Global overview

The U.S. dollar was camped near session lows as worries about the health of global banks subsided. The dollar was generally subdued against the euro, sterling, and Canadian dollar. Markets received a welcome fillip this week after First Citizens acquired Silicon Valley Bank, the collapsed U.S. bank that precipitated the wave of banking turmoil. Markets are also taking comfort from officials emphasizing that banks are “sound and resilient,” which for now has fastened a lid on the crisis. The calmer market backdrop, meanwhile, has markets considering economic fundamentals. Signs of a weakening U.S. economy suggest the Fed may be done hiking interest rates. Moreover, should the world’s largest economy lose a material head of steam, central bankers may need to reverse course and cut interest rates by year-end. By contrast, any rate cuts from Europe may lurk further around the bend, given higher rates of inflation abroad. A survey today is forecast to show U.S. consumer confidence moderated slightly in March.

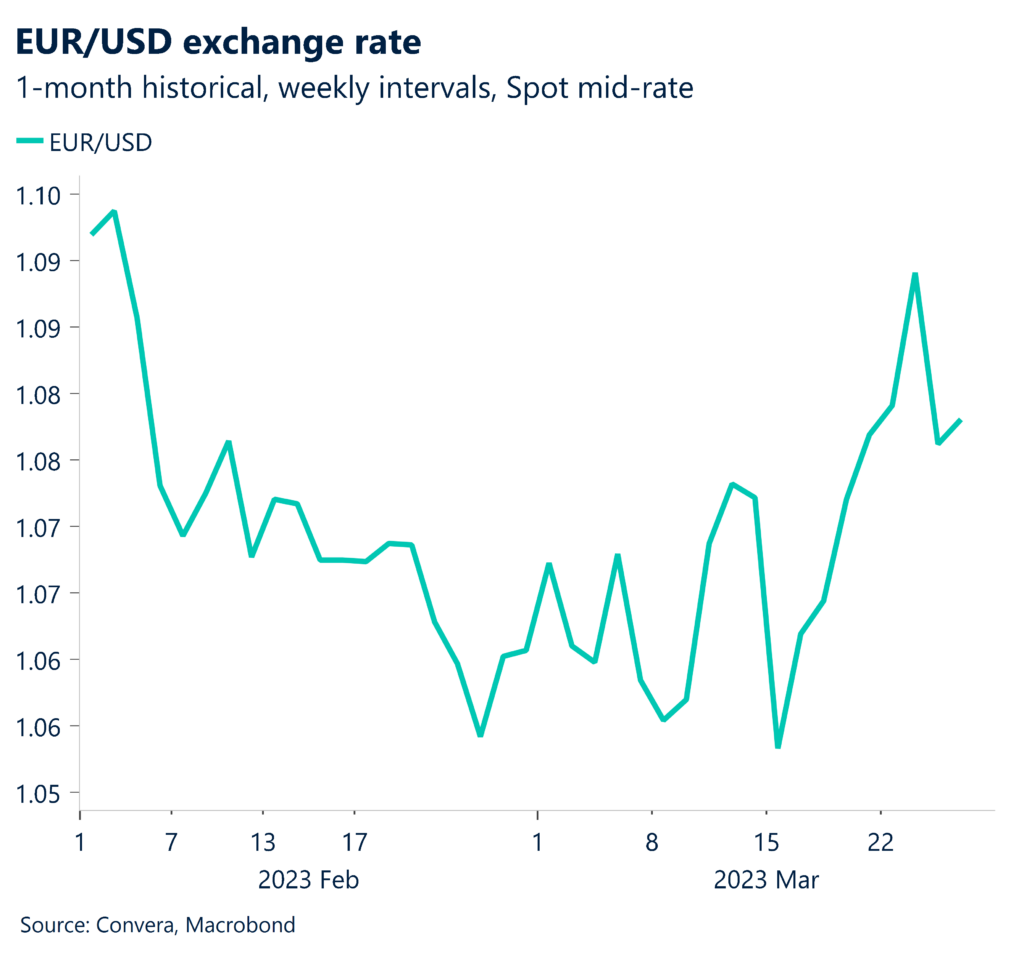

Euro firms toward 6-week highs

The euro firmed toward last week’s six-week top against the greenback as the temperature of the global banking crisis abated and curbed safety demand for the U.S. unit. Still, the banking crisis appears to be running an elevated temp, so any renewed flare up in the turmoil could spur a flight to safety in the greenback. After the banking crisis, global monetary policy is also top of mind and a source of strength for the euro, given that the ECB is penciled in to deliver more rate increases this year than its U.S. counterpart, the Fed.

Sterling boosted by BOE’s tough talk on inflation

Sterling climbed to within arm’s reach of recent 7-week peaks, buoyed by improved risk sentiment and the Bank of England reaffirming its inflation-fighting stance. The head of the BOE this week reiterated that policymakers would raise rates as needed with UK inflation remaining stubbornly high above 10%. The pound has wavered as expectations for rate increases wax and wane. The BOE last week raised rates to 4.25%, the highest level in 14 years, and kept the door unlocked to further increases aimed at putting inflation on a sustained downward path.

