Equities were broadly lower following Nvidia’s earnings report as the revenue forecast from the chipmaker at the heart of the AI revolution failed to top the high expectations. Risk appetite was tempered due to the rebound of the dollar.

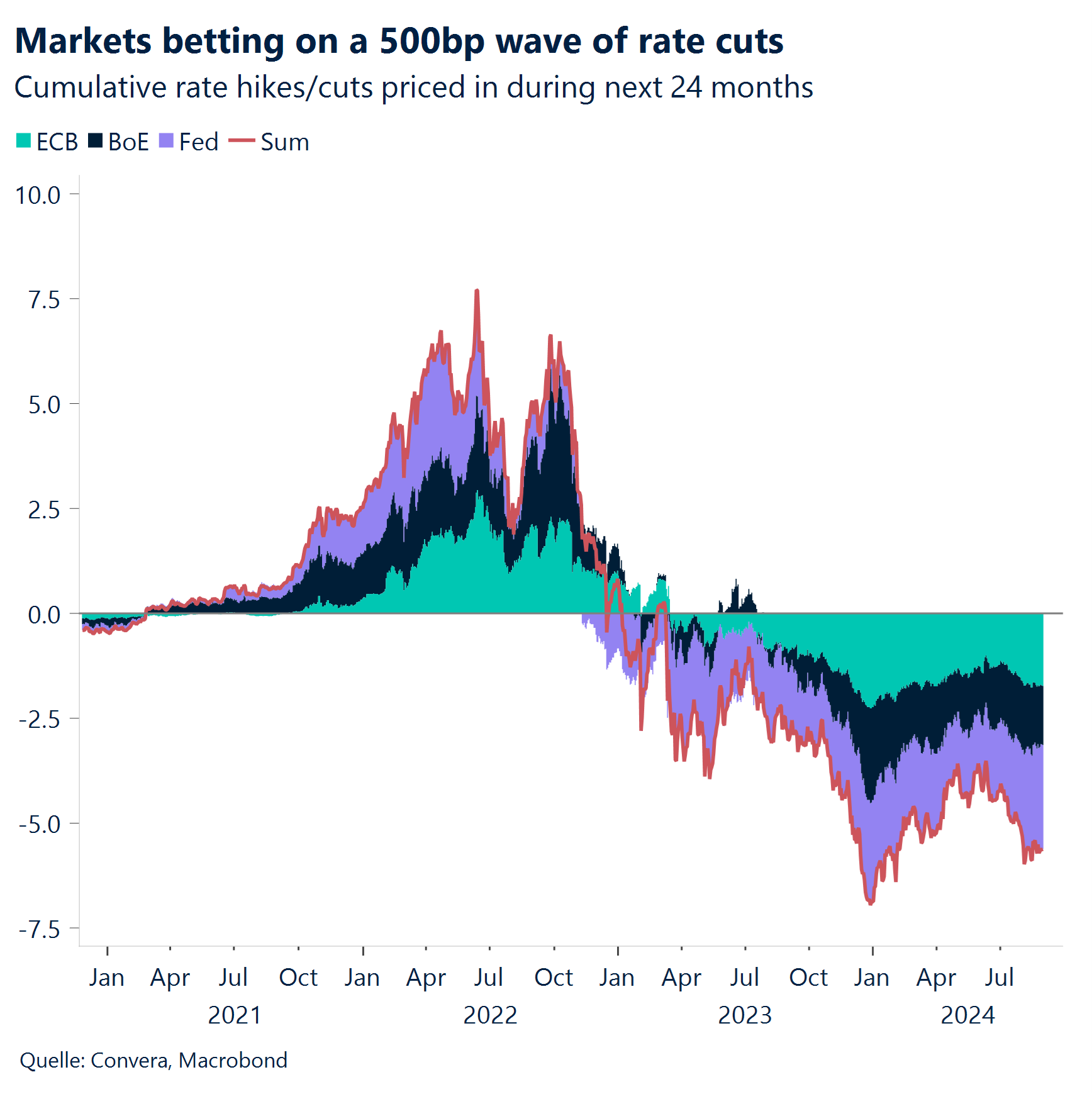

Investors continue to position for incoming rate cuts by the Federal Reserve (Fed) following Chair Powell’s dovish rhetoric in his Jackson Hole speech, with swap prices reflecting a consensus of around 100 basis points in rate cuts by year end.

