Global overview

Diminishing worries about banking instability led the U.S. dollar to tilt on its back foot a day after it caught a general reprieve. The fragile greenback slipped to one-week lows against the euro and hit its weakest level in four and eight weeks versus rivals from Canada and Britain, respectively. Market sentiment has improved amid an absence of news on the global banking crisis. The resulting calm has curbed demand for safe bets like the dollar as investors wade back into riskier waters such as equities and currencies like the aforementioned trio. Banking worries, which remain elevated, could prompted the Federal Reserve to pause dollar-positive rate hikes sooner and potentially pull forward the timeframe for policymakers to cut rates to spur growth. Still, the outlook for U.S. interest rates remains fluid and will look for some steering from influential jobs and growth data today, followed by Friday indicators on consumer spending and inflation. Evidence of solid consumer spending and inflation making a slow descent to the Fed’s 2% goal could help the dollar rebound. Ahead of the data, the dollar index was on track for a monthly decline of about 2%.

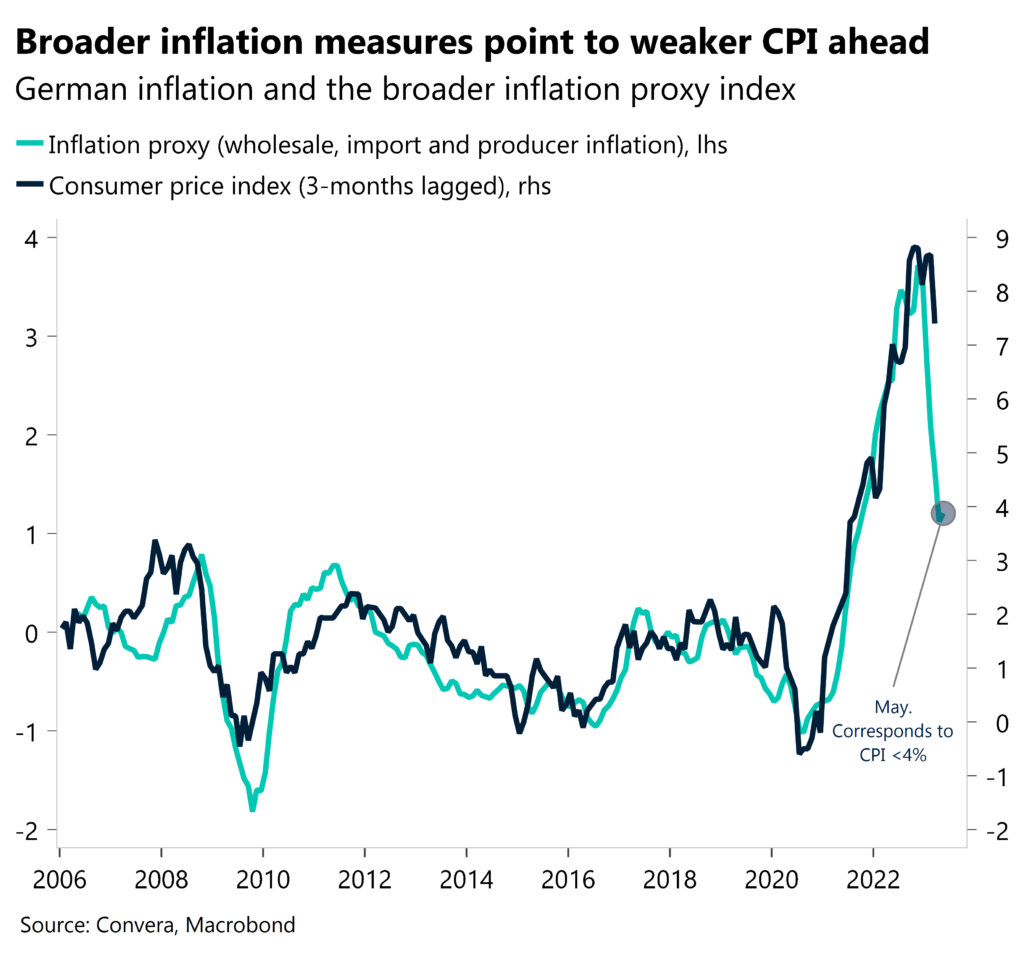

Euro maintains the upper hand

The euro’s climb to one-week highs against the U.S. dollar moved it closer to recent early February peaks. The European currency shared by 20 countries is enjoying twin tailwinds related to reduced anxiety over banking instability that’s sapping safety flows into the dollar, and expectations that the ECB has more rate hiking to do over the balance of the year than the Fed. But like the Fed, the outlook for ECB policy remains fluid and subject to change, putting heightened attention in central bank-impacting inflation data. A solid moderation in euro area inflation Friday could reduce scope for the ECB to raise rates, a scenario that could weaken the euro.

