Monday was heavily shaped by the unwinding of trades that had been popular during the last 6-12 months. The Nasdaq and USD/JPY were briefly down 6% and 3.5% and broader volatility indicators spiked to post-pandemic highs.

Dovish comments from the Bank of Japan acknowledging the turmoil, coupled with the positive macro surprises (ISM, initial claims) from the United States have calmed investors enough to form a temporary bottom in equities, yields and dollar-yen.

The take-away from recent developments is that the popular and extended trades of 2024 are not a one-way street up anymore. Investors will watch over incoming data to gauge how much the Federal Reserve will cut interest rates in September.

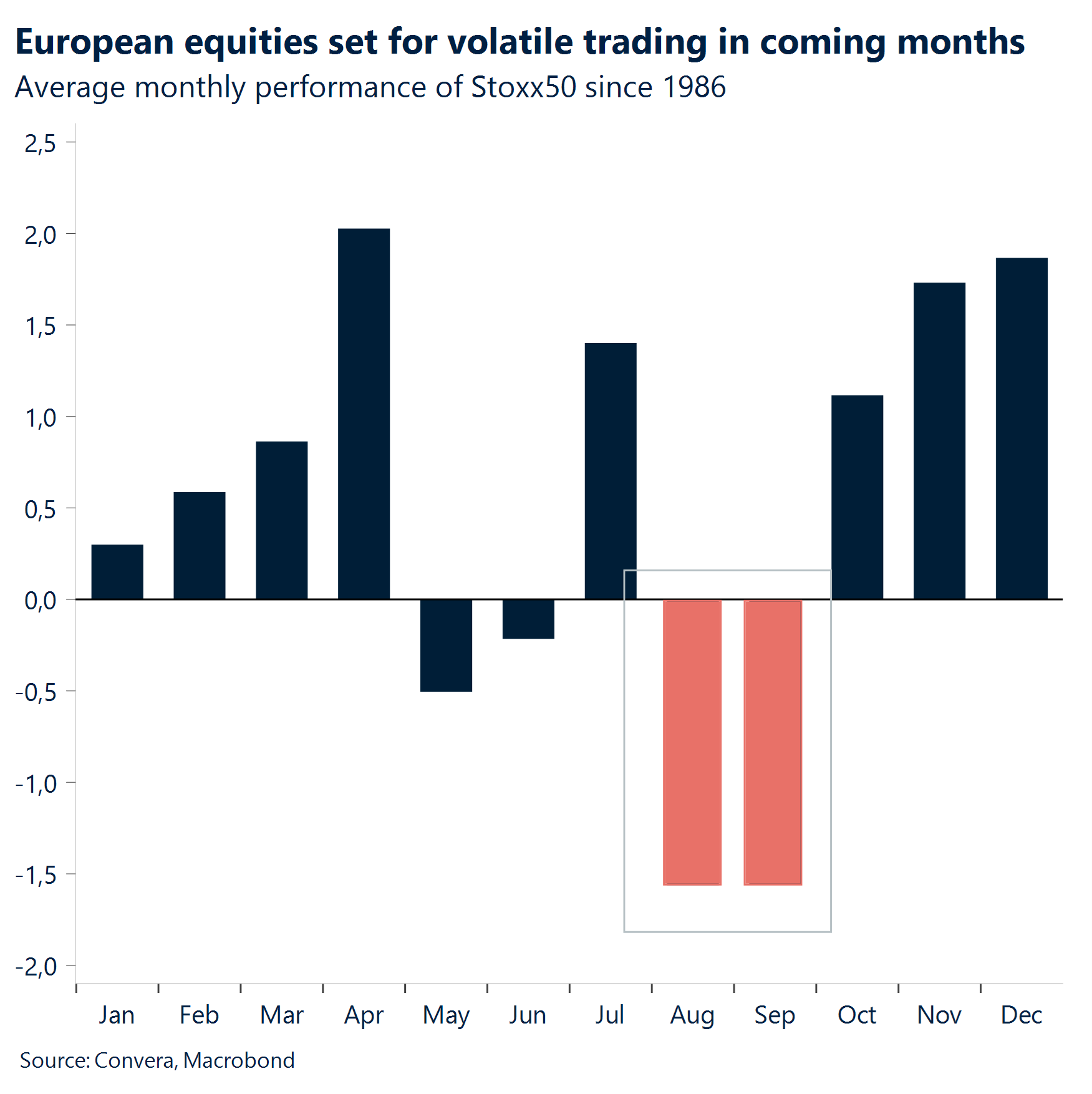

August and September have a longstanding trend of negative returns as investors tend to de-risk their portfolios. This time round the unfavourable base effects may arguably be amplified by monetary uncertainty and the US presidential election.

The pound has fallen a bit out of investors favour due to recent protests in the United Kingdom and the Bank of England commencing with its easing cycle. However, the economy is holding up and next week’s GDP data should confirm this.

The Nasdaq has risen by 5% from its weekly low but remains 10% below its peak reached in July. The two-year Treasury yield is up 40 basis points to just above 4%.

The US dollar is flat on the week and has pared its 3% intra-week losses due to a rebound against the yen and pound.

