Global overview

The U.S. dollar was mixed but mostly firmer as caution ahead of a midweek Federal Reserve meeting helped it keep above recent one-year lows. The buck rose to its highest level in one and seven weeks versus the euro and yen, respectively, while Australia’s dollar soared in response to a surprise interest rate hike Down Under. Canada’s dollar adhered to its ranges ahead of late week domestic jobs data. Australia’s shock 25 basis rate hike to 3.85%, the highest level since 2012, compared to forecast to hold steady at 3.60% and underscored how today’s increasingly uncertain economic times can lead central banks to deliver unexpected outcomes. Meanwhile, helping the U.S. dollar stabilize after it sank to one-year lows in mid-April is a Wednesday policy decision by the Fed. The Fed could deliver the final salvo of its most aggressive tightening cycle in decades with markets anticipating a quarter-point increase to 5.1%. Elevated U.S. inflation means that the Fed could maintain a rate hiking bias, a factor that’s helped the dollar find a near-term bottom. In Europe, it’s unclear whether the ECB Thursday will downshift the pace of interest rate hikes from 50 basis points after area inflation inched higher to 7%, a step in the wrong direction.

Markets unsure about size of ECB rate hike after data

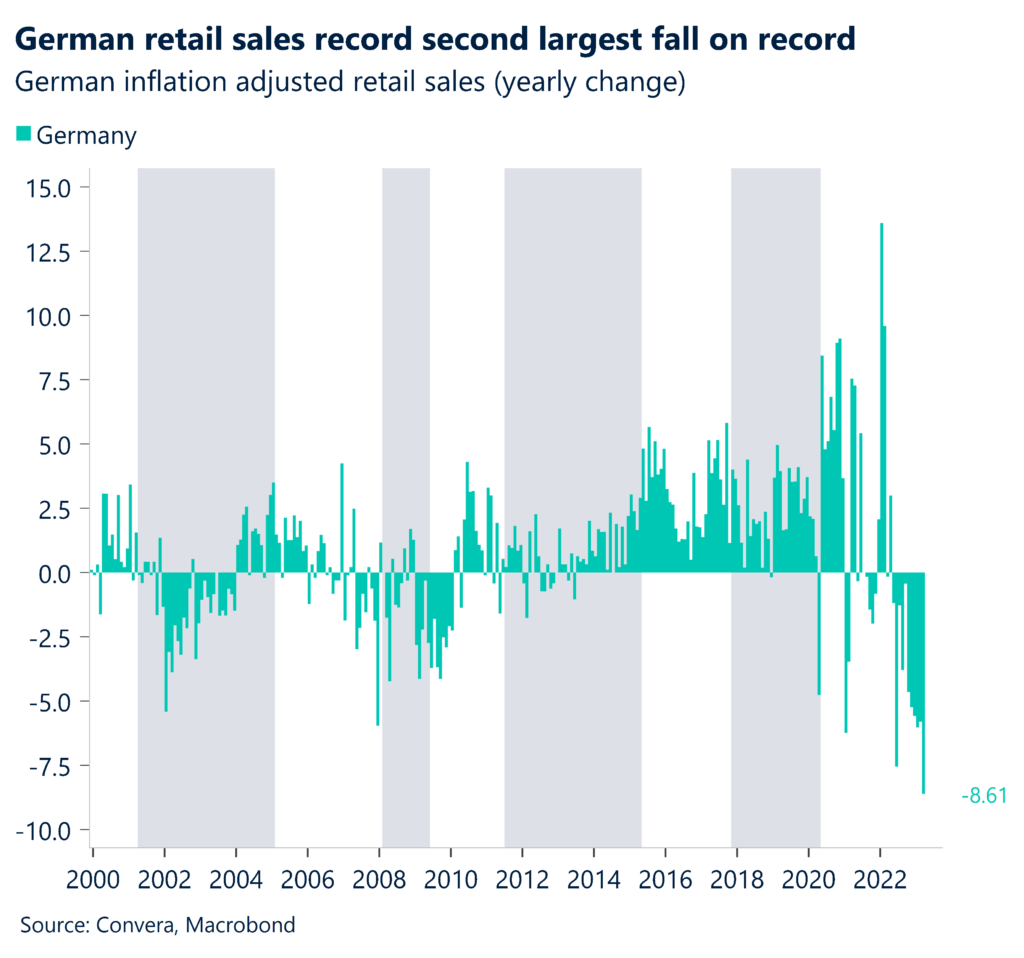

The euro slipped to 11-day lows against the greenback after mixed data from Europe were generally supportive of the ECB slowing the pace of rate increases this week. As expected, inflation across the 20-nation bloc inched up to a 7% annual rate in April from 6.9% in March. But less volatile core inflation cooled, inching down to 5.6% from 5.7%. The news on the German consumer was sobering as retail sales unexpectedly tumbled by a hefty 2.4% in March. Signs of cracks forming in Europe’s otherwise more resilient economic fundamentals can leave recent euro gains at greater risk to the downside.

