Written by Convera’s Market Insights team

USD supported by Treasury yields ticking higher

George Vessey – Lead FX Strategist

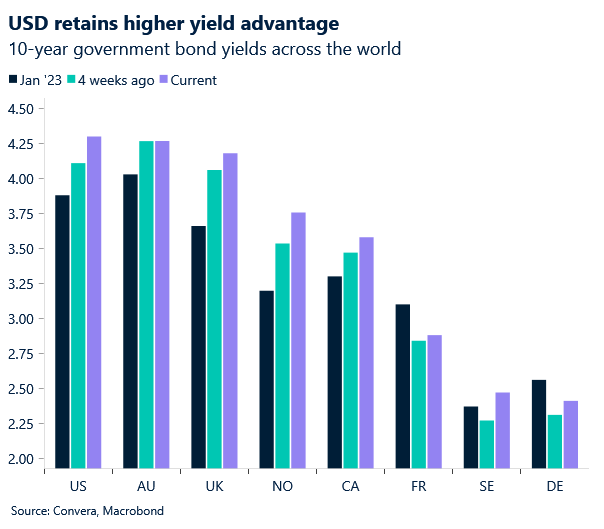

Higher-than-expected US producer prices and consumer prices data last week led to further reductions in market expectations of how soon, and by how much, the Federal Reserve (Fed) could cut interest rates this year. Futures pricing is currently pointing to just about 90 basis points worth of cuts in 2024, down from about 160 bps at the end of last year and US yields have jumped higher supporting the US currency across the board.

Although goods prices are continuing to deflate, service inflation, even excluding shelter, remains stubbornly resilient and validates the push back by Fed officials regarding an imminent rate cut. Equities received a modest case of whiplash, lurching back after absorbing a hotter than expected inflation report, but recovering in response to data revealing cooler economic activity via the weak retail sales print. We do caution, however, that economic reports for January contain more noise than other months of the calendar, reflecting the volatile effects of holidays, weather and one-offs that appear during the first month of the year.

US consumer confidence will be released today, and existing home sales and flash PMIs are due on Thursday. However, Wednesday is seen as the key day as the minutes of the Fed’s last meeting will be published, and we also have the quarterly earnings for the red hot Nvidia. For the time being it’s not just a case of USD appeal, keeping the dollar near 3-month highs, but also a case of everything else being unappealing. When this changes, and when the Fed starts cutting rates, we expect the dollar downtrend to resume.

The pound’s positioning headwind

George Vessey – Lead FX Strategist

The pound has appreciated against more than 60% of global currencies year-to-date and is, on average, 0.8% stronger. However, against the US dollar, sterling is down over 1% in 2024 and although we do expect a shallow recovery this year, there are some downside risks in the short-term to be aware of.

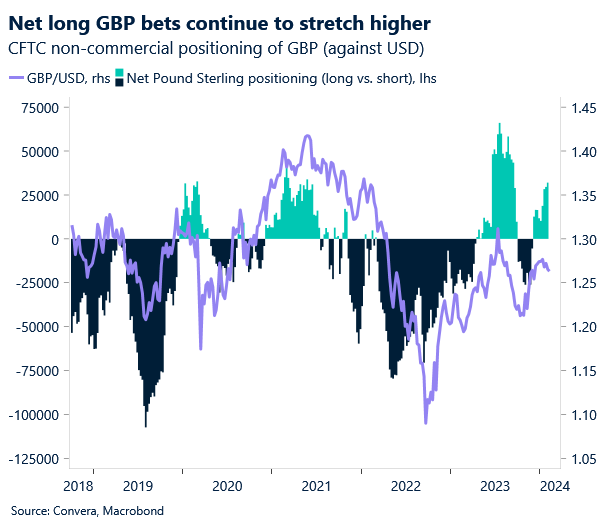

GBP/USD has mostly traded within a narrow range between $1.26 and $1.28 this year, although it has tested closer to $1.25 on occasion. This circa 2% range over the past two months is unusual for this currency pair. Over the past two years, excluding January and February 2024, the average monthly trading range of GBP/USD was double this – at 4.5%. Even the median, which is not distorted by outliers, was 4%. The warning here is that such calm and trendless conditions (as seen of late) often precede a volatile period or a significant breakout. The worry for sterling is that markets are already pricing in less Bank of England (BoE) rate cuts compared to its major counterparts so there is little room for further hawkish repricing adjustments to boost the pound. Moreover, positioning is a major headwind to consider because speculative traders continue to add more bullish bets on the pound appreciating. In fact, GBP net longs have risen for seven consecutive weeks now, the longest stretch since Jan 2020.

