Global equities have followed bond yields and the Greenback lower on mixed economic data out of the US, Europe and China this week. The S&P 500 has fallen by about 2.6%, its first weekly decline in more than a month.

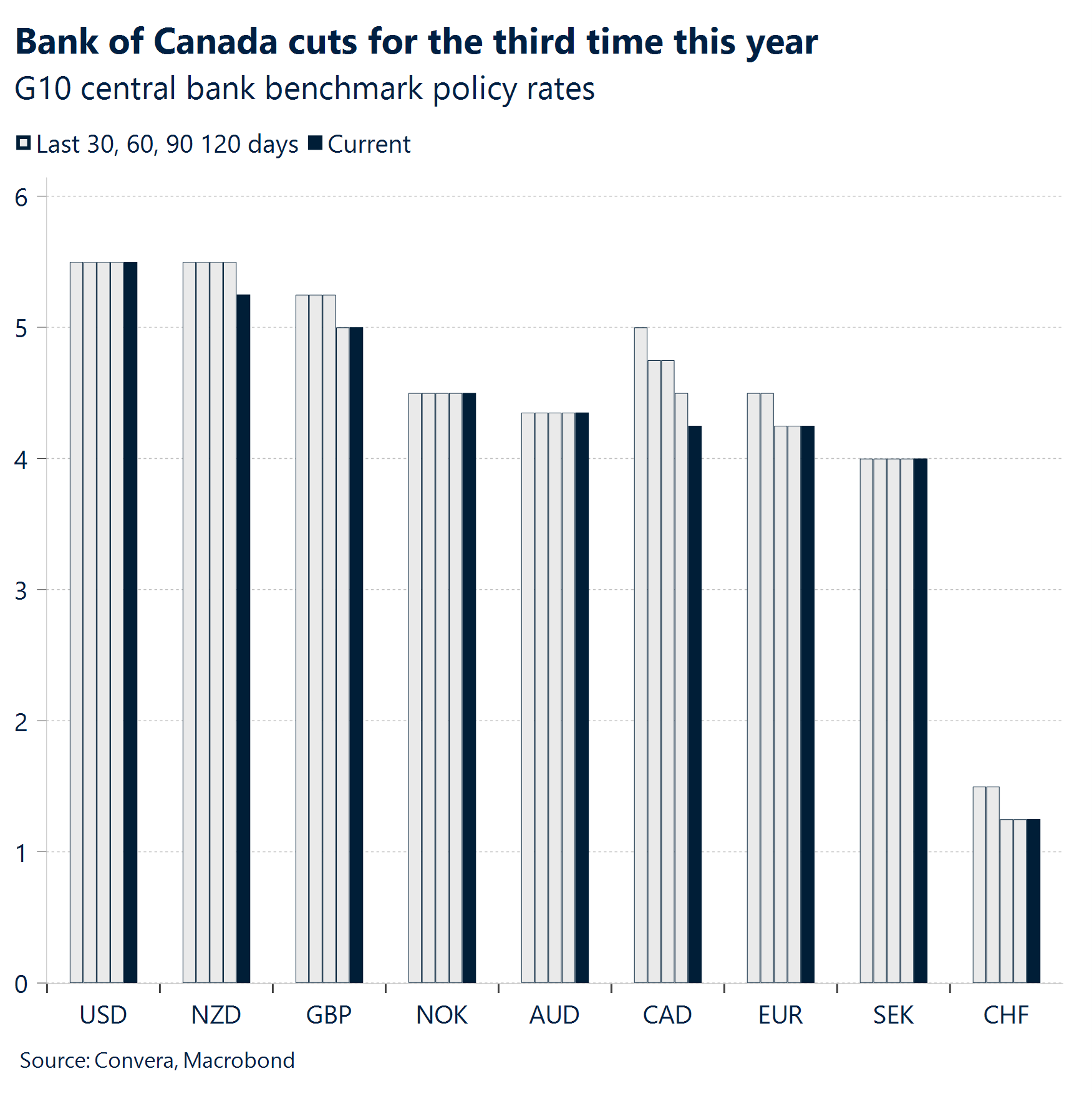

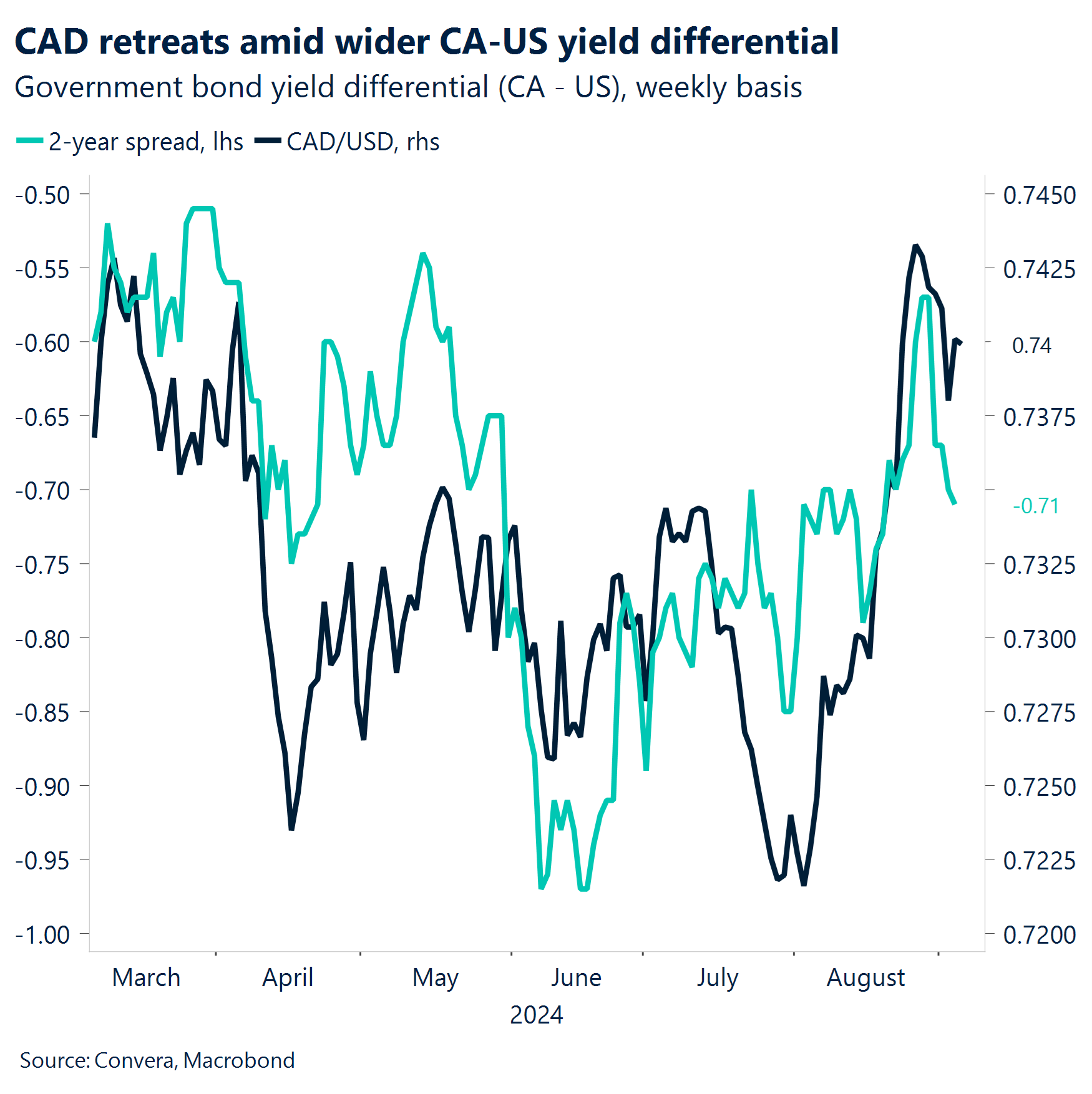

The Bank of Canada cut its policy rate by 25 basis points this week, bringing the lending rate down to 4.25%. The central bank cited mounting economic concerns, with inflation edging closer to its 2% target.

US job openings declined from 7.91 million to 7.67 million, falling to the lowest level since the beginning of 2021. The manufacturing PMI did improve for the first time in five months, but the reading of 47.2 remains well below the 50-mark.

