Written by Convera’s Market Insights team

CAD slumps to post-pandemic low

George Vessey – FX Strategist

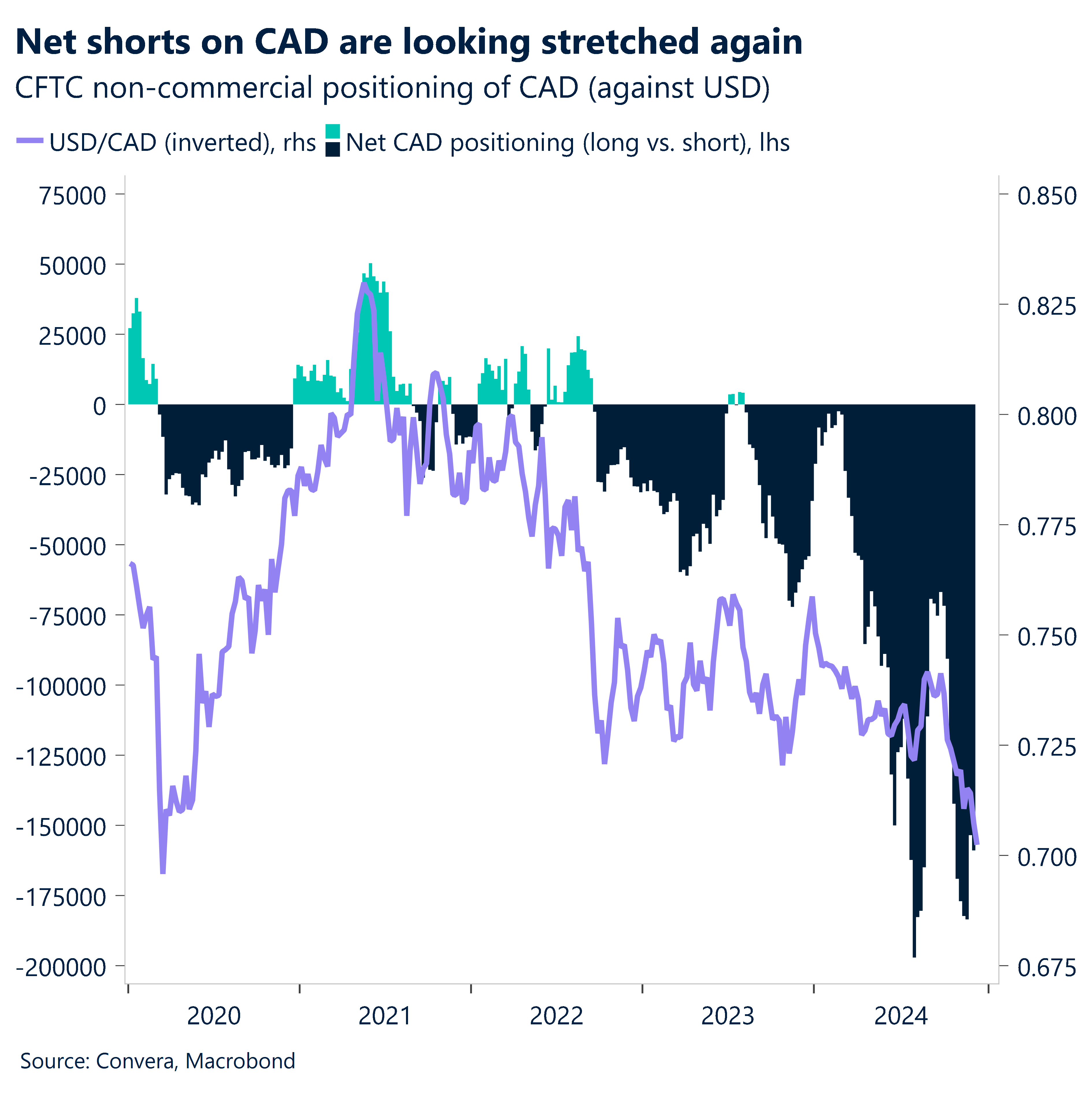

The Canadian dollar’s downward spiral against the US dollar has gained traction after the Finance Minister resigned yesterday. USD/CAD hit a post-pandemic high near the C$1.43 handle. However, FX option traders are pricing for the currency to improve from here.

Although the latest political developments in Canada add to the bearish factors on a currency that’s already vulnerable to widening rate differentials and trade risks, investors are anticipating that perhaps enough bad news is already priced. Net shorts on the so-called “Loonie” are already large, nearing their July peak, and with year-end approaching, there is a risk of broad dollar selling due to seasonality effects and potentially reduced positioning once the Fed decision is out of the way.

Today’s inflation data from Canada is in the spotlight first though. With the headline figure expected at 2%, it should reassure the Bank of Canada that its easing path is the correct one.