Global Macro

Unwinding and rewinding of popular trades

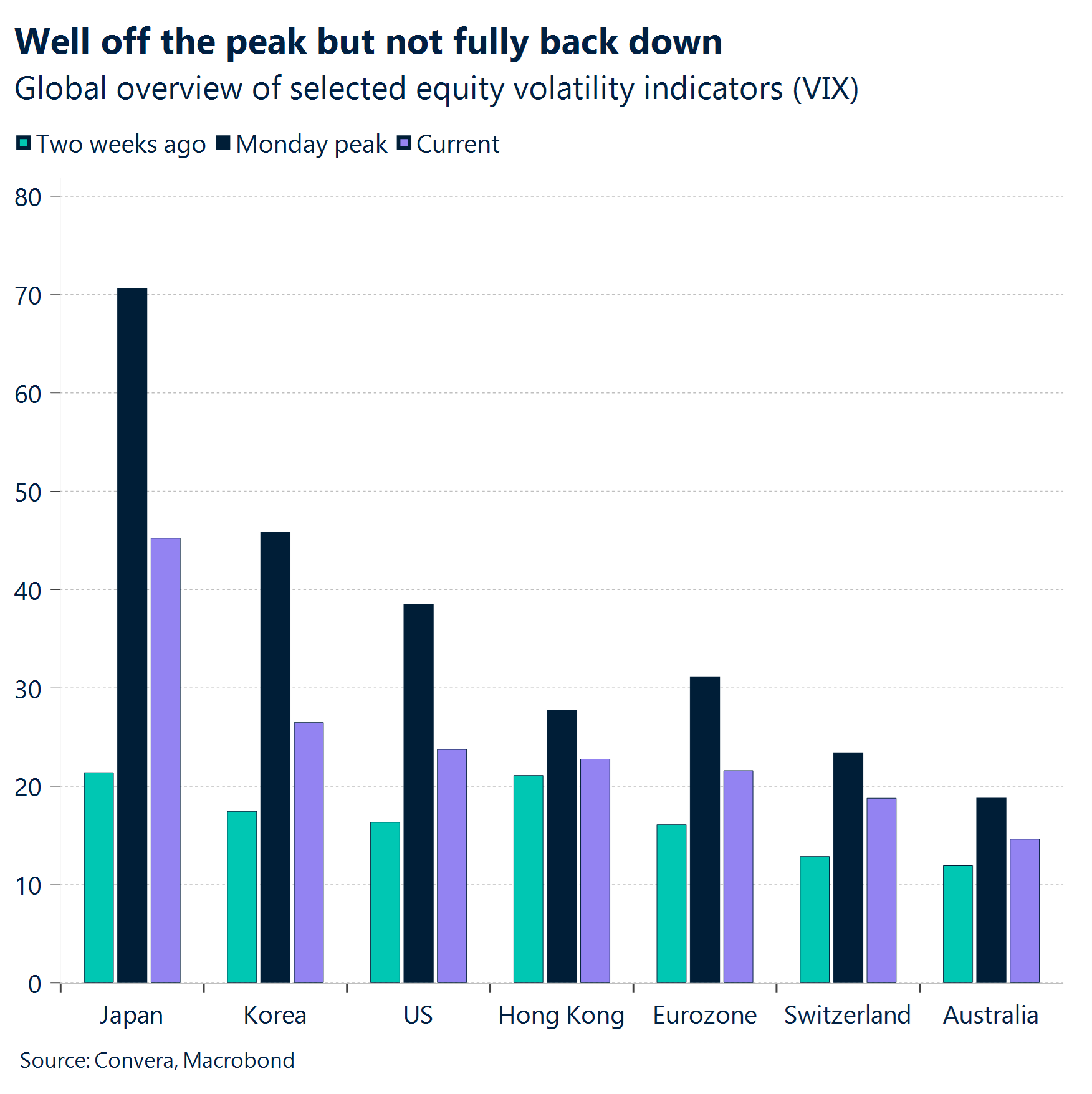

(Un-)popular. The week in macro and markets will once again end very differently than it started. Monday was heavily shaped by the unwinding of trades that had been popular during the last 6-12 months. This included broader narratives like the Fed- and Trump- trades but also going straight long technology stocks and short volatility and the Japanese yen. The Nasdaq and USD/JPY were briefly down 6% and 3.5% on Monday as the implied volatility indicators in the US, Europe and Japan experienced one of their highest intra-day spikes on record.

Calming nerves. Skipping forward a couple of days and it seems that global financial market have calmed down a bit. Dovish comments from the Bank of Japan acknowledging the turmoil and the positive macro surprises from the United States have calmed investors enough to form a temporary bottom in equities, yields and dollar-yen. The VIX has retraced almost all its advances, going from 75 to 25. The US Dollar Index and Equities are back into positive territory on the week and bond yields on the short end are trading higher than they did on Friday.

