Global overview

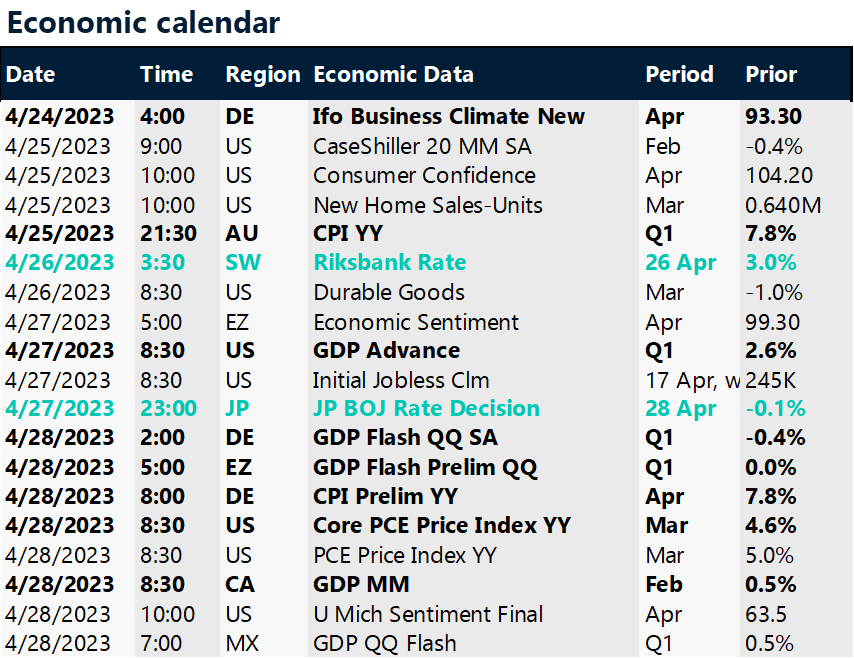

The U.S. dollar wavered after it snapped a multiweek skid with attention this week turning to American economic fundamentals. The mixed greenback slipped to 10-day lows against the euro but climbed to 3 ½ week highs against the Canadian dollar. The UK pound was little changed. The dollar eked out a gain last week, its first in six weeks that halted its longest losing streak since mid-2020. Despite the dollar’s better performance, it’s not out of the woods as the outlook for global interest rates continued to hold significant sway. Fed policy remained a vulnerability for the dollar on the view that America’s central bank may soon pause dollar-friendly rate increases. Meanwhile, the economic numbers that help dictate the direction for borrowing rates will command center stage this week. U.S. first quarter growth Thursday is forecast to show the economy slowed to a 2% annual rate from 2.6% during the fourth quarter. A key measure of underlying inflation, the core PCE price index, looms Friday and is forecast to tick down to a 4.5% annual rate in March. If realized, slower growth and cooler core inflation could reassure Fed officials and lead them to pause rate hikes in June following an expected rate hike next week.

German confidence trends higher

The euro rose to 10-day high as its slight dip the previous week gave way to renewed buying. Upside for the euro was slowed, however, after a gauge of German business confidence improved less than expected. Germany’s influential Ifo survey ticked up to 93.6 in April, its sixth rise in as many months, from a downwardly revised 93.2 in March. On the one hand, Germany appears to have enough economic momentum to dodge recession. But on the other hand, Europe’s biggest economy is still stuck in a low gear that could limit scope for ECB rate increases aimed at quashing inflation.

