Australian inflation turns lower, with monthly series extending falls

The Australian dollar was sharply lower yesterday after the latest inflation result showed price pressures rapidly easing.

The traditional quarterly headline reading fell from 1.9% in the December quarter to 1.4% in the March quarter, with the annualised rate falling from 7.8% to 7.0%.

But it was the new monthly series that continued to show an even sharper fall — down from 6.8% in annualised terms in February to 6.3% March.

The result now sees local bond markets no longer expecting any further rate hikes from the Reserve Bank of Australia.

The RBA meets again on Tuesday with only a 10% probability of a rate hike (source: Refinitiv).

Aussie, kiwi pressured by bank fears

The Australian dollar was lower on the CPI news.

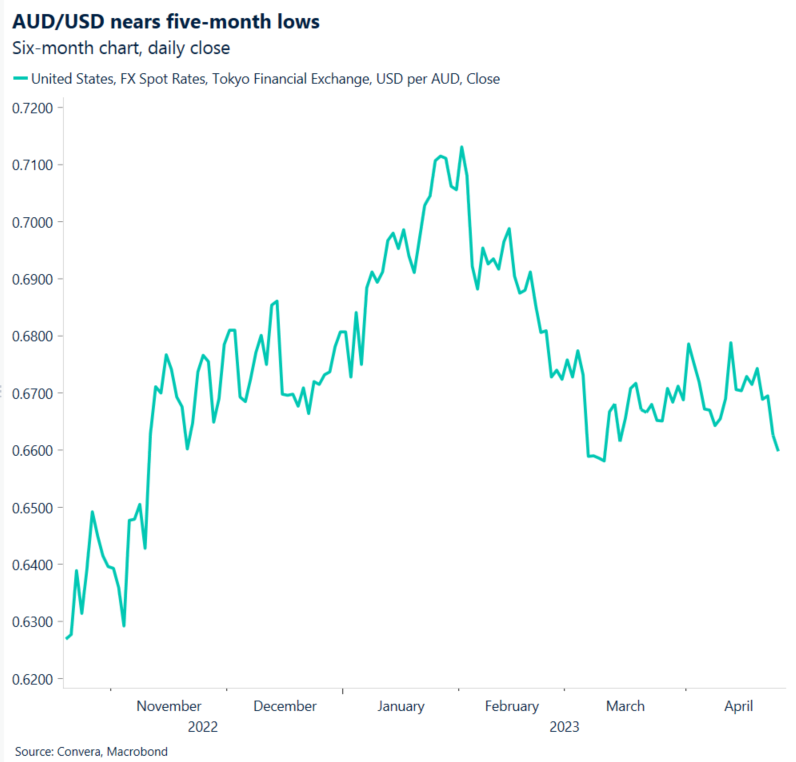

The AUD/USD fell 0.4% as it neared five-month lows.

Global markets were also weighed down by further fears around US bank First Republic as worries around its solvency continued. First Republic fell 30% overnight and is now down 96% since early March. The S&P 500 fell 0.4%.

The kiwi was also pressured with the NZD/USD down 0.3% as it neared the bottom of its recent trading range.

US GDP due

Tonight, all eyes are on the US GDP release, due at 10.30pm AEST.

Financial markets have recently soured on the outlook for the March-quarter GDP result with the key Atlanta Fed GDPNow model forecast falling from 2.5% last week to 1.1% overnight.

The main concern for the US is that consumer spending has dropped as interest rates climb. The property market has been particularly affected.

On the other hand, net exports are expected to continue to provide support.

Aussie hit after CPI

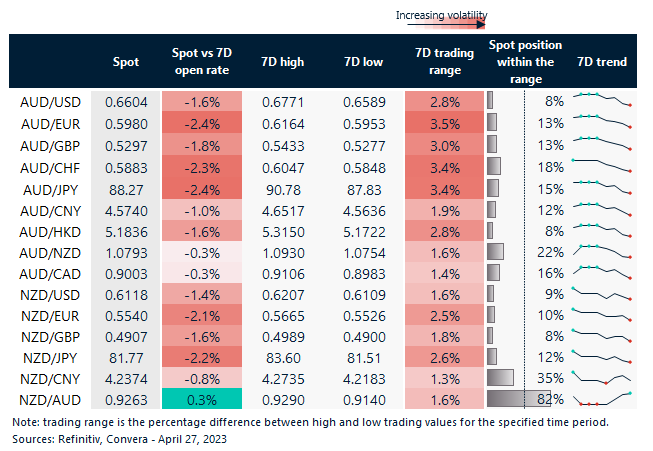

Table: seven-day rolling currency trends and trading ranges

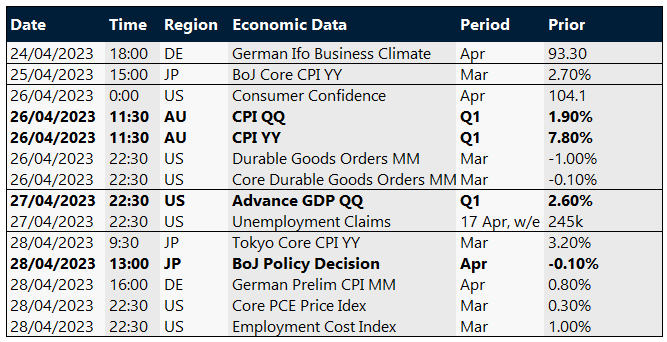

Key global risk events

Calendar: 24 – 28 April

All times AEST

Have a question? [email protected]