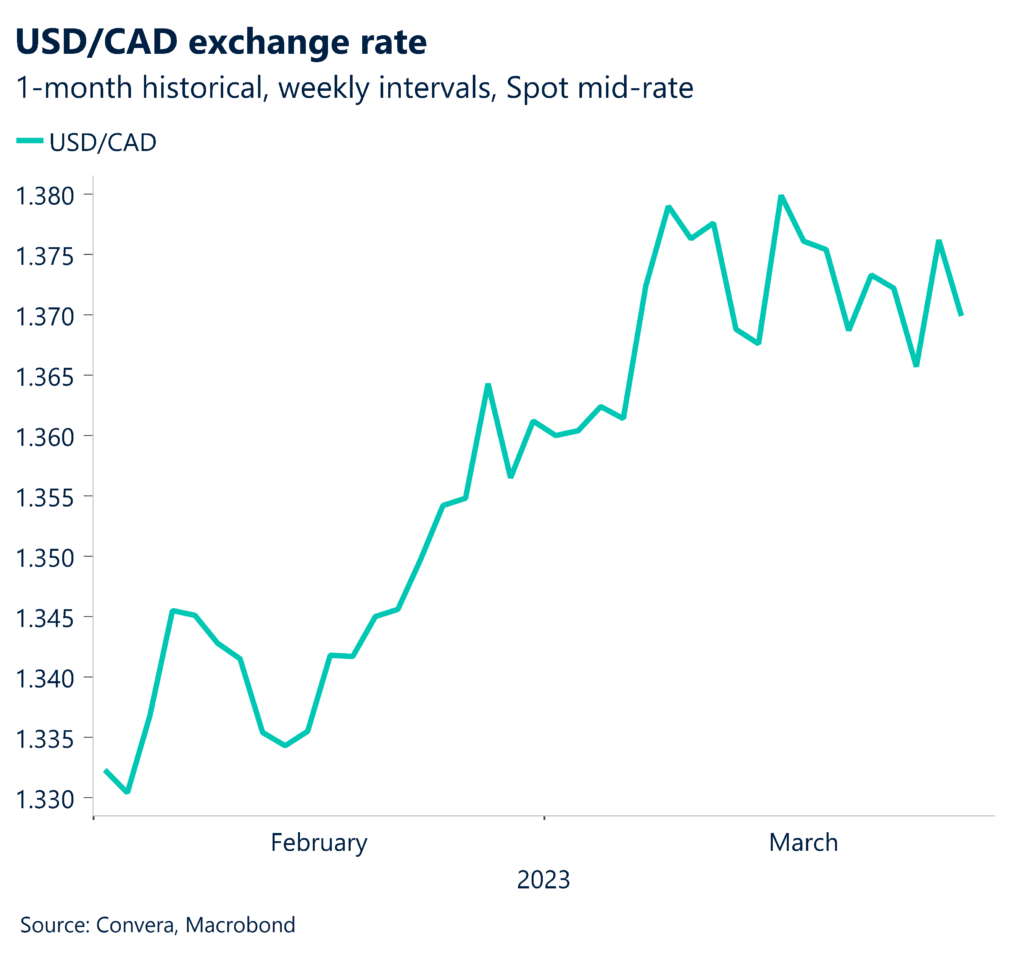

USD/CAD flirts with multiweek low

Canada’s dollar strengthened to within pips of recent March 7 highs against the U.S. dollar, as the loonie continued to serve as a barometer of the global banking crisis. The risk sensitive loonie tends to weaken when fears over a broadening banking crisis spurs a flight to safety in the greenback. So far the week is off to an encouraging start after authorities found a buyer – First Citizens Bank – for the bulk of Silicon Valley Bank’s assets. Meanwhile, oil popping to two-week highs above $73 also has been positive for the commodity-backed Canadian currency.

Dollar struggles as Fed mulls pausing rate hikes

Table: rolling 7-day currency trends and trading ranges

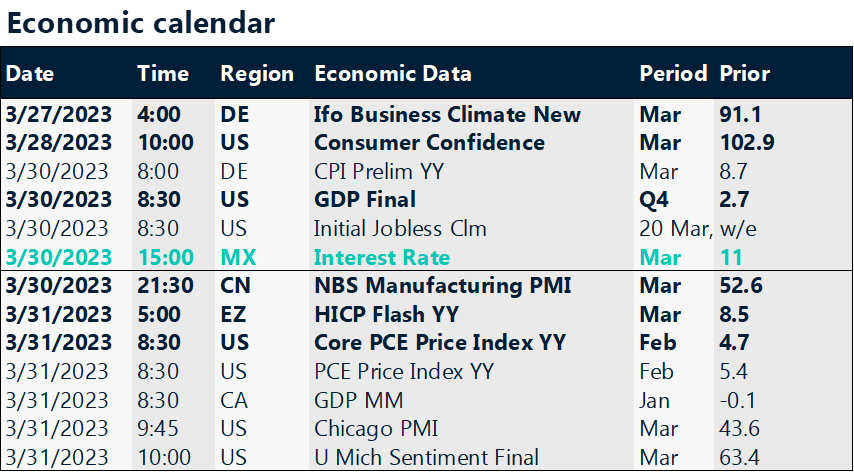

Key global risk events

Calendar: Mar 27-31

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.