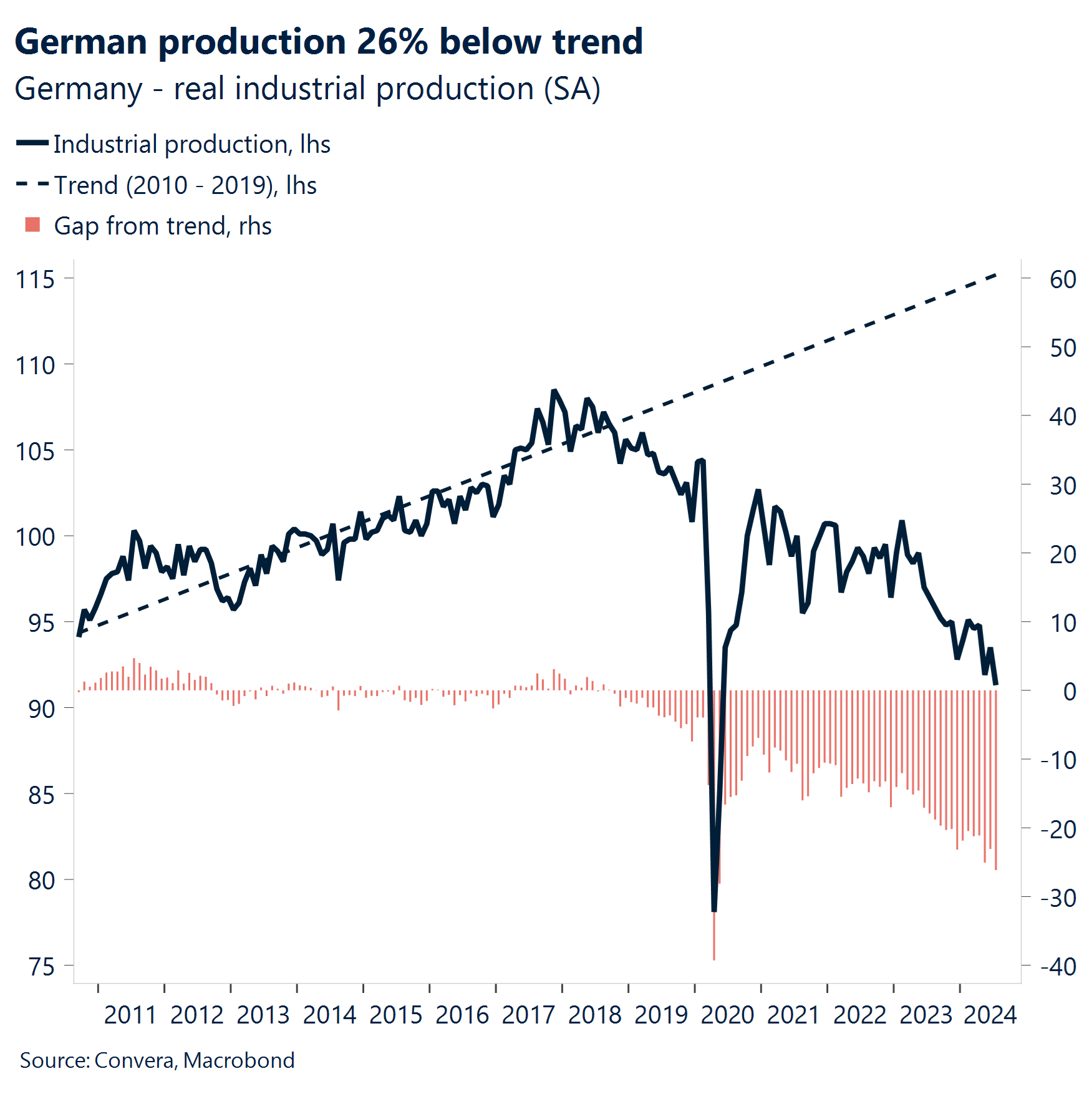

German factory orders unexpectedly rose for a second month. However industrial production over the same period dropped 2.4% MoM. The industrial sector of Europe’s biggest economy has been stuck in a rut and will likely stagnate in 2024.

China’s official composite PMI fell to its lowest level since December 2022 as the manufacturing barometer remained in contraction for a fourth consecutive month. All sub-components of the manufacturing PMI have fallen below the 50-mark.