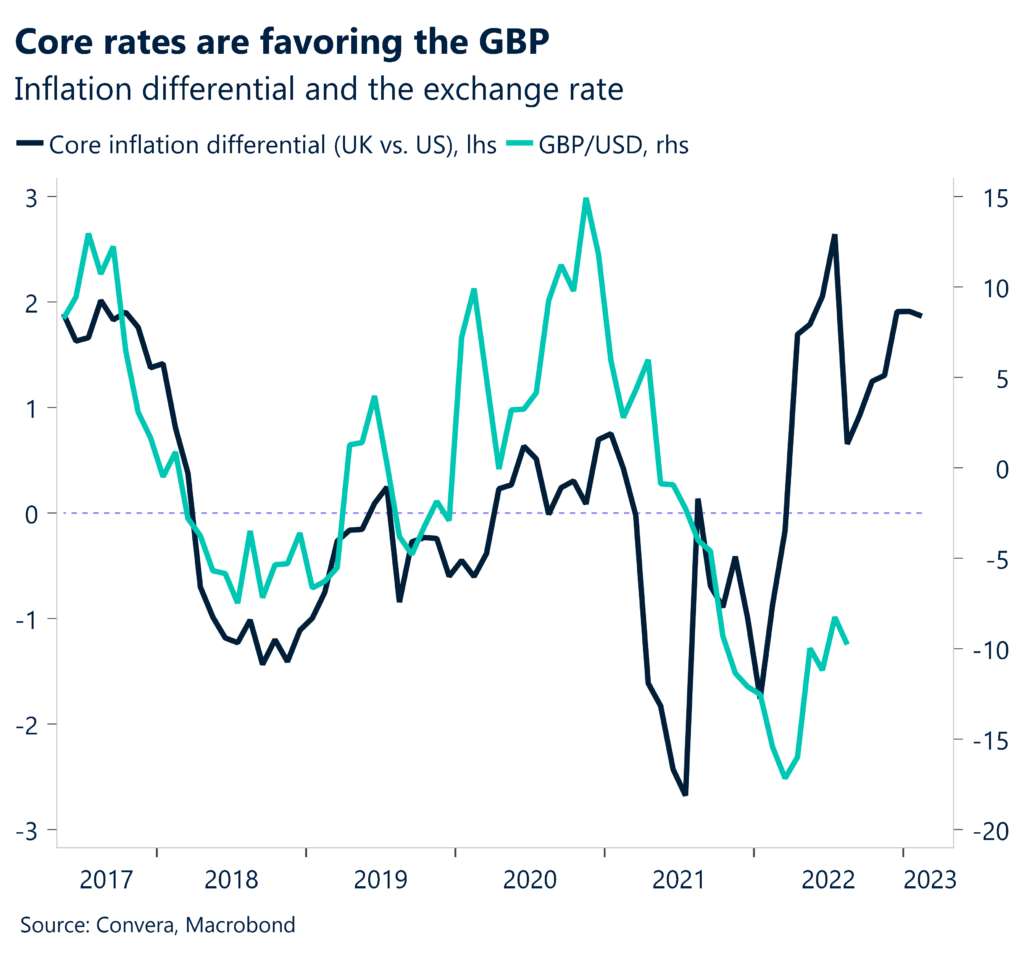

Sterling scores 8-week peak

Closing out a bullish month, the UK pound rose to 8-week highs against its U.S. counterpart. Moderating concerns about the banking sector has weighed on the safe bet dollar to the benefit of sterling. Moreover, UK inflation failing to cool in a meaningful way suggests Bank of England interest rates may need to peak at higher levels which is positive for the pound’s attractiveness. Up nearly 3% in March, GBP/USD was on track for its best monthly performance since last November.

