Global overview

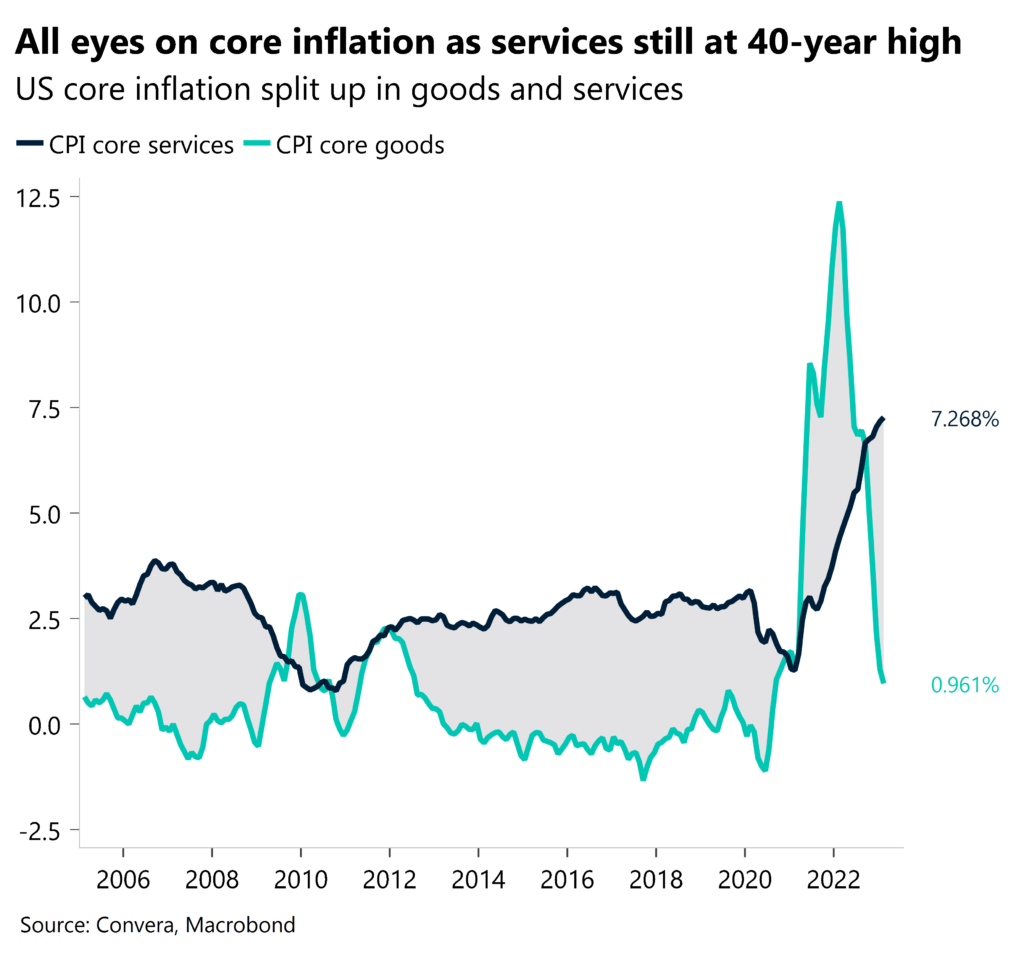

The U.S. dollar and its main peers played it broadly steady ahead of data that could help demystify the hazy outlook for U.S. interest rates. With many keeping their powder dry ahead of the 8:30 a.m. ET release of U.S. consumer inflation, major currencies mostly treaded water. Forecasts call for headline consumer prices to cool to a 5.2% annual rate in March from 6% in February. However, underlying, or core, inflation is expected to accelerate from 5.5% in February. Inflation that continues to cool but at a slow and bumpy pace could lend support to the dollar and the Fed’s forecast of keeping borrowing rates higher for longer. On the other hand, should inflation take a big step downward it could help to lower the bar for rate cuts by year-end should the U.S. economy slow significantly, a dollar-negative outcome. Also in focus today are the release of the minutes from the Fed’s March meeting, while Canada’s central bank issues a policy decision at 10 a.m. ET.

