It’s all about US inflation today

The US consumer price index (CPI) for March will be published today and is forecast to have eased to a 2-year low, but with core inflation expected to remain sticky, today’s data will be closely scrutinised for clues on how soon US interest rates will peak. The US dollar is on the backfoot this morning because although money markets are pricing in a roughly 75% chance the US Federal Reserve (Fed) will hike by 25 basis points in May, multiple rate cuts are also being priced in as early as July on an expected recession.

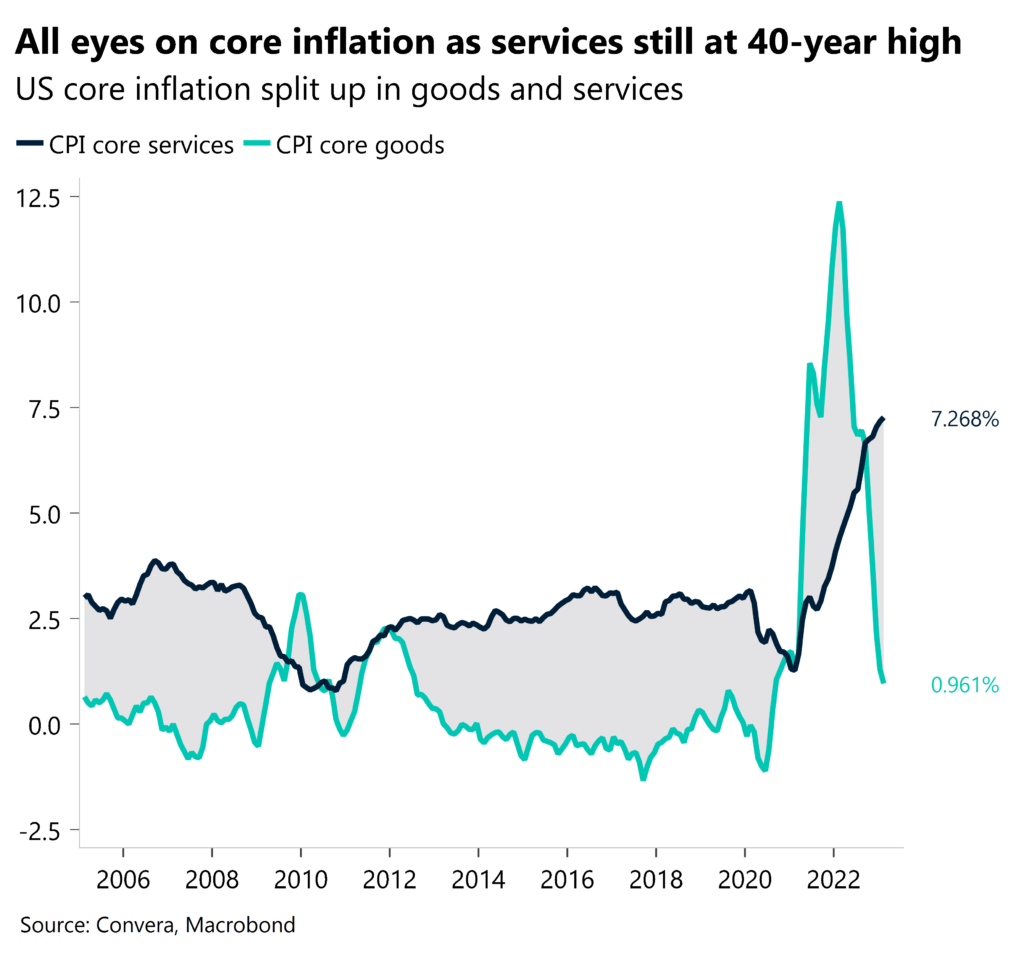

Headline CPI is expected to have risen by 5.2% year-on-year, according to a consensus forecast compiled by Reuters. However, core CPI, which strips out volatile energy and food costs, is expected to have increased by 5.6% year-on-year, suggesting that price pressures for some goods and services are still too elevated. Strong jobs data for March, released last Friday, adds to the complex situation for the Fed. Moreover, some policymakers believe that a credit crunch in the wake of several recent US bank failures could negate the need for another increase. Lending conditions continue to tighten, with commercial banks in the US decreasing their lending of loans and leases by a record $105bln during the last two weeks of March. Sentiment data like the Fed’s Senior Loan Officer Opinion Survey on Bank Lending has been hinting at a slowdown in credit creation, with around 44% of surveyed loan officers tightening lending conditions for small consumer and industrials firms. This is not only confirmed by the pullback of bank lending in March, but by yesterday’s release of the NFIB small business availability for loans, which has fallen to an 11-year low. The Fed’s data on bank loan, deposit and borrowing growth will continue to be watched carefully.

