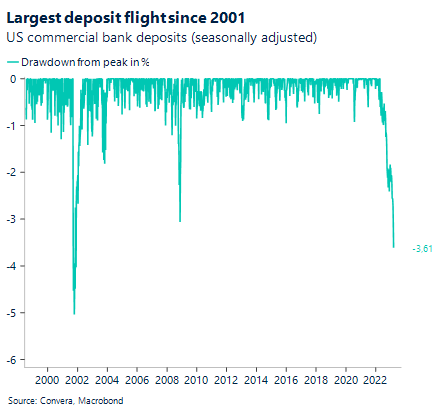

The banking sector remains crucial for gauging how markets will perceive the Fed’s willingness to hike. However, data on that front is scares. This puts even more weight on the upcoming balance sheet and deposit data releases coming out of the Fed today and tomorrow.

Hawk watching in Europe

The hawkish rhetoric at the European Central Bank (ECB) continued amidst calmer markets and no negative developments surrounding the banking sector. EUR/USD ($1.0840) was flat in yesterday’s trading but the gains from Monday and Tuesday (+0.80%) put the pair on track to record the fourth weekly appreciation in a row.

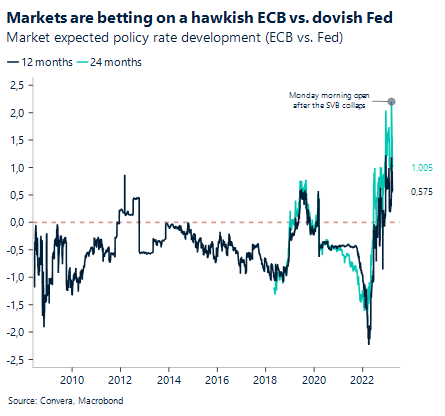

The ECB’s chief economist Phillip Lane suggested more rate hikes to come under the condition that the banking woes were contained. Similar sentiment was echoed by the Slovakian central bank president Peter Kazimir, who pushed for further increases while slowing the pace of the tightening. This had led markets to strongly bet on the Fed out-cutting the ECB over the next 12 and 24 months. The expected trajectory of policy rates in Europe vs. the US had briefly climbed to above 220 basis points two weeks ago, by far the highest level since going back 12 years.

Without any negative news on the banking front over the last few trading sessions, fixed income volatility and Fed rate cutting speculations have fallen slightly, narrowing the expected policy differential between the ECB and Fed to just above 100 basis points over the next 12 months. This trading strategy has been assuming more sticky inflation in Europe vs. the US and will be put to the test with today’s release of German inflation and Eurozone and US inflation on Friday. Spanish inflation has been released already this morning, coming in slightly below forecasts with more disinflation in the headline print versus stickiness in the core.

Strong UK data buoys rate hike bets

GBP/USD continues to trade above its key daily moving averages, and despite a modest down day yesterday, the currency pair looks destined to take out its 2023 high at $1.2448. Upbeat economic data continues to roll in from the UK, the latest being higher-than-expected UK mortgage approvals and record high food inflation, both a boost for hawks advocating higher interest rates by the Bank of England (BoE).

The BoE revealed that 43,536 mortgages were approved in February, up from 39,647 in January and above the consensus forecast of around 40,500. Demand is slowly rebuilding now that mortgage rates are starting to stabilise, despite the average rate on new mortgages continuing to rise. Meanwhile, the record-high inflation rate at UK shops is due to higher fruit and vegetable prices, according to data from the British Retail Consortium. This is further adding to signs that broader price pressures in the economy will remain a challenge for the BoE to tame. As such, money markets currently see a 60% chance of a BoE hike in May verus a 48% chance for the Fed. Markets are much more dovish on Fed rates versus BoE rates for the second half of 2023 as well. The UK-US rates convergence theme as well as stronger UK economic data, could support more of an uplift in GBP/USD before year-end.

