Equity benchmarks are once again approaching record highs, and the US dollar is down for a fifth consecutive week. Overall, the macro news flow has not been market-moving as the expectation of policy easing continues to support sentiment.

Initial payrolls figures indicated employers added 2.9mln total jobs in the year through March, but this is likely to be revised down by 818,000 according to the first revision. Fed officials didn’t indicate that the releases changed their forecasts.

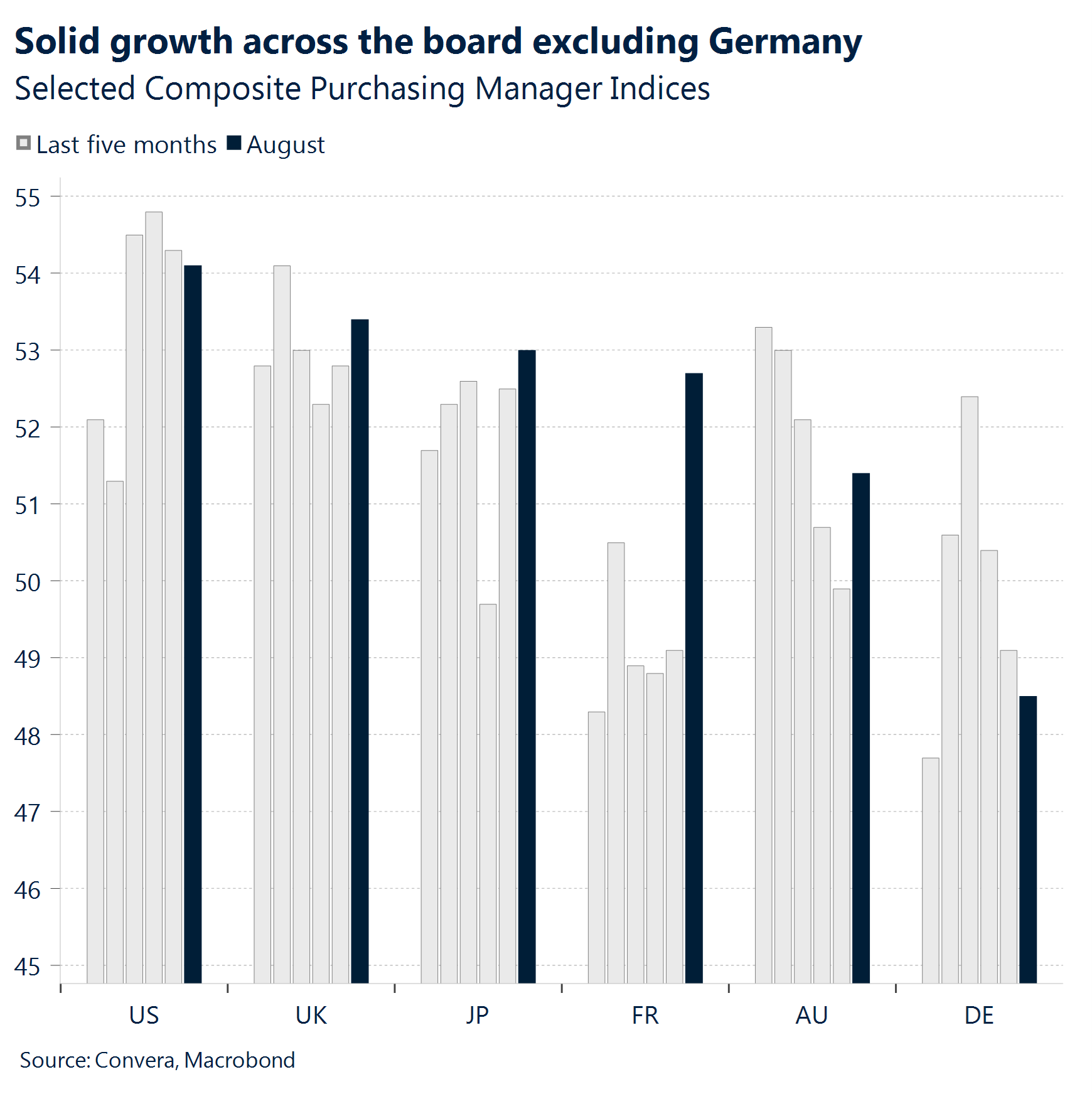

The Purchasing Manager Indices showed some solid economic resilience in the US on the services side. The services barometer for the UK picked up to 53.3, exceeding a 52.8 forecast. The measure has been in growth territory for five straight months.

Investors have welcomed the fall of inflation and are pricing in low recession and high rate cutting probabilities. The incompatibility of those two conditions and the upcoming US presidential election are the two main concerns for us right now.