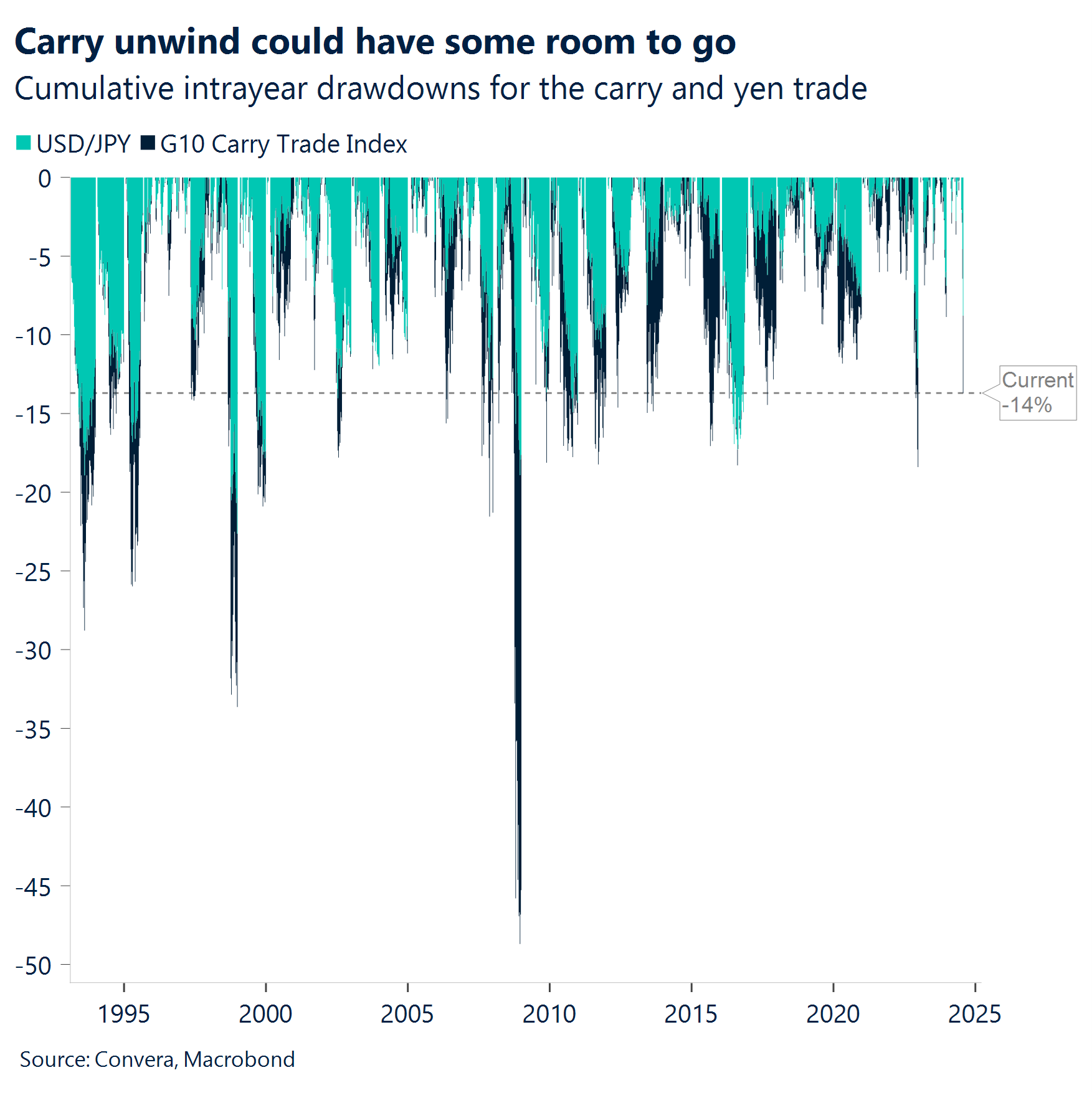

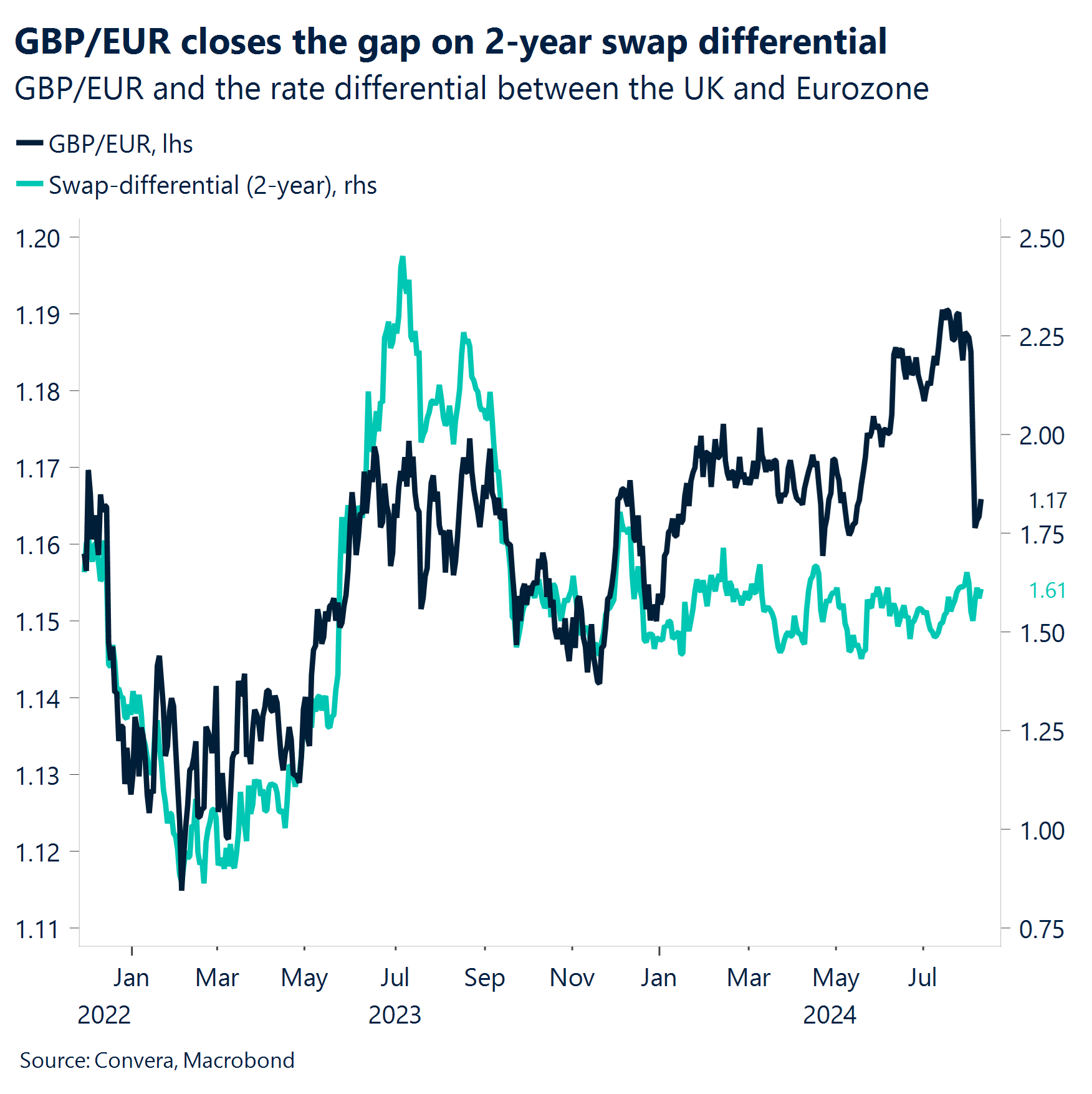

Questions remain. However, the lingering question about the actual size of the global carry trade remains. Historically, the intra-year drawdown of USD/JPY and the G10 Carry Index of 9% and 6% respectively are still not seen as noteworthy developments looking at the last 30 years, meaning that the trades do not seem stretched at all. Next week is the most data heavy in August and we will be paying close attention to the inflation numbers coming out of the US (PPI, CPI) and retail sales data. It is also the only week where important macro data is published for the United Kingdom and China. USD/JPY will retain its position as the most watched currency pair in the world and trading is expected to remain volatile.

Regional outlook: United Kingdom

Macro data remains resilient

Stronger growth. It turns out that 2022 was better than statisticians thought, as UK GDP jumped 4.8%, instead of the 4.3% previously estimated, according to annual revisions. The data suggest the economy was showing underlying resilience even as it began to be roiled by Russia’s invasion of Ukraine, which sent inflation in Britain surging to a peak of 11.1% in October 2022. The impact of the cost-of-living crisis later triggered a recession and slowed annual GDP growth to just 0.1% in 2023. However, the economy has bounced back more quickly than many forecasters had expected this year in line with the disinflation trend.

More spending. Retail sales in the UK rose 0.3% on a like-for-like basis in July from a year ago, reversing from a 0.5% fall in June and matching market forecasts. The return to growth was supported largely by consumers’ purchases of clothing and beauty products in preparation for the holidays as the late arrival of British sunshine boosted consumer spending.

Better outlook. Moreover, the final services PMI print was revised marginally higher for July too, to reflect the ninth consecutive period of expansion in the UK services sector activity. The latest improvements in economic activity have come at the same time as the Bank of England (BoE) has started cutting interest rates, leading to expectations of stronger underlying spending growth in the second half of the year.