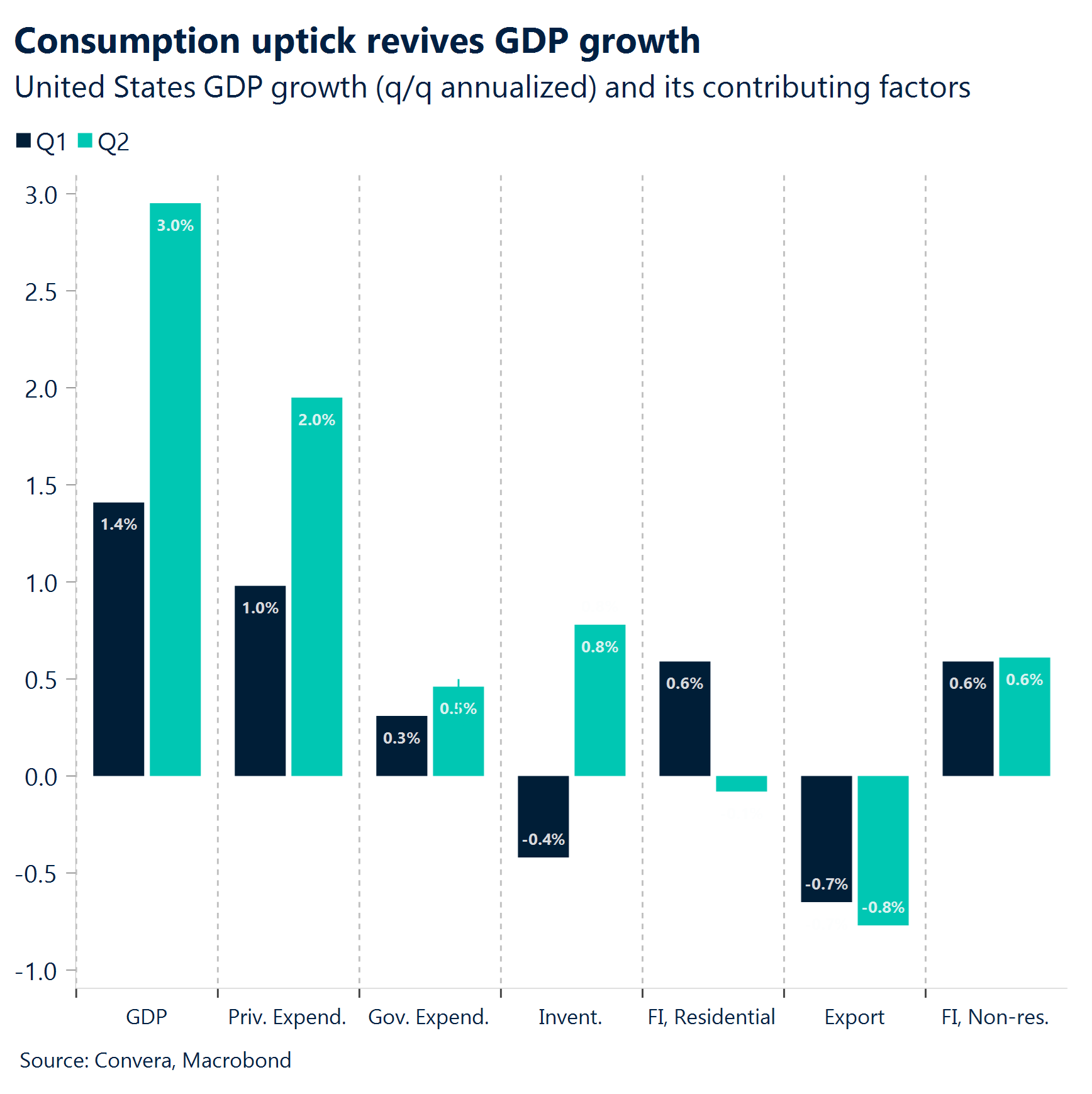

Real US GDP for the second quarter was revised higher amid upward revisions to consumer spending. The second estimate of real 2Q GDP was to 3.0%, 0.2 percentage points higher than the advance estimate.