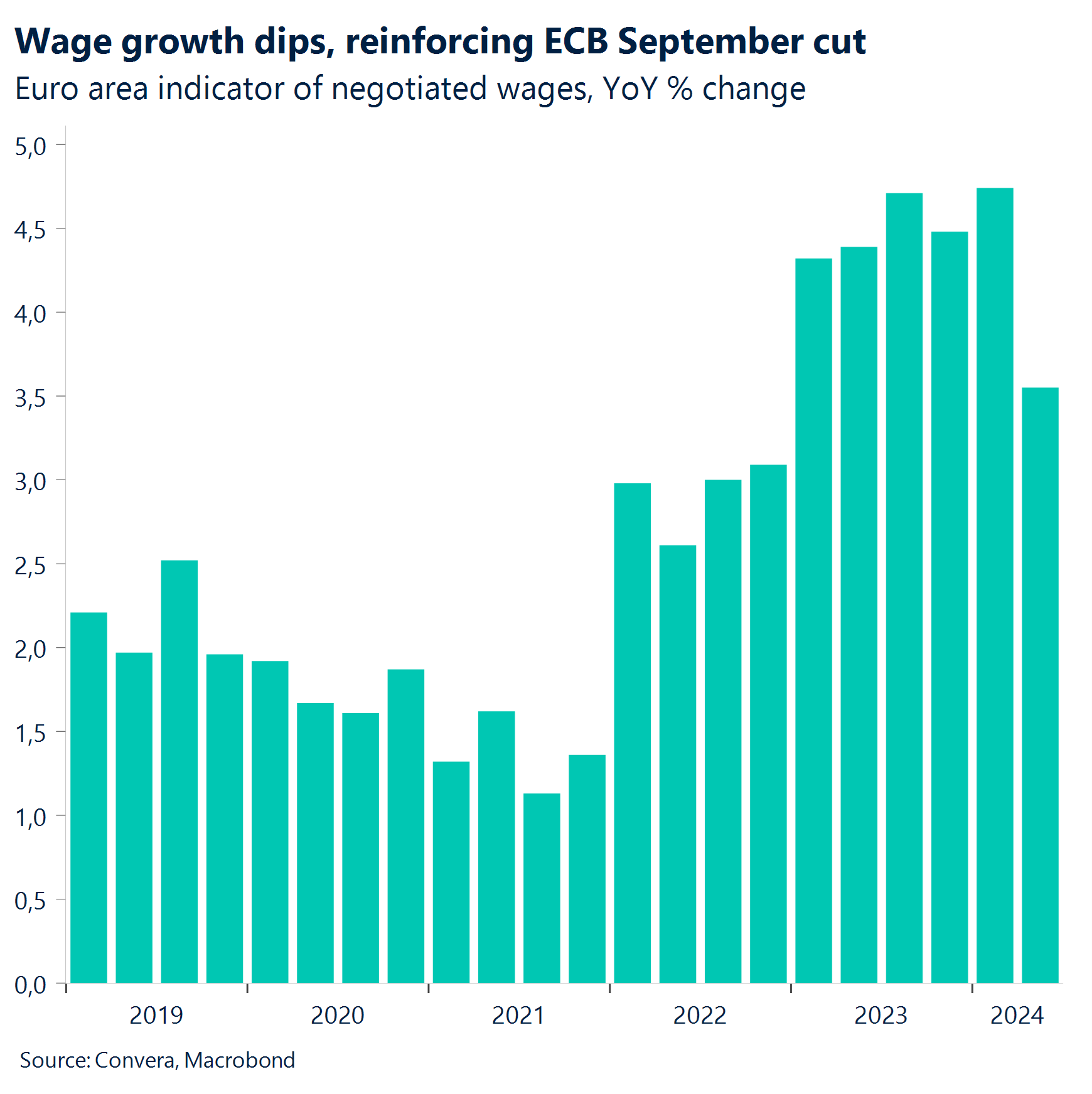

Negotiated wages in the Eurozone came in at 3.6% year-on-year in Q2 2024, down from the 4.7% in the previous quarter. This reduction eases concerns over a wage-price inflation spiral and strengthens the case for September rate cut by the ECB.

