- Donald Trump will move back into the White House next year as his second presidential term begins. As the Republicans are likely to take both chambers of congress, market discipline is the only mechanism keeping the party in check.

- The US economy will likely continue to growth above trend with inflation maintaining its upside bias. This will make life for the Federal Reserve more difficult, even though most policies will get implemented after 2025, once Powell has been replaced.

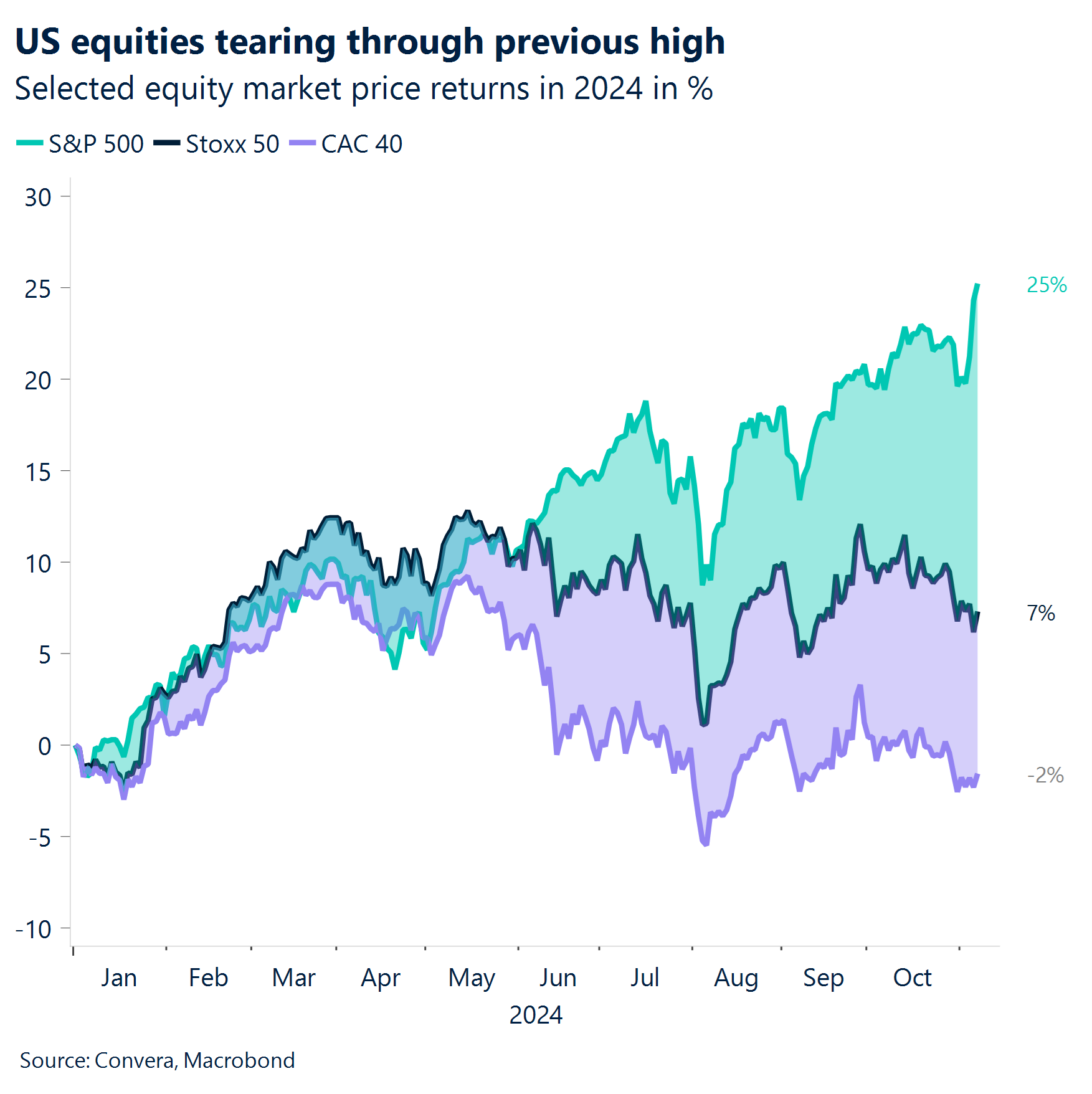

- US equities have pushed to record highs in anticipation of tax cuts and deregulation being prioritized under the incoming Trump administration. The S&P 500 now makes up more than half of global equity value. US exceptionalism continues.

- The German government has been thrown into a crisis once again when chancellor Scholz fired his finance minister after continued disagreement over the budget. The vote of confidence in January will likely be followed by new elections in March.

