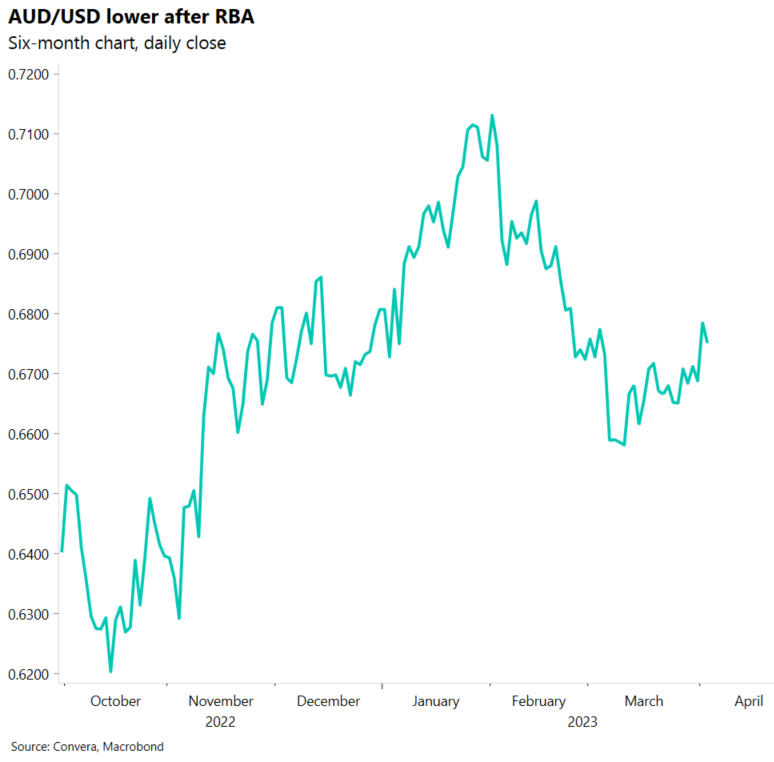

Aussie hit as RBA moves to “hold”

The Australian dollar was lower in most markets yesterday after the Reserve Bank of Australia’s decision to keep interest rates steady at 3.60%.

The RBA said further hikes remain likely, saying it “expects that some further tightening of monetary policy may well be needed to ensure that inflation returns to target”.

That said, the RBA is more concerned about an economic slowdown, saying: “There is further evidence that the combination of higher interest rates, cost-of-living pressures and a decline in housing prices is leading to a substantial slowing in household spending.”

The RBA cautiously suggested it is winning the fight against inflation. The RBA said: “A range of information, including the monthly CPI indicator, suggests that inflation has peaked in Australia. Goods price inflation is expected to moderate over the months ahead due to global developments and softer demand in Australia.”

We’ll get more information on the RBA’s outlook today. RBA governor Philip Lowe speaks to the National Press Club at 12.30pm AEST.