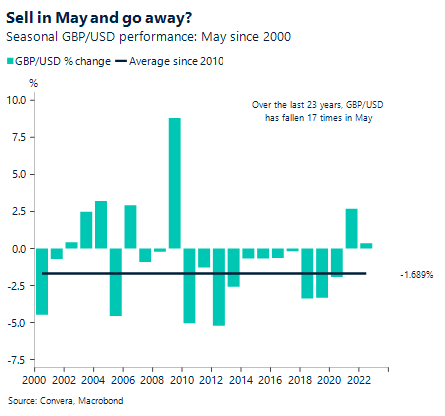

Pre-Fed caution puts a lid on sterling

The UK pound kept below recent 10-month peaks against the firmer U.S. dollar with subdued global markets limiting sterling’s upward mobility. Sterling’s bullish narrative remained intact, suggesting more limited scope for pullbacks, as final numbers on UK manufacturing enjoyed a surprise upgrade to a still contractionary 47.8 in April from an initial estimate of 46.6 where the data was forecast to remain. Britain’s economy faring somewhat better than expected is positive for the pound and for prospects for area leading rates topping out at higher levels closer to 5%.

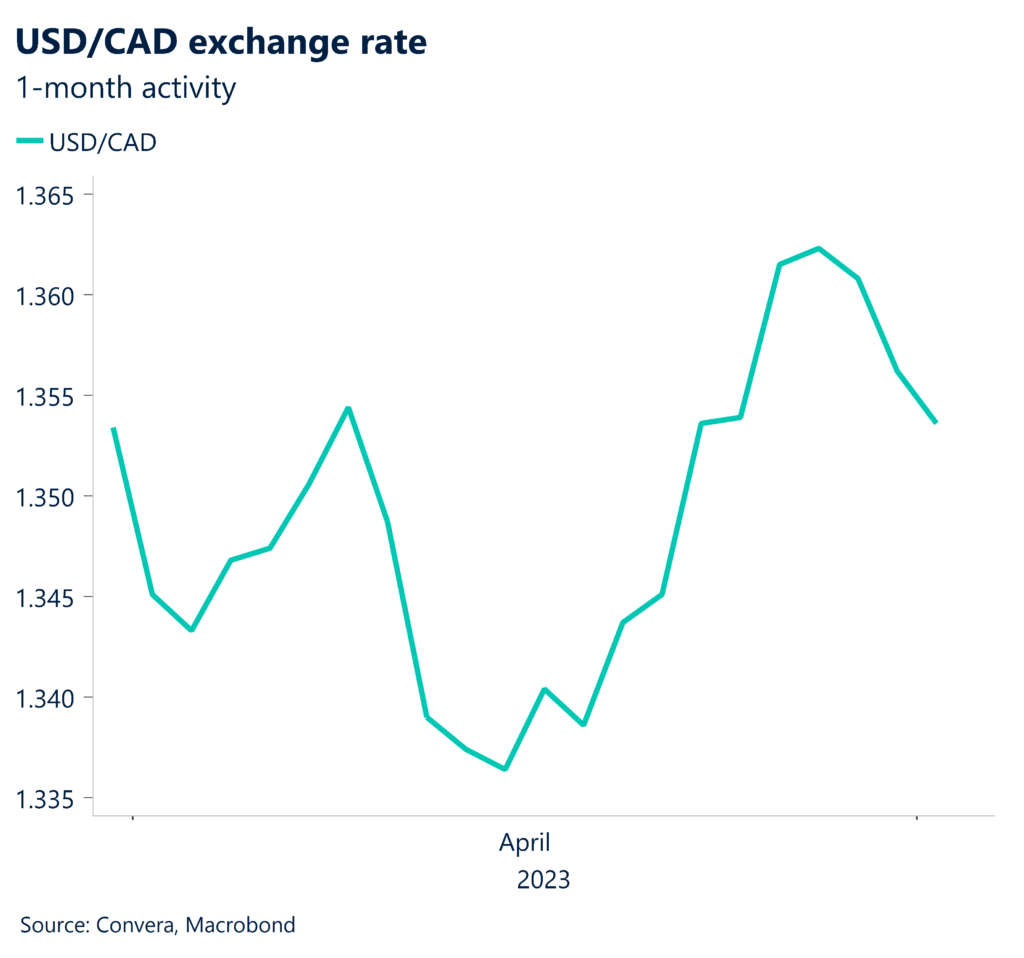

C$ plays the range ahead of Fed data

Canada’s dollar held above last week’s one-month trough against the greenback in cautious trade on the eve of a U.S. interest rate decision. USD/CAD has strengthened about 2% over the last three months as the Federal Reserve continues to raise borrowing rates while Ottawa hit the pause button earlier this year. Canada’s main domestic event risk this week is the nation’s monthly jobs report Friday. Cooler hiring and an uptick in unemployment which are in the cards would be consistent with the Bank of Canada remaining on the sidelines over coming months.