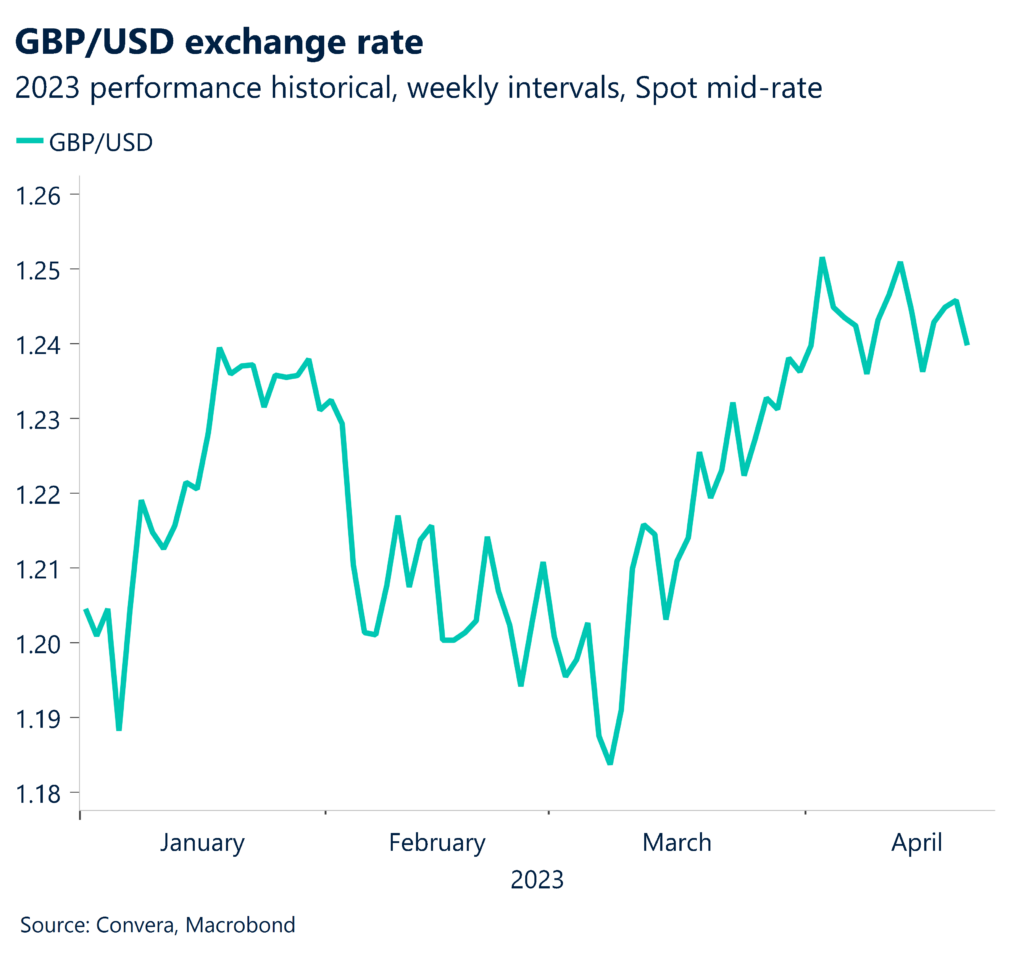

Sterling steadies after weekly rise

The UK pound stabilized below 10-month peaks against its U.S. counterpart with upside checked by the still shaky prospects for British growth. Sterling eked out a gain last week versus the otherwise firmer greenback, but it was a tepid one amid mixed signs on the UK economy. Inflation remains problematic for the Bank of England after it kept above 10% for a seventh straight month in March. High inflation opened the door wider for the BOE to remain on a higher rate path. Still, more expensive borrowing doesn’t bode well for consumer and business spending or the wider UK economy.

