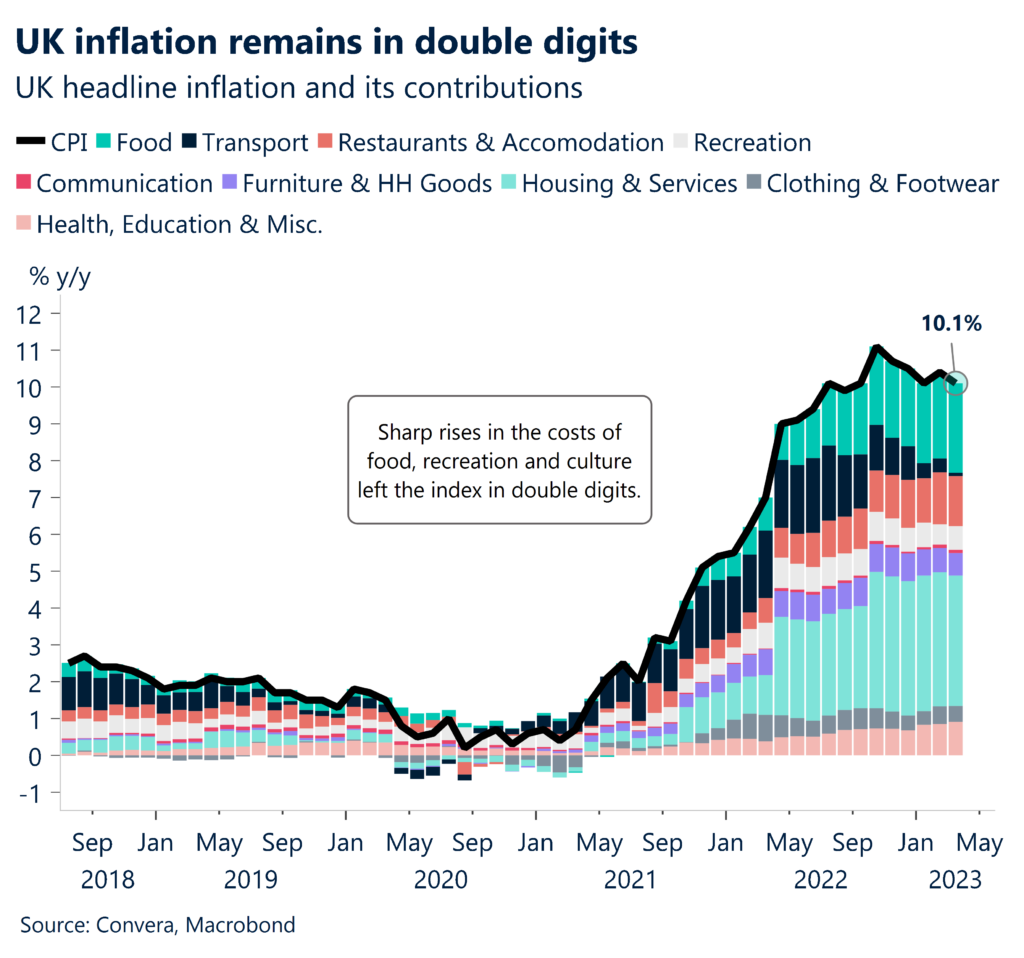

UK inflation sticks above 10%

The pound jumped yesterday after the UK labour market report showed wages are still accelerating, but all eyes shifted to the inflation report this morning, which revealed UK inflation remained in double digits in March, at 10.1% y/y. This raised the probability of a Bank of England (BoE) rate hike next month to 93% from 80%, which sent the pound surging higher.

Increasing wage growth and sticky inflation data this week might have sealed the deal for a twelfth consecutive BoE interest rate rise, which the pound has reacted positively to as money markets now bet on UK rates to peak at 5% in September. Sterling is up across the board, reaching a fresh 4-month high against the Japanese yen and stretching towards $1.25 against the dollar. Against the euro, sterling jumped more than 1% from its daily low. Digging deeper into the inflation report unveils that inflation in the services sector remained at 6.6%, whilst food price inflation soared over 19% – the fastest rate in 45 years. Meanwhile, core inflation, which strips out volatile food and energy, remained stable at 6.2%, which will concern BoE policymakers.

