Yields at 15-year highs pressure equities

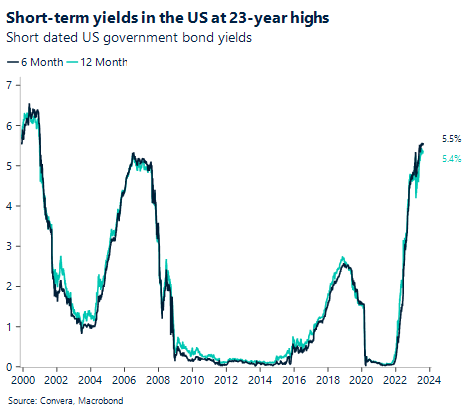

Global bond yields have been on the rise for some months now and have reached their highest level in 15 years, according to data compiled by Bloomberg. The latest leg up in August has been driven primarily by macro data such as retail sales, industrial production, building permits and jobless claims all reaffirming the resilience of the US economy. The US dollar is closing in on its fifth weekly gain in a row, which would mark its longest winning streak in 15 months.

And with the Federal Reserve still concerned with inflation, as per the meeting minutes from the last rate decision, markets have repriced their probability of a higher for longer rates regime. While this has not been enough to make another rate hike this year the base case, investors have sold long-dated bonds again. The 30-year US bond yield jumped above 4.4% in yesterday’s trading, just as the same maturity mortgage rate hit the highest level in 21 years at 7.09%.

Equity markets did not take the news well and edged lower, dragged down by Apple and other tech names. We still have some weeks to go in August, but the month is on track to be the first negative one for the S&P 500 and Nasdaq since March 2023.

PBoC pushing back against weak yuan

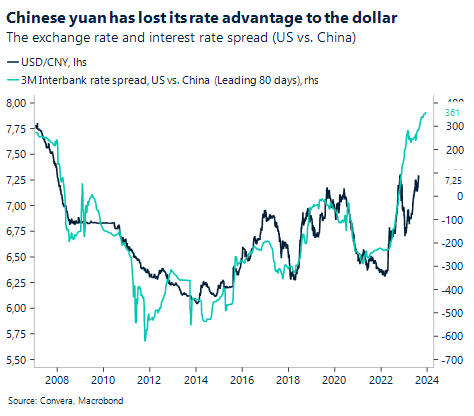

With a lack of economic data out of Europe this week, the common currency has been primarily driven by events in the US and China. Both factors have been moving against EUR/USD, with US macro data outperforming and Chinese releases underlining the worries over the second largest economy in the world.

While Chinese authorities have signaled some willingness to lend the economy a hand, the proposed measures stopped short of what has been expected, disappointing domestic and international investors alike. The People’s Bank of China propped up its currency today in an attempt to push USD/CNY away from the 9-month high at 7.31. However, it is unlikely that these ad-hoc interventions will help the yuan in the medium-term without Beijing addressing the stress in the property market. The Chinese real estate giant Evergrande filed for bankruptcy under Chapter 15 in the US, which has increased contagion fears across the country.

EUR/USD will most likely record the fifth consecutive weekly fall and is focusing on the support line from November at $1.08. Good news on the China front could establish a bottom at that level and continue the range bound movement of the currency pair.