Euro camped near peaks

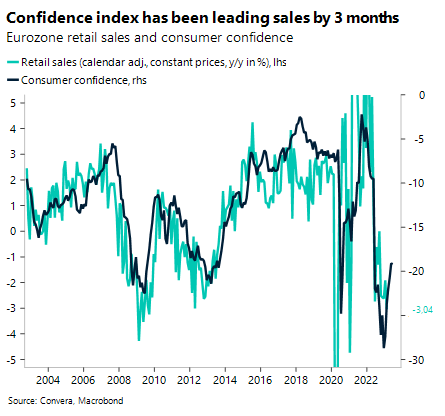

The euro pared some of its weekly gain against the U.S. dollar on caution ahead of America’s monthly inflation report. The still-elevated level of inflation around the world has helped to shape expectations for central bank policy. Inflation running hotter in Europe (6.9%) compared to the U.S. (5%) has markets anticipating more euro-positive rate hikes from the ECB this year. By contrast, the Fed may only need to approve one more rate hike, should U.S. inflation today moderate as expected. Central bank policy divergence is a big factor driving FX markets as interest rates help determine a currency’s attractiveness.

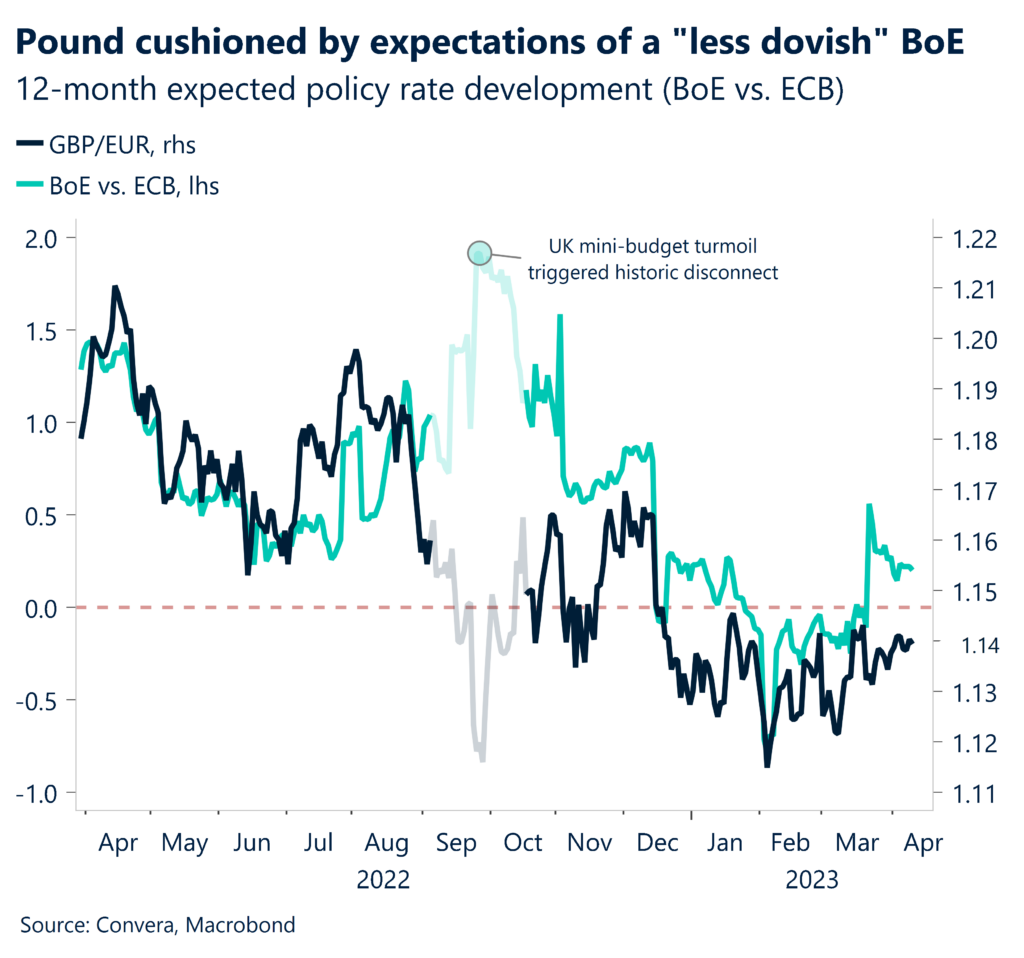

Sterling jumps after cooler U.S. inflation

Sterling was little changed for the week against the greenback with few staking major bets ahead of America’s monthly consumer price index. The pound has kept to a higher orbit on the perception that London has more rate hiking left to do this year than Washington. Still, the outlook remains fluid for global interest rates with monthly surveys on inflation helping to steer sentiment. Should U.S. inflation continue a cooling, or disinflationary trend, what will be key is the speed at which price growth moderates. A sluggish pace downward would add traction to the Fed’s view of a high bar to rate cuts this year, an outcome that could buy sterling more time below recent 10-month highs.