The pound is swinging around this morning as market participants digest the disappointing inflation report. This isn’t good news for the UK economy and puts the BoE in a tight spot as raising rates will only aggravate the current cost-of-living crisis. But it does give the pound a higher yield appeal, hence its rally higher this week.

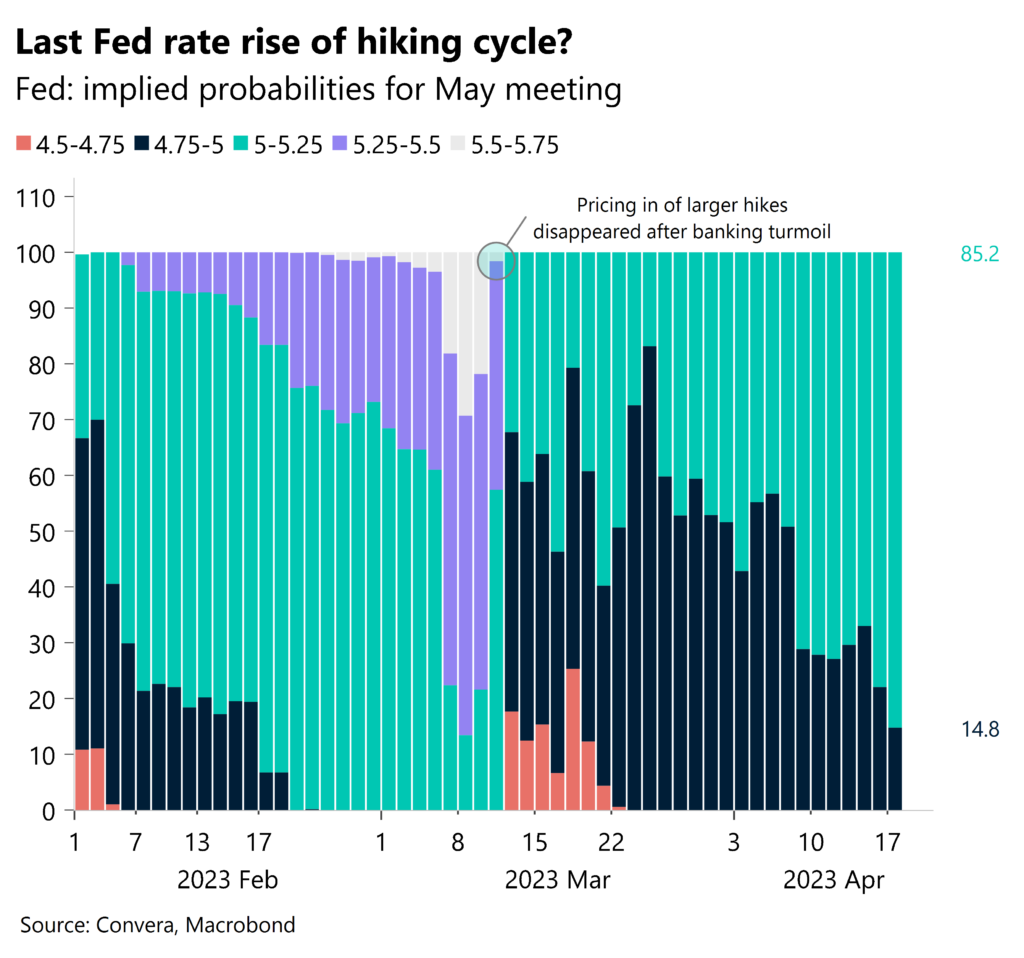

Fed’s battle against markets

The probability of a Federal Reserve (Fed) rate hike in May remains above 80%, but speculation that this will be the last rate rise of the hiking cycle is supporting risk sentiment and hurting the US dollar. Moreover, easing fears around a systemic banking crisis, thanks to robust bank earnings recently, has further dampened dollar demand.

