The demand for fast, secure, and efficient cross-border payments has never been greater. As businesses expand internationally and organizations conduct more transactions across borders, traditional systems often struggle to keep up.

Enter application programming interfaces (APIs), the technology reshaping industries and transforming how money moves globally. APIs are revolutionizing cross-border payments by enhancing security, enabling real-time data sharing, and simplifying integration with existing financial systems.

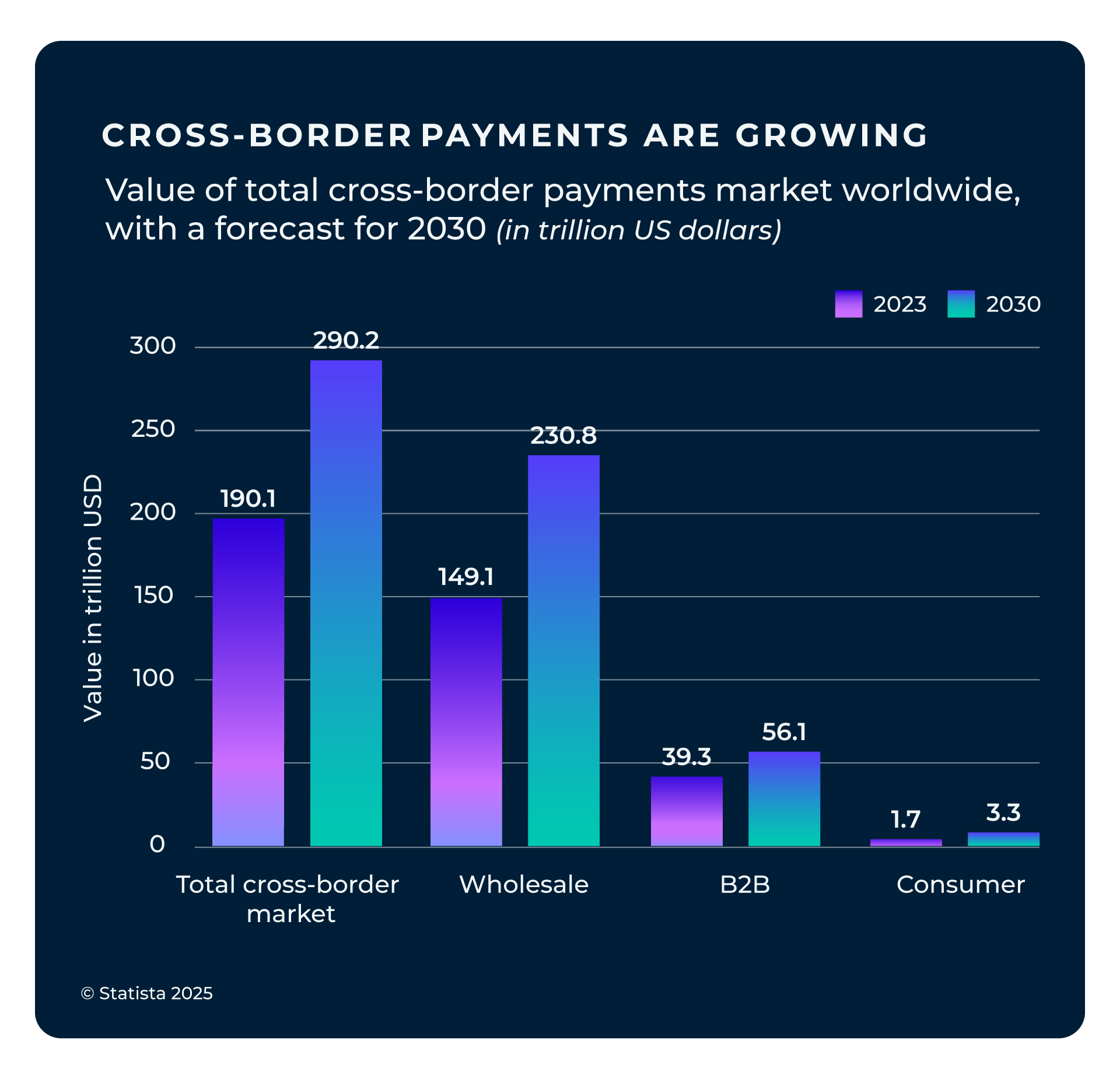

According to The Payments Pulse report, the international payments market will reach $290 trillion by 2030. The extraordinary growth is fuelled in part by faster transaction processing and real-time data exchange through APIs.

