Managing payments for international freight shipping is one of the most critical tasks in the global economy. Efficient and secure payment systems serve as the lifeblood of commerce across continents and ultimately provide stability to markets across the world. However, with each shipment comes an increasingly daunting number of variables to reconcile within a rapidly evolving industry.

The changing face of freight shipping

The stakes are high for shipping companies as they try to stay ahead of emerging trends amid an ever-changing regulatory and financial landscape. However, opportunities to address pain points with cross-border payment solutions are also reaching new heights, making it possible for operators to thrive in the modern shipping era.

To ensure the smooth exchange of goods and healthy relationships between trade partners, shippers need to rely on intricate payment processes to solve their most pressing pain points. New digital technologies for tracking, processing and protecting cross-border payments, coupled with changing market demands, are pushing the freight and logistics sector toward modernization at breakneck speed.

From rising costs and security risks to maintaining transparency and compliance, the freight shipping industry has no shortage of obstacles to navigate with each international transaction. When dealing with different currencies, jurisdictions and a host of rapidly evolving threats, it is imperative for logistics companies to utilize payment systems that are simple, smart and secure.

Understanding B2B cross-border payments

B2B cross-border payments refer to the exchange of funds between businesses across international borders. These transactions involve transferring money from one country to another, often in different currencies.

For businesses operating globally, understanding B2B cross-border payments is crucial. It helps them navigate the complexities of international transactions and optimize their payment processes. By mastering the intricacies of cross-border payments, shipping companies can ensure smoother operations and better financial management across international borders.