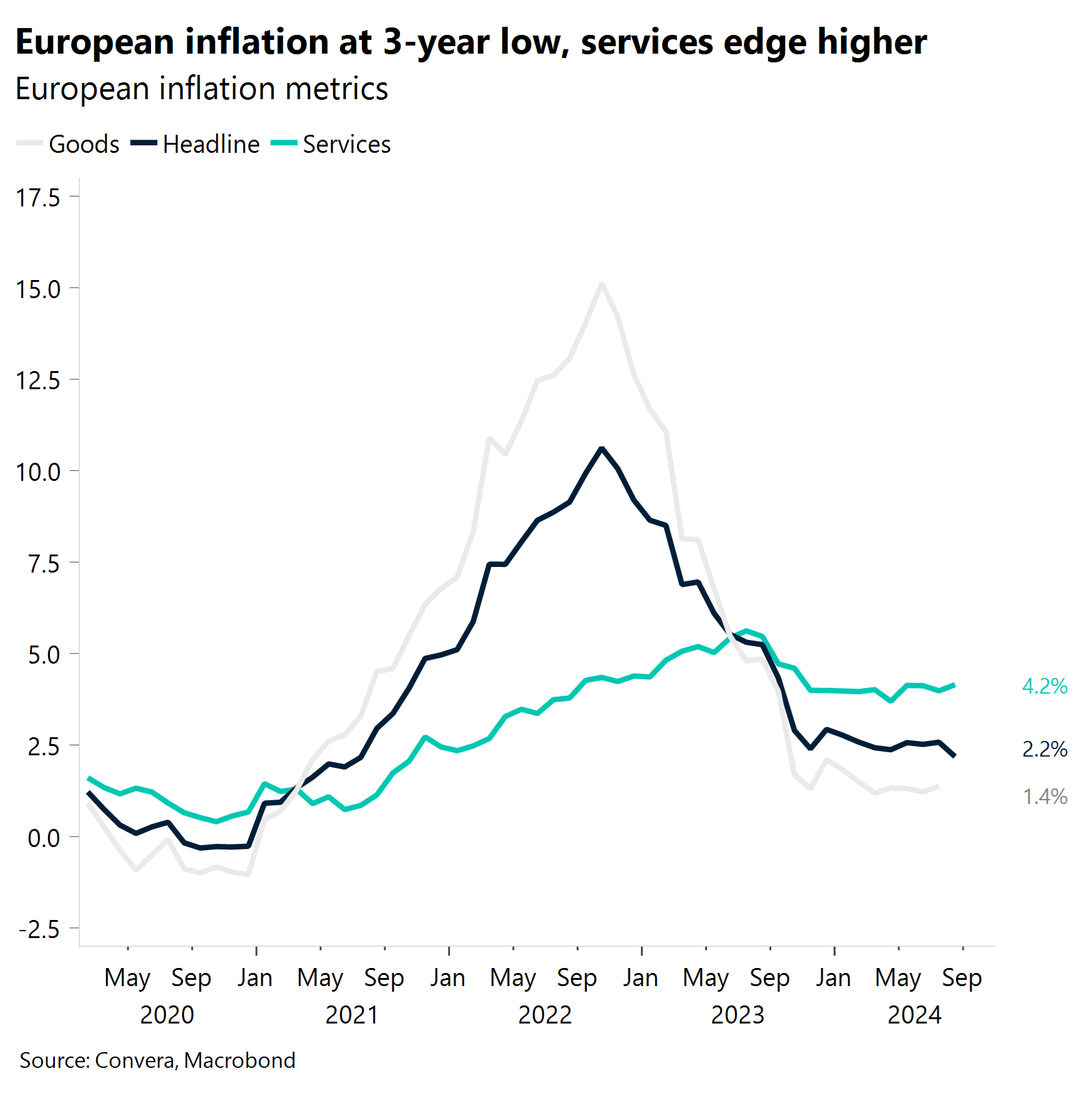

The European CPI figures this week have largely confirmed our view of a below consensus development of inflation (1.9% for Germany) going into the second half of the year, paving the way for around three more rate cuts from ECB this year.

