Written by Convera’s Market Insights team

US SME optimism surges the most in 44 years

Boris Kovacevic – Global Macro Strategist

The US dollar rose for a third consecutive day as small businesses sentiment turned positive in the first data release since Donald Trump got elected. Investors are now patiently waiting on important Treasury auctions over the next two days and the critical inflation report out later today.

Trump has long been perceived by investors as positive for US small and medium sized businesses. This was visible all throughout 2023 and 2024, a period during which the small cap equity index Russel 2000 strongly correlated with the winning odds of Donald Trump. The 20% business deduction introduced during his first term was a well-received initiative. Spiking SME sentiment following the election indicates that smaller companies are willing to ignore the planned increase in tariffs and are focusing on the promised cutting of red tape and deregulation initiatives that were announced. While actual sales numbers did not budge in November, the outlook for general business conditions in the coming six months surged by the most on record according to the NFIB survey published this week.

Focus will now shift to the CPI report later today. Economists are expecting another hot monthly print of 0.3% in November, matching the previous month’s advance. The annual change in the core figure will likely stagnate at 3.3%. However, headline inflation could rise from 2.6% to 2.7%. Investors will watch the release carefully even though markets are not in alert mode. Volatility across asset classes has fallen more since November 5th than is usually the case following presidential elections.

Pound-euro at highest since 2022

George Vessey – Lead FX Strategist

The pound has outperformed G10 peers for most of 2024, thanks to a more resilient UK economy than forecast and on expectations that the Bank of England (BoE) would be among the most cautious to cut interest rates. It’s a stark contrast to Europe, which has seen anaemic economic growth and a far more dovish European Central Bank (ECB). This is one reason why GBP/EUR has stretched above €1.21 to hit its highest level since March 2022.

The divergence between the BoE and ECB is forecast to sustain through 2025, with only three cuts by the BoE priced in by markets versus the ECB’s six. As such, the yield spread on UK-German bonds has surged from 120bps to over 220bps in just a few months. Simply put, the pound has a more attractive yield appeal than the euro. European political uncertainty is another EUR headwind, plus the UK is less exposed to Trump’s tariffs than the Eurozone, given its goods trade deficit with the US. Of course, if the US doesn’t impose these tariffs, and the ECB doesn’t cut rates as much as expected, a euro recovery looks highly plausible, but the technical set up hints at further gains for the pound…

This year:

- GBP/EUR has traded within its third smallest range (6.6%) in over a decade.

- However, the currency pair has clocked nine monthly advances in 2024 (ten if December’s gains hold) and has never dipped into negative territory since January 1st.

- In fact, it’s the first time in eight years that GBP/EUR hasn’t traded lower than €1.14.

- The pair is on track to close the year above the €1.20 handle and clock a second successive yearly gain – both for the first time since before the EU referendum in 2016.

- Bottom line – the technical backdrop looks promising and momentum is in the pound’s favour for now, with €1.2190 the next upside target.

Canadian dollar slumps before BoC meeting

George Vessey – Lead FX Strategist

The Canadian dollar printed a fresh four-and-a-half year low versus the US dollar yesterday ahead of today’s Bank of Canada (BoC) policy decision. A 25 basis point cut is fully priced in, but some 80% of swap traders expect the BoC to go large with a 50bp reduction.

Last week’s worrying Canadian jobs data tipped the scales back in favour of a 50bp cut, which has seen USD/CAD rise over 1% to breach the C$1.42 threshold briefly – its weakest level since April 2020. Widening rate differentials between Canada and some G10 peers like the US and UK this year has led both the USD and particularly GBP on track to score their biggest yearly advance against the Loonie since 2015. Moreover, because a large trade surplus has put Canada in Trump’s crosshairs, the threat of tariffs levied by US president-elect Donald Trump haven’t helped the CAD or the Canadian economy’s outlook.

Although the balance of risks for CAD remains to the downside, we are conscious it could enjoy a relief rally on the back of any hints of officials being less dovish than anticipated. A fall back towards the C$1.40 handle is possible should this be the case, whilst upside targets of C$1.45 look overstretched unless Canada does suffer the brunt of Trump’s tariff threats in 2025.

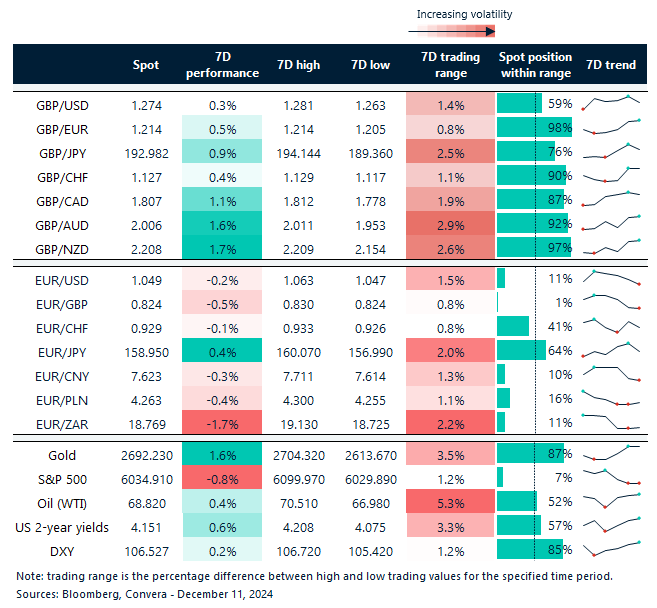

Sterling stretching higher vs major peers

Table: 7-day currency trends and trading ranges

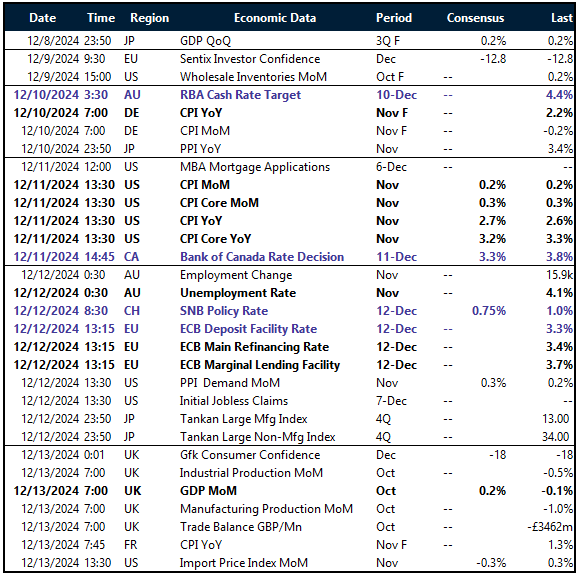

Key global risk events

Calendar: December 9-13

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.