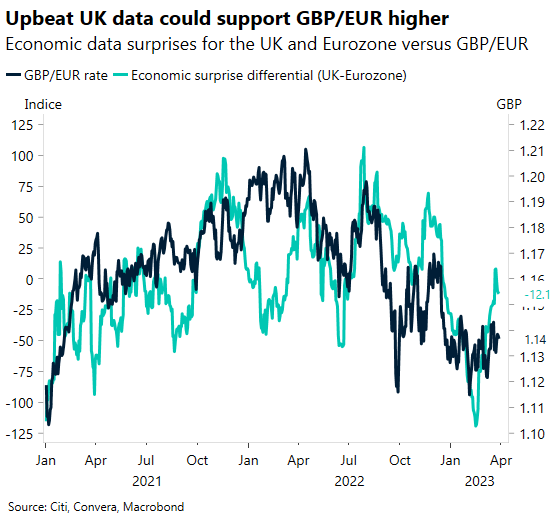

Against the euro, sterling ended a four-day winning streak yesterday with a 0.3% decline, recoiling from its 100-day moving average for the fourth day in a row. GBP/EUR remains trapped between this key resistance level and the 50-day moving average support level at €1.1320. However, amid stronger-than-expected UK data versus European data, upside potential for GBP/EUR could increase given its correlation with the UK-EZ economic surprise differential.

Secondary data becomes market moving

Without any major economic releases impacting markets so far this week, investors have focused on developments surrounding the banking turmoil. As we have described in yesterday’s update, the lack of negative news on that front has been perceived as good news and has given investors an excuse to cautiously rotate into risk assets again.

Today’s final release of US GDP will be accompanied by corporate profits and the GDP deflator (inflation data). However, some unusual and conventionally seen as secondary data releases will be watched more carefully. While the banking turmoil has faded lately, gauging the stress level in the financial system remains crucial for markets. For this reason, attention will fall on the today’s release of the Fed’s balance sheet data, that will be followed by the Fed’s deposit data on Friday. These will give us a glimpse into the recent flows between the central bank, commercial banks and the private sector.

The US dollar might be impacted by the upcoming data given that its recent weakness has been driven by the worries surrounding the US regional banks, the expected tightening of lending conditions and the consequent rate cuts by the Fed. The US dollar index has fallen 10% since reaching a 20-year high in September last year but is only marginally down (-0.9%) year to date.

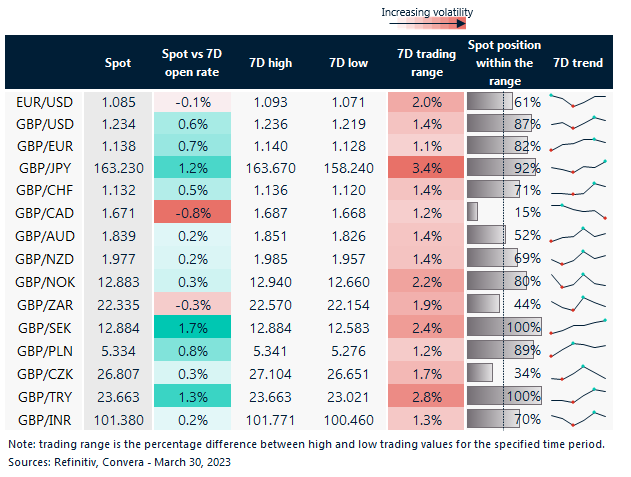

3.4% trading range for GBP/JPY in a week

Table: 7-day currency trends and trading ranges

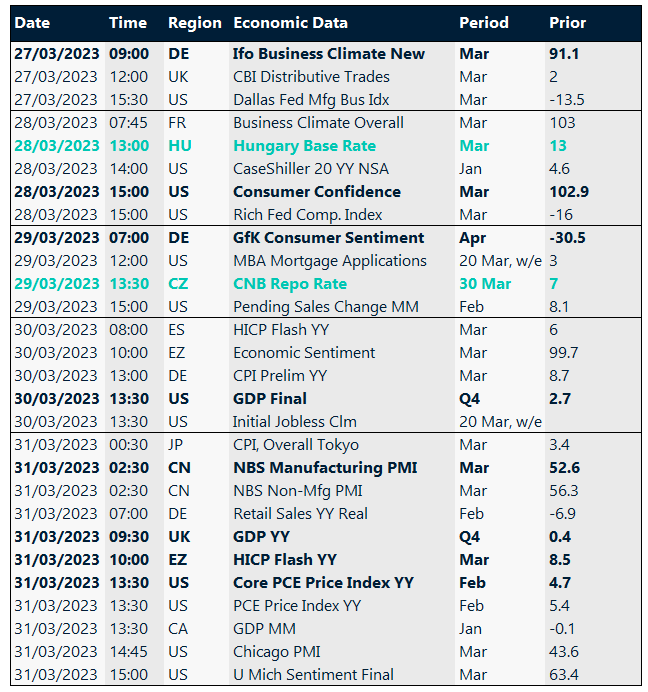

Key global risk events

Calendar: Mar 27 -Mar 31

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.