The Fed has taken action to address financial stability, but if inflation numbers beat forecasts today, then addressing monetary stability via more rate hikes could boost dollar demand and spark risk aversion across global markets in the short-term. Currently, the US dollar index is just over 1% above its 1-year low but remains above the key 100 mark. Is the dollar going to slide to a new low or climb further north of its recent base?

Sterling holds risk-related gains

The British pound closed the day out above $1.24 versus the US dollar yesterday for only the sixth time this year. After four daily declines, an improvement in global risk sentiment sent equities and the pound higher – the latter stretching towards the 10-month high reached last week. Global risk sentiment continues to ebb and flow with volatile US rate expectations, but the pound is also being supported by the lack of Bank of England (BoE) rate cuts by the being priced in by markets.

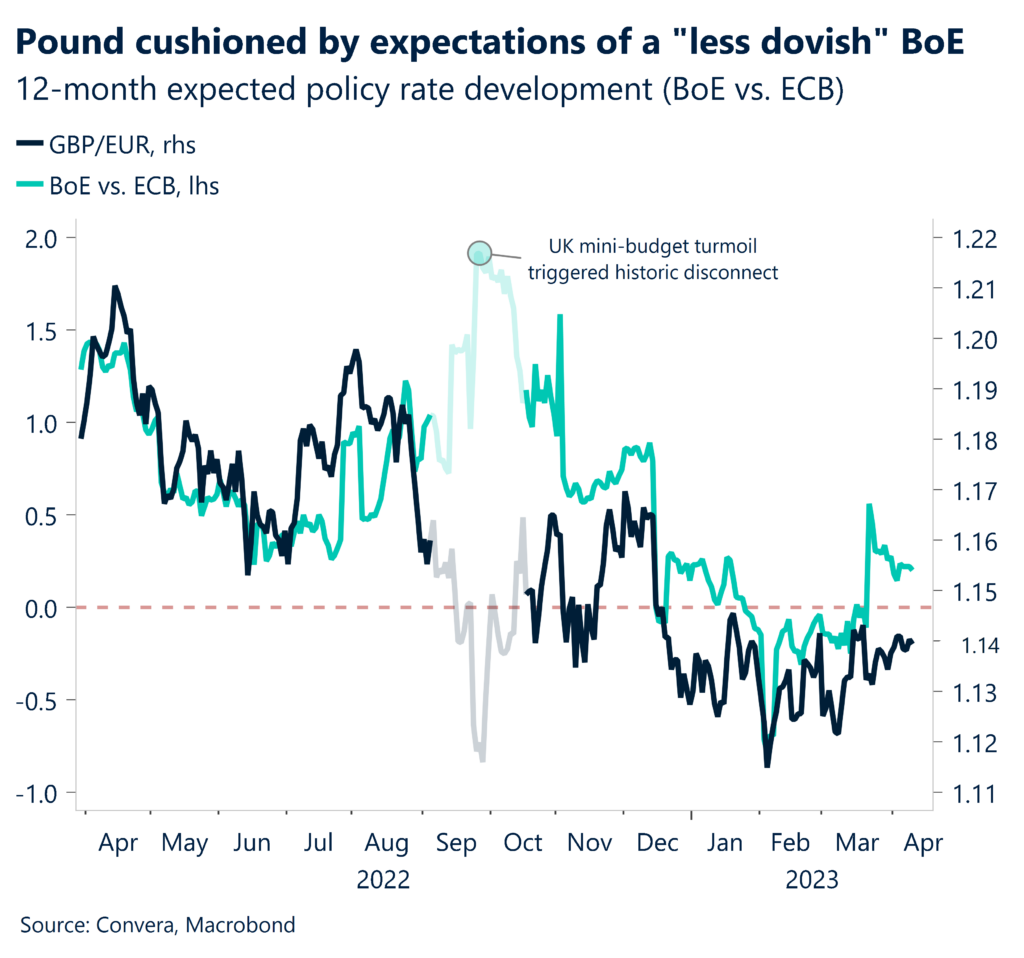

Considering the UK’s large current account deficit and its large financial sector, some analysts expected the pound to have underperformed during the recent financial turmoil. However, as the turmoil has proved more idiosyncratic – contained largely to the US – and the BoE has emphasised the resilience of UK banking sector, sterling has proved to be one of the best performing currencies of the majors. Positioning may have played a role in sterling’s circa 2% rally last month as well, with asset managers forced to cover short sterling positions – resulting in GBP appreciating. The expected policy path of central banks continues to be a key driver of FX trends. Above-forecast economic data from the UK and across Europe have led to markets pricing in rate hikes from the BoE and European Central Bank (ECB) in May. But over the next 12 months, the ECB is expected to cut interest rates more than the BoE, whilst the Fed is expected to cut rates by an even greater margin. So long as this divergence persists, the pound should be supported, sticking to the top end of its year-to-date range against both the euro and the dollar.