- Both the Federal Reserve and Bank of England cut their respective policy rates by 25 basis points as inflation continues to moderate. However, while the former is expected to add another 25bps easing to its cycle in December, the latter is not.

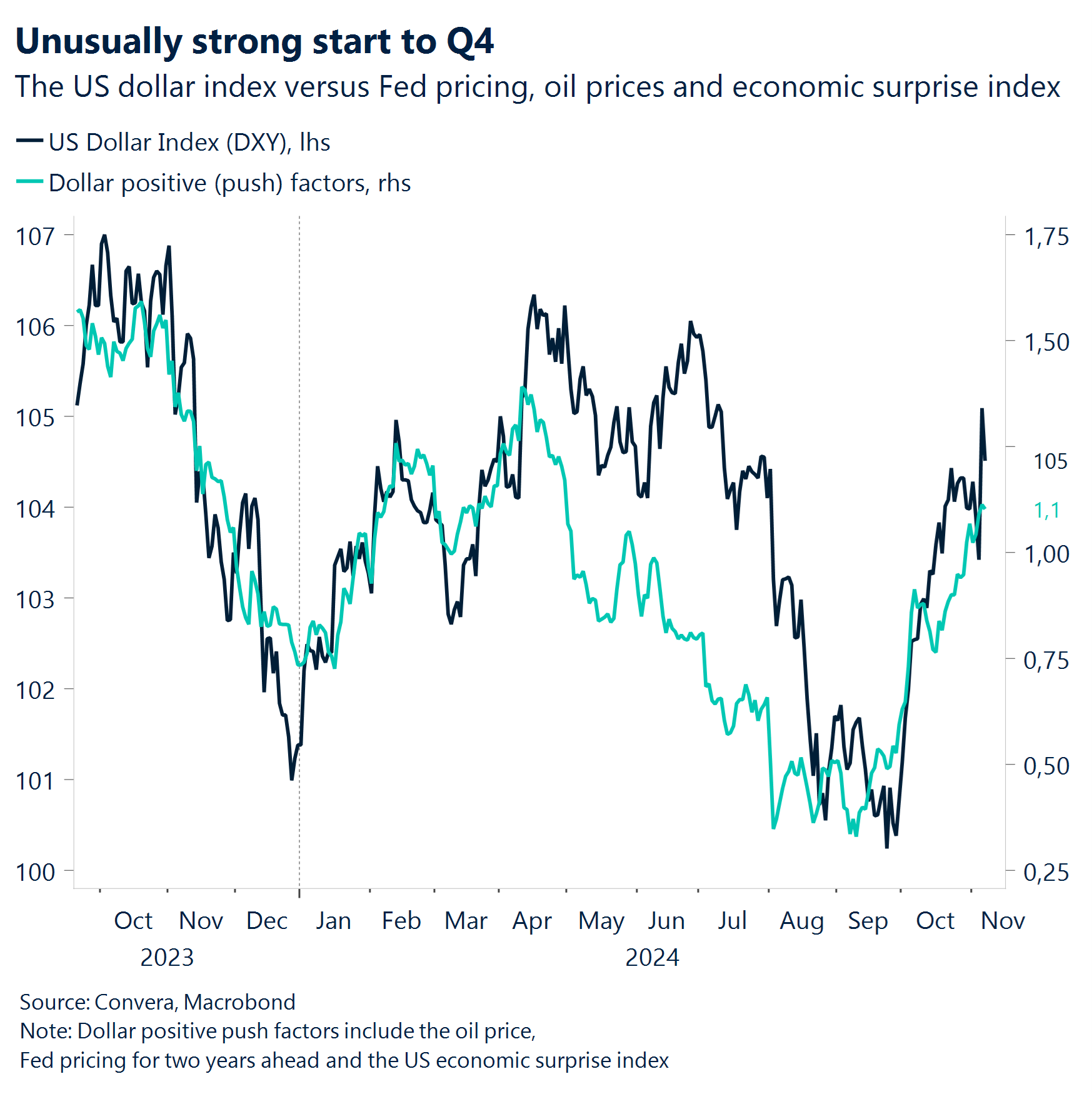

- The US dollar has appreciated for a sixth consecutive week on rising yields and bets on above growth trend going into 2025. The euro and yuan have underperformed.

