Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

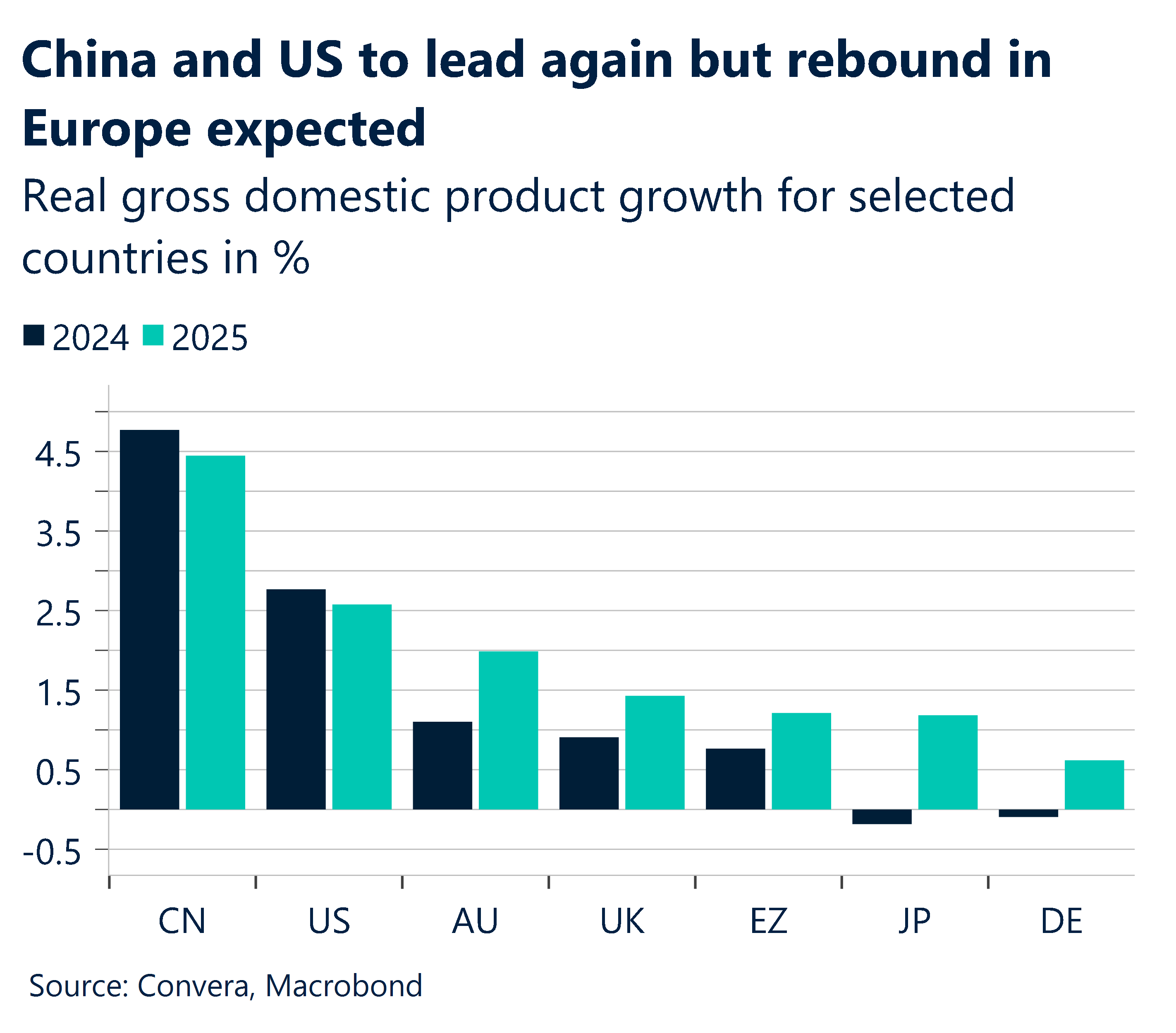

Chinese news boosts regional FX

The Australian dollar led gains overnight after commentary from Chinese policymakers signaled an increase in fiscal and monetary policy in 2025.

Following a monthly meeting of the Politburo, a key policy-making body, Chinese state media reported that monetary policy would be “moderately loose” in 2025 while fiscal policy would be “more proactive”.

The release followed commentary in September that also announced a series of stimulus measures that saw regional equity markets surge.

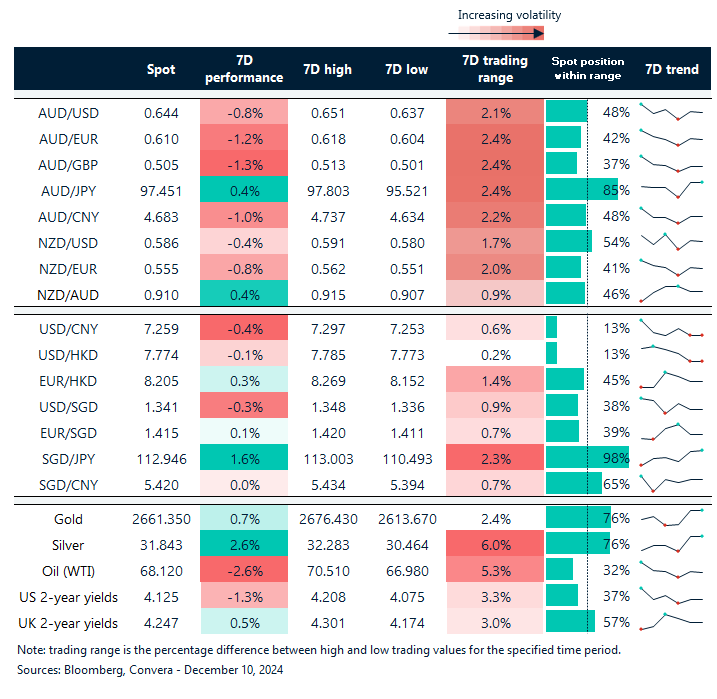

The Aussie outperformed with the AUD/USD up 0.7% and the AUD higher in most other markets. The Aussie’s best gains were versus the euro (up 0.9%) and the Japanese yen (up 1.6%).