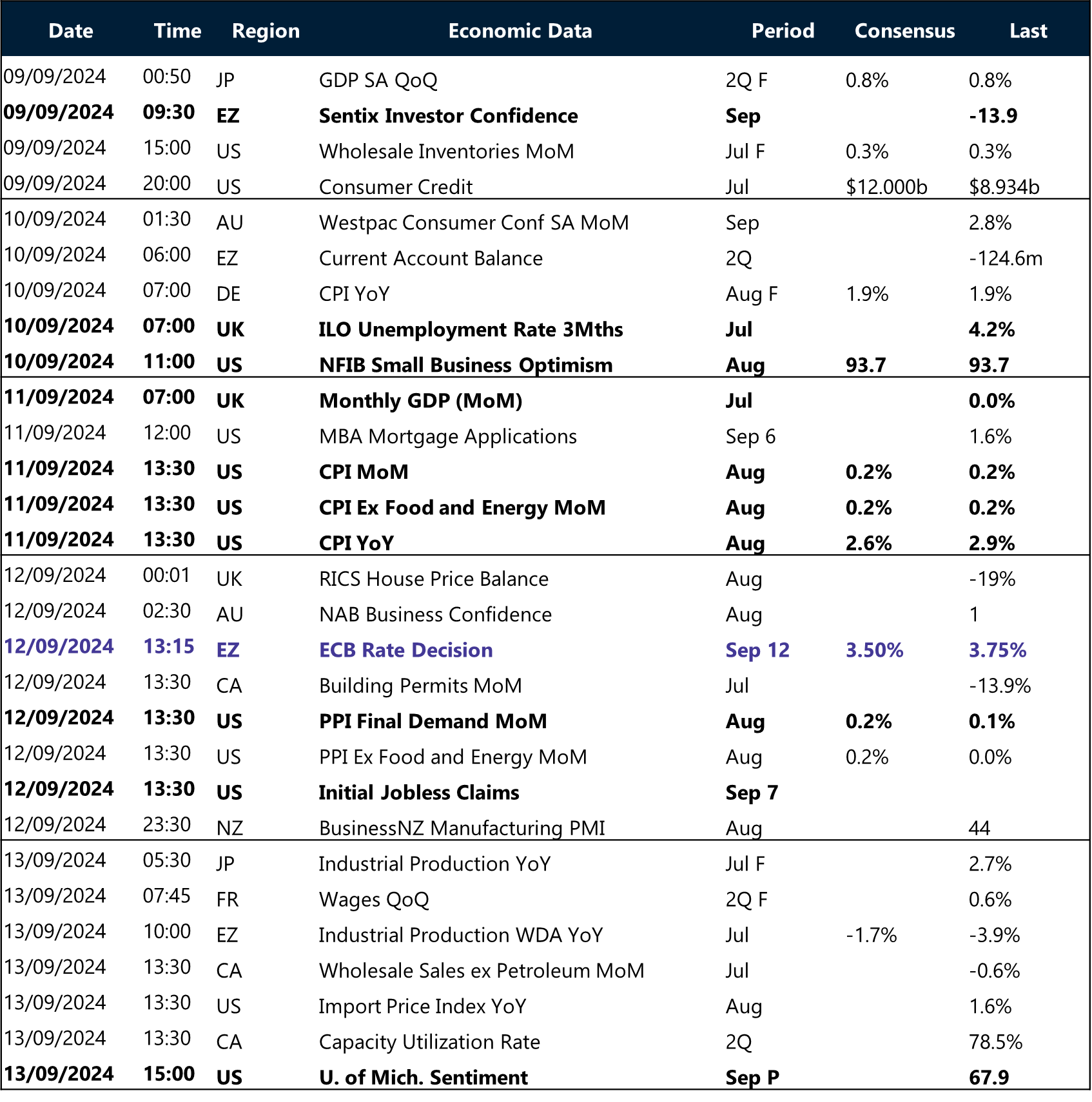

The upcoming week will keep markets interesting as investors shift their attention to US inflation, the British labor market report and European rate decision. Disinflation should be the key theme as the ECB delivers its second rate cut this cycle.

Global Macro

Cyclically weak macro data spurring rate cuts

Easing set to continue. The Bank of Canada cut its policy rate by 25 basis points this week, bringing the lending rate down to 4.25%. The central bank cited mounting economic concerns, with inflation edging closer to its 2% target. Preliminary data suggests downside risks to Q3 growth relative to the July projections, while the labour market remains stagnant. This hints at the potential for rate cuts in upcoming meetings. The Fed and ECB are expected to follow suit and cut rates as well in September.