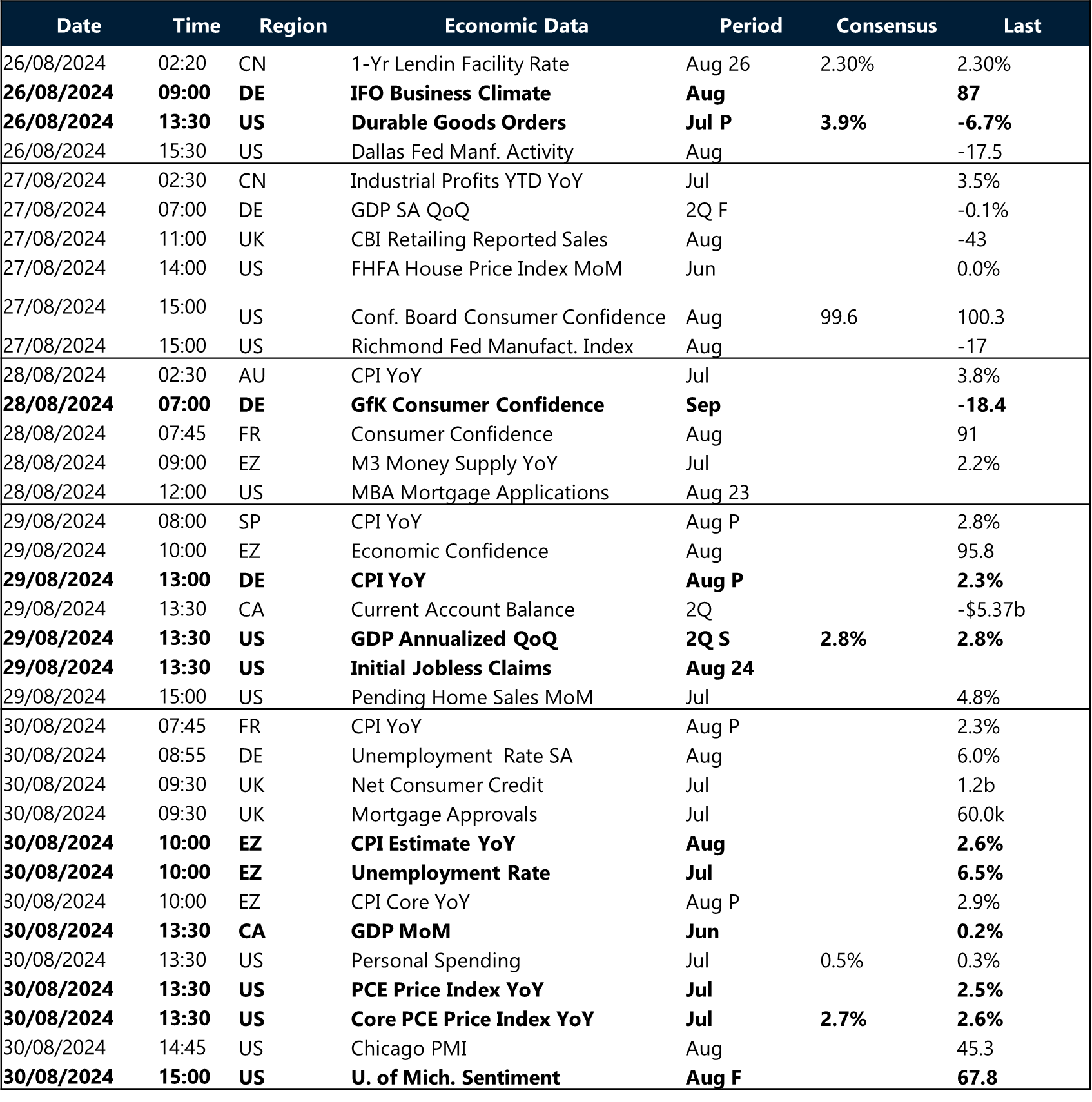

Besides the inflation prints in the US, Eurozone, Australia and Tokyo, sentiment data for Germany and the US will be closely watched as well.

