Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

RBA’s inflation worries no help for Aussie

The USD ended broadly stronger as Russia-Ukraine headlines drove risk-off sentiment during the New York session, though some gains were pared into the close.

EURUSD bounced off the key 1.05 handle.

USDJPY consolidated near 156.00, with flows suggesting a bias to fade rallies as JPY buying persisted on safe-haven demand.

CNH stabilized around 7.25 with PBoC fixing remaining near 7.20.

Overnight, NVIDIA’s in-line earnings may pressure tech-correlated Asian FX like KRW at the open.

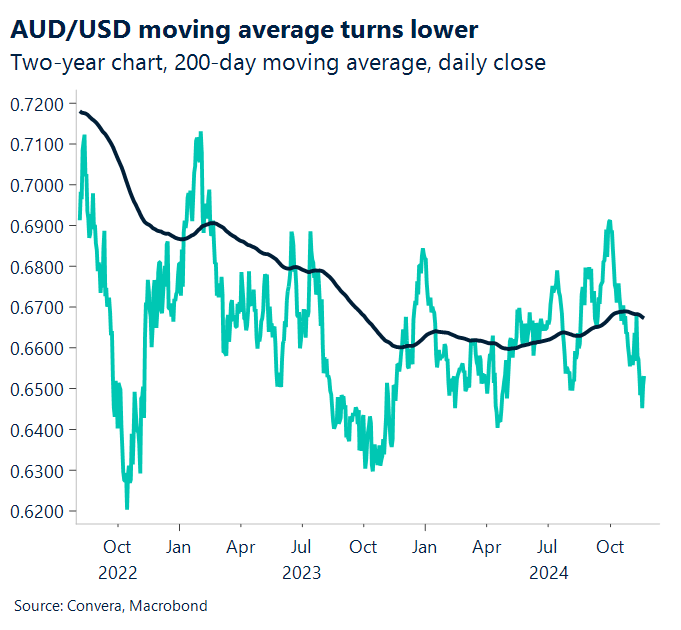

Elsewhere, the Australian dollar staged a small recovery this week, but the broader outlook has turned more negative following the US presidential election, despite a more hawkish Reserve Bank of Australia.

As noted in this week’s RBA minutes, the Australian economy remains too hot for the RBA’s liking.

Last week’s employment reading, which saw unemployment steady at 4.1%, wage data that is only slowing gradually, and an improvement in this week’s Melbourne Institute leading index, turning positive for the first time in a year, have all signaled any rate cut is still some time away.

That said, support for the Aussie will be limited. The dominant theme remains the outperforming USD following Donald Trump’s election win and broader worries about trade.

Therefore, the local fundamental story will likely only provide limited support to the Aussie, and any move towards 0.6600 to 0.6800 will provide opportunities for USD buyers.

Technically, the 200-day exponential moving average has recently turned lower – another negative signal for the AUD/USD.