Consequently, risks are beginning to look more unbalanced, whereby a downside surprise could prompt a larger negative response in GBP/USD compared to any positive reaction to a topside surprise. Several BoE policymakers will answer questions from the Treasury Select Committee about the BoE’s Monetary Policy Report today ahead of flash industry PMIs this Thursday.

Eurozone wages key for ECB

George Vessey – Lead FX Strategist

A survey by the European central Bank (ECB) of negotiated wage rates in the Eurozone will be closely scrutinised by investors today. Eurozone wages look likely to remain hot. Salary growth is expected to have picked up speed in Q4 2023, rising from 4.7% to 4.9%. This could further reduce the market implied probability of an ECB rate cut in April – currently priced at 43% – and help strengthen the euro across the board, which has already seen GBP/EUR break below €1.17 again.

The average new contract signed in Q4 2023 was over 5% year over year, confirmed by the ECB suggesting there would be some near-term persistence in pay increase that is negotiated. Leading signs, however, suggest that wage growth is probably going to continue into mid-2024. We still have a negative stance on the euro in the short-term, believing that it is better utilized as a funder in favour of higher-yielding peers, but over the long-term we see the US dollar depreciating amid Fed rate cuts, boosting demand for pro-cyclical currencies like the common currency. The economic news has been slightly more positive in Europe recently. Employment growth in the bloc actually accelerated in Q4 to 0.3% q/q and surveys continue to show a large, unmet demand for labour among euro area companies. The strong labour market reduces pressure on the ECB to cut rates and adds to concerns about a potential rebound in inflation from high wage growth.

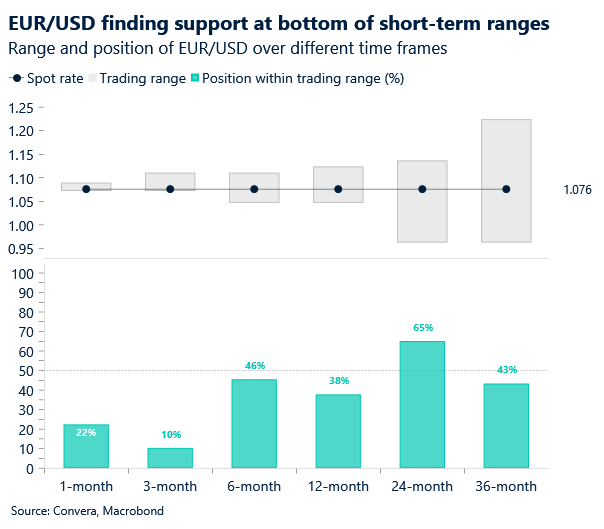

EUR/USD has seemingly developed a strong floor around the $1.07 area, but in the short-term, the $1.08 is still acting as a strong resistance barrier to the upside. EUR/USD is at the bottom of its 1 and 3-month ranges but is actually in the top half of its 24-month range – since the tightening cycle began – which is a promising sign for the euro.

Euro higher across the board

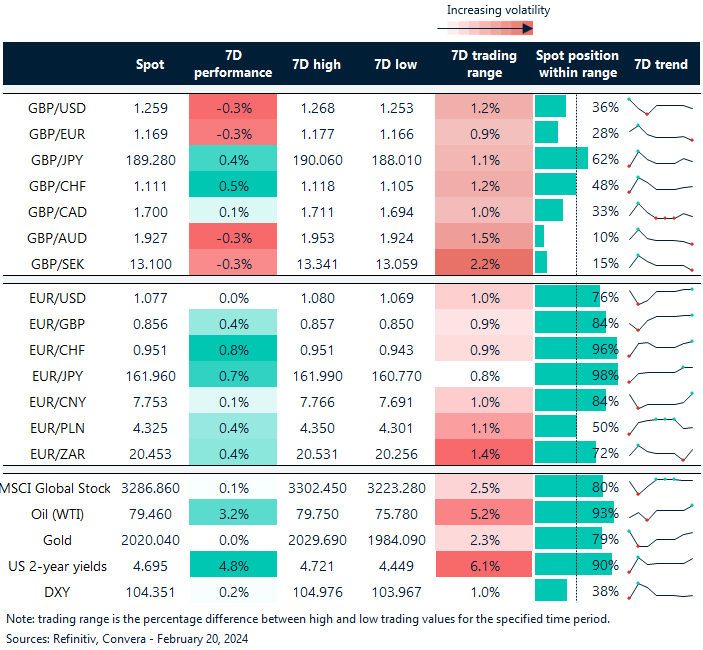

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: February 19-23

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.