Regional outlook: Eurozone

Struggling to find equilibrium

PMIs revised up. The final HCOB Eurozone Composite PMI for July was revised slightly higher to 50.2, up from the preliminary 50.1. The print still marks a decrease from June’s 50.9 and indicated only fractional growth, the weakest since activity levels started to rise in March. Business activity levels increased at a slow pace, with services being the primary source of growth.

Momentum is slowing. Eurozone retail sales fell 0.3% m/m in June, more than the expected 0.1% decrease, driven by a marked decline in sales of food, drinks, and tobacco products. The HCOB construction PMI edged down to a six-month low in July, with activity and output declining significantly, particularly in housing. Germany showed a sharp fall in exports in June, which was counteracted by better-than-expected industrial production and factory orders growth in June. This suggests that while the export-oriented growth model is fundamentally struggling, there could still be a small cyclical improvement in the second half of the year.

Not the time to buy the equity dip. The velocity of the equity self off has slowed but Stoxx50 remains over 4% down MTD, the worst month for European equities not only this year but going all the way back to September ’22. Retail investors have showed some interest in buying the dip, but now is arguably not the entry point for long equity positions. August and September have a longstanding trend of negative returns as investors tend to de-risk their portfolios ahead of a historically challenging period. This time round the unfavourable base effects may arguably be amplified as we enter the uncertain period of Fed easing and the US presidential election, not to mention the political risks looming at home. France has until 20th September to deliver a budget plan to comply with the EU rules. Failure to do so could lead to French bonds being downgraded (Fitch already issued such warning earlier in July), causing renewed volatility in the European government bond market and euro weakness.