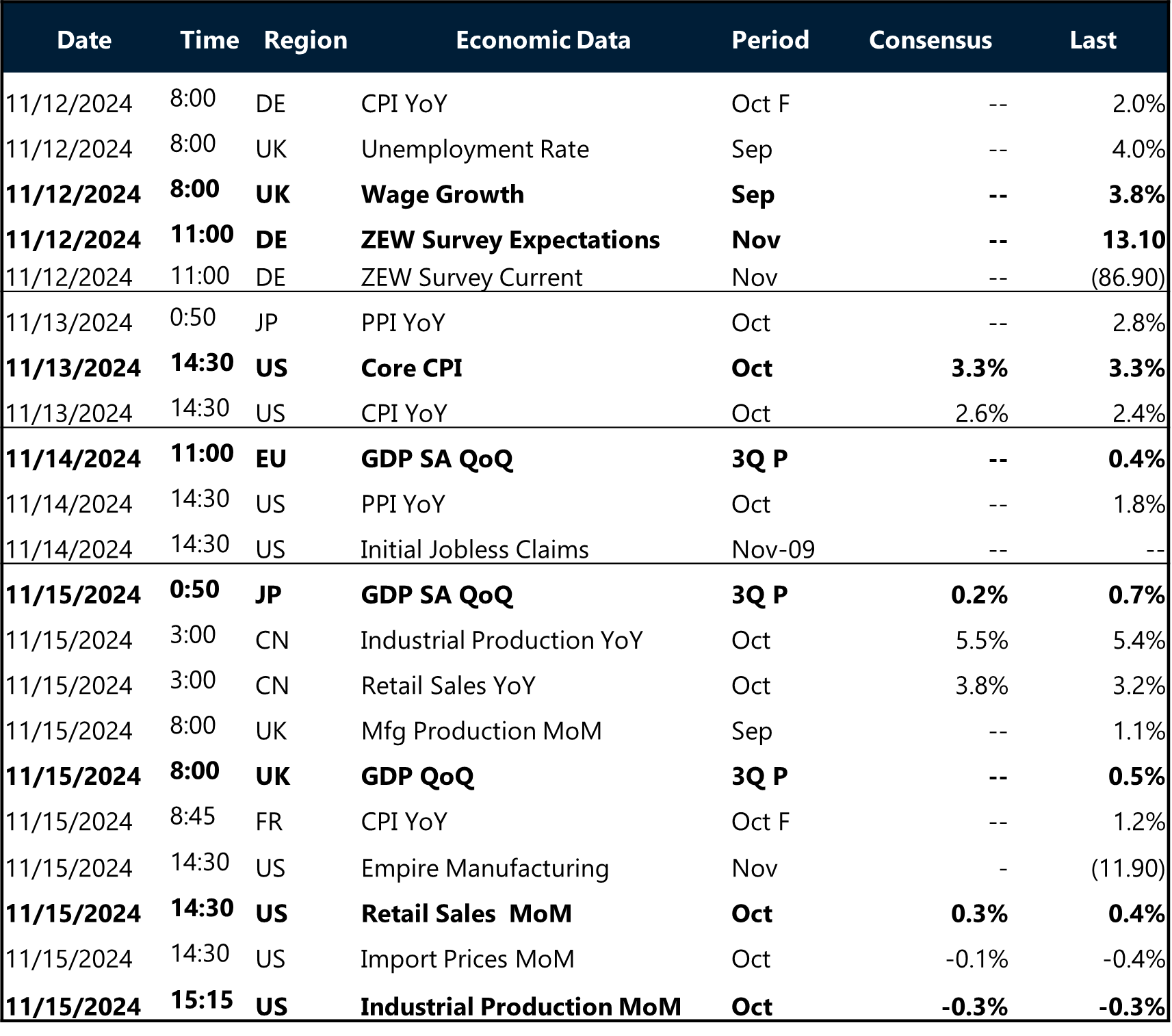

- •Next week will be all about US inflation and the macro path from the UK and China.

Global Macro

First developments post US-election

Fed cautiously cuts by 25bps. The pro-growth agenda of president-elect Donald Trump has arguably made the job of Fed Chair Jerome Powell more difficult going into next year. While Thursday’s decision to cut interest rates by 25 basis points to 4.5% has not been altered by political considerations and had been well telegraphed, some details would suggest that the December meeting might be more nuanced. The committee noted that labor market conditions have generally eased but removed the comment that job gains have slowed. Equally, the phrase regarding the FOMC gaining greater confidence that inflation is moving towards the 2% target has been removed as well. That was enough for investors to push back expectations on the next rate cut from December to January. We remain under the impression that a rate cut at the next meetings seems likely.

Fed unfazed by Trump. While the Fed sees itself as being impartial, the policy agenda of the White House does have an impact on the economy and therefore monetary policy. Jerome Powell intends to finish his four-year term ending in May 2026 despite clashing multiple times with Donald Trump during his first presidency. It took Trump around a year to push the tax cuts and tariffs across the finish line. These two developments make it likely that Powell will not have to think too much about the Trump agenda next year. This will change the year after, where policies such as 1) deportations, 2) tariffs, 3) expansive fiscal policy, and 4) tariffs could start impacting the Fed’s inflation projections and therefore interest rates. The uncertainty surrounding government policy and the overall outperformance of the US economy have led investors to significantly push back on their rate cutting expectations for 2025.