Consolidation at high levels

Boris Kovacevic – Global Macro Strategist

The US dollar consolidated at high levels as investors await G10 central bank decisions later this week. The currency began the week on slightly weaker footing but has opened today’s session with slight gains across the board.

The overall backdrop is clear. We are living in a low volatility regime. Other than the oil markets, implied volatility rates are lower than their 2024 average and compared to 60 days ago. The euro has not been able to profit from this fact, mainly because it’s a low volatility, strong dollar environment. This might sound counterintuitive. However, the low volatility is not caused by falling yields and a weaker dollar but by the resilience of the US economy and high probability of a soft landing, which is supporting the Greenback.

This case has been made once again by yesterday’s data releases. The US composite PMI rose from 54.9 in October to 56.6 in November, reaching the highest level since March 2022. The services sector expanded by the most in three years, showcasing the strength and resilience of the US consumer. This is why the Fed is expected to deliver a hawkish undertone when cutting interest rates by 25 basis points on Wednesday, which will open up the way for a pause in January.

US policy makers have probably gotten ahead of themselves when it comes to their lenient inflation assessment. Ever since prices started rising at the beginning of 2021, the FOMC’s inflation risk perception tracked its preferred price measure, the core PCE figure. Since 2022, policy makers have been even more cautious than inflation would have suggested or justified. This has turned in September, when only three FOMC members saw upside risks to core PCE. We expect the assessment to shift to the upside as the Fed prepares to pause its easing cycle in January.

Stagnation at year-end

George Vessey – FX Strategist

The euro is grappling with the $1.05 handle versus the USD at the start of the week, despite flash PMI data highlighting the ongoing huge divergence between European and US economic activity. Overall, the December flash PMIs for Europe point to a still weak growth picture at the end of the year, with the continent stagnating in the fourth quarter.

That being said, although the composite PMI remains below the 50 threshold (no expansion) it has recovered most of the decline observed in November. The improvement was driven by a significant rebound in the headline services index, which rose by 1.9 points to 51.4. Geographically, France remained the laggard, with an abysmal manufacturing survey, though the services PMI showed some resilience. The German services PMI also fared better than forecast, lifting the nation’s composite PMI. Ultimately, it doesn’t change the narrative of the ECB cutting rates deeper and more aggressively than the Fed in 2025. Thus, nominal and real interest rate differentials favour the dollar over the euro.

However, although the euro is down 0.75% this month, seemingly defying seasonality patterns, we note that’s it actually the last two weeks of December when the common currency exhibits strong seasonality bias. So, we’re not ruling out a tepid euro recovery over the festive period, though Q1 2025 looks tough given policy divergence, ongoing political headwinds in Germany and France and the threat of severe trade tariffs once Trump is inaugurated.

Pound rises with UK wages

George Vessey – Lead FX Strategist

A barrage of UK data has already been published this week. The composite PMI moved sideways, supported by the services sector, whilst the downtick in employment and uptick in prices were notable. The unemployment rate (4.3%) came in line with expectations, but wage numbers came in hot. Sterling has appreciated modestly across the FX space, with GBP/USD and GBP/EUR approaching $1.27 and €1.21 respectively, both up almost a cent from yesterday.

Overall, private sector business activity remains in slight expansion, marking the 14th straight month of growth, with expansion in services offsetting another contraction for manufacturers. Digging into the detail reveals some concerns though. It showed Britain’s private-sector firms cut jobs at the fastest pace since the global financial crisis, outside the pandemic, aligned with concerns of lower employment as the UK’s new budget hiked the payroll tax. New orders dropped for the first time in 13 months to raise doubts on future spending patterns. And rising wages contributed to average prices charged increasing at the fastest pace for nine months. This will cause concern for Bank of England (BoE) policymakers ahead of their final policy decision of 2024 this Thursday.

In terms of the labour market data released this morning, it’s wages that are in the spotlight and lifting the pound higher. UK regular wage growth accelerated more than forecast in the three months through October. Private-sector regular pay growth, the gauge most closely watched by the BoE, increased to 5.4% from 4.9%. Hence, money markets have pared bets on UK interest-rate cuts through 2025, trimming about 10 basis points to 62 basis points of cuts priced in, i.e. less than three 25bps cuts in total.