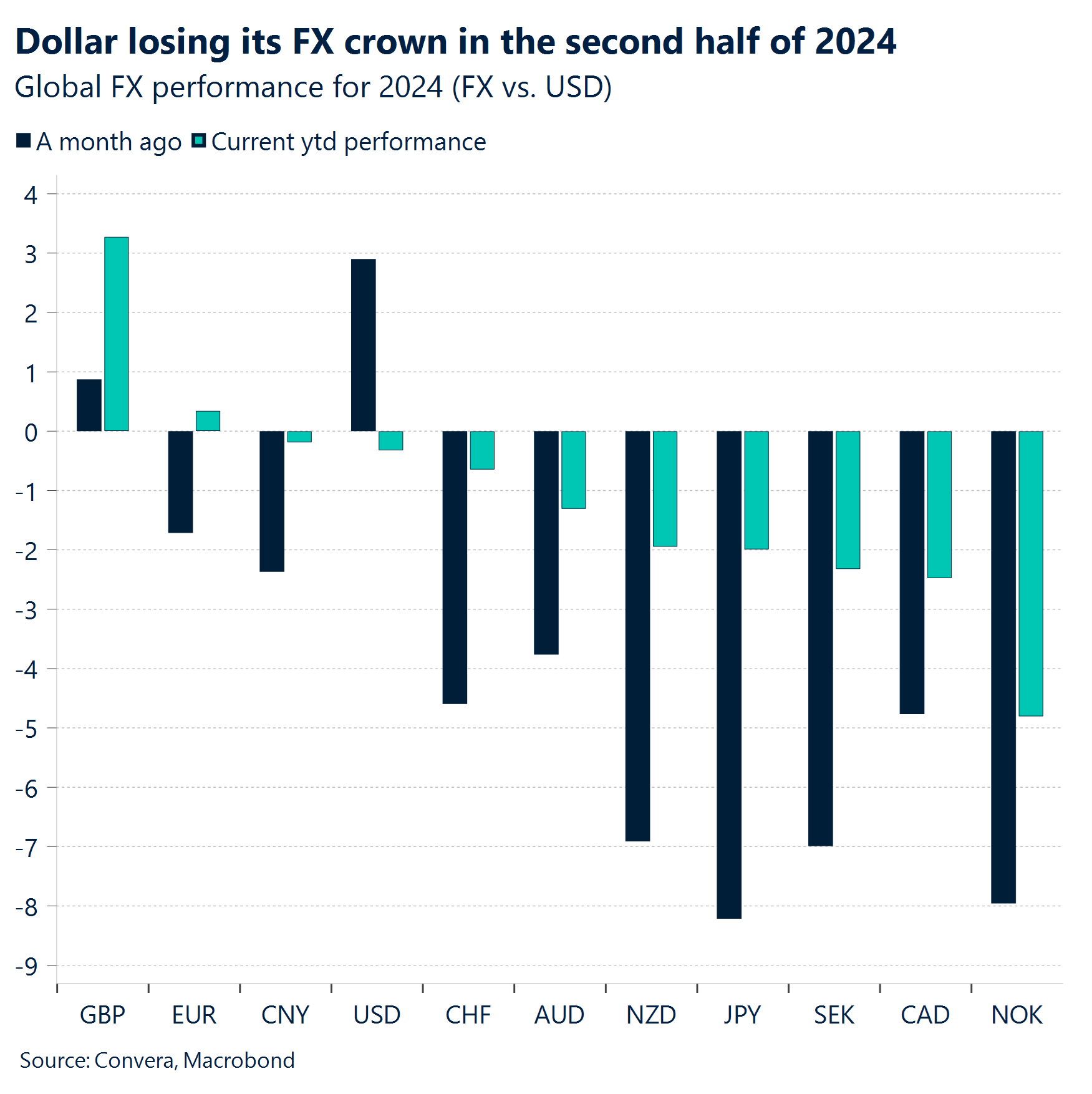

Lower dollar. The Greenback continued to follow bond yields lower this week as signs are mounting that US economic momentum is slowing. However, we noted that this trend has not been linear, and that this ambiguity has somewhat slowed the dollars decline. It will now be up to the non-farm payrolls report to decide the fate of the dollar and broader markets.

Germany stagnates. German industrial production has fallen about 16% since peaking in 2017 and is 26% below its pre-pandemic trend. This is the third longest rout (2009, 2020) in the 21st century. Production dropped 2.4% in July, ending a weak first half of this year. Leading indicators don’t promise too much change in the next six months and have turned lower recently after the strong recovery in Q1. The Ifo institute now expects the German economy to stagnate in 2024.

Angst over China. The cyclical part of the Chinese economy continues to suffer from fiscal constraints, weak domestic demand, and expectations of higher tariffs. Loan growth has fallen to the lowest level on record in July, matching the unprecedented descent of Chinese bond yields across the curve. August did not start any better. The official composite PMI fell to its lowest level since December 2022 as the manufacturing barometer remained in contraction for a fourth consecutive month. All sub-components of the manufacturing PMI have fallen below the 50-mark last month.