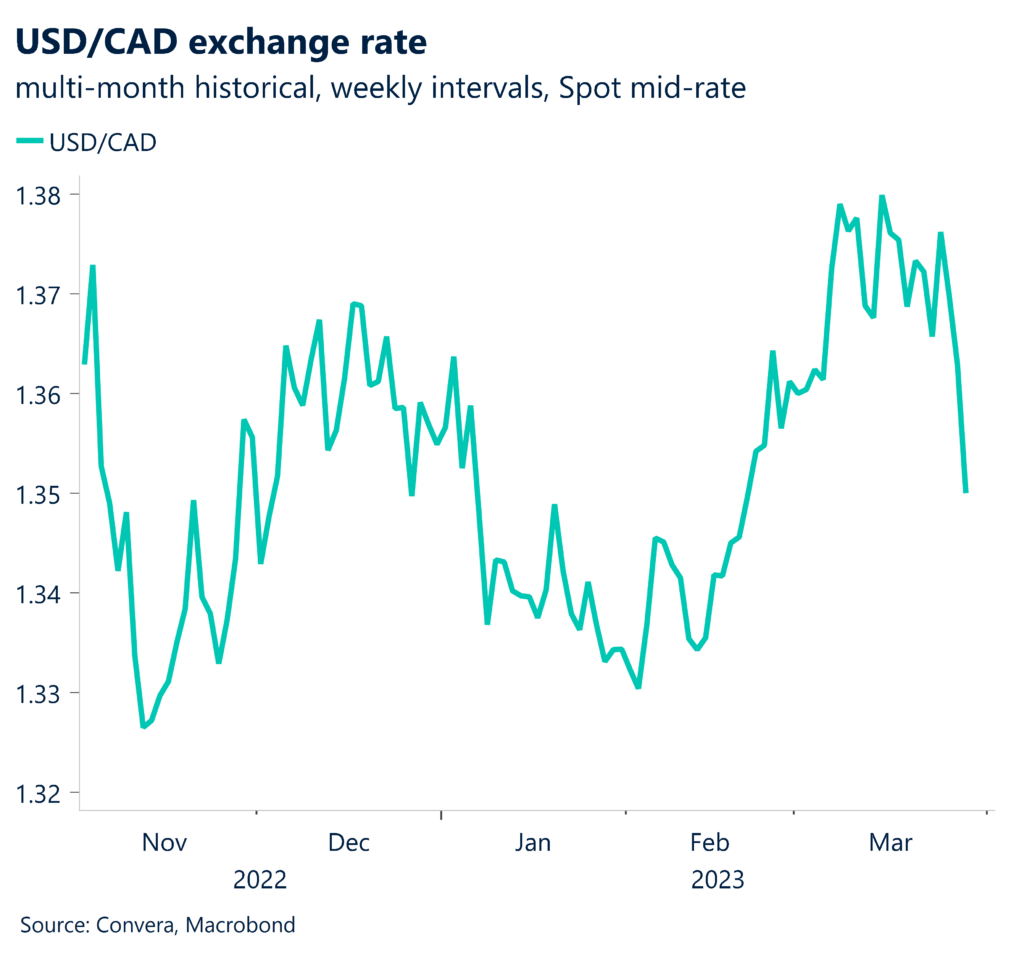

C$ ascends to 1-month highs

A trifecta of positive forces boosted the Canadian dollar to more than one-month peaks against its U.S. rival. Improved risk sentiment stemming from fading in worries over banks has been positive for the loonie, along with oil prices climbing to multiweek highs above $70. Adding traction to the loonie’s bounce higher has been C$ bears who have started to abandon some of their bearish positions which by one measure have risen to the highest level since early 2019.

Dollar falls as data underwhelms

The U.S. dollar carved out fresh session lows after weaker than expected data bolstered the argument that the Fed may be done raising interest rates. Weekly jobless claims rose more than expected to 198,000 in the latest period, a still historically low level but above forecasts of 196,000 from 191,000. U.S. economy grew at a slightly slower 2.6% annual rate during the fourth quarter, compared to expectations of 2.7%. More influential data looms Friday on consumer spending and inflation. The dollar would be vulnerable to testing new lows if U.S. inflation should continue a cooling trend.