German crisis. The firing of German finance minister Christian Lindner by Chancellor Olaf Scholz has opened the door for a snap election early next year and has added another pressure point for the euro. The initial reaction of investors has been to sell German government bonds as the potential replacement of the fiscal hawk Lindner could be met with more bond issuance. However, the bigger issue is that growth expectations for 2025 will remain muted. Planning uncertainty will continue to dampen business investment and expansion plans. According to the DIHK, more than half of German companies classify domestic economic policy as a counterproductive for their own development. In a world of rising geopolitical tension and trade fragmentation, the ruling coalition has not set up Europe’s largest economy for success.

Last BoE cut of the year. The Bank of England (BoE) reduced its benchmark interest rate by 25bps to 4.75%, as the consensus and markets expected. The BoE’s update was interpreted as hawkish. Policymakers emphasised the need for restrictive monetary policy, favouring a gradual easing approach. The central bank projected inflation to rise from 1.7% to around 2.5% by year-end. Additionally, it estimated a GDP lift of approximately 0.75% at peak impact within a year, with a temporary inflation increase of nearly 0.5 percentage points. These upgrades were largely a result of the expected easing of fiscal policy beyond next year in the wake of the UK Budget. The chance of a December rate cut, therefore, looks remote and traders continue to expect just two more quarter-point reductions from the BoE by the end of next year.

Global Markets

Equity investors welcoming Trump

Best day in 100 years. The so-called Trump trade was in full swing this week, reverberating through financial markets, as the former president clinched a second White House term. Equities rose to all-time highs – the Dow Jones notched its biggest daily jump in more than 100 years and the S&P500 is poised for the best election-year return in nine decades. Bond yields surged on worries of a swelling budget deficit and rebound in inflation, with the 30-year yield clocking its biggest daily jump since 2020 on Wednesday.