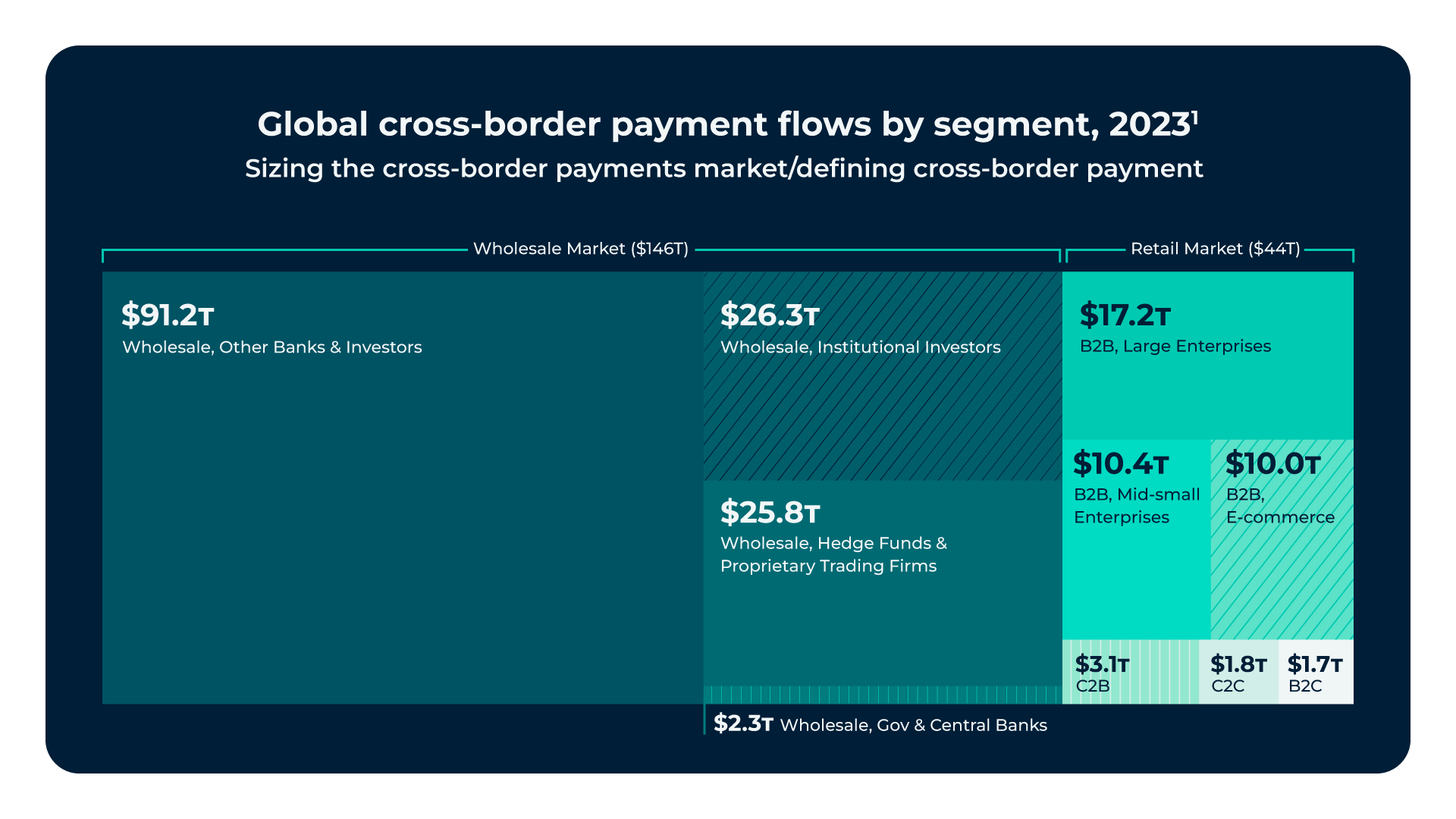

The $250 trillion cross-border payments market is fueled by surging demand for international trade, remittances and consumer payments, according to McKinsey’s Global Payments Report 2024. The industry annually handles 3.4 trillion transactions, accounting for $1.8 quadrillion in value and a revenue pool of $2.4 trillion, and is expected to grow steadily for the next five years.

Convera’s Fintech 2025+ report forecasts that by 2030 cross-border payments flows will reach $290 trillion and the Asia Pacific (APAC) region is projected to become the largest cross-border payments market, while continuing to dominate the logistics market . The expected boom in cross-border payments across APAC reflects rapid economic growth, advances in infrastructure and payments technologies.

Types of payment methods

When it comes to B2B cross-border payments, businesses have several options.

Bank transfers are a popular choice due to their security and reliability. However, they can be slower compared to other methods.

Wire transfers offer faster transaction times but often come with higher fees.

Digital payment platforms, such as online payment gateways, provide a convenient and cost-effective alternative. These platforms streamline the payment process, making it easier for logistics companies to manage their cross-border payments efficiently.

Each method has pros and cons, and businesses should choose the one that best fits their needs.

Challenges of international transactions

International transactions pose several challenges for businesses:

- High transaction fees can quickly add up, eating into profit margins.

- Complex payment processing systems often involve multiple financial institutions, leading to delays and increased costs.

- Currency conversion risks further complicate matters, as fluctuating exchange rates can impact the final amount received.

- Additionally, the risk of fraud and security breaches is higher in cross-border transactions, making it essential for businesses to implement robust verification and security measures.

Addressing these challenges is key to maintaining efficient and secure international transactions.

What are freight audit and payment services?

Without the ability to quickly and accurately verify, reconcile and pay transportation invoices, freight and logistics companies are at a serious competitive disadvantage. Reliance on manual processes in traditional freight payment processing leads to errors and inefficiencies. Companies must comply with the terms of each contract while staying ahead of a changing regulatory landscape.

To ensure compliance, a shipper conducts a freight audit prior to each payment. This process typically involves verifying the terms for invoices, including the rates and charges as well as any discounts, fuel surcharges and accessorial charges (fees for additional services). The charges are classified by category and can be sorted or flagged immediately through automation. The physical parameters, such as weight and volume, are assessed to ensure compliance with the contract.

Once invoices are audited, freight payment services ensure that the correct amount is paid to the carrier or freight provider. A smart cross-border payments system can calculate, share and reconcile up-to-date balances accounting for currencies’ exchange rates, tariffs or additional variables.

The data and insights from advanced cross-border payment platforms help shipping managers save time and control costs, while avoiding overpayments or regulatory entanglements.

Limitations of traditional cross-border freight payment processing

With complexities and regulatory hurdles increasing by the day, traditional cross-border payment solutions have hindered the freight shipping industry’s ability to reach compliance while keeping up with the speed of the competition and safeguarding resources from bad actors.

Freight companies often have to deal with multiple intermediaries, hidden fees and fluctuating exchange rates, all of which can add up quickly. Managing liquidity across different currencies and regions presents further challenges, requiring companies to have a keen understanding of financial markets and sophisticated tools to manage foreign exchange. High-value transactions, in particular, come with additional costs and risks associated with cross-border payments, including potential fees and the reliability of bank transfers.

Navigating the regulatory landscape of cross-border payments is a significant hurdle. Freight and logistics companies must adhere to various national and international regulations, including compliance with anti-money laundering (AML) and the “know your customer” (KYC) requirements. This regulatory maze can lead to payment delays, especially when funds cross multiple jurisdictions with differing compliance standards.

Another major pain point in traditional cross-border payments is the lack of transparency. Without clear insights into the status of transactions, freight companies often find themselves in the dark, uncertain when funds will arrive or how much they will ultimately pay after fees and currency conversions. This opacity can lead to disputes, cash flow issues and operational inefficiencies.

Cross-border payments involve the transfer of large sums of money across multiple financial systems and jurisdictions, making them a prime target for fraud. Whether through wire transfer fraud, phishing attacks or cybercrime, logistics companies risk losing sensitive financial data and funds unless strong security measures are in place.