However, due to the current “more hawkish” pricing of BoE policy, this also increases the risk of a sharp reversal for sterling because an early pause from the BoE in May could support the view that GBP/USD will struggle to sustain any move above $1.25, whilst GBP/EUR could slide back towards €1.11. BoE Governor Andrew Bailey is scheduled to speak today and could give clues on the future path for monetary policy.

Euro taking its cue from the US

European markets enjoyed their first trading session after the long weekend, but the lack of economic data or central bank speeches led to an uneventful weekly open. Price action continues to be determined by global and US centric events, and it will stay this way until German inflation data comes out on Thursday.

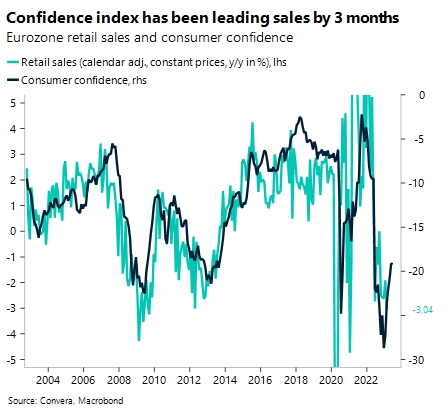

Yesterday’s release of Eurozone retail sales for the month of February has gone unnoticed given the focus shift to the US and the lagging nature of such economic data. Inflation adjusted sales fell by 3% during the last twelve months, the fastest decline since the beginning of 2021. Rebounding real wage growth due to falling headline inflation and improving consumer confidence could support consumer spending going forward. However, it is still unclear how the recent banking turmoil might impact the consumer and especially household availability for loans and leases.

The euro will take its cue from the US inflation print and ECB speakers today. While the $1.10 mark might be tough to break this week, the continued weakening of price pressures in the US and expectations of further hikes in the Eurozone might narrow the rate differential between the two regions further, putting the US currency under pressure.

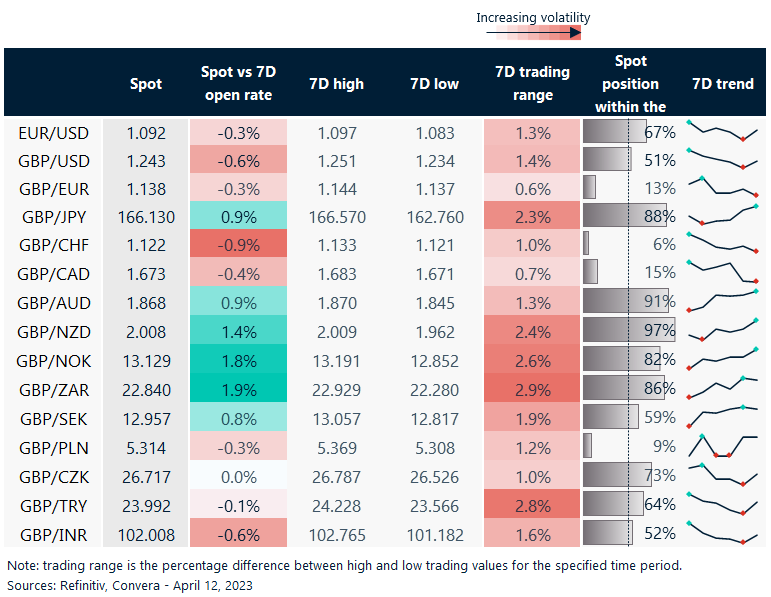

Big GBP gains seen against riskier currencies

Table: 7-day currency trends and trading ranges

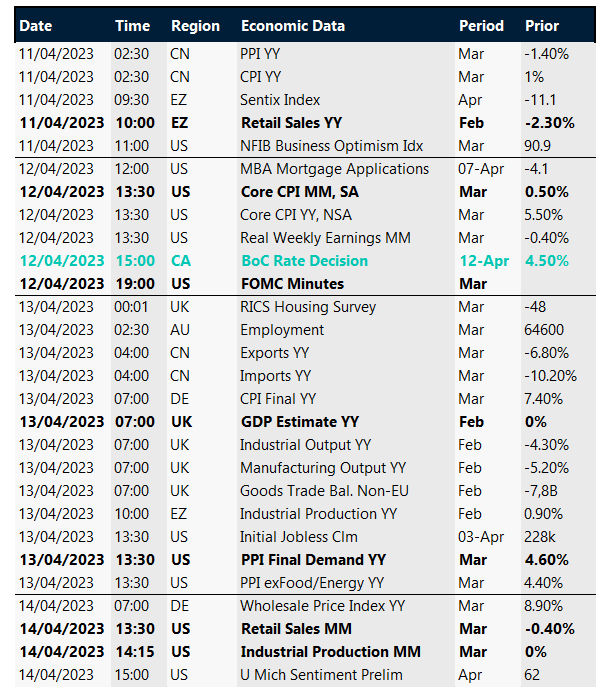

Key global risk events (CEST time zone)

Calendar: Apr 10-14

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.