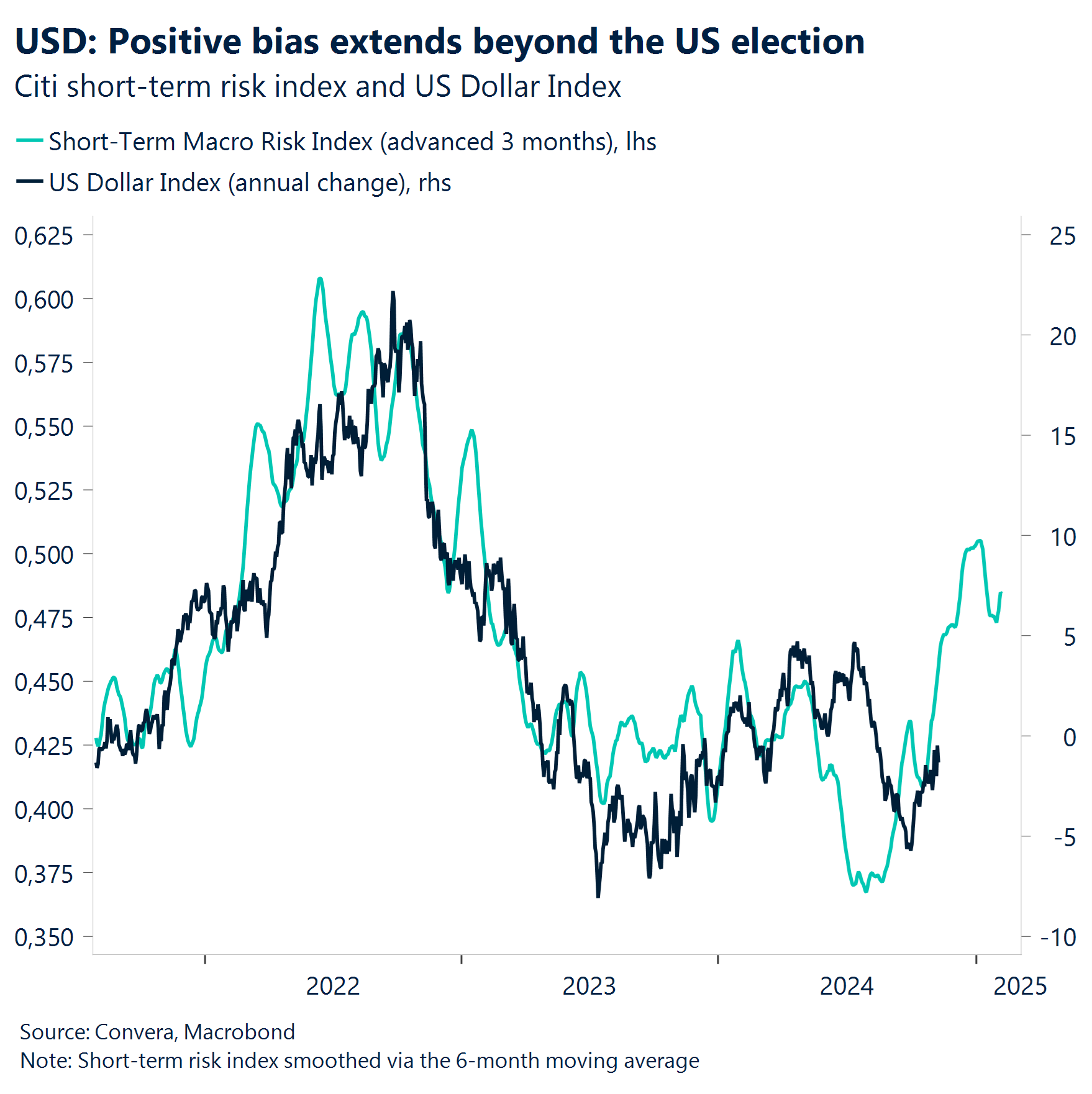

Dollar bulls rejoice. In the FX space, the US dollar soared while the Mexican peso, Chinese yuan, Japanese yen and euro all suffered. The prospect of higher tariffs could exacerbate these moves in a further boost to the buck. As such, the world is preparing for what may become the most consequential wave of tariff hikes since at least the 1930s. Trump has pledged to impose a broad levy on all products entering the US from overseas. This would not only be trade-negative but also highly troublesome to the structure of the global economy. The shift in relative interest rate expectations in favour of the US is one of the transmission mechanisms hurting G10 FX.

Higher neutral rate. Options markets are pricing in three additional rate cuts until the Fed ends the easing cycle at 3.75%. The growth agenda of Trump and investors paring back easing bets have pushed the US dollar to its highest level since July 2023. The Greenback is set to appreciate for a sixth week in a row. However, yesterday’s pullback despite the hawkish Fed statement seems to indicate some exhaustion of relentless dollar buying. The same can be said for the selling of government bonds but not for equities, which remain at record highs on the aggregate level (S&P 500, Nasdaq, Dow Jones).

Week ahead

Inflation comes into focus again

The most anticipated event of the year ended with Donald Trump securing a second presidential term in the White House. The remainder of the year will now be about developments on the macro front, the question of rate cuts in December, and policy announcements of the incoming administration. Next week opens with US inflation figures and a big data patch from China and the United Kingdom.

Lack of progress. Inflation figures out of the US will be closely watched as investors gauge how likely another rate cut from the Federal Reserve in December really is. Core CPI is expected to have stalled at 3.3% in October, while the headline rate could have slightly picked up pace from 2.4% to 2.6% last month. This development alone is unlikely to deter another cut in December. However, it could make the meeting more ambiguous. Retail sales figures published a day after will show how much the effects of Hurricanes Helene and Milton have impacted the consumer.

Slower growth. In the United Kingdom, a big week featuring wage and GDP data is coming up. Growth likely slowed from 0.5% to 0.2%, reflecting one off effects such as a big surge in government spending last quarter. The job report on Tuesday should show a steady decline in regular pay growth from 4.9% to 4.7%. Wage growth is moving in the right direction for the Bank of England, but only slowly.

Stimulus shows. In China, investors could get first signs that the recently announced stimulus measures are starting to ripple through to the real economy. Industrial output, retail sales, and fixed-asset investment are all expected to have risen on a year-to-year basis in September.

FX Views

FX under the Trump spell

USD Triumphant under Trump. The US dollar held near four-month highs, having scored its biggest one-day rally in two years following Donald Trump’s. Standout gains of almost 2% were made versus the JPY, EUR and CHF, although an over 3% rally versus the MXN sharply unwound. The dollar’s appreciation reflects a view that the Republican’s policies are positive for the US economy with tariffs dollar positive via the risk-sentiment and trade slowdown channel. If inflation rebounds, impeding the Fed’s bias to cut rates, it would additionally be dollar-beneficial via the monetary policy channel. Assuming Trump delivers targeted and large-scale tariffs against Europe and China, economic theory predicts that the dollar should further appreciate mid-single to low double digits. However, we are wary that the dollar tends to change direction significantly upon a new administration and that under a Republican administration’s whole term, the dollar underperforms. Bottom line, Trump could accelerate the dollar’s appreciation in the short-term, but over the long-term, we could witness a regime change. With the election behind us, the market will refocus on macro fundamentals for now.