Week ahead

Losses pared but what now? The data will tell

Global markets have worked through their largest drawdown so far this year and have made up all the losses from Monday’s historic sell-off. Still, equities seem more vulnerable and data dependent than before the US job report and volatility rates remain elevated. The main take-away from recent developments is that the popular and extended trades of 2024 are no longer a one-way street up. Investors will cautiously watch over incoming macro data to gauge just how much the Federal Reserve will cut interest rates in September and beyond.

US inflation. The first test for the current recovery rally comes in the form of US inflation. Both headline and core CPI are expected to ease further on an annual basis, falling from 3.0% to 2.9% and from 3.3% to 3.2%, respectively. Producer price inflation should be soft as well and we therefore think that, absent any upside surprises, the inflation numbers should be benign and well received by investors.

Retail sales. This will shift the focus to US retail sales, which are expected to rise from 0% to 0.4% in July. Anecdotal evidence from earnings calls, cooling wage growth, an easing labour market and rising delinquency rates are highlighting the rising sensitivity of the consumer to a weakening growth environment. However, the actual spending data remains strong.

UK macro patch. The pound has fallen out of investors favor this week, but the volatile data might come to the currency’s rescue. Wage growth likely slowed from 5.7% to 5.3% in the three months to June as leading indicators continue to suggest further weakening is in the pipeline. However, inflation is expected to have rebounded from 2% to 2.3% in July, driven by energy and base effects. And Q2 GDP likely expanded 0.6% after the stellar 0.7% expansion the previous quarter. This should support the BoE’ cautious view but a November cut remains on the table.