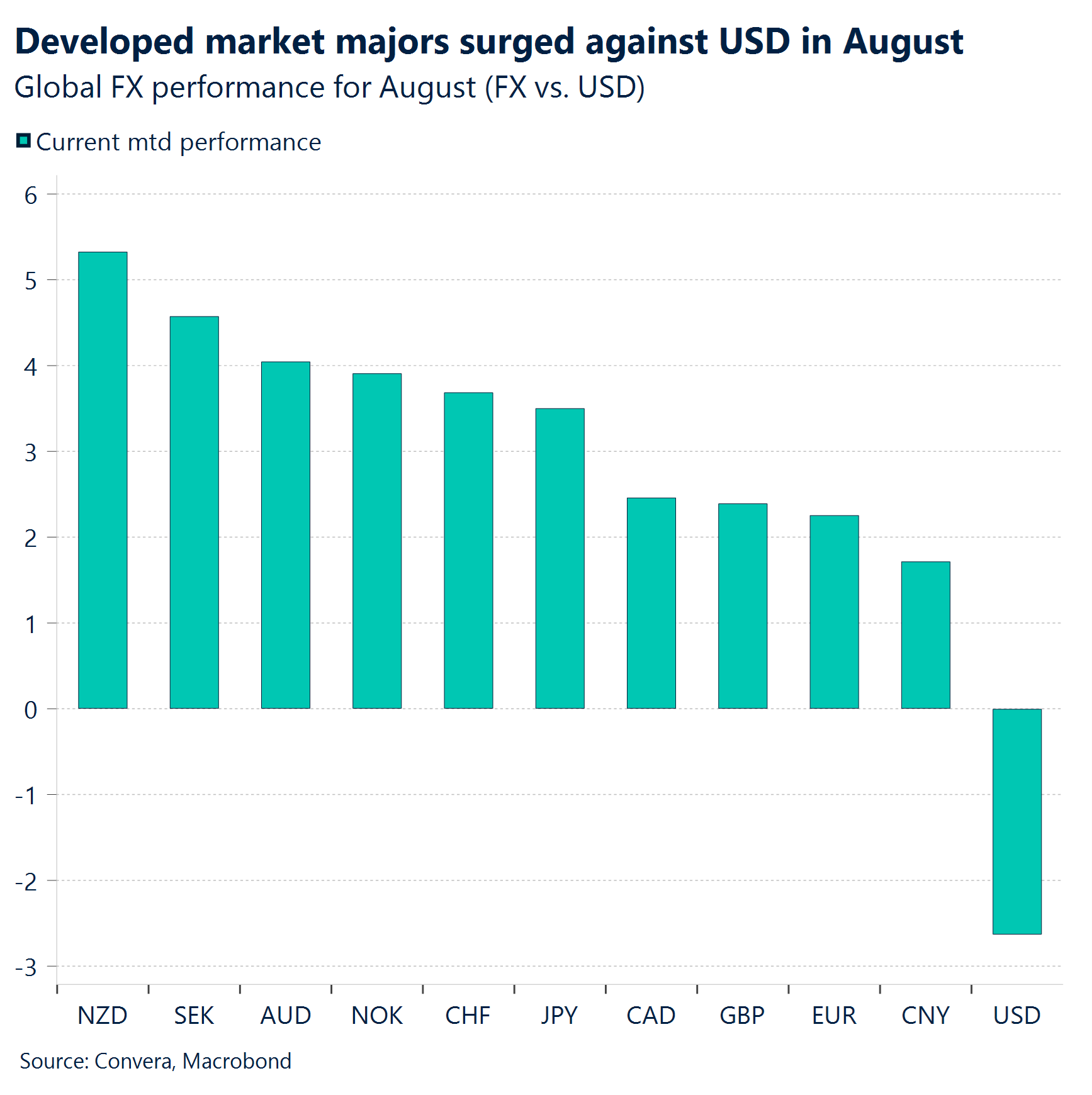

Defying bullish season trends in August, the US dollar is poised to record its biggest monthly drop since November as markets remain convinced the Fed will cut rates by at least 25-basis points at its next three meetings this year.

