Written by Convera’s Market Insights team

Bonds volatile; US inflation in spotlight

George Vessey – Lead FX Strategist

The US dollar was unmoved after the release of the US Federal Reserve’s (Fed) meeting minutes last night, which showed almost all participants thought upside risks to inflation had diminished and downside risks to employment had increased. The dollar is pausing for breath after its longest run of gains in more than two years as market participants brace for the US CPI inflation report later today.

Digging deeper into the Fed’s meeting minutes, the US central bank noted that the 50bps reduction should not be interpreted as evidence of a less favourable economic outlook or as a signal that the pace of policy easing would be more rapid than participants’ assessments of the appropriate path. In addition, almost all members expressed confidence that inflation was moving sustainably toward 2%. And although today’s inflation report is expected to show further moderating, supporting the Fed’s anticipated easing in the coming months, another round of inflationary pressures could be just round the corner. The rising tensions in the Middle East has caused a surge in energy markets, and has the potential to see oil prices back above $100 a barrel. A repeat of ‘70s inflation is the key concern for policymakers and would offer strong support to the dollar and US yields.

Meanwhile, the MOVE Index, which is to bonds what the fear-gauge VIX Index is for stocks, spiked to the highest since January this week as the US presidential election came into play. With that event now incorporated into the implied volatility of constant one-month options, bond trading might become more erratic.

Pound should fare better versus euro

George Vessey – Lead FX Strategist

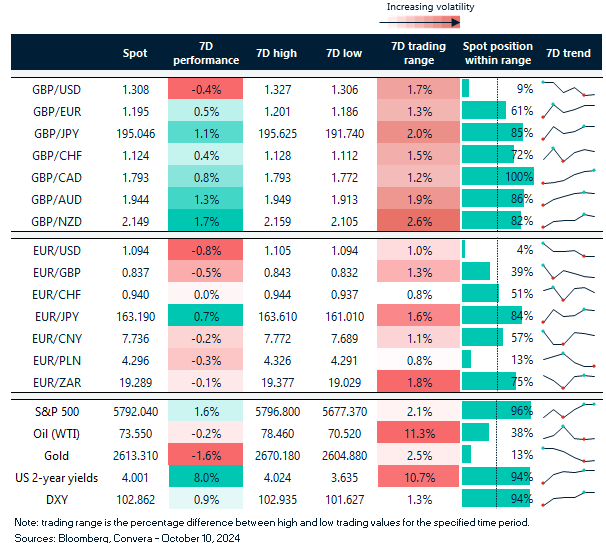

The pound is still licking its wounds from Bank of England (BoE) Governor Bailey’s dovish comments last week. GBP/USD is struggling to reclaim $1.31, whilst GBP/EUR remains in the lower region of the €1.19-€1.20 range. However, the BoE is expected to maintain a more measured monetary policy easing path than peers into the year-end, and that might cap additional sterling losses, absent any global risk off plays.

That said, it is becoming increasingly clear that the US dollar might remain firm going into the US election in November. The dollar’s high yield and safe haven appeal suggests that GBP/USD downside risk is greater than that of GBP/EUR, especially given the dovish ECB and weak data coming out of Europe lately – a likely reason for the widening UK-German yield spread. Hence, a correction below $1.30 against the dollar remains possible this month, but GBP/EUR should remain supported at €1.19. Once the UK Budget and US election risk events are behind us, FX traders are likely to refocus attention on the monetary policy outlook. Money markets are betting the UK central bank cuts interest rates by about 38bps by December, whereas the Fed and ECB are seen delivering closer to 50bps by then.

If incoming economic data doesn’t move the dial too much, then rate differentials should see the pound fare better against its peers like the dollar and euro. However, a big downside surprise in UK services inflation, combined with weak activity data would likely trigger a bigger dovish recalibration of BoE rate expectations and erase yet more of sterling year-to-date gains.