APIs: The backbone of modern cross-border payments

At their core, APIs act as digital bridges that allow different systems, platforms, and applications to communicate with each other seamlessly.

Using APIs in cross-border payments eliminates the inefficiencies of legacy infrastructure by enabling:

- Automated processes that reduce manual intervention and human error

- Real-time updates that keep both businesses and customers informed

- Faster settlement times that cut down on costly delays

For global enterprises, APIs provide a way to integrate payment services directly into their platforms.

For smaller businesses, APIs simplify payments as well, enabling the sending and receiving of money internationally without requiring deep technical expertise or costly infrastructure.

Payment API integration to enhance security and compliance

Security is a top concern for businesses, especially when moving money across borders. Traditional systems often rely on multiple intermediaries, increasing the number of points where fraud or data breaches can occur.

Fintech and banking APIs can protect international transactions by:

- Encrypting sensitive data during transmission

- Providing greater transparency, enabling faster detection of suspicious activity

- Standardizing security protocols such as OAuth 2.0 and token-based authentication

By consolidating payment flows through secure API connections, financial institutions can reduce the attack zone for cybercriminals while ensuring compliance with global regulations.

Cross-border payments come with complex compliance obligations, from anti-money laundering (AML) checks to know-your-customer (KYC) requirements. Such processes can be automated by APIs, including:

- Running instant KYC/AML screenings during the payment process

- Keeping transaction records updated and accessible for audits

- Ensuring compliance with local regulations in multiple jurisdictions

By embedding compliance into the payment flow itself, APIs reduce the risk of fines, delays, or transaction failures.

API key benefit: Sharing data in real time

One of the most powerful benefits of APIs is their ability to deliver real-time data that enables accounts payable and receivable teams to make informed decisions.

In traditional payment systems, reconciliation delays often frustrate businesses that rely on up-to-the-minute financial visibility, but APIs solve these issues by:

- Instantly allowing banks, fintech platforms, and businesses to access transaction statuses and currency spreads

- Facilitating real-time currency conversion rates, enabling smarter decision-making and stronger risk management

- Supporting real-time compliance checks that help transactions move smoothly across borders

Real-time payment APIs can provide great speed, but more importantly, they can offer valuable business intelligence and agility. Businesses gain immediate insights into their financial position, improving forecasting and liquidity management.

Payment API integration: fast and simple

A traditional challenge of adopting new financial technologies is the complexity of integrating them with legacy systems. APIs, on the other hand, are designed to provide flexible, modular connections.

A forward-looking global payments provider, such as Convera, can help integrate its API with a company’s enterprise resource planning (ERP) system.

Convera offers a robust, secure, and compliant API suite that embeds cross-border payments and strategies into existing workflows, including support for more than 140 currencies across more than 200 countries and territories. API integration empowers international companies to scale quickly without disrupting current operations and reach a quicker return on investment.

With APIs that support everything from payment initiation to tracking and reconciliation, Convera helps international organizations bridge the gap between traditional finance and the fast-paced demands of global commerce.

APIs in fintech in 2026

As the market for cross-border payments continues to expand, APIs will remain central to shaping the fintech ecosystem, ensuring compliance while supporting speed and innovation.

These are fintech APIs trends we are likely to see in the near future:

- Greater adoption of real-time cross-border payment networks powered by API connectivity

- AI-driven fraud detection, integrated directly into API flows

- Increased interoperability between banks, fintechs, and alternative payment providers

By enhancing security, enabling real-time data sharing, simplifying integration, and streamlining compliance, APIs are driving the global economy into a new era of efficiency and trust. In turn, businesses that embrace APIs today will be best positioned to thrive in tomorrow’s interconnected financial world.

For organizations seeking to scale globally, partnering with API-driven solutions like those from Convera offers a path to faster, more secure, and more reliable cross-border payments.