The banking crisis in March had reignited global recession fears, sending the US dollar briefly to a 3-month high last month, but it also sparked a rapid revaluation of US monetary policy, as a significant amount of US rate cuts began to be priced in by money markets. Most Fed officials who have spoken in recent weeks have pushed back against this, highlighting the need to do more to return inflation to their 2% target. Persistent price pressures exist in the Fed’s preferred measure of “super-core” inflation (core service inflation less shelter costs). Fed policymakers have pencilled in one additional 25-basis point hike this year, lifting their benchmark rate to 5.1%, whereas St. Louis Fed chief James Bullard stated yesterday that another 75-basis points of hikes needs to be delivered.

A key driving force behind the volatility in the US dollar is the volatility in bond markets, and this is being driven by the ebb and flow of monetary policy expectations, which are being driven by data and Fed talk. It’s no surprise then that volatility at the end of a tightening cycle has been shown to be more elevated given the difficulty of pricing what central banks will do.

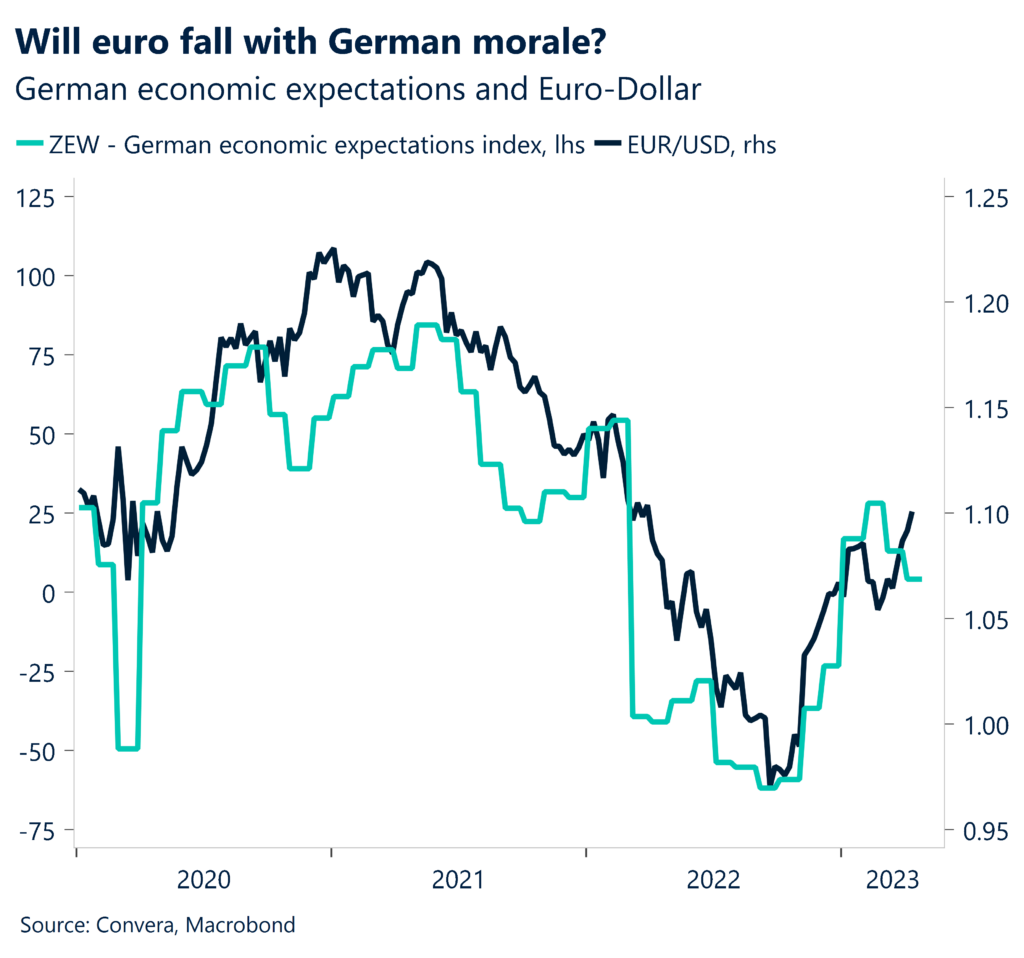

Euro brushes off German morale decline

The euro erased Monday’s losses against the US dollar yesterday and European shares held at a one-year high as investors cheered upbeat economic data from China and overlooked the disappointing German ZEW surveys.