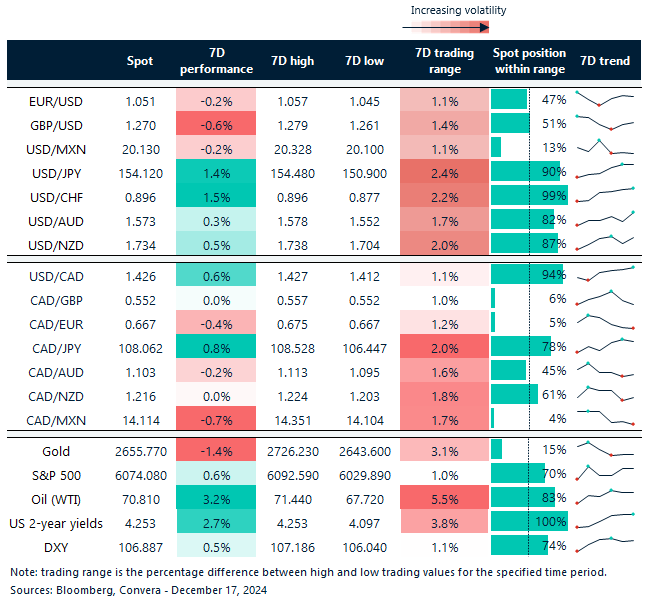

Safe havens on the defensive

Table: 7-day currency trends and trading ranges

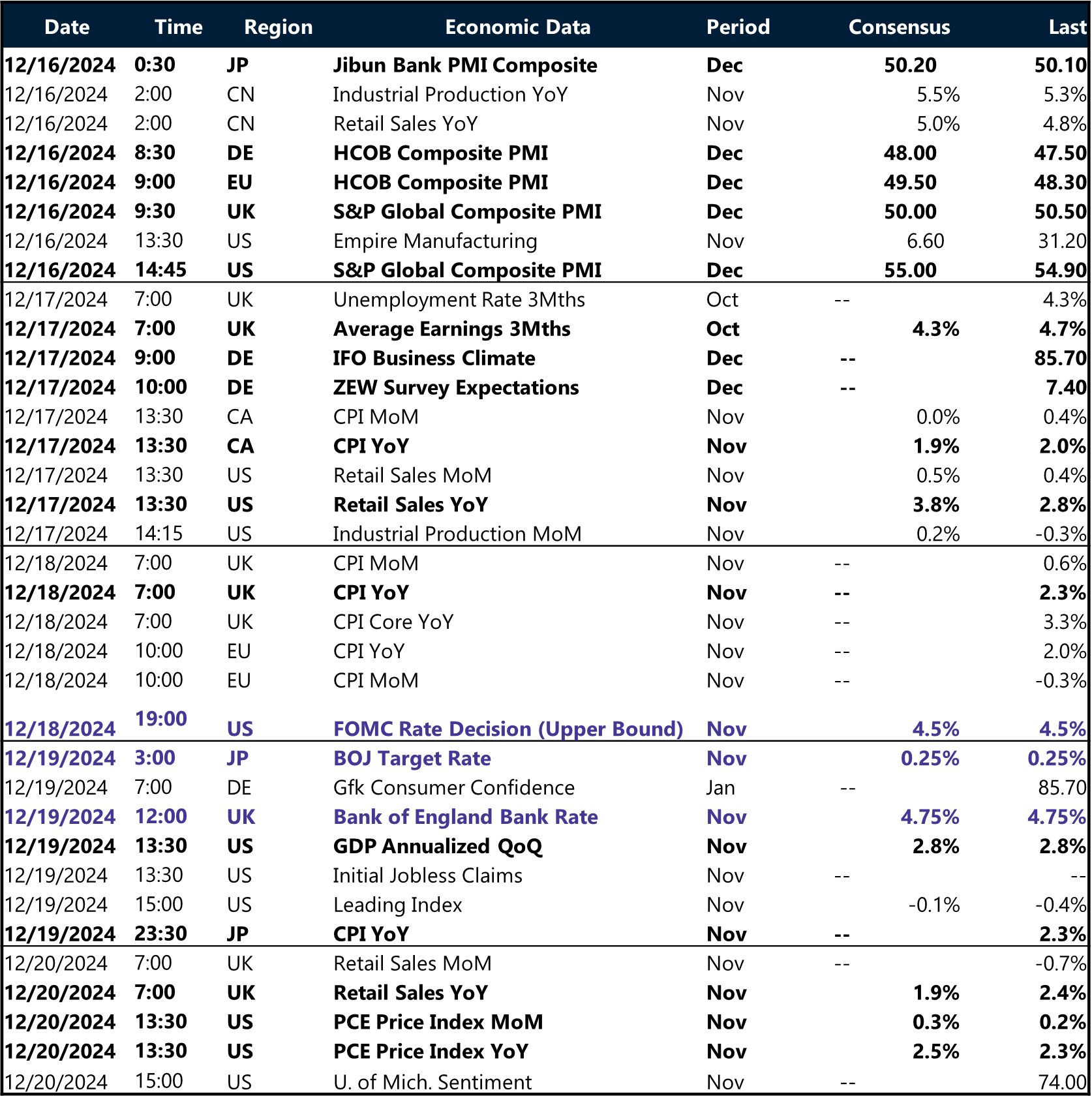

Key global risk events

Calendar: December 16-20

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.