Dollar rebounds ahead of Fed decision

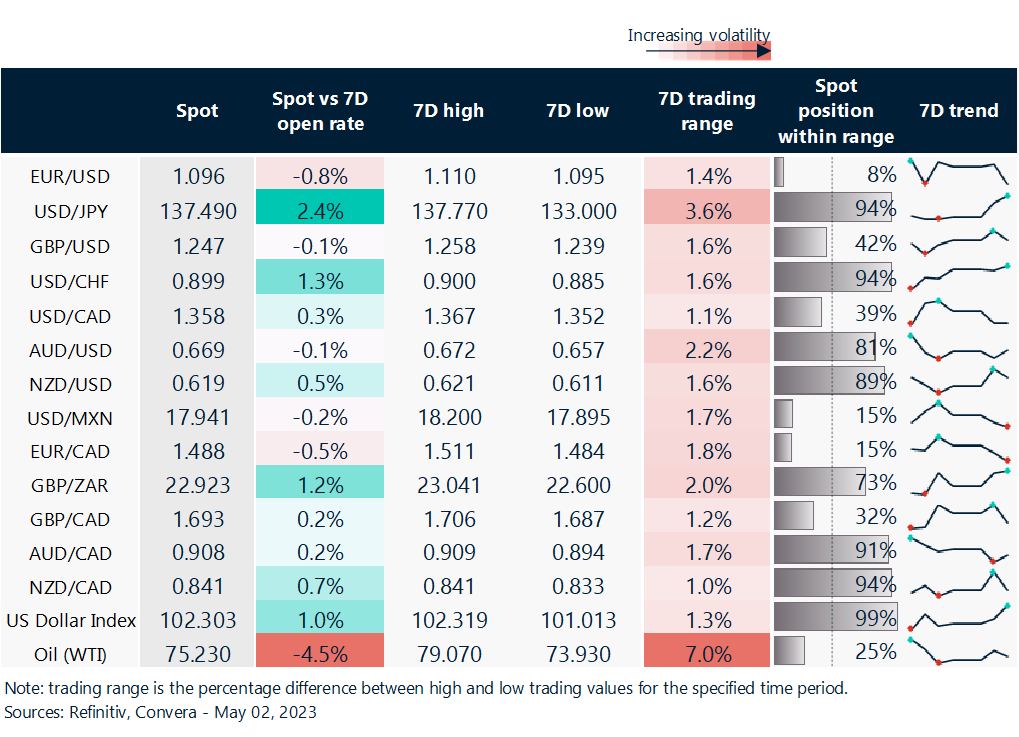

Table: rolling 7-day currency trends and trading ranges

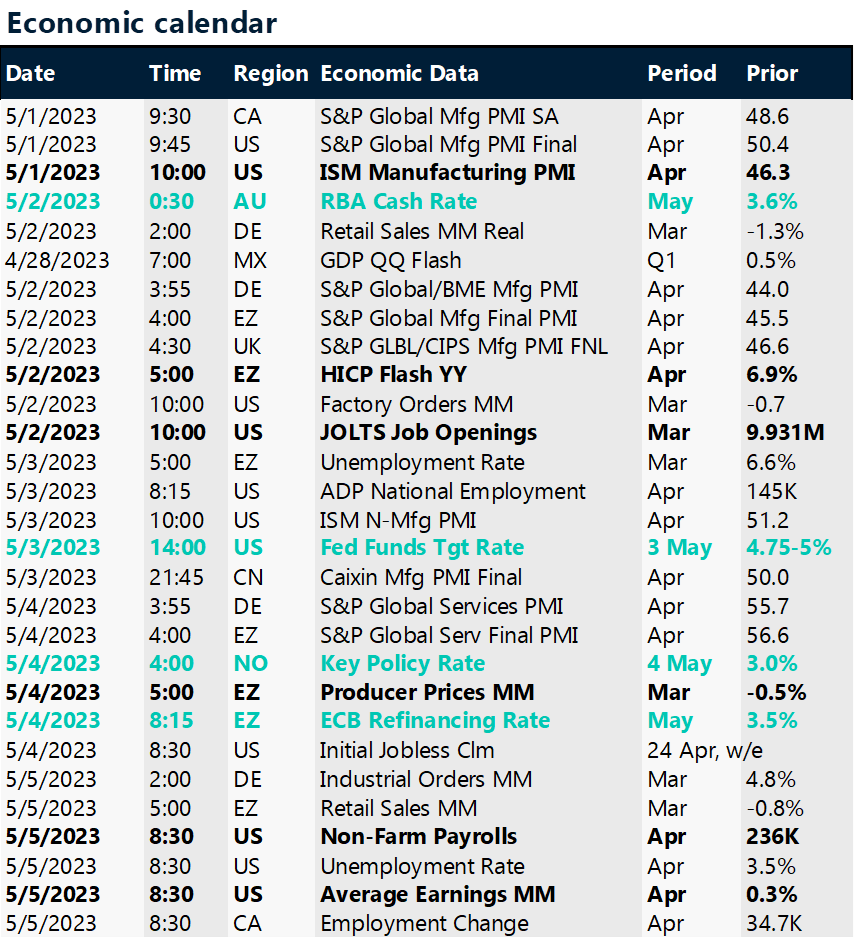

Key global risk events

Calendar: May 1-5

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.