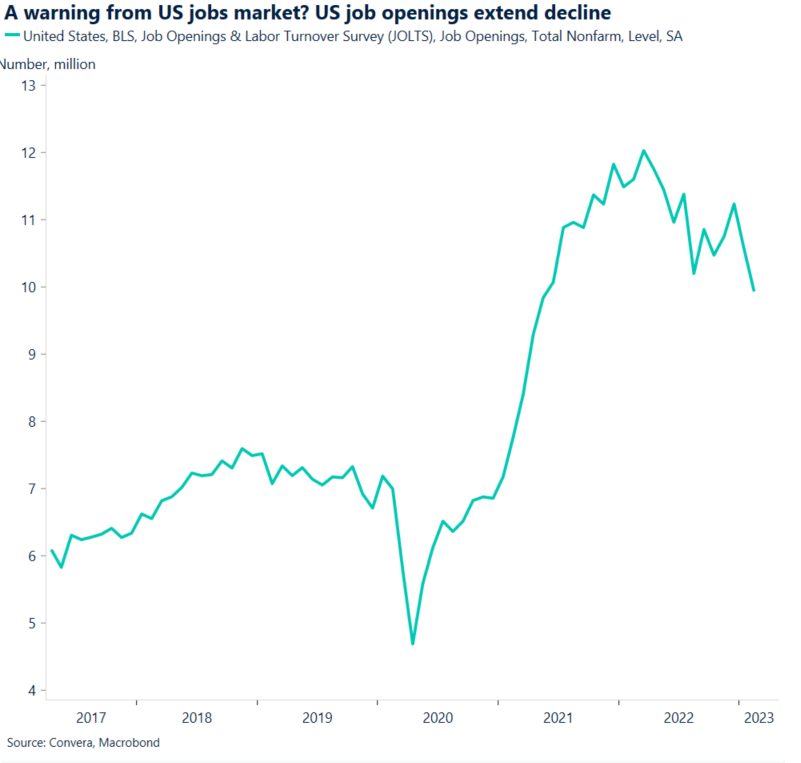

US job numbers spark doubt

In the US, sharemarkets were lower after a sharp fall in key economic data.

US factory orders fell 0.7% in February – extending a recent theme of weakening in manufacturing – but the big drop in the JOLTS job opening series was a major shock to markets.

US job openings fell below the 10 million mark for the first time since mid-2021 in a sign that the recent strength in the US labour market might be waning.

US ADP jobs data is out tonight while the all-important monthly non-farm employment release is out on Friday night.

RBNZ outlook in focus

This afternoon, the Reserve Bank of New Zealand is expected to raise rates 25 basis points to 5.00%. The RBNZ decision is due at 12.00pm AEST.

The latest market pricing sees an 85% chance for a hike.

This big risk for the NZD is if we see any suggestion of a pause from the RBNZ – a signal that the RBNZ might be on hold could cause the kiwi to be sharply lower after the announcement. The NZD/USD traded to seven-week highs overnight.

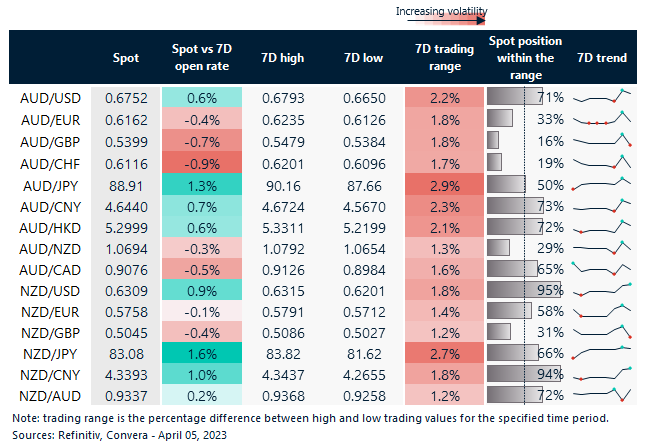

Aussie lower after RBA, but NZD holds at highs Table: seven-day rolling currency trends and trading ranges

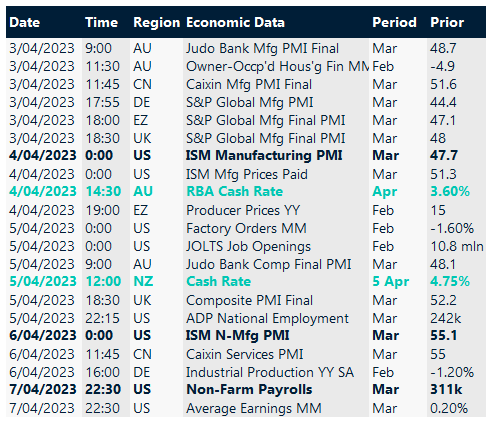

Key global risk events

Calendar: 3 – 7 April

All times AEST

Have a question? [email protected]