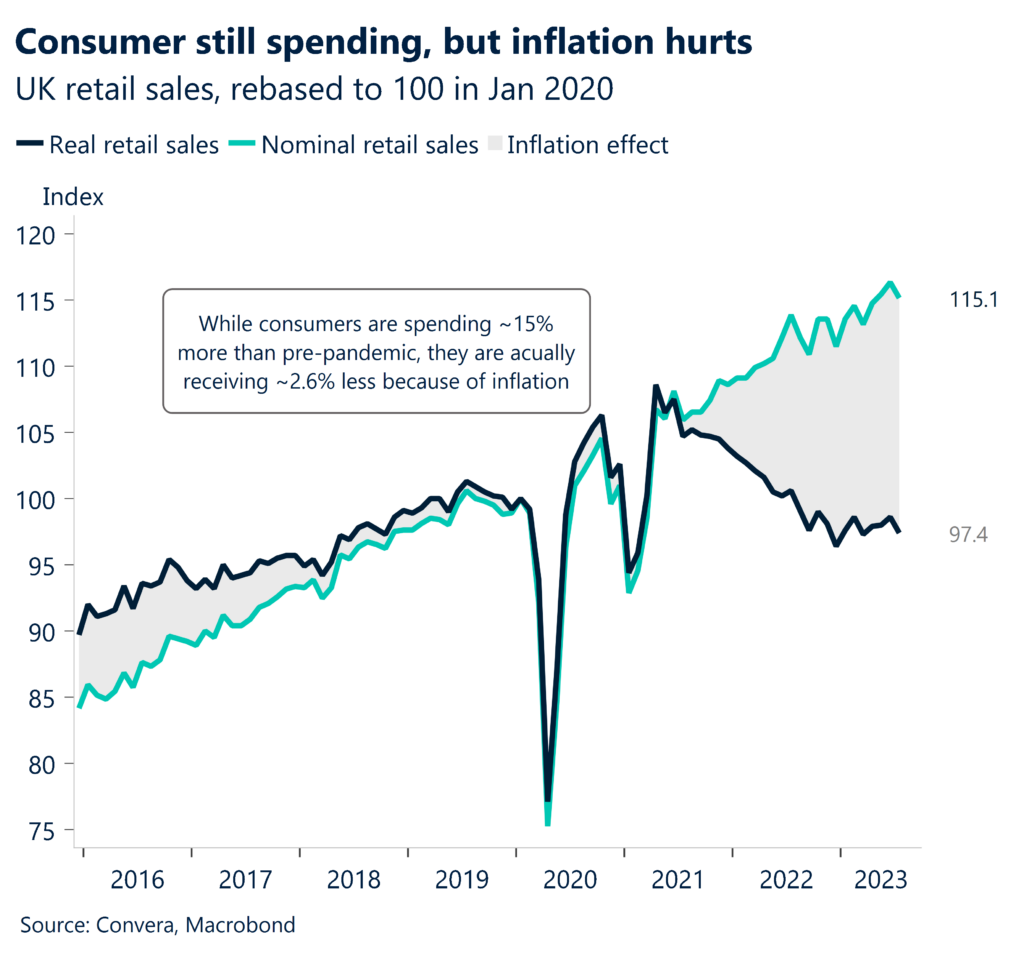

Sterling stumbles after retail sales miss

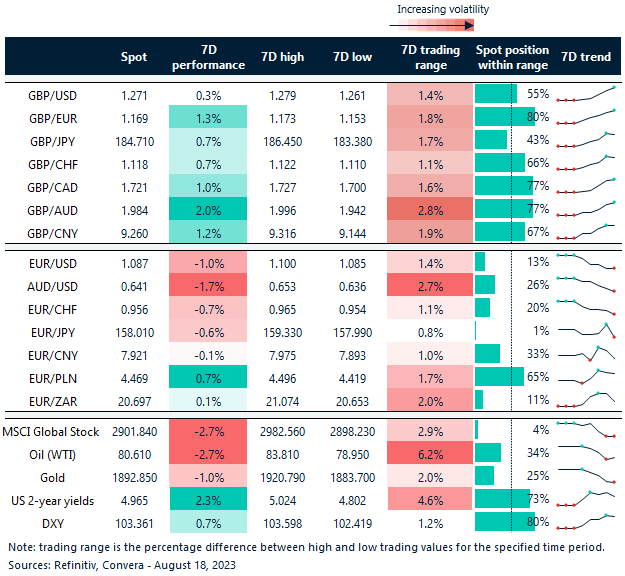

UK retail sales dropped by 1.2% between June and July, much worse than market forecasts of a 0.5% fall. The British pound has come under selling pressure after a relatively positive week following strong wage growth and stubborn core and services inflation data. GBP/USD is back near $1.27, but GBP/EUR remains elevated near €1.17 on widening yield differentials as the 10-year gilt yield approaches 15-year highs.

The UK economy has defied expectations of a contraction in 2023, largely thanks to the dominance of the services sector and tight labour market conditions. There are cracks starting to appear though. This was the first contraction in retail trade since March. Sales declined for both food and non-food, reflecting the impact of wet weather and cost pressures. The resilience of consumer spending is dwindling under the burden of higher interest rates, tighter lending standards, debt refinancing and generally stubbornly high inflation. Meanwhile, in financial markets, volatility has been unusually low this year despite the uncertainty surrounding the aggressive global monetary tightening campaign. Stock markets have soared, closing in on all-time highs, while currency traders have established some big bets and risky carry trades have flourished.

The pound has prospered with global equities amid buoyant investor risk appetite, but the UK currency is also benefiting from the carry trade given its high yield appeal. This has likely contributed to GBP/JPY rising to its highest level since 2015, though we’ve witnessed a near 1% slide from here over the past couple of trading days.

GBP/EUR up 1.3% in seven days

Table: 7-day currency trends and trading ranges

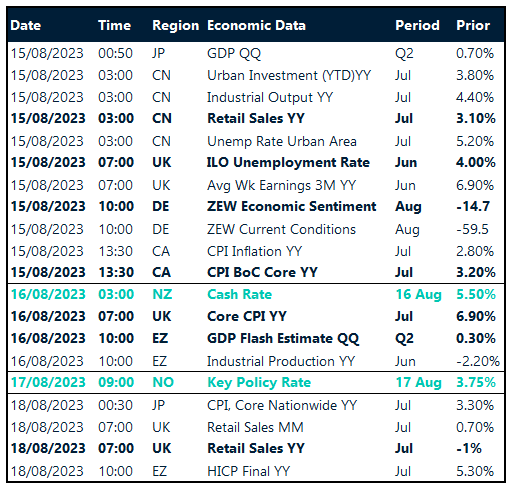

Key global risk events

Calendar: August 14-18

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.