FX options implied probability puts a near 40% chance of GBP/USD trading between $1.30-$1.35 by year-end.

The first week of September will give policy makers enough data and confidence to make the decision on the 18th September.

Global Macro

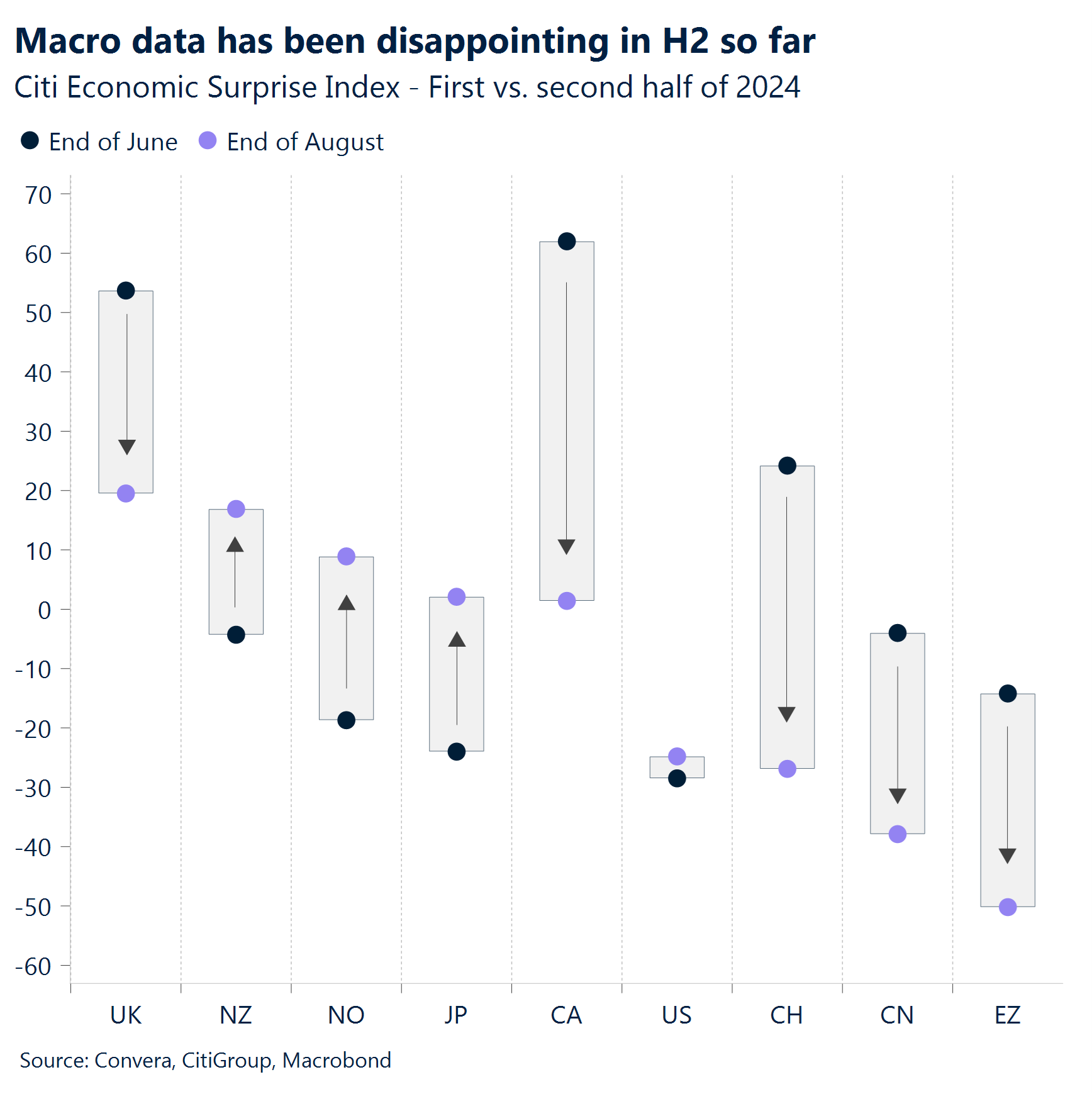

Strong Western easing bias

Strong data… Investors are convinced about and fully positioned for the commencement of the Federal Reserve’s cutting cycle in September. This easing bias goes so far that even this week’s stronger than expected macro news flow in the form of better durable goods orders, revised Q2 GDP figures, and higher consumer confidence did little to nothing to alter investors’ views.

…muted reaction. Around a 100 basis points of cuts are expected for 2024 alone. This explains why the Greenback’s rebound remained muted and can be seen as a function of idiosyncratic factors like the fall of German inflation to below 2%. It is still important to note that the US Dollar Index increased after five consecutive weekly declines, while equities traded lower for the first time in four weeks.

Inflation down. The European CPI figures this week have largely confirmed our view of a below consensus development of inflation (1.9% for Germany) going into the second half of the year, paving the way for around three more rate cuts from the European Central Bank by year end. However, the risk remains tilted to policy makers only easing rates two times this year as economic growth stabilizes.

