Fed guidance is key today

The US Federal Reserve (Fed) is widely expected to increase the target for the fed funds rate by 25 basis points to 5%-5.25% today. The focus, however, will be on the forward guidance in its post-meeting statement, which could signal that it is set to pause at the next meeting. A hawkish surprise would likely hurt risk appetite and strengthen the USD, whilst a dovish tilt could see both GBP/USD and EUR/USD stretch towards fresh 1-year highs.

Yesterday, the dollar came under renewed selling pressure after data showed US job openings fell for a third straight month in March and layoffs spiked to the highest in more than two years. This increases hopes that a softening labour market could help the Fed’s fight against inflation. In addition, the recent tightening in monetary policy has contributed to the recent stress in the banking system, with the collapse of First Republic Bank unnerving investors . A tightening in lending standards could also reduce the need for the Fed to hike in June, as the decision to hike at its last meeting was a close call and some Fed officials have since signalled the need to adopt a more cautious approach because of the reduction in the availability of credit. Moreover, a failure by Congress to act on the debt ceiling before the end of the month would have severe negative ramifications for the US and the wider global economy, which the Fed will also be wary of.

However, with inflation still running hot, especially in the services sector, the Fed is likely to push back against the market pricing of interest rate cuts before year-end. The US dollar index hasn’t convincingly pulled away from 1-year lows over the past three weeks. Will a hawkish Fed surprise be the catalyst for a stronger dollar rebound or will a dovish steer send the dollar tumbling instead?

Credit tightening favours slowing hiking pace

Inflation excluding food and energy slowed in the Eurozone for the first time in 10 months, giving the European Central Bank (ECB) some room to consider stepping down the pace of the interest rate hikes. However, while core inflation ticked down by 0.1% to 5.6%, headline inflation increased to 7% in March, complicating the picture for ECB policymakers.

Underlying price pressures remain extremely elevated from an historic standpoint and would justify continuing the tightening cycle in the Eurozone. But calls for a decrease of the rate hiking pace from 50 to 25 basis points has gained traction within the Governing Council. Yesterday’s weaker than expected German retail sales have been followed by the publication of the ECB’s survey of bank lending, which showed that credit standards tightened by more than previously expected in Q1. Household credit growth has slowed seven months in a row to 2.9% (y/y), the lowest rate since 2018. Firm’s demand for credit fell to the lowest level since the global financial crisis. These are just some of many signs that the tightening of monetary policy has started to work its way into the real economy. This is something the ECB will need to take into consideration, which is why a 25-basis point increase is the most likely scenario for Thursday’s meeting.

A lot of the hawkish divergence between the ECB vs. Fed seems to be priced in, which explains why EUR/USD has had a hard time staying above $1.10. New catalysts will be needed to move the pair in either direction. These will come in the form of the two rate decisions (Fed, ECB) and the non-farm payrolls report on Friday.