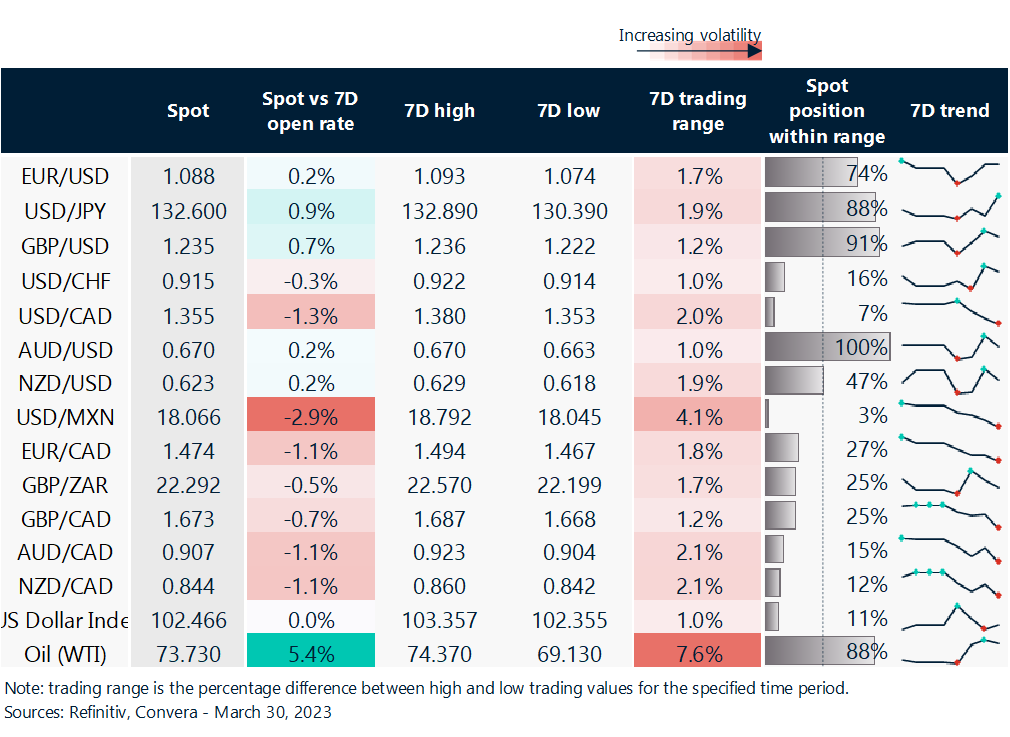

Dollar struggles as U.S. interest rates near peak levels

Table: rolling 7-day currency trends and trading ranges

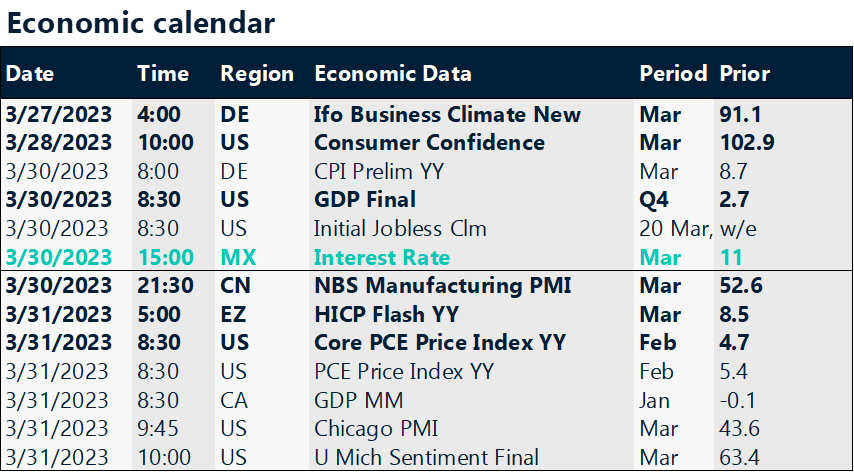

Key global risk events

Calendar: Mar 27-31

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.