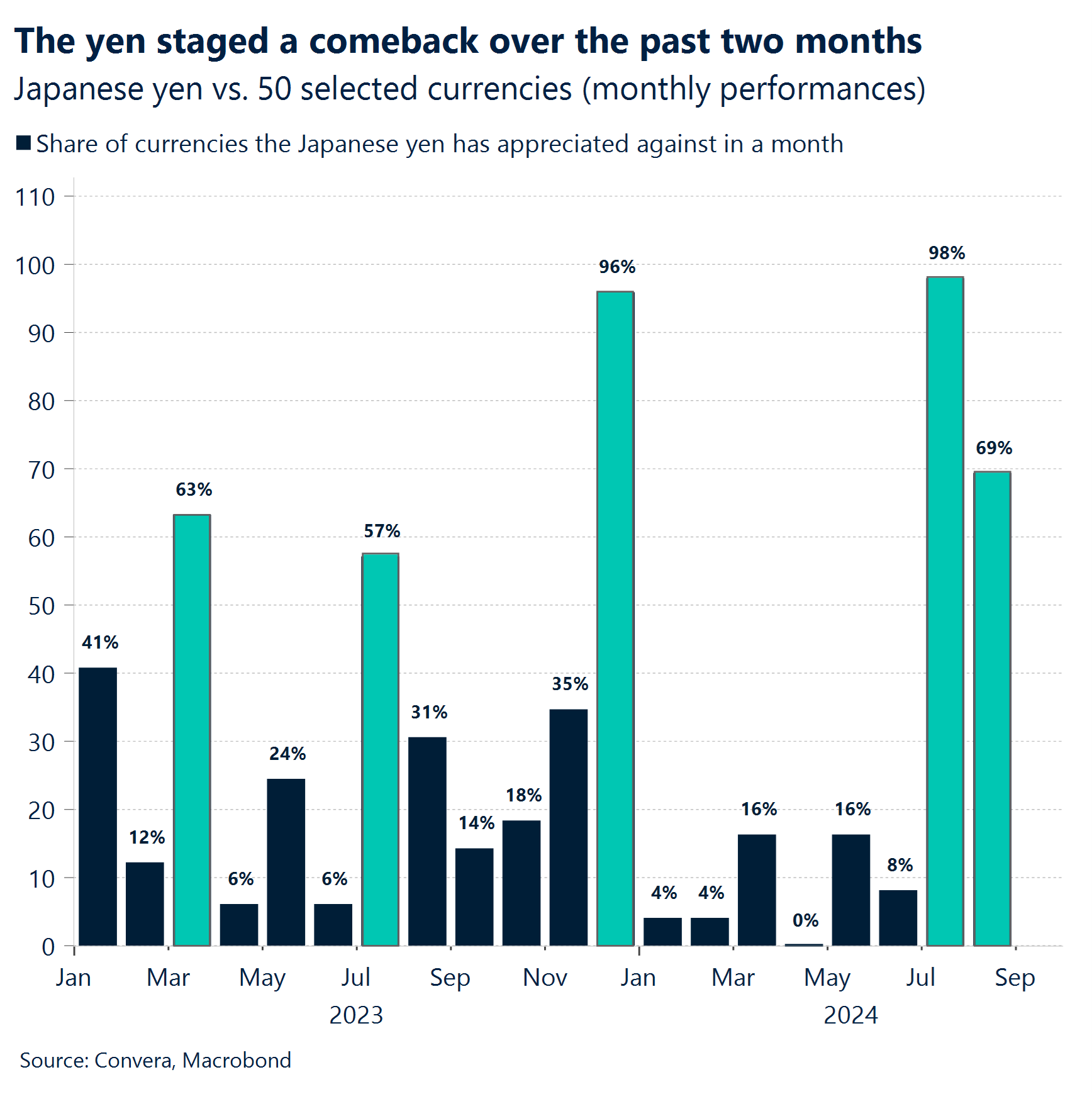

BoJ hike to support the yen? Markets have calmed down; equities are on the rise and the yen has stabilized. Such an environment has made Japanese policy makers data dependent again and the goods driven bounce back of inflation has put the rate hike for 2024 (October or December) back on the table. The unwinding of the global carry trade via the closing of yen short positions has induced a sharp reversal of the currency. The yen has risen against 98% and 69% of its peers in July and August respectively, ending a rout that lasted six months.

Regional outlook: United States

Strong data minimal effect on Fed easing bets

Easing bias. Investors continue to position for incoming rate cuts by the Federal Reserve (Fed) following Chair Powell’s dovish rhetoric in his Jackson Hole speech, with swap prices reflecting a consensus of around 100 basis points in rate cuts by the central bank in its three remaining decisions this year.

Goods orders spike. Indications of some level of robustness in US growth, lastly evidenced by a sharp rebound in durable goods orders, sparked some doubt on the magnitude of total rate cuts in the incoming loosening cycle. Durable goods orders numbers came in at a strong 9.9% for July which was more than double the expected 4% increase coming from the 6.7% plunge seen a month earlier.

Brighter outlook. US consumer confidence improved as well in August, with the index rising to 103.3 from 101.9 prior and beating forecasts of 100.7. However, despite being the highest reading in six months, the labour market differential reading fell to its lowest level since March 2021. This placed the focus on the initial jobless claims, which remained stagnant at 230 thousand without any implication for markets.