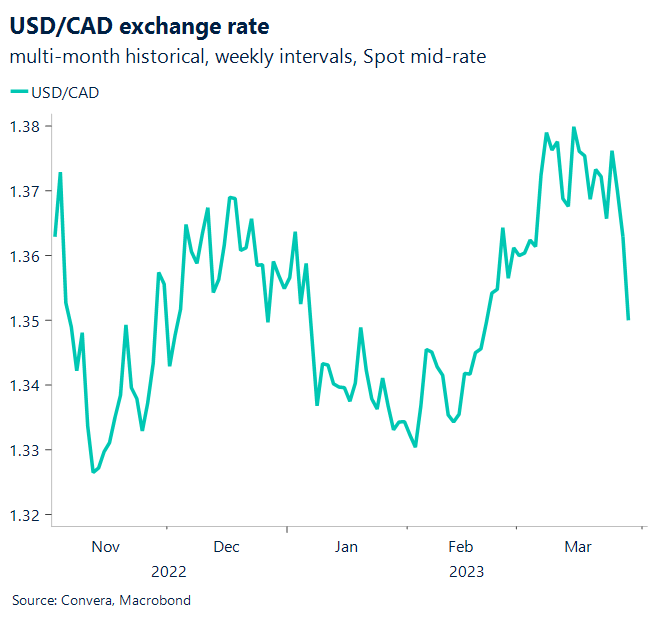

C$ flat ahead of 10 a.m. ET BOC decision

Canada’s dollar steadied but could test the limits of its recent range against the U.S. dollar ahead of an eventful day ahead for North America. The Bank of Canada is expected to hold interest rates at 15-year highs of 4.5% for a second straight month as Canada’s economy continues to absorb the surge in borrowing costs over the past year. Should Ottawa play down recent signs of a resilient Canadian economy, the loonie could move lower on the view that area borrowing rates have peaked and the next move could be lower.

Dollar tumbles as disinflation gains traction

The U.S. dollar tumbled after a bigger than expected cooldown in American inflation backed the view that the Fed may only have one more quarter point rate hike on the table. Headline consumer prices cooled to two-year lows of 5% in March, a full percentage point lower than 6% in February. Core inflation accelerated a tick as expected to 5.6%. The big step down in headline inflation, if sustained, could help to lower the bar for the Fed to cut rates by year-end, a key theme that’s pressured the greenback this year.

Dollar hovers near multimonth lows

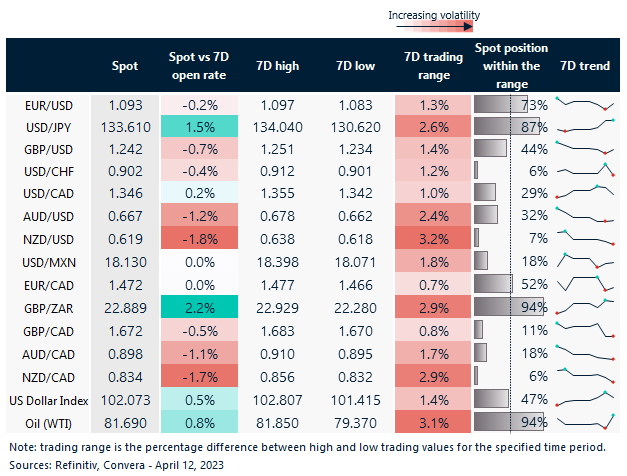

Table: rolling 7-day currency trends and trading ranges

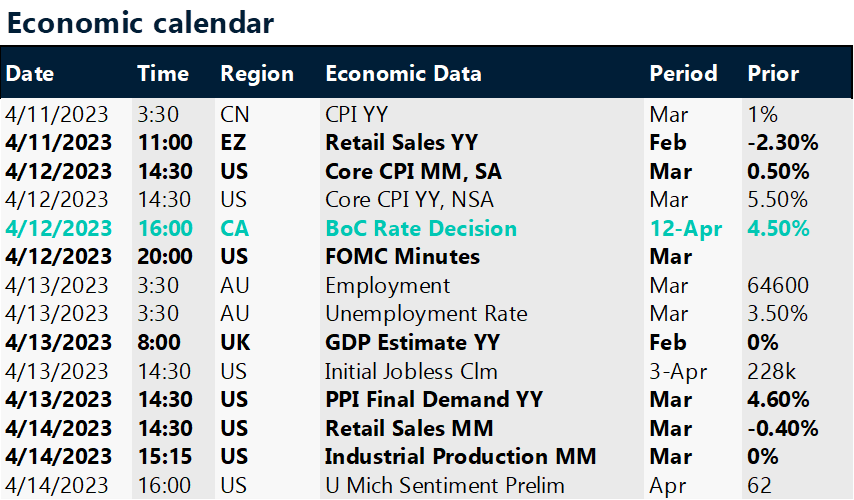

Key global risk events

Calendar: Apr 10-14

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.