straight 0.4% fall in March. The buck continues to move in fits and starts as mixed data leads markets to recalibrate the path ahead for Fed policy.

Euro bounces back

Europe returned from the long Easter holidays by buying the euro, following its Monday dip. Improved risk sentiment buoyed the euro as it curbed safety flows into the greenback. The euro was little moved by data that showed euro zone retail sales contracted 0.8% in February, following a 0.3% gain the prior month, a decline that met market expectations. The data added pressure on Europe’s inflation fighters to continue to push borrowing rates higher, given the toll it’s taking on consumers. Europe’s higher rate outlook, meanwhile, has been a source of strength for the euro, particularly with the Fed seen nearing the end of its rate hiking campaign.

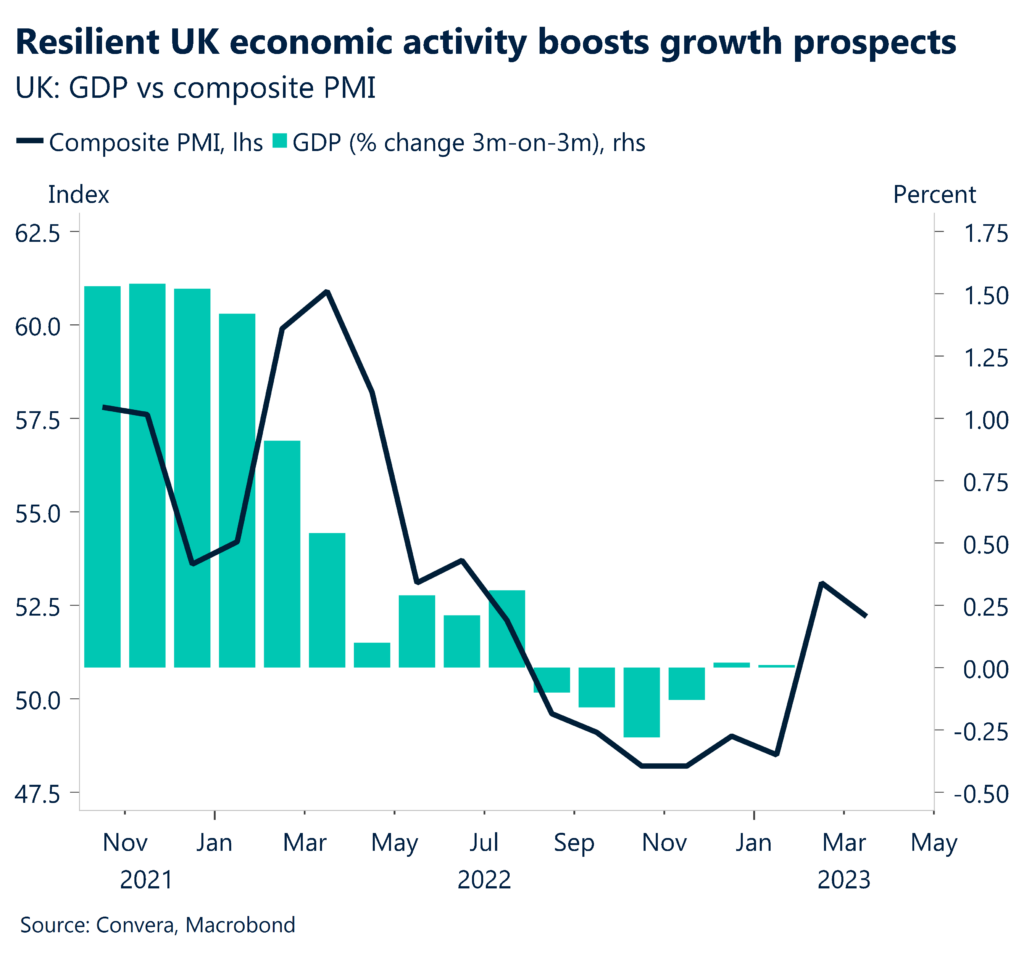

Sterling resumes ascent

Sterling jumped toward recent multimonth highs as the greenback softened and European markets returned from the holiday with an appetite for risk taking. It’s also helping that the UK’s double-digit rate of inflation suggests more pound-positive rate hikes are on the Bank of England’s table. The choppy pattern for GBP/USD is likely to remain in place over the short run, given influential data from both sides of the pond this week on U.S. inflation and UK growth. Ahead of America’s recent jobs report, the pound had been flying at its highest level in 10 months.