FX Views

Uncertainty after the storm

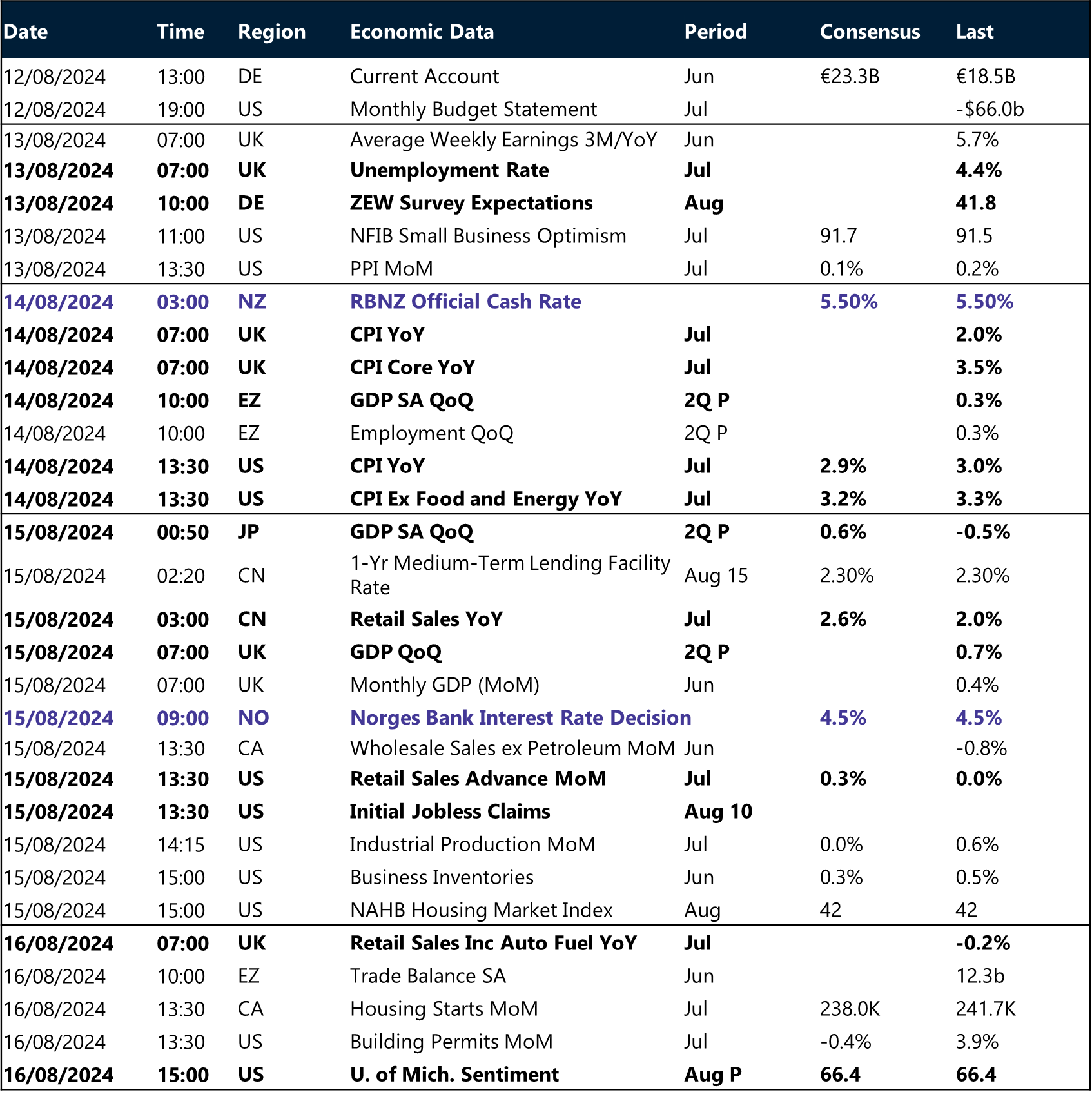

USD Softer rate position raises vulnerability. The US dollar index plunged to its lowest level since early January at the start of the week, weighed down by a surging Japanese yen amidst a rapid unwind of carry trades. US dollar’s safe haven appeal meant it held up well against high beta currencies, but the recent deterioration of the dollar’s high growth and high yield appeal will test this dynamic. A notably weak employment report has reignited US recession risks, triggering an adjustment to a more aggressive Fed easing-cycle narrative and hindering the US exceptionalism trade that has propped up the dollar this year. Short-dated US yield dropped to a fresh 15-month low, thus narrowing rate differentials have weighed on the dollar across the board. Although the dollar index has erased its weekly losses, it appears to be in a more vulnerable position in light of global events. Its softening rate advantage bolsters the case for weakness against pro-cyclical peers, especially assuming further stabilisation in risk sentiment. Looking ahead, inflation and retail sales data from the US will test this thesis but barring any upside surprises or more global market turmoil, the path of least resistance appears lower.

EUR Defends newfound gains. The euro found support from a softer US economic outlook, rallying to an 8-month high earlier in the week, driven by safe-haven demand and the unwinding of positioning flows. The momentum soon faded as stronger-than-expected US ISM and initial jobless claims data soothed concerns of an imminent hard landing for the US economy. The room for further downside in US Treasury yields is limited, but the market is likely to adopt a cautious stance on EUR/USD ahead of the upcoming US CPI release. While a push back towards $1.10 remains possible, the overall tactical outlook for the next three months remains euro bearish. The recent exaggerated moves in US rates are starting to correct, leading to a partial scaling back of Fed easing expectations. This adjustment presents some upside risks for the US dollar, though at a structurally lower level than observed last week. Additionally, the broader weakening in global growth prospects does not favor the pro-cyclical euro. The political risks in Europe further cloud the outlook, potentially adding pressure on the euro.