EUR Bearish bias intensifies. Relative growth and yield differentials were already weighing on the euro, but Trump’s win and the increasingly likely Red Sweep result could be a game changer for the common currency. EUR/USD slumped 1.8% on Thursday to near $1.07, its biggest drop since March 2020. At one point, it was heading for a six-standard-deviation shift from its average, which has never happened before. The magnitude of the euro’s drop was a big warning signal from the spot market around global trade tariffs being a further headwind for the Eurozone’s fragile economy. In addition, German political turmoil adds an extra layer of uncertainty on the common currency’s prospects. Six-month realized vol stands at 5.60% which compares to the decade average of 7.77%. If the gauge rises above the 10% handle, we could see a bigger trend develop. When Trump was elected back in 2016, EUR/USD fell about another 4% through November and December. If history repeats, the world’s most traded currency pair could be trading below $1.03 before year-end.

GBP Yields a cushion. Sterling was on track for a sixth weekly decline in a row versus the dollar, but it’s bounced forcefully off its 200-day moving average in the lower realms of $1.28 as UK yields rose to multi-month highs. Currencies have been at the mercy of the dollar’s onslaught post Trump’s win, but the pound hasn’t absorbed as much of the dollar’s strength compared to the euro, yen or swissy. Sterling capitalised on the weakness of these G10 peers and GBP/EUR reclaimed €1.20 as a result. The BoE’s hawkish rate cut as a result of inflation concerns following the UK Budget provided the pound additional support. Thus, relative yield differentials continue to support the UK currency. Despite the more than 1% swing on election day, volatility remains highly subdued with six-month realized vol at 6.2% compared to the decade average of 9%. And whilst 1-week implied volatility — a measure of future currency swings — had its largest rise since 2020 once the US election date was captured, it fell just as quick once the uncertainty of the risk event came to an end. FX options traders still see risks skewed to the downside for GBP/USD because the cost to protect against a further drop in the currency pair is greater than the cost to protect against a rise. A clean Red Sweep was seen dragging the pair back towards $1.25, but with focus back on monetary policy dynamics already, eyes are back on $1.30 for now.

CHF Sensitive to the rates story. The Swiss franc depreciated past 0.87 per USD, the weakest level in about three months, as the dollar soared after the US election result. The outcome revived “Trump trades,” with expectations policy changes will be inflationary and keep interest rates elevated. Hence, despite the franc’s low beta to risk, its high beta to US rates has led to its depreciation against the buck. Moreover, on the domestic front, softer-than-expected CPI data has strengthened expectations of a jumbo 50bps rate cut by the SNB next month. Nevertheless, the haven appeal of the franc and Switzerland’s economic outperformance vs. Euro-area peers gives the swiss currency an edge over the euro. The pair continues to gravitate towards 0.94, stuck in a tight 1.2% range for over a month.

CNY China’s offshore investment tax plans and deflationary pressures. China has begun imposing a long-overlooked tax on profits from offshore assets. Tax officials have reportedly contacted wealthy individuals in recent months to assess possible payments, including those that are past due. This comes as the government’s fiscal income is declining due to reduced land sales. Meanwhile, China’s September CPI came in lower than anticipated, at 0.4% y/y vs a consensus of 0.6%, reversing the 0.5% and 0.6 percent y/y increases in August and July. The core CPI increased just 0.1% compared to August’s 0.3% y/y rise. Initial support for the USD/CNH pair, following a breakthrough, is located around the 7.1118. A consistent break above the high of 7.1862 would shift focus to the resistance level of 7.206, indicating higher levels.

