UK data to sway BoE?

The UK economy is performing better than many had anticipated, which has helped the pound outperform many major currency peers this year. Waning economic gloom, coupled with resilient risk appetite across financial markets amid hopes of the global tightening cycle coming to end, has helped boost demand for risky assets of late. This week though, a raft of economic data could determine the Bank of England’s (BoE) next policy decision and steer sterling.

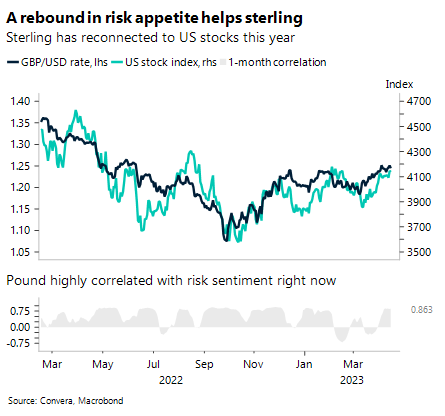

The narrative that cooling US inflation data could prompt the Federal Reserve (Fed) to end its tightening cycle and cut rates by the end of this year is fuelling demand for riskier assets like stocks. The one-month correlation between GBP/USD and the benchmark US stock index has risen to 0.86, which suggests one of the main drivers of the pound is the global investment mood. But this week we see UK labour market data, inflation, retail sales and flash industry PMIs – all highly important for the BoE’s next policy decision in May, whereby markets are pricing a near 70% probability of a 25-basis point hike. Will another surprise higher in UK inflation boost the odds of a hike and support sterling? BoE Chief Economist, Huw Pill, recently stated the UK could experience a “positive demand shock,” supporting economic growth, but potentially adding pressure on the pace of price growth. Meanwhile, retail sales and PMIs are likely to be consistent with the relatively stagnant economic backdrop, meaning the BoE may opt to keep rates unchanged.

Remarks by BoE rate setters Jon Cunliffe on Monday and Catherine Mann on Wednesday will also be watched for new clues. Will GBP/USD look to retest and extend beyond its recent 10-month high of $1.2550 this week? Or is this the new ceiling of a newly established trading range of $1.18 to $1.26ish? Economic data and global risk sentiment developments remain pivotal.

Hike in May, but expected cuts still weigh

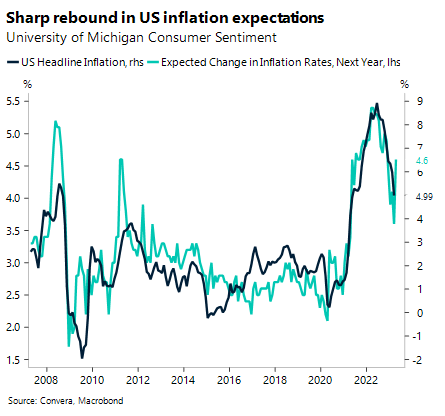

After falling to a fresh 1-year low against basket of currencies last week, the US dollar ended last Friday on a more positive not after a US report showed sentiment improving and an index of one-year inflation expectations rising more than expected. EUR/USD clung on to the key $1.10 handle, but GBP/USD fell nearly 1% from 10-month highs.

The annual increase in US consumer prices slowed for the ninth consecutive month, the longest stretch of disinflation since 1984, but core inflation remains highly elevated and is viewed as the better indicator of underlying inflation, up 5.6% from a year ago. It’s the first time in over two years that the core came in above the overall measure. Producer prices unexpectedly fell 0.5% month-on-month in March – the biggest decline in nearly three years. Core producer prices also decreased for the first time since 2020, raising hopes that lower core consumer inflation could follow. The revival of the dovish Fed interest rates outlook keeps the dollar vulnerable, however, heading into the weekly close, the dollar rebounded thanks to hawkish comments by Fed policymakers and an uplift in US consumer inflation expectations boosting the odds of a hike in May. As the Fed remains data-dependent, speeches from the central bank’s policymakers will be closely scrutinised for future policy paths. It’s relatively quiet week on the data front in the US barring some key housing data, the Philly Fed index and flash PMIs.

Although EUR/USD is back under the $1.10 threshold this morning, it is still over 2.5% higher year-to-date. With evidence mounting that the Fed’s next rate hike will be the last of this tightening cycle, the debate is shifting to when the Fed will start cutting rates, which will likely have more bearing on the dollar’s appeal.