Leaving (a strong) Q2 behind. Real US GDP for the second quarter was revised higher amid upward revisions to consumer spending. The second estimate of real 2Q GDP was to 3.0%, 0.2 percentage points higher than the advance estimate. Despite the large upward revision to consumer spending, now estimated to have grown 2.9%, investment and several other major categories were revised lower.

Regional outlook: Eurozone

Falling inflation cements September cut case

Inflation falls to 3-year low. The flash annual inflation rate in the Eurozone fell to 2.2% in August, down from 2.6% in the earlier month, to mark the softest increase in consumer prices since July 2021.The slowdown was due to a sharp decline in energy costs thanks to base effects. On the contrary, services inflation, a closely observed metrics by the ECB, picked to 4.2%, while core cooled to 2.8%. The month-on-month inflation edged higher by 0.2%, in line with expectations.

Broad sentiment indicators decline further. The economic sentiment indicator in the Eurozone rose to the highest level in over one year, but was mainly boosted by French data, which immediately suggests that optimism around the Olympics boosted morale. Other surveys meanwhile reveal the fundamental picture continues to worsen. GfK Consumer Climate Indicator for Germany dropped to -22.0, driven by concerns over job security, rising insolvencies, and a weakening economy. The Ifo Business Climate indicator dropped to 86.6 in August, the lowest level since February, down from 87 in July, driven by increased pessimism among companies and a worsened assessment of their current situation.