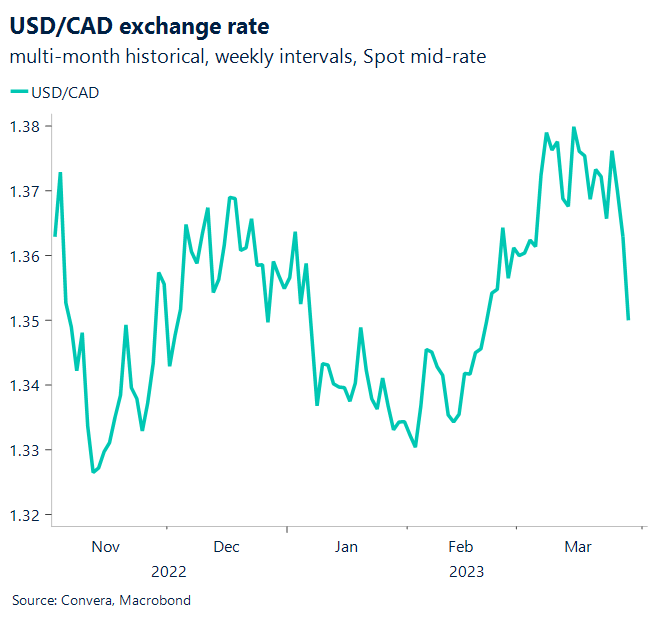

C$ steadies ahead of BOC decision

Canada’s dollar recovered after hitting April lows the previous day as markets readied for a policy decision from Ottawa. The Bank of Canada Wednesday is expected to hold interest rates at 4.5%, following a welcomed slowdown in domestic consumer inflation to a 5.2% annual rate in February, the lowest level in more than a year. Central bankers will issue updated economic projections that could indicate whether borrowing rates have peaked. The rate outlook will be critical for the loonie and any downplaying of rate cut prospects this year could add traction to the Canadian unit’s climb.

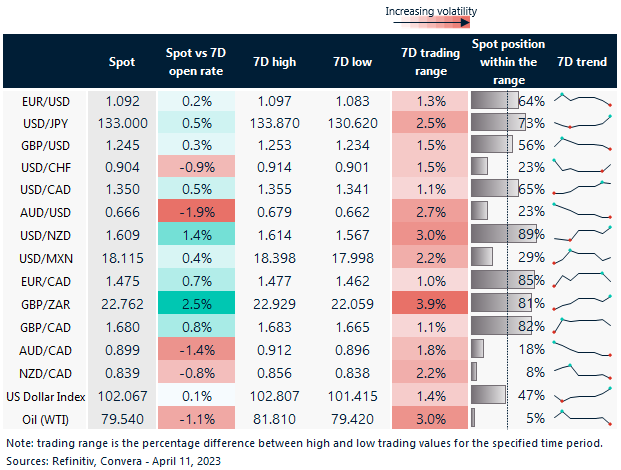

Dollar seesaws as markets weigh U.S. interest rate path

Table: rolling 7-day currency trends and trading ranges

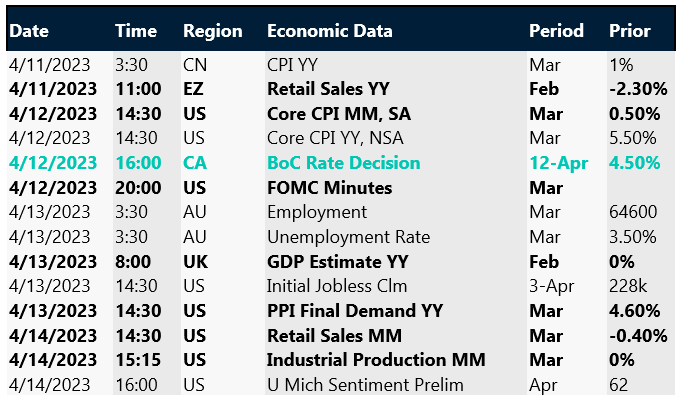

Key global risk events

Calendar: Apr 10-14

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.