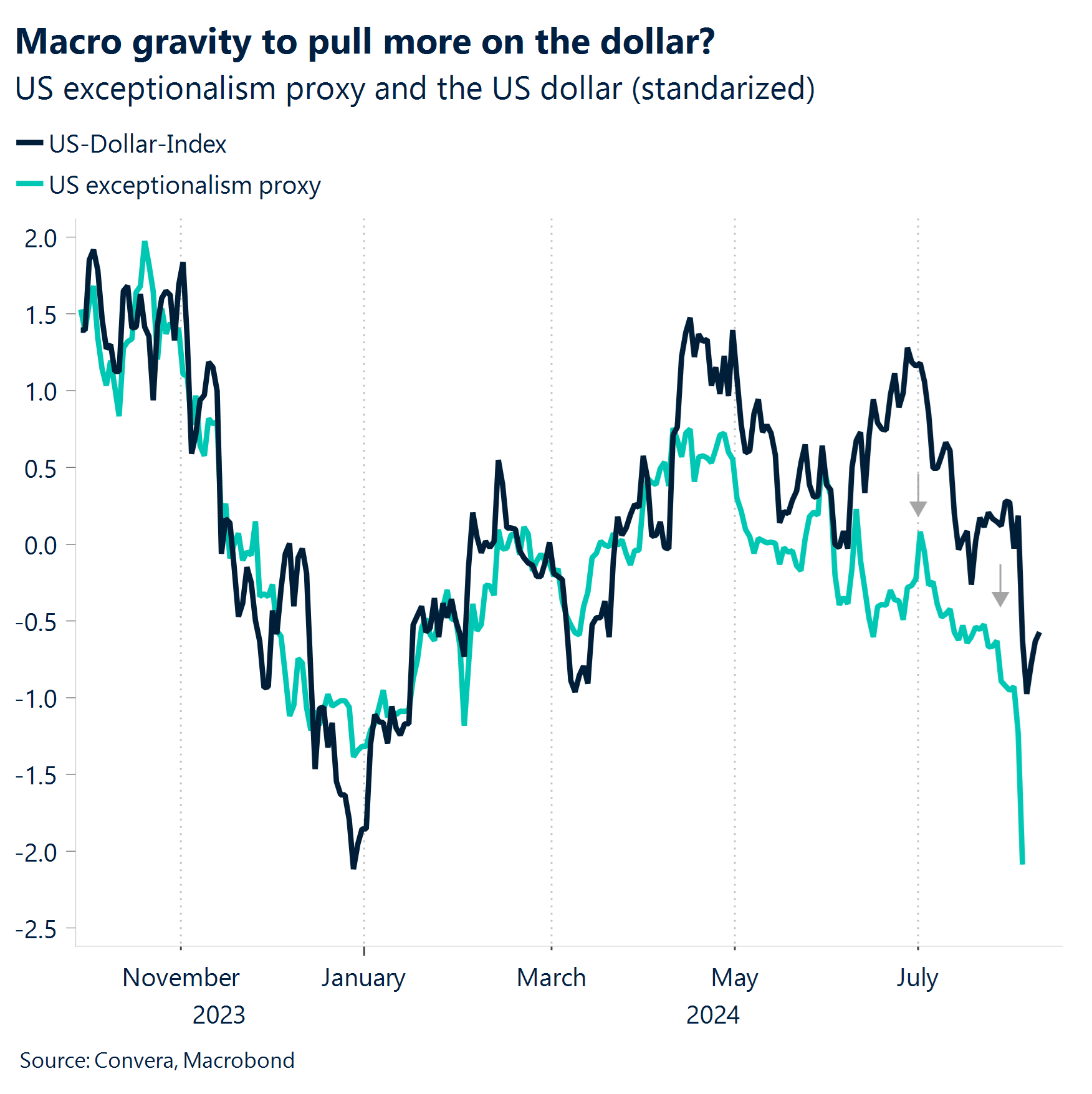

GBP Stability dented; fresh bullish catalyst required. Recent price action reveals the pound is not immune to global forces. The unrest in the UK and the prospect of tax hikes have dampened the post-UK election euphoria and sterling has thus erased gains seen since the vote in early July. But the broader turbulence in global markets has shone a light on the pro-cyclical pound’s sensitivity to risk sentiment too, sliding against its safe haven peers. In fact, the UK currency is the worst performer among its G10 peers in August and has suffered its biggest 2-week slide against the euro since early 2023. Rate differentials were pointing to an overstretched sterling against the euro, so we’re not surprised to see GBP/EUR close the gap lower to trade at a fairer value near €1.17. However, 1-year UK-US rate differentials do suggest sterling’s 3% decline versus the dollar since mid-July looks overextended. Indeed, downward momentum has slowed at the 100- and 200-day moving averages just under the $1.27 mark. Looking forward, sterling needs a fresh positive trigger to resume its climb from the first half of 2024 and next week’s UK inflation data could be that catalyst if sticky core and services prints result in a hawkish repricing of BoE rate expectations. Sustained improvement in global risk appetite will also be a welcome relief for the UK currency.

CHF Havens status offsets rate cuts. The tidal wave of risk aversion that swept through markets at the start of the week accelerated the Swiss franc’s 4-week rally with EUR/CHF slumping up to 7% during this period and to a fresh decade low near 0.92. The franc has appreciated against 90% of its global peers so far this month – its safe haven allure offsetting the prospect of further rate cuts by the SNB. But the franc’s strength is spurring calls for the central bank to take more action to cool its gains to prevent hurting exporters and endangering the economic recovery. Easier said than done. If cross-asset volatility remains elevated, we could see more uncoiling of the carry trade supporting the low-yielding franc. Moreover, although investors have been slashing their bets for the franc to weaken for two weeks running, the overall bearish position is still near the highest since 2007, suggesting the unwind has much more room to run. For now, though, amidst the rebound in risk sentiment, the safe haven franc has given back large portions of its recent gains, with EUR/CHF back above 0.94.

CNY Yuan jumps initially, but weakness persists. The Chinese yuan was initially pushed strongly higher as the heavy USD-selling across Asia boosted the Chinese currency. USD/CNH fell to the lowest level since May 2023. However, the Chinese yuan’s strength was only short lived, and USD/CNH rebounded over the week. The Chinese yuan remains pressured by weak growth forecasts and recent moves to loosen policy from the People’s Bank of China. That said, an uptick in Chinese inflation, up 0.5% over the year versus the 0.3% expected, saw the yuan strengthen and defined topside resistance at 7.2000 on USD/CNH. Looking forward, major data is due on Thursday, with industrial production, retail sales and fixed asset investment all released.

JPY Yen surges as shorts squeezed. The Japanese yen was the focus of FX markets over the week, with the yen strongly higher as global equity markets were sold off on Monday driven by the Japanese Nikkei, which suffered its worst one-day loss since 1987, falling more than 10%. In FX markets, USD/JPY led the losses, with the risk-sensitive carry trade, in which traders borrow in the low-interest rate JPY and buy US dollars, turning sharply lower as participants rushed for the exits. USD/JPY fell 1.7% on Monday and was down as much 12.5% from last month’s 38-year highs. The pair saw a small recovery through the week but remains at risk of further losses with the pair now below the key 200-day moving average. Looking forward, topside targets are to 149.25 with downside targets to 143.65. In terms of upcoming data, GDP, including price levels, due on Thursday, will be the upcoming week’s main highlight from Japan.