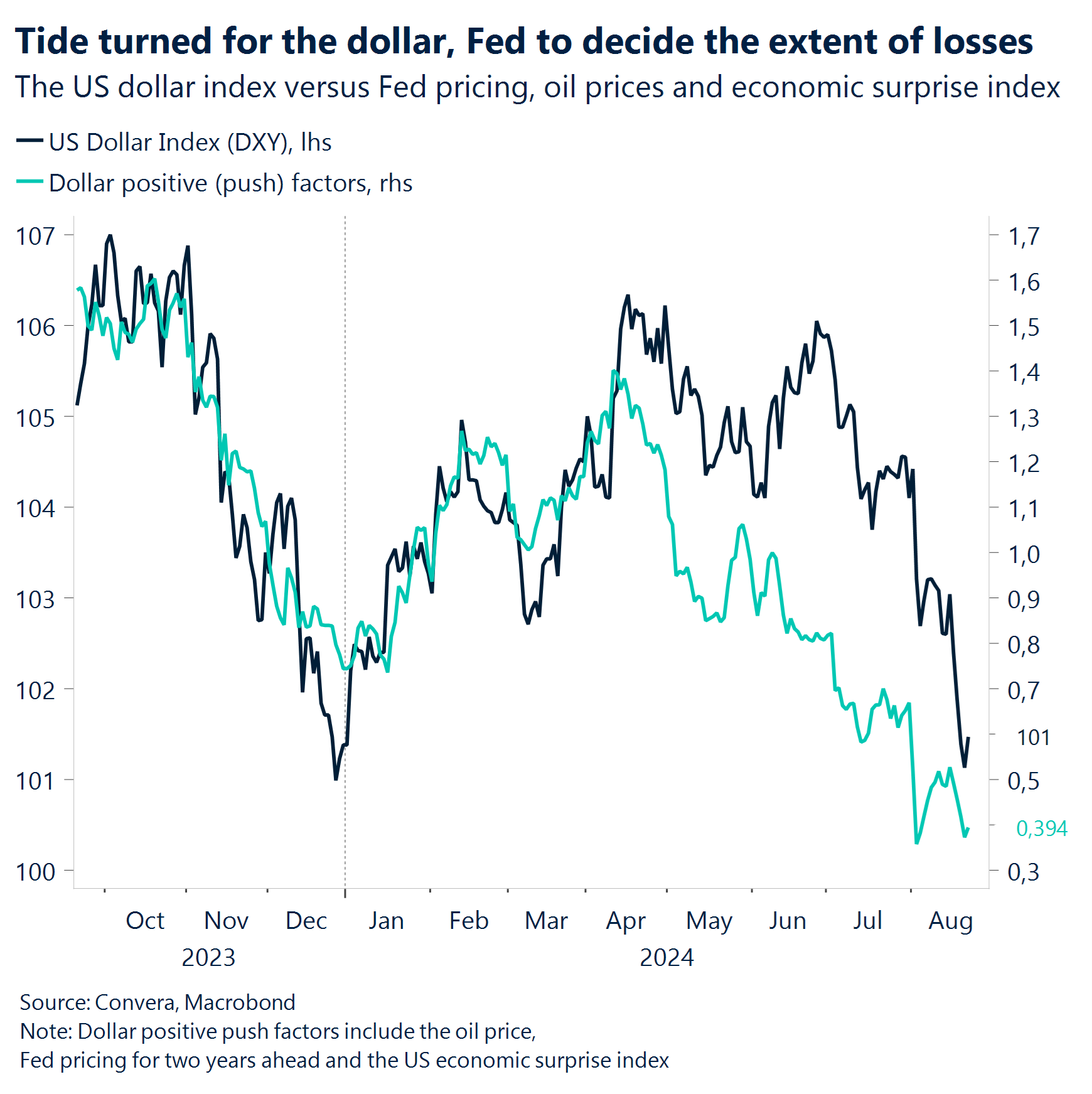

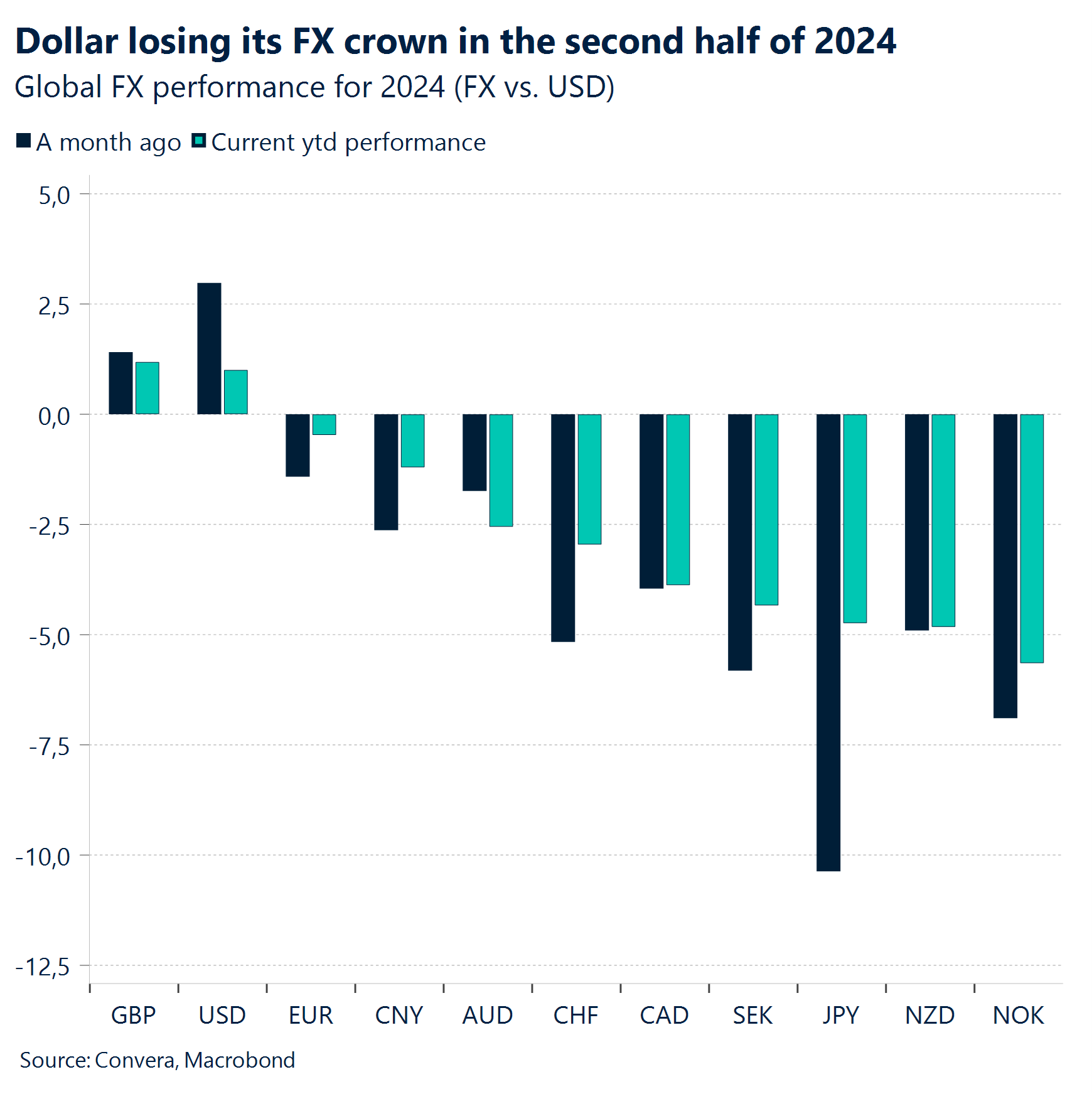

Bearish US dollar momentum built this week, with the US dollar index (DXY) slumping to its lowest level of 2024. The Greenback is poised to record its biggest monthly drop since November.

Global Macro

September meetings still up in the air

Risk on. Investors seem to have all but forgotten the volatility shock from two and a half weeks ago. Global equity benchmarks are approaching their previous highs as capital continued to flow out of the US dollar into the euro, pound, yen and yuan. Overall, the macro news flow this week has not altered the global narrative too much. The expectations of significant policy easing coming over the coming months embedded into market pricing has not budged as the purchasing manager indicators for the US and UK outperformed the consensus.