PMI bottoming but limited EUR/USD recovery

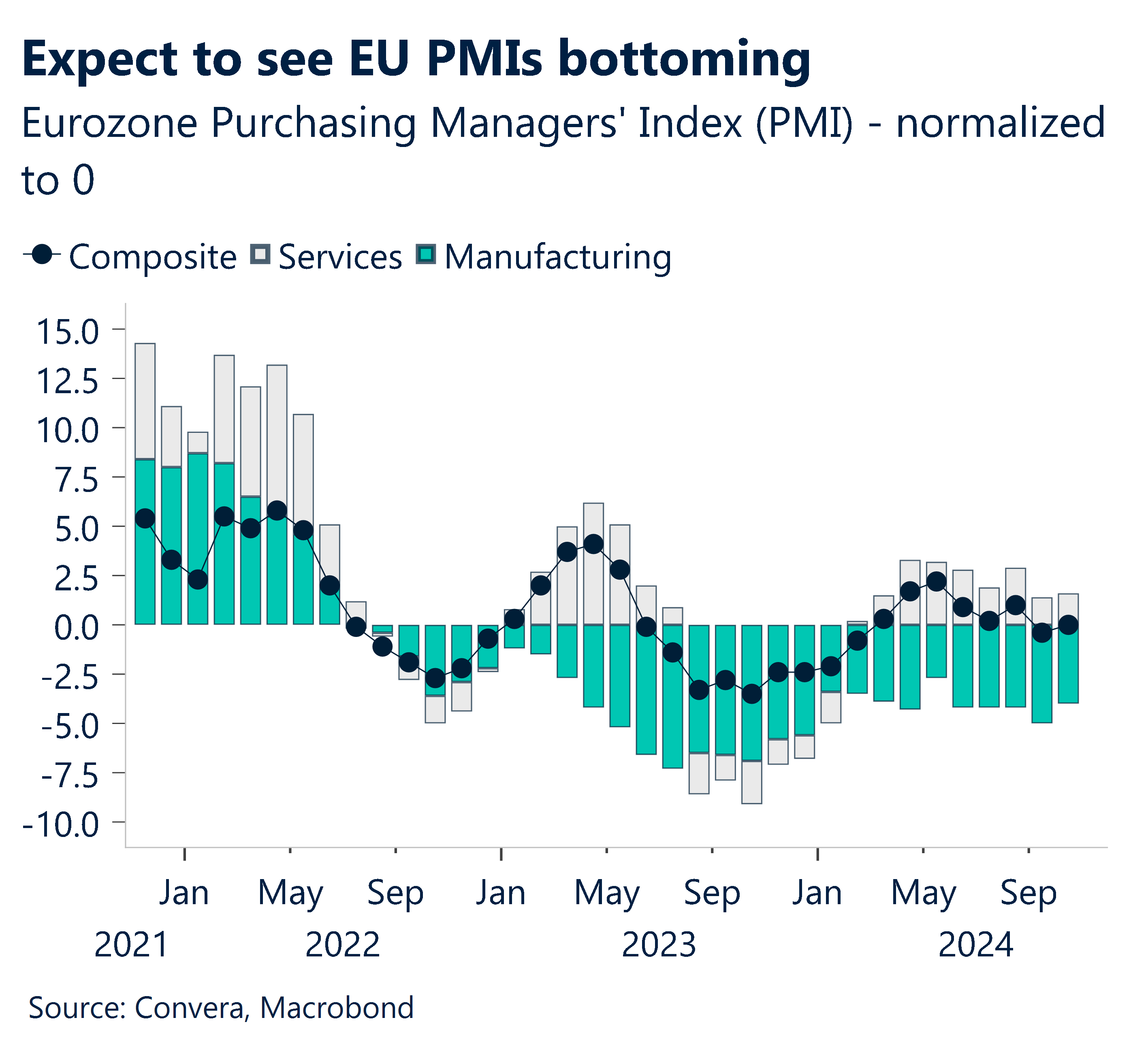

This Friday will see the release of the European PMIs.

We anticipate seeing indications of a bottoming in European surveys in the November PMI.

With comparable increases in the manufacturing and services indices, we anticipate a half-point increase in the composite PMI in November.

Output prices are still higher even if the cost of services inputs are nearly at their pre-Covid norms. Similar half-point increases in the UK’s manufacturing, services, and composite activity indexes have been factored in.

The most recent reading of 57.7 is around six points higher than the pre-pandemic norm, indicating that service prices are still high in this area.

With early resistance near the 1.086 200-day moving average, we anticipate limited rally potential following the election results.

As a new range develops, we do not anticipate a consistent break over 1.095 in the future.