In other markets, the NZD/USD gained 0.5%, the USD/SGD fell 0.1% while USD/CNH lost 0.3%.

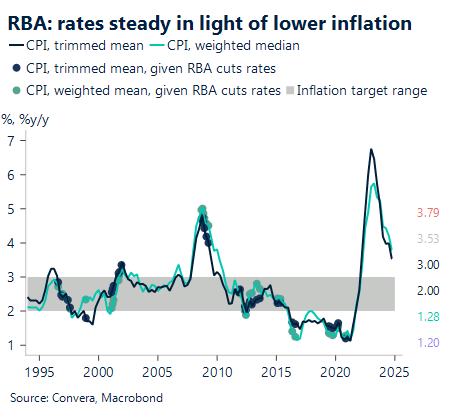

RBA to hold rates, but AUD vulnerable to dovish signals

The RBA policy meeting decision is due Tuesday (14:30 AEDT).

The market pricing sees only a 6.0% chance of a 25bps cut – and therefore the RBA looks likely to declare an unchanged cash rate of 4.35%.

The RBA will likely reiterate several of the statements from its meeting just few weeks ago, including the following: i) underlying inflation is still too high; ii) getting inflation back to target is still the top priority; and iii) it will take all necessary steps to reach that goal.

That said, it’s noteworthy that Q3 GDP, and Q3 consumer spending in particular, fell short of forecasts, notwithstanding the fact that recent activity data has been inconsistent.

We believe that parts of its communication may lean more dovishly in light of the recent, generally lower inflation and wage indications. We’re looking for a 25-basis point rate cut in February 2025.

If the RBA appears more open to rate cuts, the AUD/USD could see losses. If AUD/USD breaks the strong support at 0.6360, this sets up a move to 0.6250.

Malaysia industrial production drums manufacturing beat for MYR

Later, Malaysia industrial production will be announced.

We expect industrial production growth to edge up to 3.1% y-o-y in October from 2.3% in September, reflecting higher goods export growth.

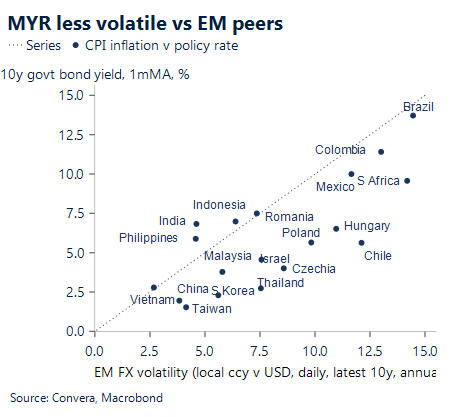

The chart below shows MYR is less volatile than EM peers – in particular THB.

Technically speaking, USD/MYR short term price action is slightly negative, with 4.4000, the 21-day EMA acting as strong support.

If this support were to break, the next key level support will be 4.3615 where USD buyers may look to take advantage.

Aussie rebounds on China news, but still pressured

Table: seven-day rolling currency trends and trading ranges

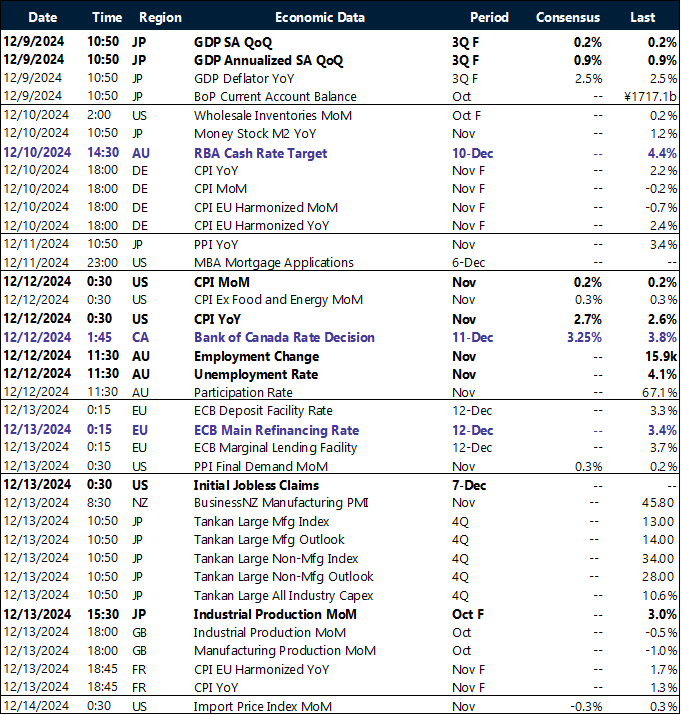

Key global risk events

Calendar: 9 – 14 December

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.