Making cross-border payments smarter and safer for the freight shipping industry

As the challenges of traditional cross-border payment systems persist, businesses in the freight and logistics industry are looking for solutions that simplify transactions while addressing the need for security and speed. Ideally, an advanced cross-border payment system, which utilizes the latest innovations in automation, artificial intelligence and blockchain technologies, will address usability, processing and transparency.

To stay competitive, freight companies are looking for a system that is easy to use and allows them to access payment information quickly. This includes features like intuitive dashboards, simple navigation and the ability to view transactions in the way that makes the most sense for their operations.

Exploring new and innovative payment options in supply chain management is crucial. Advanced freight billing and payment auditing services can streamline these options, benefiting shippers who aim to optimize their payment processes.

Fast, reliable payment processing is key to reducing operational downtime. Freight companies need a payment platform that lets them complete transactions quickly, so they can focus on their core business activities.

Transparency is crucial for maintaining trust and control. Shippers should look for solutions that offer real-time transaction tracking and allow them to see when funds have been received, reducing the unknowns associated with cross-border payments.

A smart payments platform should automate complex tasks and reduce human error. Shipping companies often deal with a range of payment approval models and multiple regulatory environments. A good system will simplify the approval process by automatically addressing compliance requirements, such as payee formatting and environmental standards.

As shipping companies grow and enter new markets, they need a payment solution that will scale with them. Cloud-based platforms that support rapid scalability are key to adapting to new regulatory demands and meeting future market trends. SaaS solutions can reduce the time spent on procurement and maintenance, ensuring that shippers can always access the latest tools.

Freight companies require assurance that their transactions and client data are protected from bad actors. A secure payment platform should include multi-factor authentication, encryption and solid fraud detection. With sensitive financial information on the line, protecting data from unauthorized access is crucial. Payment solutions that adhere to best practices in data protection will help minimize the risks that threaten the freight shipping industry.

Selecting a payment services provider

To summarize, choosing the right payment services provider is crucial for businesses handling B2B cross-border payments on a regular basis, such as logistics and shipping companies. Key factors to consider include cost savings, payment terms and foreign exchange rates. A provider offering competitive rates and flexible payment terms can significantly impact a company’s growth plan.

Additionally, a secure payment processing system is essential to protect against fraud and ensure smooth transactions. Businesses should also look for providers that offer supply chain solutions, such as freight payment and invoice financing, to streamline their payment processes and enhance overall efficiency — now and in the future.

On the horizon and beyond

The future of cross-border shipping is closely tied to transforming its digital payment capabilities to overcome current cross-border payment inefficiencies.

Large corporations can utilize various shipping modes — including the cost-efficient less-than-container load (LCL) — to enhance freight management strategies and financial efficiencies. However, effective freight auditing and payment processing are crucial to reducing costs and errors in supply chain operations.

Blockchain technology is a notable trend within the sector. Looking ahead, the market for blockchain in the global supply chain is projected to be $3.6 billion by 2031 and growing annually by 35%, according to Business Research Insights.

The industry is set to expand its fintech infrastructure, reaching new markets globally and bringing accessibility to the rails that connect freight shipping companies, enabling them to share or exchange assets and process their payments.

How tokenized trade finance assets are streamlining the shipping industry

To streamline operations for freight and logistics companies, sensitive assets such as trade guarantees are beginning to be tokenized and transferred on blockchain platforms. This means faster, more secure payments. Decentralized ledgers are also living on these cryptographically protected exchanges of data that are hard to hack, alter or steal.

Because fewer intermediaries are involved, tokenized asset deals close much faster with the aid of smart contracts that can trigger payments automatically across borders once a fulfillment request is accepted.

While blockchain technology is still in its early stages of adoption in the freight industry, its potential benefits are substantial. As the technology continues to mature and become more widely adopted, it is expected to revolutionize how international payments are processed and managed.

Future-proofing the shipping industry with smart cross-border payments

In the face of mounting challenges, freight and logistics companies must embrace new payment solutions that simplify, secure and streamline their cross-border transactions. By choosing smart payment platforms that enhance usability, transparency, security and scalability, shipping companies can stay ahead of the curve in an increasingly competitive and changing market.

The future of cross-border payments is bright, and those companies that prioritize adopting advanced, secure and transparent digital payment solutions — like Convera — will be better positioned to navigate the complex world of international shipping, ensuring that their operations run smoothly and efficiently for years to come.

Want more insights on the topics shaping the future of cross-border payments? Tune in to Converge, with new episodes every Wednesday.

Plus, register for the Daily Market Update to get the latest currency news and FX analysis from our experts directly to your inbox.