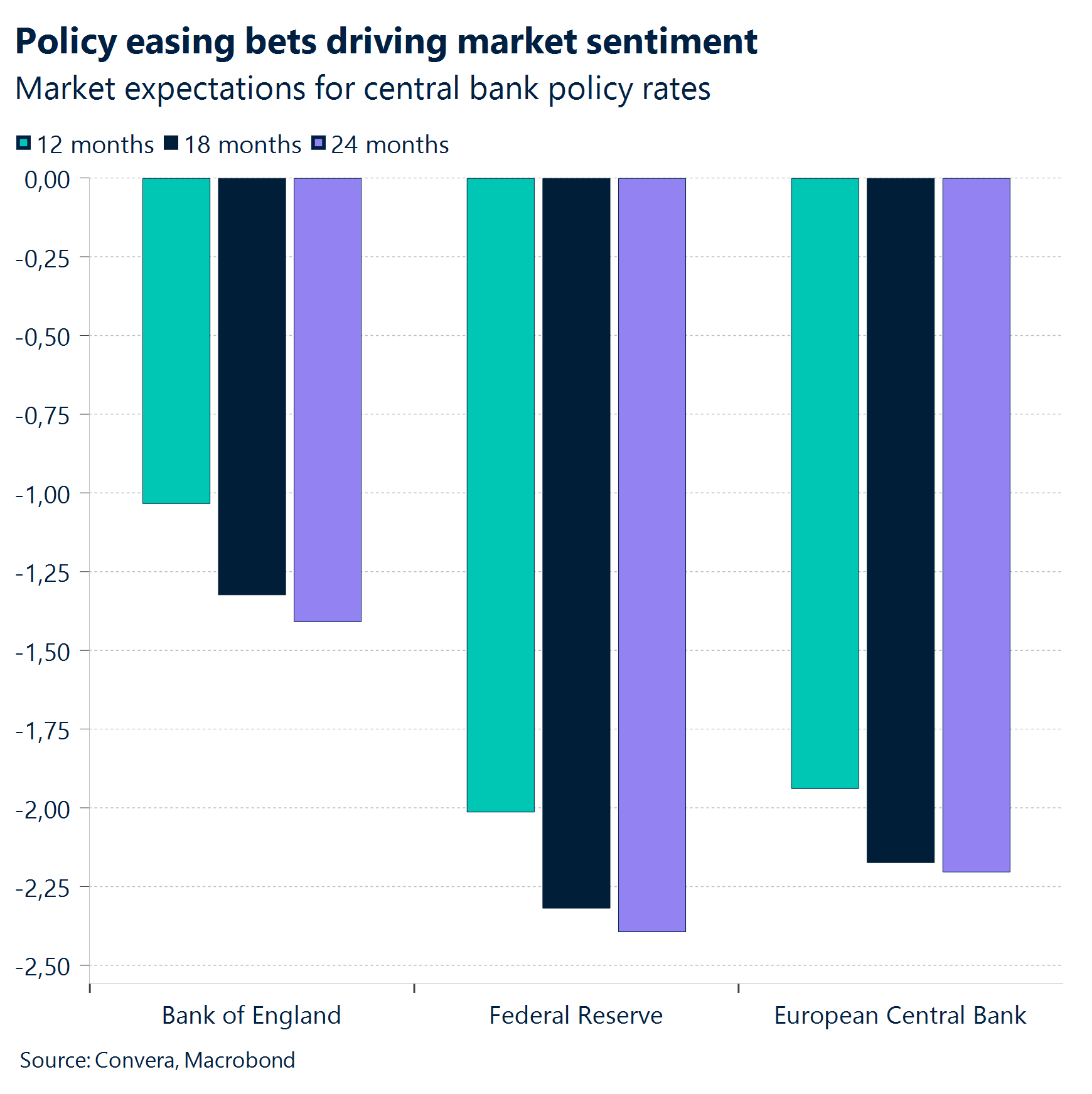

Two risks. The totality of the data continues to add to policy makers confidence to lower interest rates to a more neutral level. Inflation is easing and the labor market is cooling off. Both have been welcomed by investors as the pace has been fast enough to justify rate cuts without raising recession risks materially. The incompatibility of those two conditions (no recession accompanied by significant policy easing) and the upcoming US presidential election are the two main concerns for us right now.

No change. US policy makers would like the adjustment of rates to happen gradually as most Fed officials pointed out this week in Jackson Hole. It also seems that the payrolls revision did not alter their views on where monetary policy should be headed. This means that the next PCE and job report will decide the fate of the FOMC meeting in September.

Divergence. For the ECB it seems more straight forward with a 25-basis point cut the practical move on the table. The Bank of England could stay put in September, while the Bank of Japan under Kuroda held its possibility of another hike this year open. Central banks are therefore starting to diverge from each other.

Regional outlook: US & UK

Data no deal breaker for Fed, BoE

Services vs. manufacturing. The Purchasing Manager Indices showed some solid economic resilience in the US on the services side. However, manufacturing fell from 49.6 to 48, the lowest reading of the year, which dragged the composite reading down to a 4-month low. In terms of the composite details, employment sagged from 51.6 to 48.9, though new orders were largely unchanged at 52.3. Input and output prices were also little changed.

Fewer US jobs without consequence? US job growth was most likely far less robust in the year through March than previously reported, according to data published by the Bureau of Labor Statistics (BLS). While the payroll revision was fairly in line with expectations, it was the largest downward revision since 2009. Initial payrolls figures indicated employers added 2.9mln total jobs in the year through March, but this is likely to be revised down by 818,000 according to the first revision.

UK resilience. UK August services data picked up to 53.3, exceeding a 52.8 forecast. The measure has now been in growth territory for a tenth successive month. Manufacturing was also in expansion at 52.5 and beat estimates, pointing to a more balanced recovery. Digging deeper into the surveys revealed rising business activity and resilient demand helped drive the fastest employment growth since June 2023. At the same time, inflationary pressures moderated across the private sector, with input costs rising at the slowest pace since January 2021.

Job advertising up. Data from Adzuna this week revealed British companies stepped up advertising for jobs for the first time this year, a sign of strength in the UK labour market. The jobs-search site also said the number of people looking for work increased, making it the most competitive market for hiring since the country was emerging from Covid-19 lockdowns in May 2021.

Regional outlook: Eurozone

Summer Olympics keeps growth afloat

Private sectors expands more than expected in August. The flash HCOB Eurozone Composite PMI rose to 51.2 in August, well above market expectations of 50.1 to mark the sixth consecutive expansion in the private sector activity. Growth was carried by an expansion in French services sector, a welcome boost due to the summer Olympics. However, this temporary lift will soon fade, and the underlying data remains fundamentally weak. The manufacturing sector activity has declined for the past two years and output in Germany, Europe’s largest economy, continues to decline faster than expected. The growing risks to Eurozone economic growth further strengthen the argument for rate cuts in September and possibly beyond, which has already been acknowledged by ECB’s Rehn this week.