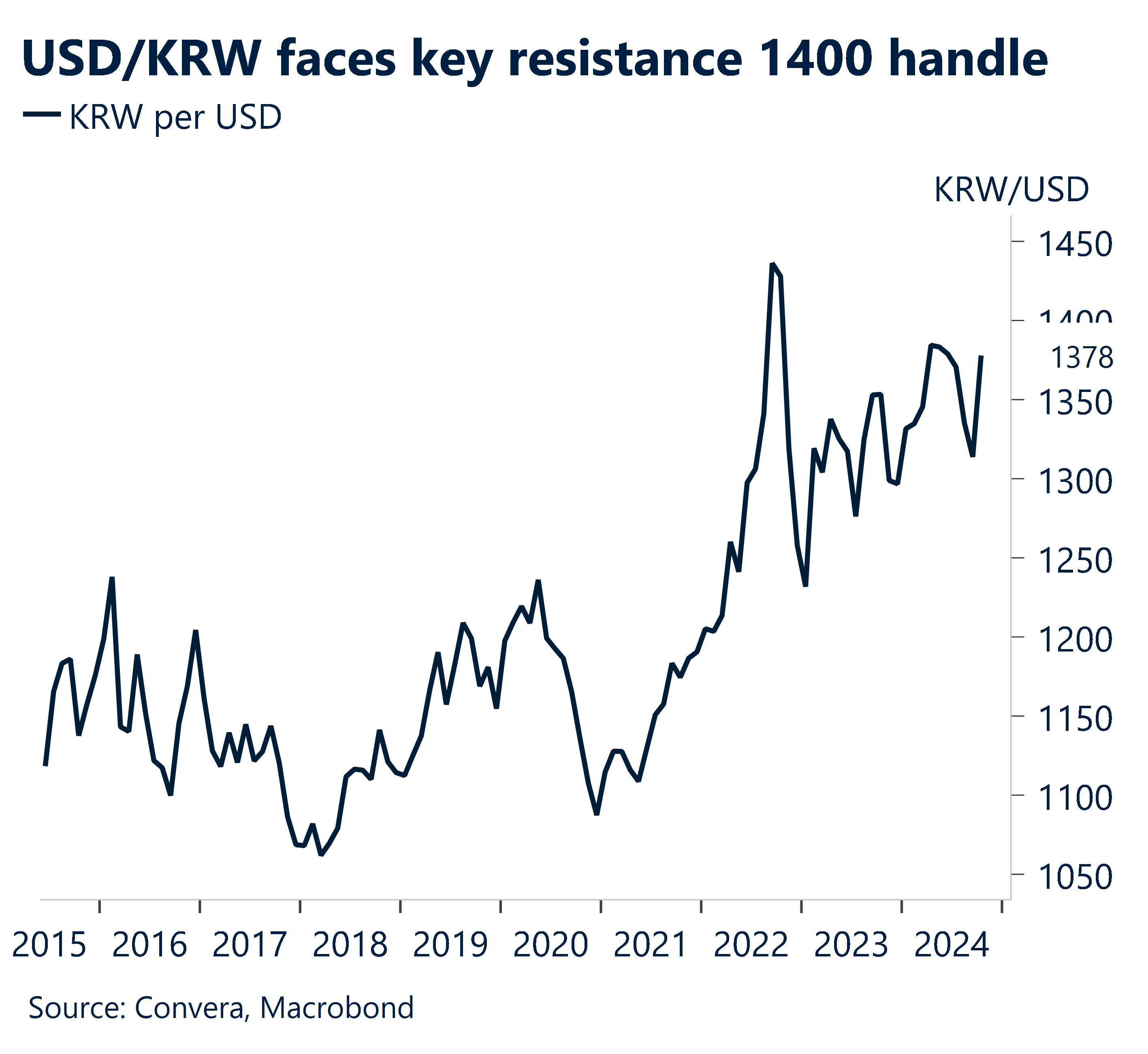

Chip export slowdown tests USD/KRW 1400 level defense

During the first 20 days of November, we anticipate that export growth will rise from -2.9% in October to 1.3% year over year.

The daily average exports probably increased by the same amount with the same number of working days.

We anticipate that export growth will drop from double digits to single digits due to diminishing base effects.

The delay in NVIDIA’s Blackwell shipments and the continued low demand for legacy chips in the face of declining low-end chip pricing probably caused a brief slowdown in chip export growth in November.

Verbal intervention seems to have increased as a result of the key 1400 level breach. We’re keeping an eye out for any headlines about the NPS.

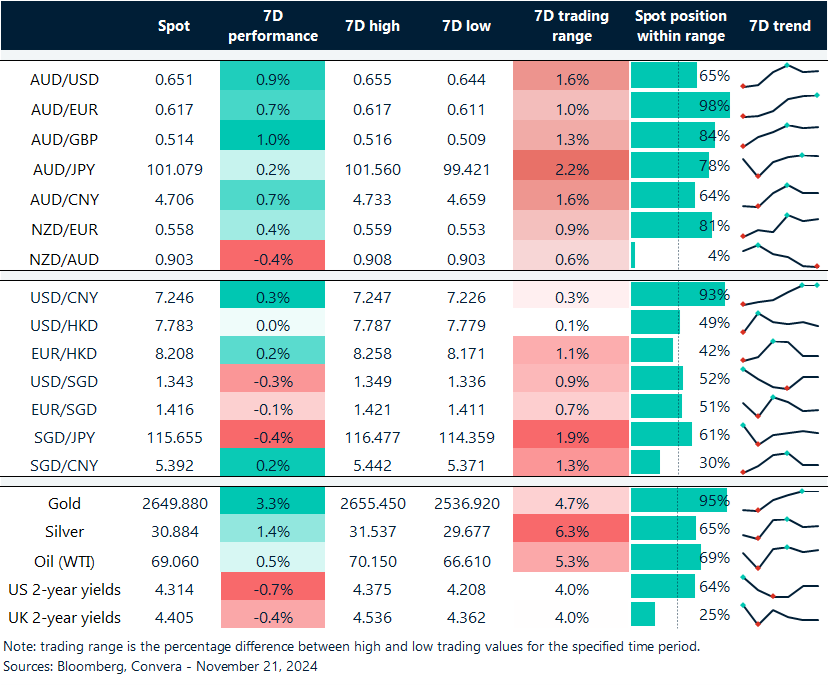

AUD crosses pared back

Table: seven-day rolling currency trends and trading ranges

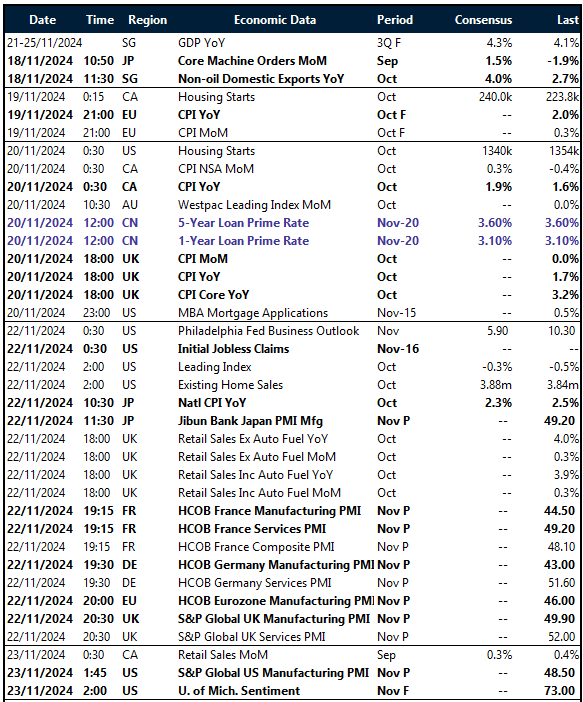

Key global risk events

Calendar: 18 – 23 November

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.