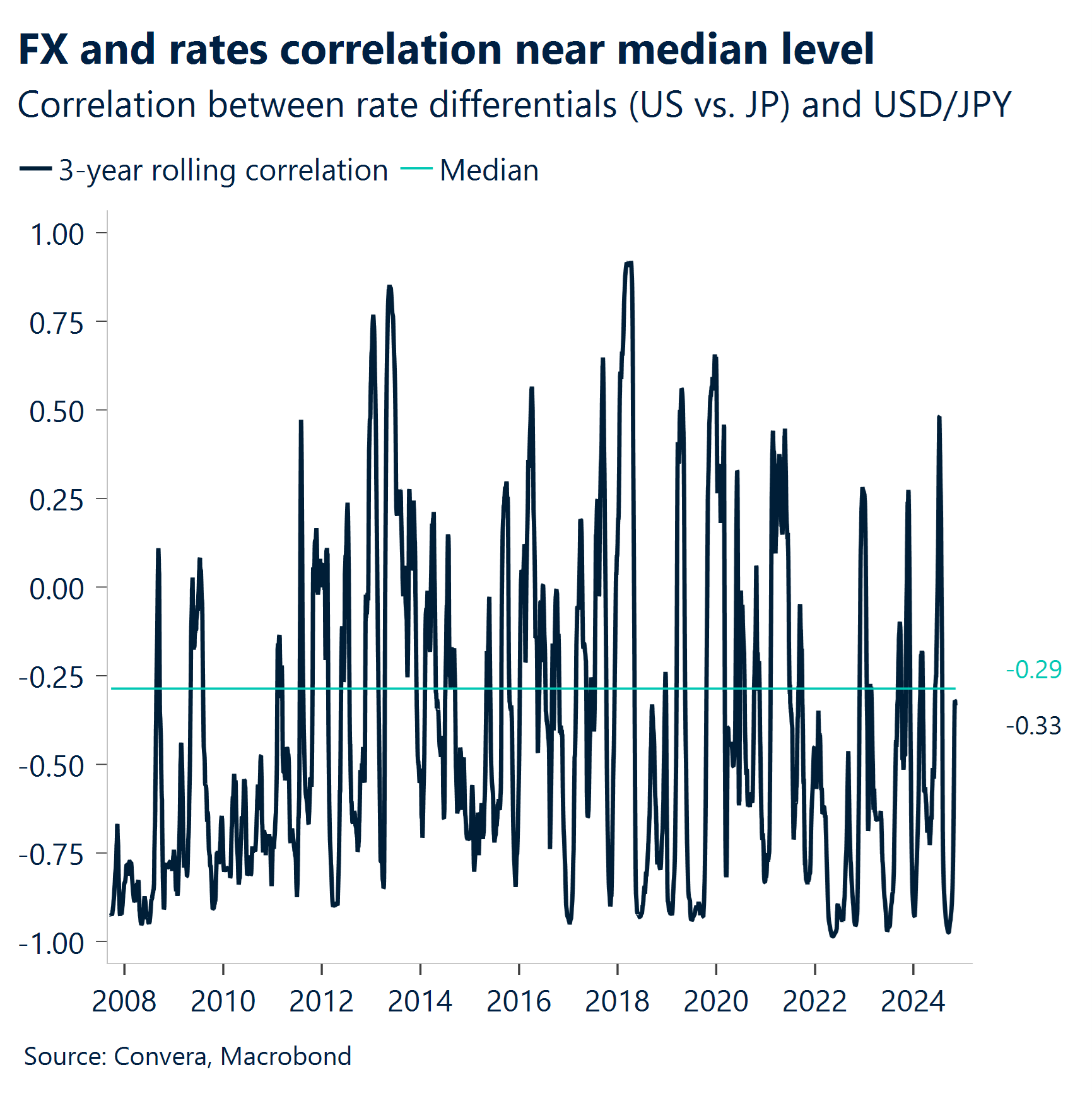

JPY BoJ signals cautious approach to rate normalization. The Bank of Japan maintains a cautious stance on the pace of rate hikes. While the option for policy normalization exists, there is no immediate move to further normalize monetary policy at this time. Preparations for a very moderate/slow pace suggest no more than one hike per quarter, with no definite commitment to a neutral rate prediction. The BoJ remains concerned about the effects of policy rates, leading to caution about the pace of rate hikes despite usually low inflation and regular concerns about the US and European economies. USDJPY, near 2-month highs at the point of writing, hovers above the psychological 150 level as currency authorities monitor FX movements with heightened vigilance. Post US and Japan elections, USDJPY has trended into the “red” zone” that could prompt FX intervention. Chart shows 3 year correlation between USDJPY and rate differential which is near the median level. The pair is expected to peak at the next significant level of 155, where the bounce from major support around 140 extends.