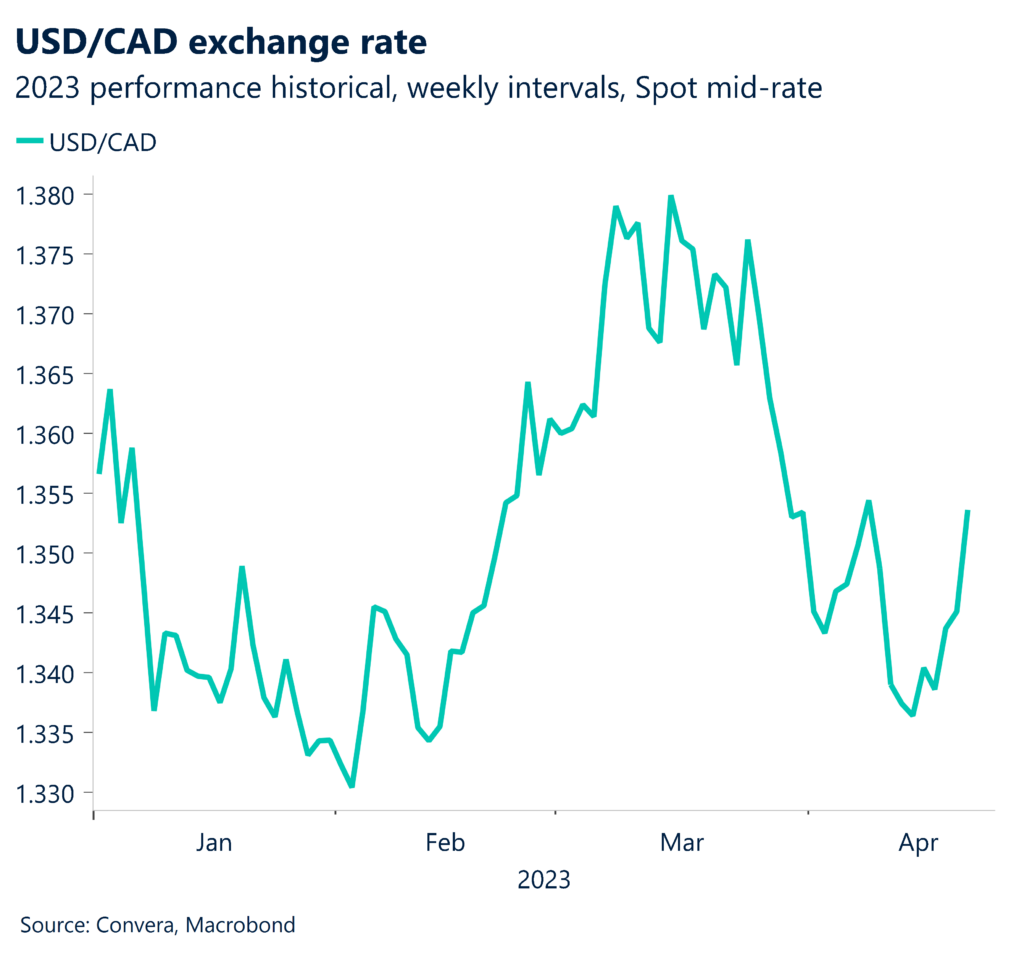

C$ falls to 3 ½ week low

The Canadian dollar fell to 3 ½ week lows against the U.S. dollar as ongoing worries about global growth kept oil prices to lower levels below $80. USD/CAD is little changed on the month and for the year, amid expectations that U.S. and Canadian borrowing costs are at or near peak levels. Canada issues monthly growth Friday that’s forecast to show the economy cooled to a 0.2% pace of expansion in February after it grew 0.5% in January. The Bank of Canada has forecast slower growth as the economy absorbs higher interest rates designed to return inflation, currently at 4.3%, back to its 2% goal.

U.S. economy looms large for dollar this week

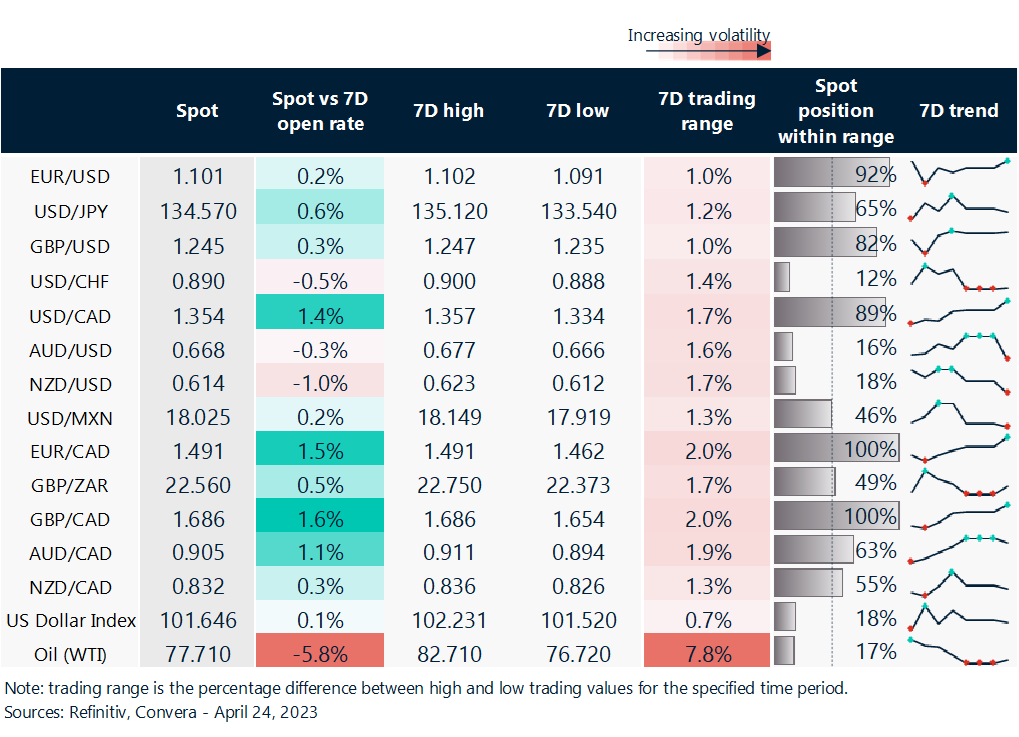

Table: rolling 7-day currency trends and trading ranges

Key global risk events

Calendar: Apr 24-28

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.