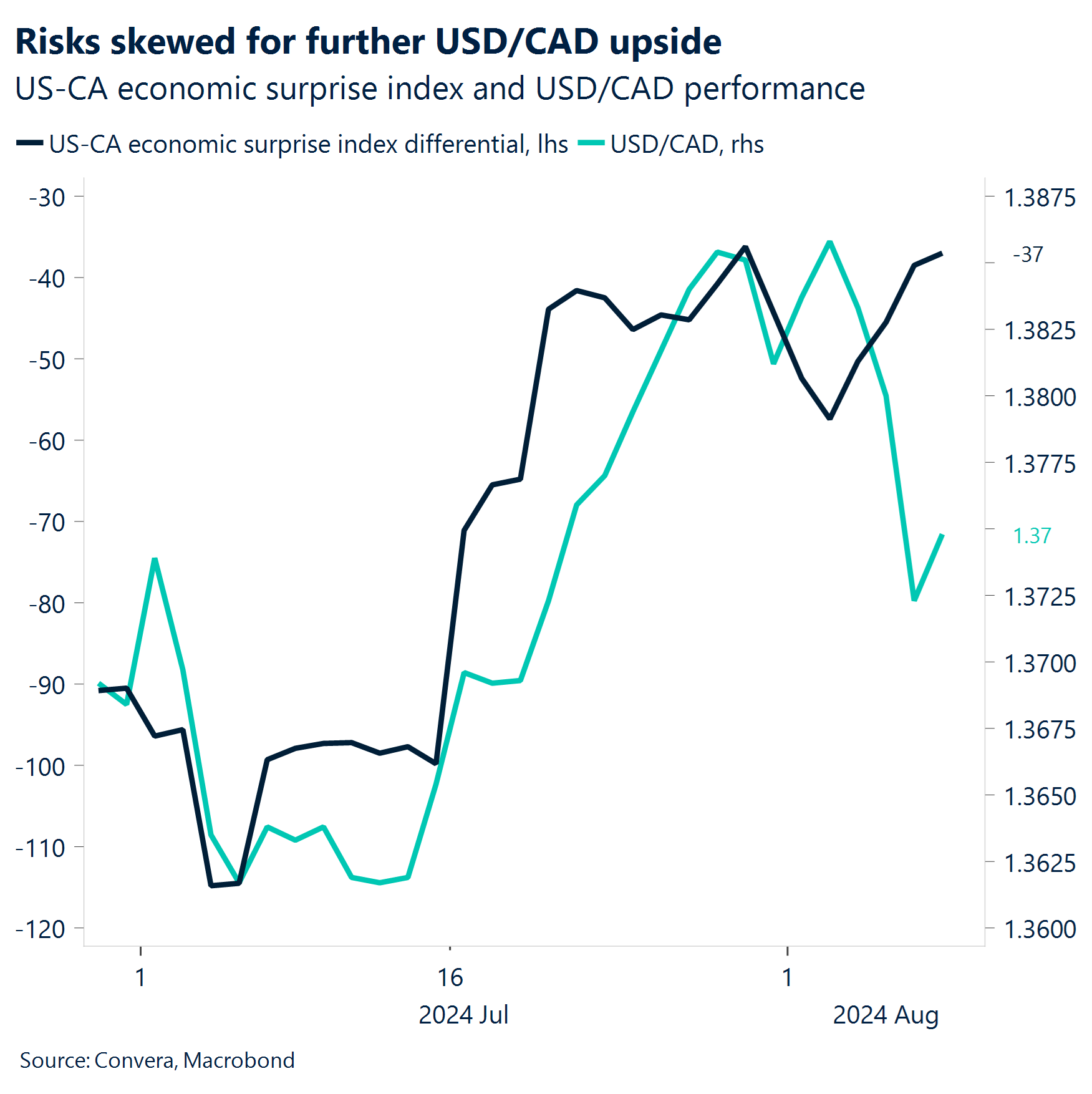

CAD Reprieve from positioning adjustment. The Canadian dollar benefited during the recent global market selloff, gaining 1% week-to-date, as the US dollar traded lower on expectations of an aggressive Fed easing cycle. USD/CAD spot briefly dipped to a two-week low of $1.372 amid positioning unwind flows, though momentum remains mildly bullish. The Canadian Treasury yield curve has shifted sharply downward, mirroring a global rush to bonds. The front end of the curve experienced the most significant rally, with the 2-year Canadian bond yield dropping over 40bps in the past seven days. The US-CA 2-year yield spread briefly narrowed to 52bps, a one-month low, before widening back to Friday’s level amid a pullback in US Treasury bonds. Looking ahead, seasonality remains unsupportive of the Canadian dollar, and signs of further Bank of Canada (BoC) easing add additional pressure. The BoC’s summary of deliberations from its July interest rate decision highlighted a shift in focus toward downside risks to inflation, suggesting faster rate cuts are increasingly likely. The year-end expectations priced into the OIS curve stand at 75bps, which seems appropriate given the lingering risks to the domestic outlook. Against this backdrop, the trajectory of USD/CAD will largely be influenced by adjustments to the currently stretched Fed easing expectations. However, the still significant short positioning in CAD may limit further CAD weakness.

AUD Aussie still supported by RBA. The Australian dollar was caught up in the week’s volatility with AUD/USD swooning down below 0.6400 before later recovering to trade above 0.6600. Monday’s market-wide sell-off saw AUD/USD heavily sold in line with losses across Asia. However, the AUD was helped higher by Tuesday’s Reserve Bank of Australia decision that signalled the central bank doesn’t expect a pre-Christmas rate cut as inflation remains too elevated. For now, the RBA looks likely to lag other major central banks and this might provide support to the Aussie. Technically, the AUD/USD might be capped by short-term resistance at 0.6600 – which aligns with the 200-day moving average – but any break higher could look for orders to 0.6665. To the downside, support is seen at 0.6500. A big week for data with wage price index on Wednesday and the July jobs report on Thursday.