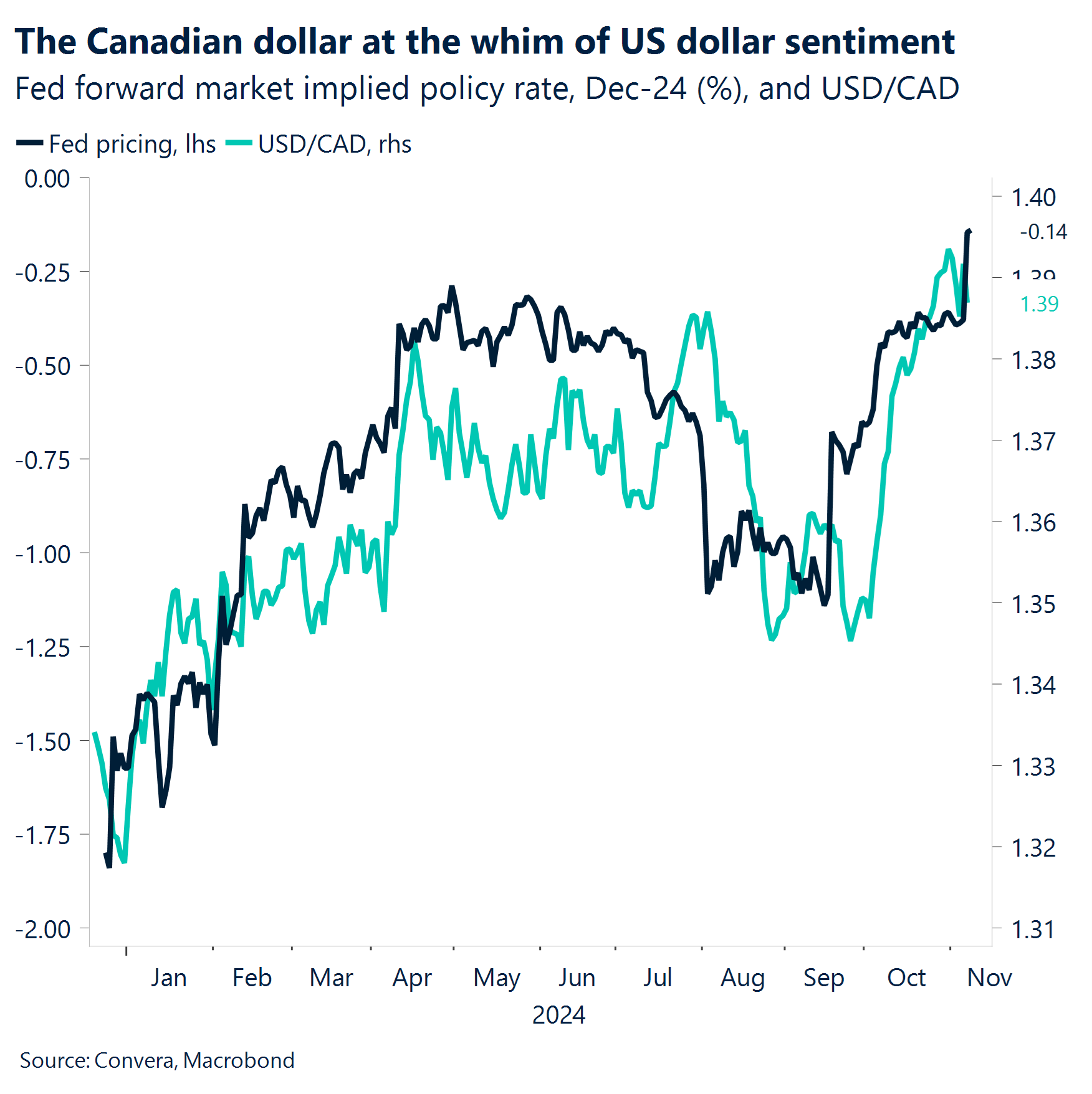

CAD Dollar proxy benefit. After falling to a fresh 2-year low, the CAD bounced back thanks to near-term fatigue with the Trump trade. Moreover, the virtues of the loonie’s role as a dollar proxy probably appealed to those believing the US economy will outperform, but who’re concerned about the long-term, structurally dollar-bearish implications of Trump’s policies, in particular when it comes to debt sustainability. Hence, this week, the CAD has been one of the the best performing of the G10 after its North-American counterpart. However, Canada’s economy will be highly exposed to Trump’s trade policies and would suffer from any rupture in bilateral trade, so the potential renegotiation of the 2020 USMCA accord, will be crucial for USD/CAD. Still, a broadly growth- and yield-driven bullish USD context may benefit Canadian GDP and therefore CAD too. Domestically, GDP revisions show Canada’s economy growing at a faster pace than originally expected over the last three years.

AUD Strong jobs data fuels labor market optimism. Australia had a 64.1K increase in employment in September, above the 25K forecast. The participation rate was slightly higher at 67.2% compared to the consensus of 67.1%, while the unemployment rate was 4.1%, below the 4.2% estimate. The majority of the employment gain was fueled by a 51.6K increase in full-time work, while a 12.5K increase in part-time employment. As job openings continue to stay above pre-pandemic levels, the Australian Bureau of Statistics said that “the record employment-to-population ratio and participation rate shows that there are still large numbers of people entering the labor force and finding work in a range of industries.” Technically speaking, the main focus is on whether the pair can hold above the nearest support area, which is located 0.66541. AUDUSD had recently bounced off from its 1-month lows. Alternatively, an upward break would aim for the high of 0.7159, the next resistance.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.