Regional outlook: United States

Mixed data ahead of job report

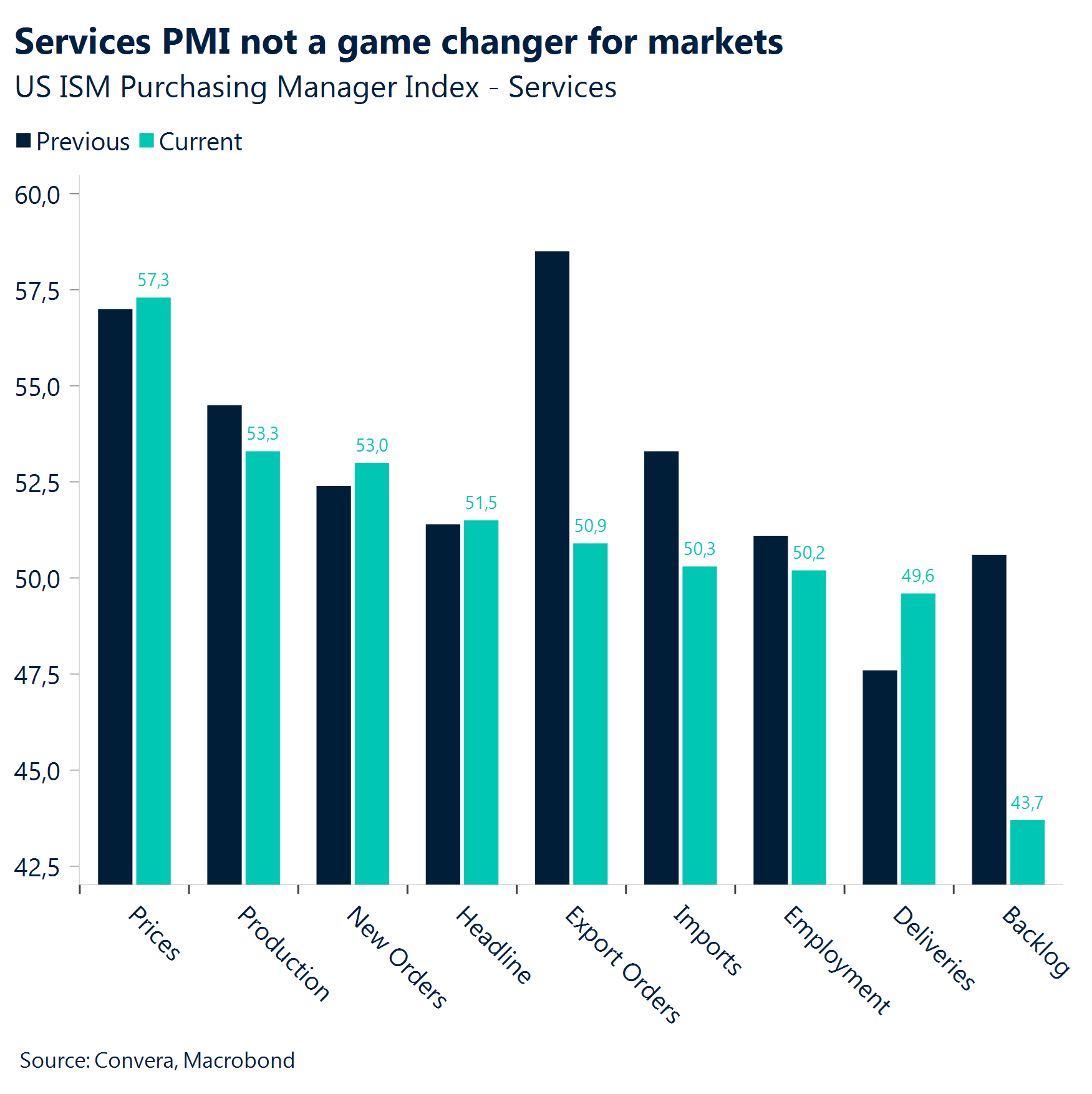

Mixed employment signals. Looking at this week’s news flow, the ISM PMIs and ADP employment report came in mixed. The US service sector stayed in expansionary territory in August (51.5) but the medium-term downward trend continued. Most sub-indicators from new orders to employment improved. However, with the headline index close to the 50-mark dividing contraction from expansion, the positive surprise in August did not do much to calm investors nerves with the job report coming up. This holds true especially against the backdrop of the weaker ADP report. Private hiring fell from 111k to 99k in August, recording the fifth monthly slowdown.

Manufacturing contracting. The manufacturing PMI did improve for the first time in five months, but the reading of 47.2 remains well below the 50-mark dividing expansion from contraction. The employment sub-index ticked higher from 41.7 to 43.6 but extended its contraction streak to three months. A pessimistic outlook over the next 3-4 months is warranted, given that the most prominent leading indicator for the headline index – the ratio between new orders and inventories – continued its descent.

Vacancies decline. Job openings declined from 7.91 million to 7.67 million, falling to the lowest level since the beginning of 2021. Looking more closely into the report published by the Bureau of Labor Statistics, a closely watched metric by the Fed, the number of vacancies per unemployed worker, set a new three-year low. Both the number of people leaving their job and getting a new one have fallen below their pre-pandemic level to 3.28 million and 5.52 million.

More weakness? Survey data such as the labor market ratio (jobs plentiful vs. jobs hard to get) from the Conference Board suggest another leg lower next month. The same tendency holds true for Tuesday’s manufacturing PMI release. The new order vs. inventory leading indicator points to further pain for the manufacturing sector over the coming months.

Regional outlook: Eurozone

Not enough to brighten struggling outlook

August PMIs get a downgrade. The composite Eurozone PMI for August was revised to 51.0, lower than the preliminary print of 51.2. The manufacturing component was revised higher to 45.8 amid greater than expected expansion in Germany and Italy, but services disappointed. Namely, August services PMIs were revised lower to 52.9, down from a preliminary figure of 53.3. Although this marks the seventh consecutive month of expansion in the Eurozone’s services sector, the growth was heavily driven by an expansion in French services, likely boosted by preparations for the Olympic Games. Excluding the one-off factors, the private sector growth continues to weaken.

German industrial sector remains weak despite upbeat factory orders. German factory orders unexpectedly rose for a second month, with demand in July advancing 2.9% MoM, contrasted against the market consensus of 1.7% drop. The uptick was due to large-scale orders, without which the gauge would have dropped 0.4%. However industrial production over the same period dropped 2.4% MoM. The industrial sector of Europe’s biggest economy has been stuck in a rut, mainly due to subdued foreign demand and concerns over loss of competitiveness to China. The latest alarm signal came earlier this week when Volkswagen AG announced it is considering unprecedented plant closures in its home market, the first such instance in 87-years.

Consumers spending remains cautious. Retail sales in the Eurozone edged higher by 0.1% from the prior month in July, in line with the market consensus, and trimming the 0.4% slump in June. Retail volumes were higher for food, drink, and tobacco products (0.4%). When compared on an annual basis, retail volume fell by 0.1%, a second consecutive decline when compared to the same time the year prior. Leading indicators in Germany, Europe’s largest country, may hint at further softening in consumer spending. New passenger car registrations plunged by -27.8% YoY in August, the largest decline since Nov ’21.

Week ahead

US inflation to slow, ECB to cut rates

The upcoming week will keep markets interesting as investors shift their attention to US inflation, the British labor market report and European rate decision. Disinflation should be the key theme as the ECB delivers its second rate cut this cycle.

US inflation in focus. The disinflationary process in the United States is expected to have continued in August. Last month saw headline CPI rise by 20 basis points, a growth rate consistent with the annual 2% target of the Federal Reserve. Another such print would put the yearly inflation rate to 2.6% (vs. 2.9% in July) and would confirm the dovish tendencies of the FOMC. Shelter inflation ticked up last month and will be watched carefully for a potential reversal to the downside. This should give the Fed more confidence to continue shifting their focus from inflation to their second mandate, the labor market.

