Written by Convera’s Market Insights team

Like the week never happened

Boris Kovacevic – Global Macro Strategist

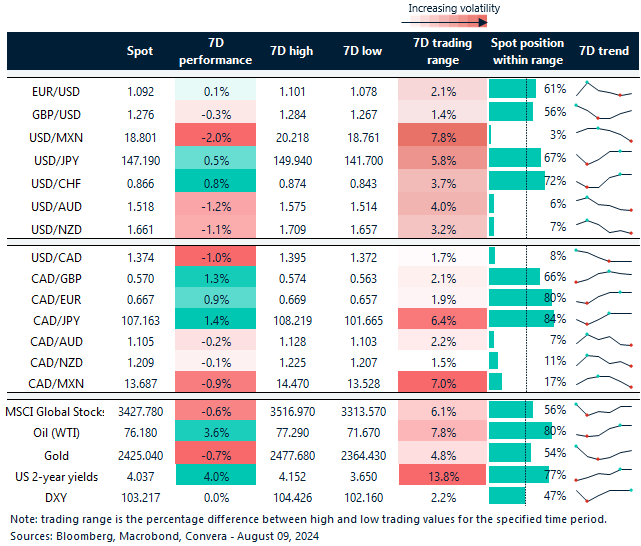

The week in macro and markets will once again end very differently than it started. Monday was heavily shaped by the unwinding of trades that had been popular during the last 6-12 months, including going long technology stocks and short volatility and the Japanese yen. The Nasdaq and USD/JPY were briefly down 6% and 3.5% on Monday as the implied volatility indicators in the US, Europe and Japan experienced one of their highest intra-day spikes on record. Skipping forward a couple of days and it seems that global financial market have calmed down a bit.

Dovish comments from the Bank of Japan acknowledging the turmoil and the positive macro surprises from the United States have calmed investors enough to form a temporary bottom in equities, yields and dollar-yen. The VIX has retraced almost all of its advances, going from 75 to 25. The US Dollar Index is back into positive territory on the week and bond yields on the short end are trading higher than they did on Friday. However, the lingering question about the actual size of the global carry trade remains.

Historically, the intra-year drawdown of USD/JPY and the G10 Carry Index of 9% and 6% respectively are still not seen as noteworthy developments looking at the last 30 years, meaning that the trades do not seem stretched at all. The expected convergence of the BoJ and Fed and a politically induced volatility spike around November remain the largest drivers of a continued unwinding of underweight yen positions. Going into next week, we will be paying close attention to the inflation numbers coming out of the US (PPI, CPI) and retail sales data. USD/JPY will retain its position as the most watched currency pair in the world.

All eyes on inflation next week

George Vessey – Lead FX Strategist

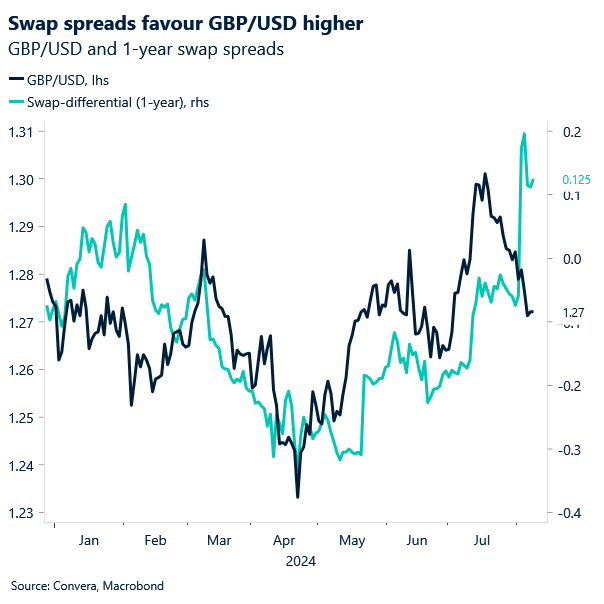

After eight days of lower highs weighing on GBP/USD amid the risk in risk aversion hurting the procyclical pound and supporting the safe haven dollar, downward momentum slowed at the 100-day and 200-day moving averages just under the $1.27 mark. Sterling has rebounded from over 1-month lows and short-term rate differentials do suggest further downside risks are limited from here.