Wage growth signals green to September cut. Negotiated wages came in at 3.6% year-on-year in Q2 2024, down from the 4.7% year-on-year observed in the previous quarter. This reduction eases concerns over a wage-price inflation spiral and strengthens the case for September rate cut, currently priced in with a 98% probability in the OIS curve. Despite the abating wage pressures, risks prevail and must be monitored. While wage growth slowed in France, the Netherlands, and Austria, it further accelerated in Belgium, Italy, and Spain. For now, the overall trend is encouraging and is supportive for further ECB easing.

Riksbank cuts rates, signals more to come. Sweden’s Riksbank cut its policy rate for the second time this year to 3.5% and indicated it could cut rates a further two or three times before year-end, which is one more than it had proposed in June. This refreshed forward guidance aligns more closely with current market expectations of 78 basis points priced into the OIS curve.

Week ahead

Inflation figures around the world

The calm after the storm continues. Equity benchmarks are once again approaching record highs, and the US dollar is down for a fifth consecutive week. Upcoming inflation data across the world will be used as renewed impetus for potentially repricing or reaffirming the elevated policy easing bets for central banks in the developed world. Besides the inflation prints in the US, Eurozone, Australia and Tokyo, sentiment data for Germany and the US will be closely watched as well.

Underlying inflation in the US is expected to have increased by 0.2% in July to 2.7%. While this constitutes an acceleration from the annual growth rate seen in June at 2.6%, it is likely not enough to move the needle when it comes to the expected Fed rate cut in September. The job report in the following week will therefore be the decider of the magnitude (25 vs. 50bp) of easing at the next meeting.

Inflation in the Eurozone is set to have fallen drastically in August, continuing the disinflationary trend of the second half of 2024. Should the print on Friday confirm the drop from 2.6% to 2.1%, this would increase the confidence of the European Central Bank to cut interest rates a second time in September.

The CPI report for Tokyo, seen as an early indicator for national wide price trends, which is up next Friday, is expected to show a pickup in the core rate from 2.2% to 2.3%. This will keep the speculation about another BoJ hike this year on the table.

The policy divergence between the Fed and ECB on one side and the BoJ on the other should be strengthened by the upcoming inflation prints next week.

FX Views

Easing bias is a drag on dollar

USD Fifth successive weekly loss. Bearish US dollar momentum built this week, with the US dollar index (DXY) slumping to its lowest level of 2024. The Greenback is poised to record its biggest monthly drop since November as markets remain convinced the Fed will cut rates by at least 25-basis points at its next three meetings this year. With attention shifting from inflation to the labour market, the huge downward revision in payrolls published this week supported the rates outlook and dollar depreciation. However, ongoing US economic resilience, seen via the PMI surveys, halted the dollar sell off and saw US short-dated yields climb back above 4%. Indeed, the risks for the dollar in the short-term are slightly upside-tilted. Fed repricing has gone some way already with markets more dovish the Fed than its major peers. However, the Fed’s coming easing of financial conditions is typically a dollar-negative development that has the potential to overwhelm dollar-positive drifts from weakness in European and Chinese growth. We’re keeping a close eye on the key psychological handle of 100 in the DXY, which it has only been below for five days out of the past two years. A break below could support an acceleration to the downside. The Fed’s preferred measure of inflation published next week will be a key test.

EUR Strength masks economic weakness. The euro’s ~3% rally in August has been relentless, pushing it to a one-year high against the mid-week as market participants ramped up their Fed easing bets. While the euro has legs to potentially test the 30-month range ceiling around mid-$1.12 (the July 2023 high), the momentum is slowing. From a technical perspective, the RSI momentum indicator is in overbought territory, signalling a pullback is likely. From a fundamental perspective, economic momentum continues to weaken. The Eurozone Citi Surprise index fell to a fresh 11-month and negotiated wage growth for Q2 eased from historical lows, posing a strong case for ECB September rate cuts and beyond. Alongside buckling fundamentals, the 3-month outlook for the euro remains bearish due to lingering political risks in both the Eurozone and the US. In times of uncertainty, the dollar tends to benefit via the safe haven channel.