ECB to cut. The ECB is broadly expected to ease policy by 25 basis points for the second time this year. Inflation and wage growth have come down more than expected since the last meeting. Meanwhile, economic growth and sentiment have disappointed expectations, especially in Germany. This should lead the institution’s economists to revise down their inflation and growth forecast slightly.

Wage growth to slow. In the United Kingdom, the debate about a potential rate cut in September is not as clear as it is in the US and Eurozone. The upcoming labor market and CPI reports will therefore decide the immediate policy path of the Bank of England. Regular pay growth is expected to slow from 5.4% to 5.1%. However, the unemployment rate is set to fall from 4.2% to 4.1%.

FX Views

Dollar turns negative ahead of jobs report

USD Losing momentum. The US dollar remained broadly unsupported this week after experiencing a slight rebound last week. The dollar fell against most of its G10 peers on expectations of the labor market weakening triggering a dovish Fed response in September. The continuation of the cyclical downtrend in China and Europe did little to cushion the fall of the dollar this week, which could morph into the sixth weekly decline in seven. The US Dollar Index turned negative on the year and has fallen by 11% against the yen since peaking at the beginning of July. The negative risk sentiment and fall of equity prices hasn’t helped much as it was largely compensated by lower bond yields in the US. Next week’s CPI report will be crucial to gauge how much near-term downside the dollar is facing.

EUR Bullish bias to be tested. The euro capitalised on a series of weaker-than-expected US labour market reports, gaining ~0.6% week-to-date. The momentum, stabilising after the late-August pullback, remains mildly bullish. The narrowing of 2-year DE-US yield spread to 142.9bps, the smallest gap in nearly 16 months, continues to provide support for the euro. A 25bp rate cut during next week’s ECB rate decision is almost certain, with the primary focus shifting to the communication and details of the ECB staff forecasts. Firm signals regarding the timing of future rate cuts are unlikely, as the GC will aim to retain maximum optionality. Financial markets are currently pricing in 1-2 additional 25bp cuts, assuming a cut next week. Against this backdrop we outline 3 reasons for possible euro weakness next week: (1) the current pricing offers attractive levels for longs with only 60bps priced by year end and arguably is too little risk premium for any type of growth concerns/equity weakness over the next couple of months; (2) a shift in narrative from inflation to growth concerns could see an acceleration of the cutting cycle; (3) given the strong correlations between USD and EUR rates, risks are tilted towards dovish near-term moves on any soft comments from Lagarde next week.

GBP British pound back near highs. The British pound started the new month mostly higher with some encouraging economic data suggesting growth accelerated over summer. Manufacturing PMIs came in as forecast at 52.5 while the services PMI beat expectations at 53.7. GBP/USD moved back towards the 1.3200 level – near 30-month highs. In other markets, the pound’s best gains were against the commodity currencies, with the GBP strongest versus the Australian dollar, Norwegian krone and NZ dollar. The GBP flagged versus safe havens like the Japanese yen and Swiss franc. Looking forward, while GBP/USD remains in both short- and long-term uptrends, major resistance is seen at 1.3265 with key support at 1.3050. Coming up, UK jobs on Tuesday and July GDP on Wednesday are the key releases to watch.

CNY Industrial resilience amid diplomatic breakthroughs. China’s industrial profit growth shows modest expansion, defying earlier negative indicators. This economic backdrop is now complemented by significant diplomatic developments, with U.S. National Security Adviser Jake Sullivan’s visit to Beijing seen as positive. From a market perspective, improved U.S.-China relations could boost investor confidence and support CNY. Current price at 7.0858 is sitting at the 100-day EMA support, which will indicate a bearish trend if broken. Traders should monitor both economic indicators (PMIs, manufacturing data) and diplomatic outcomes for insights into yuan performance. The interplay between economic trends and geopolitical progress will be crucial in shaping CNY’s trajectory. Any concrete advancements in bilateral relations could provide a substantial boost to the Chinese currency.

