China data in focus

FX markets were broadly steady after Friday’s big jump in the US dollar with all eyes on today’s key Chinese GDP release.

Chinese March-quarter GDP numbers are due at 12.00pm AEST with markets looking for a 2.2% result over the quarter (up from 0.0% in the December quarter) and 4.0% for the year (up from 2.9%).

Also in focus today, China releases retail sales, industrial production, industrial output and urban unemployment numbers.

While Chinese GDP and industrial production has been volatile in nominal terms, in real terms, there’s been an obvious decline over the last decade as the average pace of Chinese growth slowed.

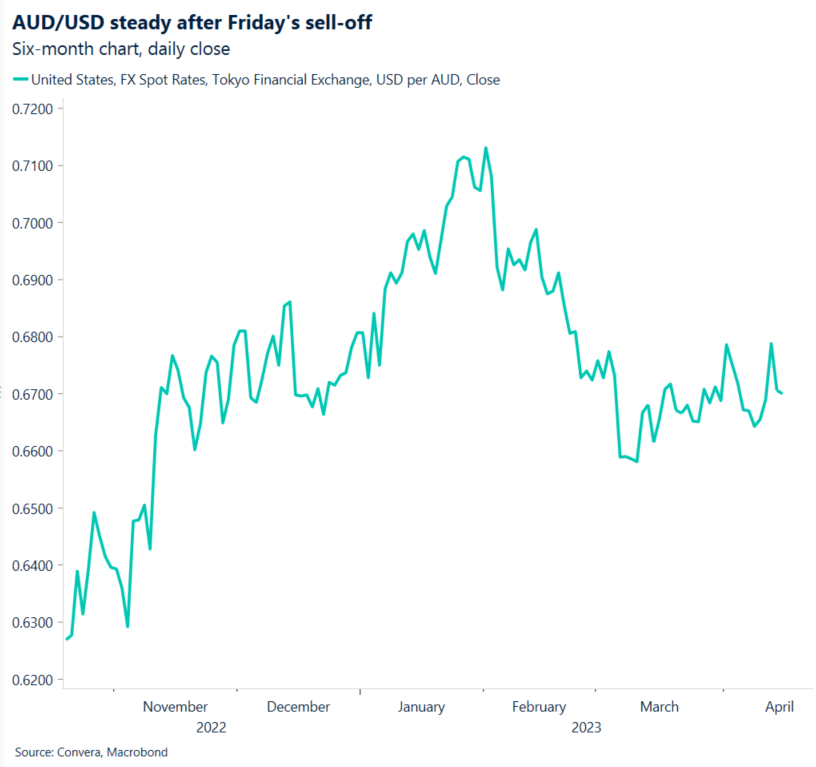

Aussie quieter after Friday’s sell-off

The AUD/USD drifted 0.1% overnight after Friday’s big sell-off from seven-week highs.

The Aussie was better in European markets with the AUD/EUR up 0.6% and the AUD/GBP up 0.2%.

The AUD/JPY gained 0.2%.

The NZ dollar was lower versus the greenback but also higher in Europe.

Euro, pound in focus ahead of key releases

European markets will be in focus this week with major data from the UK and Eurozone.

The UK sees unemployment numbers tonight with any weakening in the UK labour market potentially weighing on the GBP. However, the labour market remains tight.

Financial markets still see another Bank of England rate hike as more likely than not with the market ascribing a 73% chance for an increase from 4.25% to 4.50% when the BoE next meets on 11 May (source: Refinitiv, 18 April).

Tomorrow, final results for Eurozone March inflation will be released.

Aussie, kiwi rebound in Europe

Table: seven-day rolling currency trends and trading ranges

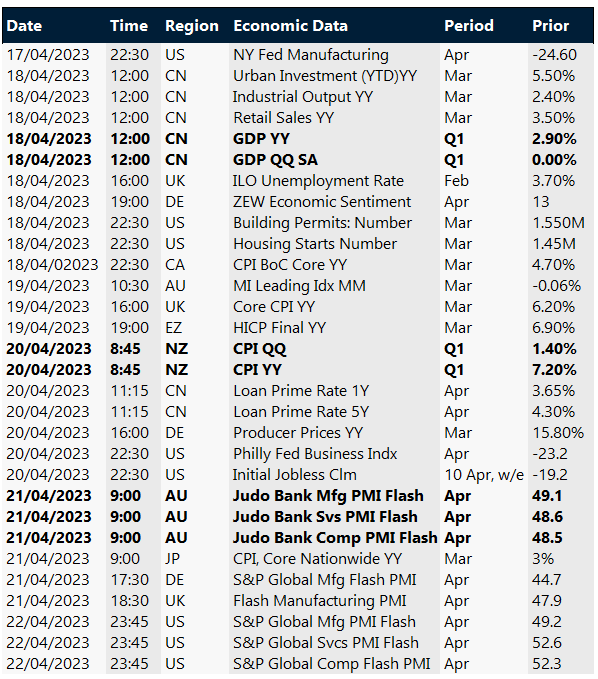

Key global risk events

Calendar: 17 – 22 April

All times AEST

Have a question? [email protected]