Although soft seasonals could hamper gains through August, with the pair historically returning an average of around -1% since 2000 during this month, the 1-year swap spread between the pound and dollar suggests the decline in GBP/USD looks to be overstretched. Since the start of July, sterling has fallen circa 3% against the buck, coinciding with declines in global equities as investors sought refuge in haven currencies. With risk sentiment in the driving seat, the pair diverged from what rates are suggesting though as 1-year swap spreads remain elevated and point to further upside potential for the British pound. The stickiness of core and services inflation in the UK has markets pricing less than two 25-basis point of additional cuts by the Bank of England by year-end versus the Fed’s expected four quarter-point cuts.

We’ll get more confirmation of whether this pricing is accurate next week as both UK and US consumer price inflation data will be published. For GBP/USD to establish another run at $1.30, fundamentally we’ll need to see UK inflation remain sticky and US inflation to surprise lower, while technically we also need to see a break and hold above $1.2810 – which is the 38.2% retracement from the July high to August low.

Euro anchored above $1.09, looks for clearer signals

Ruta Prieskienyte – Lead FX Strategist

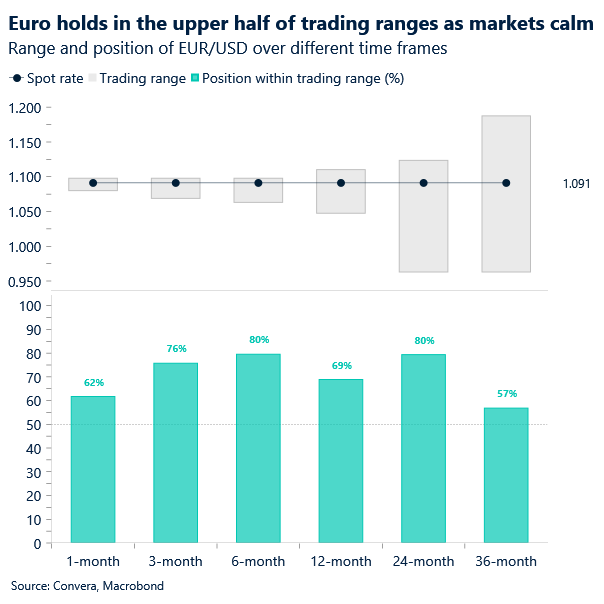

On a relatively quiet day for European macroeconomic releases and bond supply, the market’s attention was squarely on the US initial jobless claims data, seeking indications of a potential slowdown in the US labour market. EUR/USD spot rates retreated slightly after the report surprised to the downside, which somewhat alleviated investor concerns about the US economy’s health.

In Europe, stock performance was mixed as sentiment continued to stabilize. German bonds, which had initially gained, reversed course after the US jobless claims data. The 10-year Bund yield held steady at 2.26% after briefly dipping to 2.22%, reflecting a slightly steeper curve at the long end as traders adjusted to the recent volatility and sought a new equilibrium for yields. Despite ongoing concerns about the European growth outlook, the market has become more comfortable pricing out aggressive near-term expectations for the European Central Bank (ECB). The year-end rate cut expectations priced into the Overnight Index Swap (OIS) curve have pulled back to approximately 69 basis points, down from around 94 basis points at the start of the week.

With an empty economic calendar on both sides of the Atlantic, it is expected that euro volatility will decrease across the board today. The short-term market sentiment in EUR/USD, as indicated by the 1-week risk reversals, has now become neutral. However, this does not mean that risks have entirely subsided. The EUR/USD volatility surface has shifted upwards, with one-month convexity reaching a two-year high, signaling that market participants remain cautious about potential fluctuations.

JPY gives up majority of weekly gains

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: August 05-09

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.