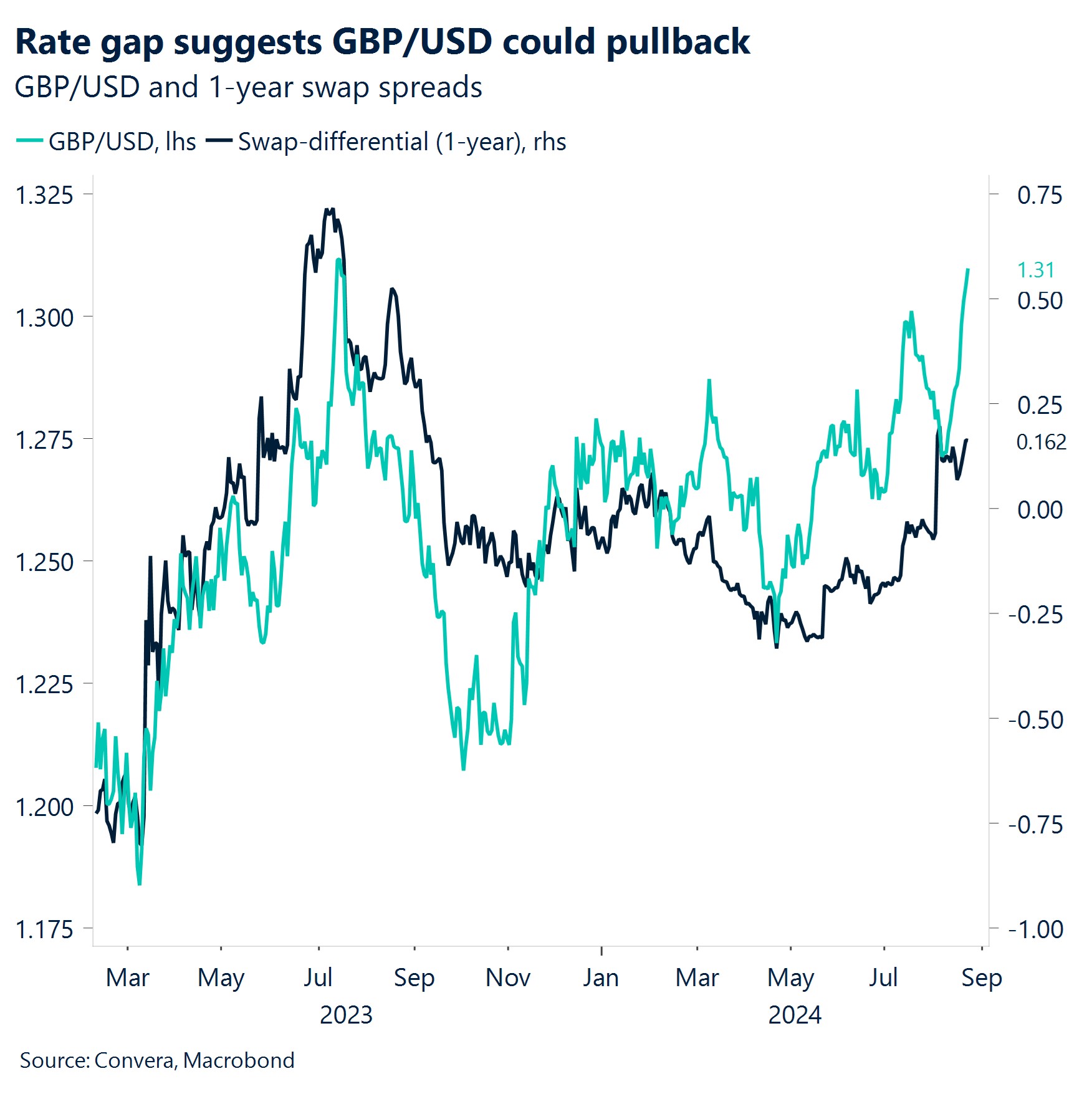

GBP Extends gains beyond $1.31. GBP/USD is trading just 20 pips away from a 2-year high and the long-term outlook remains bullish given the sustained break above its 200-week moving average. Sterling has been provided a fresh boost thanks to a rebound in risk appetite, tracking global equities higher, but the UK PMI data beat across the board also suggests Britain’s economic recovery has further room to run. GBP/USD has climbed for 11 days out of the past 12 trading sessions and is lingering near $1.31 – a level it has only spent four days above of the past 523 trading days. According to FX options pricing, the implied probability of GBP/USD being above $1.32 by the end of the year is around 40% versus a 25% probability of it being below $1.28. But in the short-term, the relative strength index is in overbought territory, and rate differentials also point to sterling being overstretched, particularly if US rate cut expectations recede. This means we might see a pullback or period of consolidation soon. Against the euro though, the convincing break above its 100-day moving average this week, coupled with an uplift in UK-German yield spreads, points to a looming retest of the €1.18 handle.

CHF Another stellar week. Despite renewed risk appetite across financial markets this week, the Swiss franc has strengthened about 1% against both the euro and US dollar. EUR/CHF and USD/CHF remain trapped in a descending channel for now, with the former having fallen to a 9-year low earlier this month and poised to suffer a fourth monthly drop on the trot. We’re skeptical of further declines though. In Switzerland, the domestic central bank has long shifted to a stance that is more inclined toward accommodating the economy. That bias may have only been heightened by what has been a materially stronger franc in recent weeks, which tends to constrict growth in an economy where exports represent the main economic engine. Thus, the twin dynamics of a market that is due to reprice the relative rate trajectories as well as an SNB that is wary of undue currency strength suggest that EUR/CHF could head higher, back towards its key long-term daily moving averages around 0.96 and beyond.

CNY Yuan woes persist as property sector struggles to find footing. The Chinese government’s efforts to stabilize the property market continue to face headwinds, with previous rescue measures yielding limited results. New initiatives targeting local government funding aim to stimulate property purchases, but implementation challenges remain. Recent data underscores the sector’s ongoing weakness, with significant year-on-year declines in home sales and prices. The yuan remains under pressure as investors question the efficacy of current policy measures. Technically, key support level for USD/CNY remains at 7.10 handle. Traders should watch for potential breakouts from recent consolidation patterns, with upcoming economic releases such as industrial profits and PMI data likely to influence short-term price action. The Chinese equity market and property sector’s performance remains a critical factor in shaping yuan sentiment. Chart shows strong correlation between CSI300 and CNY FX which may augur well for CNY if the equity market performance improves.

JPY Divergent PMI trends keep Yen in focus. Japan’s economy presents a mixed picture, with services sector strength offsetting continued manufacturing weakness. The composite PMI reached its highest level since May 2022, driven by robust service sector expansion. However, manufacturing activity remains in contraction territory, highlighting sectoral imbalances. Inflationary pressures persist, particularly in input costs, though manufacturers show hesitancy in passing these on to consumers. From a technical standpoint, USD/JPY appears poised for range-bound trading above the 140 level in the near term. Upcoming economic releases, including Tokyo CPI and industrial production data, may provide further directional cues for the yen.