German investor morale unexpectedly deteriorated in April on concern about the banking sector and elevated inflation. The ZEW indicator of economic sentiment declined for a second month to 4.1 in April, the lowest so far this year, from 13 in March and well below market forecasts of 15.3. According to the survey results, no significant improvement in the economic situation is to be expected in the next six months. On a more positive note, a gauge of current conditions rose more than anticipated, but is still considered relatively negative. This so-called soft data has been a bellwether for the euro’s rebound since late 2022, so the fall in investor morale may unnerve traders betting on an extension of euro strength.

Although narrowing US/German yield spreads favour the euro, the circa 13% rally in EUR/USD is the biggest 6-month change since 2009 and speculative traders are heavily overweight euros, which could spark a contrarian view to crowd sentiment – betting against the euro. One catalyst that could spark a rapid reversal of EUR/USD could be a more hawkish Fed meeting next month.

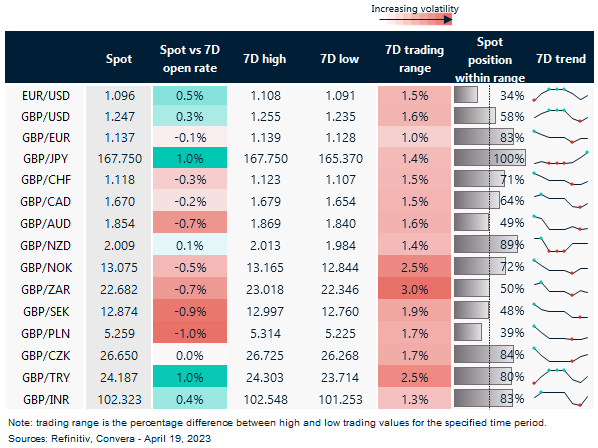

GBP/JPY hits 4-month high

Table: 7-day currency trends and trading ranges

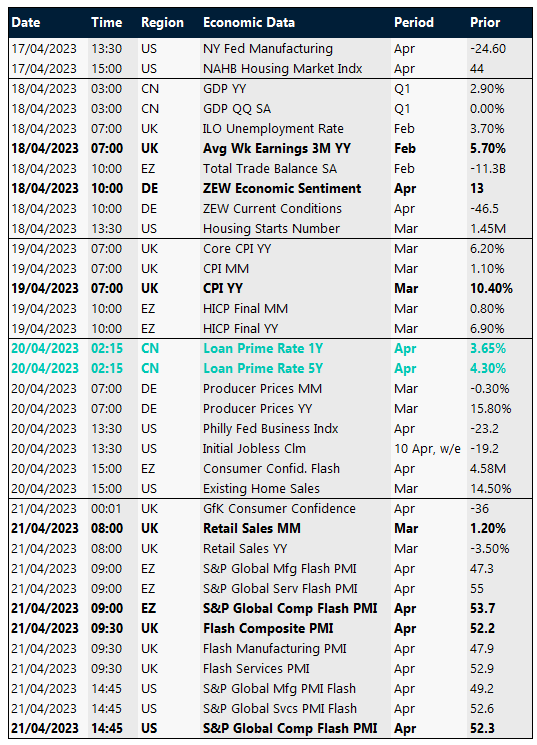

Key global risk events

Calendar: Apr 17-21

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.