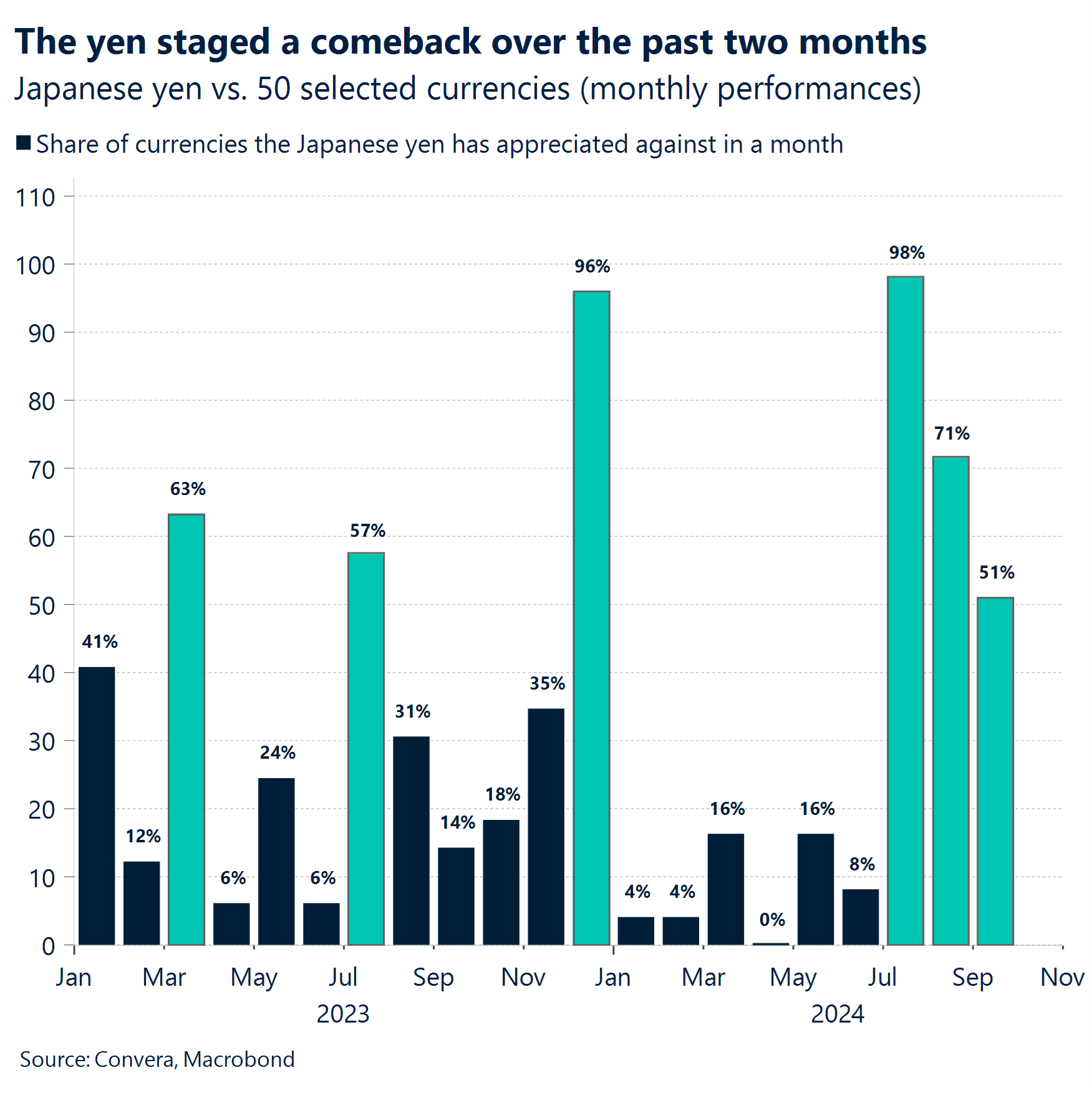

JPY Consumer sentiment stagnates, implications for BOJ policy. Japan’s consumer confidence remained unchanged in August, falling short of market expectations. While overall livelihood perceptions improved marginally, income growth sentiment weakened. The data reveals a complex picture of consumer attitudes towards the economy and inflation expectations. Technically, USD/JPY is experiencing a bearish consolidation phase. Price action suggests continuation of bearish momentum as indicated by 50 day EMA that cuts through the 100 day EMA in early August 2024. Traders should monitor upcoming releases on capital and household spending, as well as the au Jibun Bank Japan services PMI, for potential catalysts that could influence the pair’s direction and provide clues about future Bank of Japan policy decisions.

CAD Appeal undermined by yield differential. Having touched a 6-month high in late August, the Canadian dollar has been on a gentle decline since. Loonie lost 0.2% value against the US dollar during the first week of Sep as weak fundamentals and widening policy rate differentials are weighting on the currency. The Bank of Canada cut its policy rate by 25bps for third consecutive time, bringing the overnight lending rate down to 4.25%, citing mounting economic concerns and hinting at further cuts in upcoming meetings. The Canadian bonds showed little reaction to the BoC’s rate decision, and the widening of the front US-CA spread provided USD/CAD with a momentary support. Despite the mounting market concerns over US labour market weakening, the Canadian dollar remains one of the more vulnerable currencies within the G10 sphere as yield differentials undermine its appeal. The BoC has already cut rates three times this year and is expected to continue easing every meeting, whereas the magnitude of the Fed’s easing remains largely uncertain. The OIS curve is currently pricing in an additional 60bps of cuts by the Bank of Canada by year-end, compared to 103bps expected from the Fed. Loonie may weaken in the near term if expectations for “supersized” interest rate cuts from the US central bank begin to fade.

AUD Capex contraction signals economic headwinds. Recent data reveals an unexpected decline in Australia’s private capital expenditure for Q2, contracting 2.2% quarter-over-quarter. This development raises concerns about the broader economic outlook. The building sector showed particular weakness, while plant and machinery investments also softened. This trend could potentially impact key economic indicators like exports and employment figures. From a technical perspective, AUD/USD has rebounded to the upper bounds of its established trading range after testing support in early August. The pair may be approaching a short-term ceiling around the 0.68-0.69 resistance zone. Traders should keep an eye on upcoming economic releases, including building approvals, current account data, and GDP figures, which could influence the pair’s trajectory.

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.