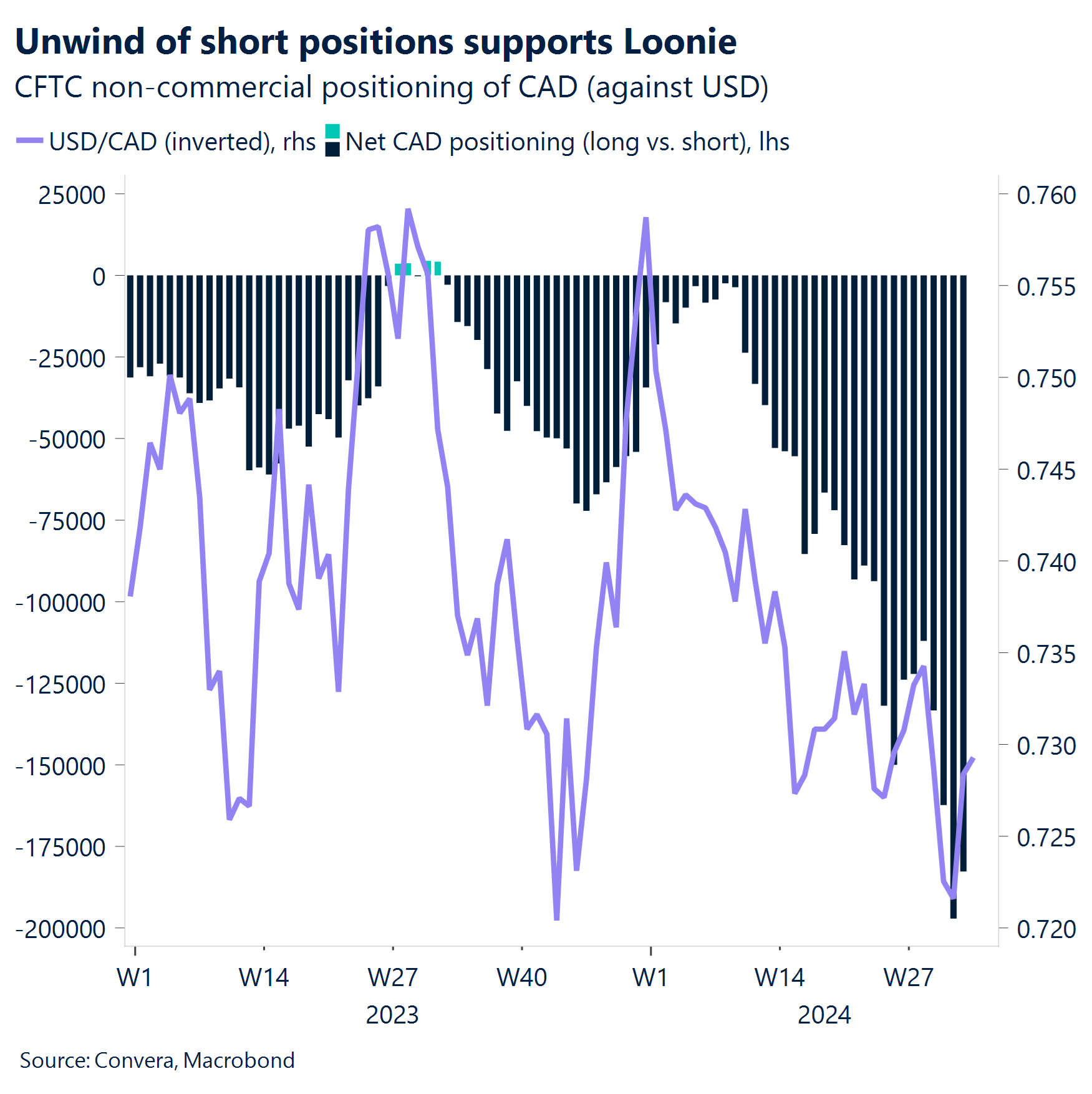

CAD Green light for further cuts. The Canadian dollar strengthened below C$1.36, reaching a four-month high, as US dollar weakness overshadowed domestic data supporting a dovish stance from the Bank of Canada. The headline inflation rate fell for the third consecutive month to a three-year low, giving the central bank a green light for further easing. In response, market participants have increased their cutting bets, now pricing in 83 basis points of easing by year-end into the OIS curve, up from 76 basis points at the start of the week. Despite the dovish backdrop and a weakening domestic economy, speculation around the Fed’s easing pace has overshadowed FX dynamics. Additionally, the unwinding of stretched bearish CAD positions continue to act as a tailwind for the Loonie, suggesting that USD/CAD may still have further room to fall. The pair is currently resting at its 200-day SMA, but a breach below this level could see the CAD test April highs near the low C$1.35 range.

AUD Aussie gains ground as services sector leads economic rebound. The Australian economy shows signs of resilience, with the composite PMI returning to growth territory. Services continue to drive expansion, while manufacturing struggles to keep pace. New orders and employment trends paint a positive picture, though inflationary pressures persist. From a technical perspective, a decisive break above 0.6628 level could challenge the bearish narrative, potentially opening the door for further upside. However, failure to breach this level may reinforce the existing range-bound pattern. Traders should closely monitor the interplay between price action and moving averages for confirmation of directional bias. This week’s economic calendar, featuring CPI data and retail sales figures, may provide additional catalysts for currency movements.

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.