Pound trapped in 2.5% range

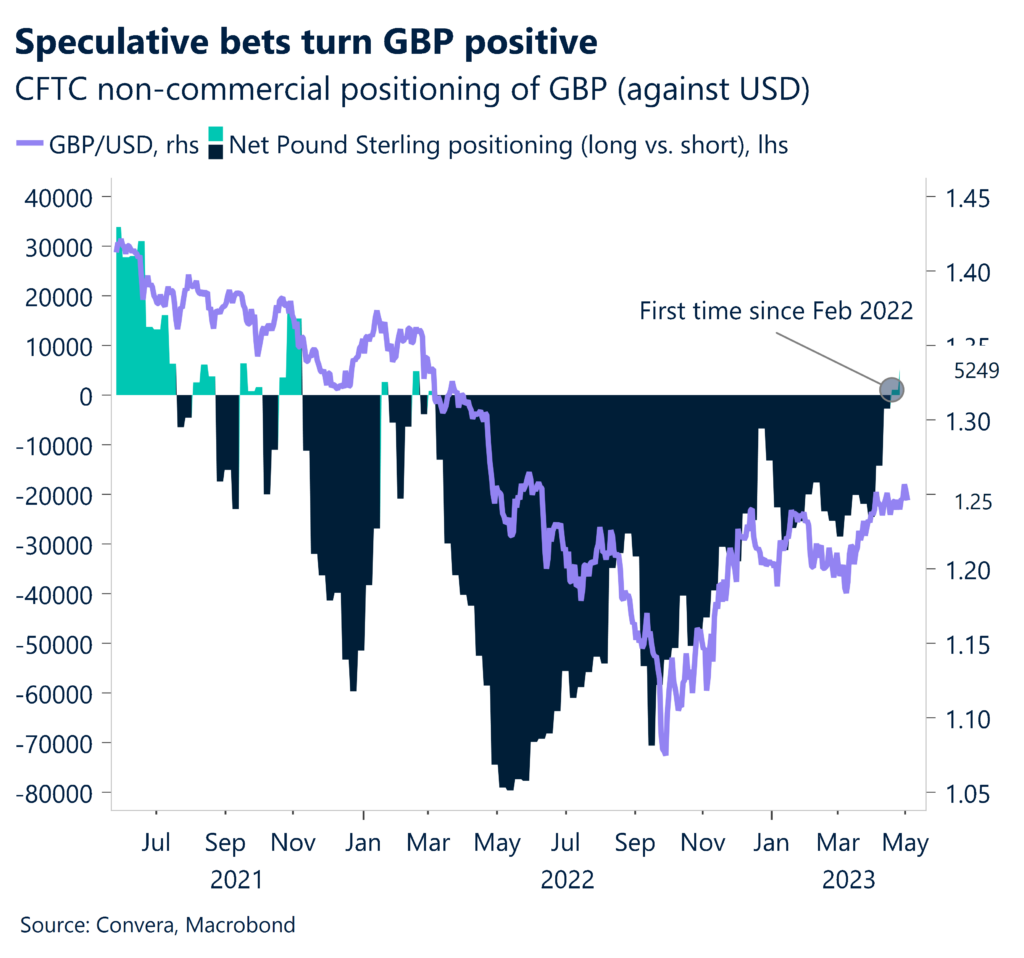

GBP/USD has been oscillating within a narrow 2.5% range for a month now and is less than 1% away from its 1-year high of $1.2583. The low volatility climate has benefited the risk-correlated pound, as well as narrowing US-UK interest rate differentials as traders price more Bank of England (BoE) hikes compared to the Fed for the remainder of 2023.

There has been a steady increase in GBP long positions (betting on sterling appreciating) as a result, with speculators adding to these positive bets through last week and taking the net GBP long position to a 17-month high – which was back when GBP/USD was in the $1.30 zone. With UK inflation currently still exceeding 10% and wage growth unexpectedly accelerating, the BoE is expected to raise rates by another 25 basis points next week to 4.5% and to hike twice more before year-end. Separate data releases yesterday showed UK food prices staged their largest annual increase on record in April, house prices rose after seven straight months of declines and manufacturers were more optimistic whilst input costs rose at the weakest rate since May 2020. Amidst the surprisingly strong inflation and economic data of late, it is no surprise that the BoE is not done with its rate hike cycle yet and that financial markets have priced in a higher terminal rate.

But with markets priced for a relatively more hawkish BoE, a dovish shift could put the bottom end of its 1-month range into sharper focus. That said, sterling’s fate this week lies with the Fed and ECB decisions. GBP/EUR suffered its biggest daily decline in a month yesterday, but remains 0.3% higher year-to-date.

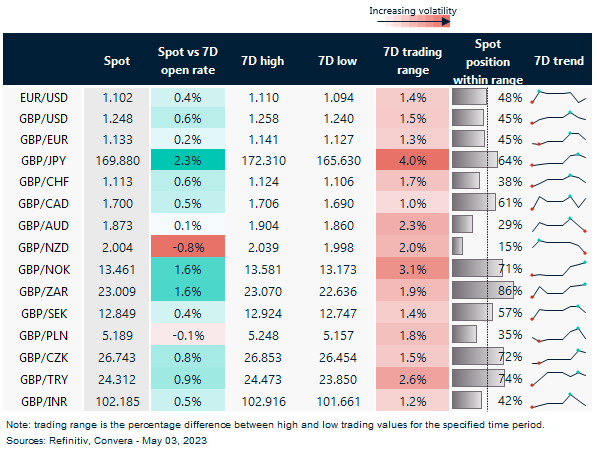

GBP/JPY swings 4% in a week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 1-5

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.