Lack of impetus

Boris Kovacevic – Global Macro Strategist

The euro continued its recent descent and fell to the lowest level since mid-August in yesterday’s session. The drop below the $1.10 mark has given way to more weakness as EUR/USD slid to the low $1.09 level. Meanwhile, the US equity benchmark S&P 500 reached another record high and is on track for its best performance on record this year. The positive risk sentiment has done little to cushion the euro’s fall from the $1.12 level a week ago.

France is struggling to shore up investor confidence in its sovereign debt as the Prime Minister attempts to bring down the budget deficit to 5% by proposing new plans and cutbacks. The risk rally in China following the announcement of stimulus measures has fizzled out as well, leaving the euro with a lack of positive catalysts. A downside surprise in today’s US inflation print is needed to establish a temporary bottom in the euro.

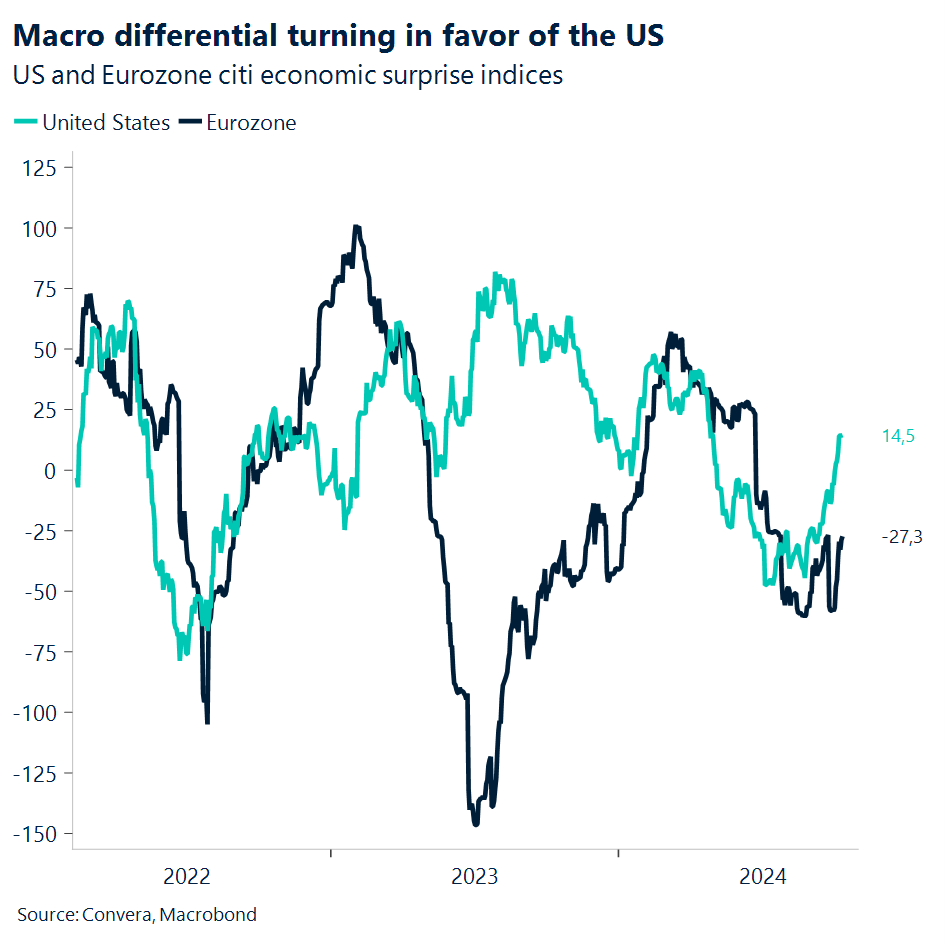

German industrial production did manage to rise by 2.9% in August, clocking in its best month in almost three years. However, more upbeat macro data is needed for a turnaround in sentiment. The Eurozone economic surprise index remains in negative territory and has been there for the entirety of the second half of 2024.

Dollar and yields at top end of range

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: October 07-11

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.