Hawkish ECB tones support euro

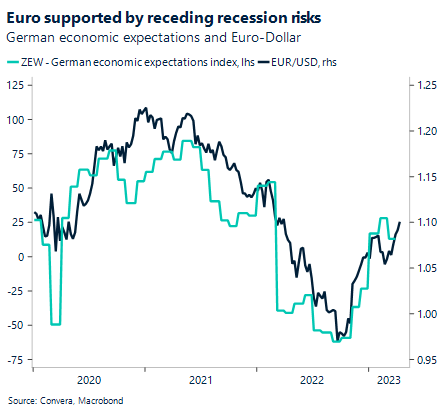

As it stands, the Eurozone looks likely to avoid a systemic banking crisis, and with core inflation sticky, the European Central Bank (ECB) is expected to deliver two more 25-basis point rate hikes by mid-year. This is helping to buoy euro demand, but we will closely monitor volatility in market sentiment over the coming months and the slew of key data due this week, which could influence the ECB’s decision.

While consumer-related data and surveys remain soft, robustness of the labour market and slowing overall inflation suggest that the near-term consumer outlook is improving. Tomorrow, we see Germany’s ZEW surveys released, which have recently been a key driving force behind euro demand. Moreover, the March PMIs indicated that activity has remained resilient in the Eurozone, which implies some upside risk to first quarter GDP results. Flash PMI data will be a key focus this week for clues around whether this encouraging trend persisted in April. Meanwhile, despite headline inflation in the Eurozone recording its lowest in 13 months in March, the recent rally in oil prices after OPEC’s surprise output cuts, could reignite price pressures, whilst both core and food inflation recently hit a fresh record high. Overall, resilient economic activity across Europe, combined with sticky core inflation, especially in the services sector, has given the May ECB meeting a hawkish tilt, with several policymakers debating whether a 50-basis point hike might be necessary.

As EUR/USD is the most traded currency pair in the world, trends in this currency pair can manipulate other currency pairs like GBP/EUR. As such, GBP/EUR suffered its biggest weekly decline since early February last week, stuck under the €1.13 handle and now in the bottom half of its year-to-range.

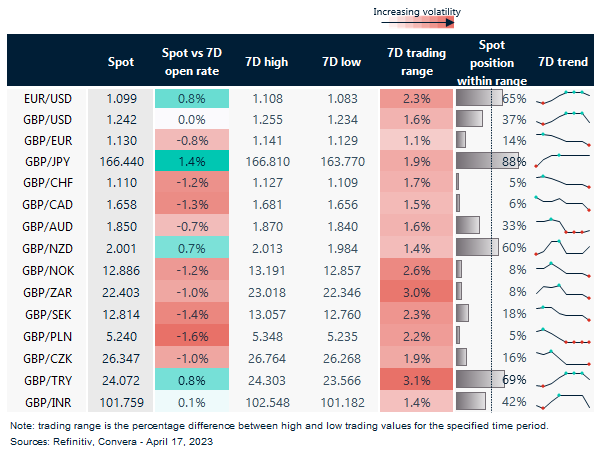

GBP/JPY over 1.4% higher

Table: 7-day currency trends and trading ranges

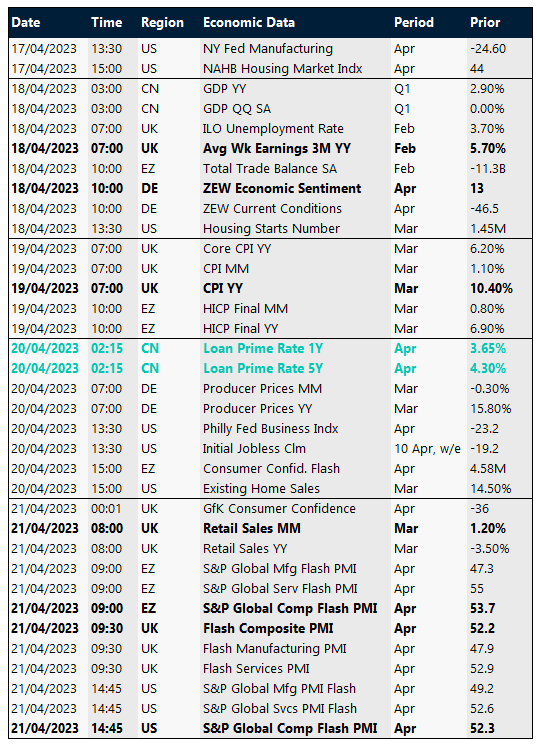

Key global risk events

Calendar: Apr 17-21

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.