ECB outlook beyond Sep remains cloudy. Easing 2Q wage growth pressures along with the latest progress on inflation should give the central bank confidence to cut in September, but what holds beyond is unclear, for both the market as well as the ECB policymakers. Based on public comments, the GC members remain divided, some giving green light to subsequent rate cuts, some urging caution. ECB’s Patsalides confirmed that further rate cuts are likely if the ECB’s projections continue to materialise. On the other hand, Schnabel, Nagel and Lane all continue to stress caution, advising that the return to 2% “is not yet secure”.

Week ahead

A make-or-break week for the Fed

Big picture. Markets have almost fully recovered from the unwinding shock seen at the beginning of August. While the aftermath has therefore been less impactful than initially expected, the main takeaway is that markets remain highly data dependent and sensitive to macro surprises. The US data patch in the first week will decide the magnitude of the Fed’s rate cut, while the labor market data and CPI print will settle the debate if the Bank of England needs to ease policy in September. Macro data from the Eurozone will be less impactful given that the expectation about the ECB’s 25 basis points cut is seen as a done deal. The attention will therefore be on the German state elections in Thuringia, Saxony and Brandenburg as the far-right FDP continues to move up the polls. In Asia, both the BoJ and PboC are data dependent, although displaying opposite policy biases. Strong data from Japan could front load any potential tightening of policy from Spring 2025 into this year. The inflation and macro patch from China will decide if easing is likely this month.

US data kickstarts September. US manufacturing and job growth surprised to the downside in August, sparking recession risks and the flash crash on Monday 5th. The following services PMI report and solid retail sales helped markets work back their losses and have further suppressed implied recession odds. The speeches given at the Jackson Hole Symposium confirmed the Fed’s easing bias, which has been welcomed by investors. We continue to believe that a 50-basis point cut is on the table for the FOMC meeting in September. While not the base case, even a slight 0.1% increase in the unemployment rate to 4.4% would likely increase such a scenario exponentially. A fall of the jobless figure and improving ISM employment sub-indices would break the will of the doves looking for a 50 basis point cut. The first week of September will give policy makers enough data and confidence to make the decision on the 18th September.

FX Views

Dollar licks wounds after worst month of the year

USD Big picture leans bearish. Defying bullish season trends in August, the US dollar is poised to record its biggest monthly drop since November as markets remain convinced the Fed will cut rates by at least 25-basis points at its next three meetings this year. The dollar has bounced off 13-month lows this week though, helped by month-end flows and better-than-expected US economic data, supporting last week’s call of short-term USD risks tilted slightly to the upside. The big picture remains the same though, the overall Fed narrative is obviously negative for the dollar given weakening rate differentials, whilst the soft landing narrative is denting safe haven dollar demand too. If the Fed embarks on a loosening cycle that delivers as much in rate cuts as the markets expect, further dollar depreciation beckons. Indeed, recent positioning data shows speculators have turned bullish on the euro, pound, and yen simultaneously versus the dollar for the first time since early 2021. We’re keeping a close eye on the psychologically important 100 mark of the US dollar index, which it has only been below for five days out of the past two years. A soft US jobs report in the upcoming week could trigger a break below this key level and support an acceleration to the downside.

EUR Bearish on encouraging inflation figures. The latest macro news has endorsed the readjustment lower in EUR/USD, with the pair falling over 0.9% week-to-date, while still maintaining monthly gains of over 2.3%, its best performance thus far in 2024. Faster-than-expected disinflation in Europe triggered some dovish repricing in the EUR OIS curve, dampening the euro’s appeal. Given that the market is pricing in the bottom of the dollar smile scenario, the largest chunk of the dollar decline has most likely already materialised. Consequently, the upside surprises from the US macro side this week, along with month-end rebalancing flows, swung to favour the dollar. Given lacklustre fundamentals and Eurozone inflation at a three-year low, a move in EUR/USD back above $1.120 may be unlikely, yet this ultimately rests on next week’s US NFPs. Euro volatility into payrolls is set for its strongest close since January, rising to 7.96%. Risk reversals briefly fell below parity for the first time in two weeks, indicating that the market hinges the euro’s prospects on next week’s US labour market report.

GBP Yield-driven bull run. The Bank of England’s broad sterling index is back to challenge the July high which marks the highest levels since the Brexit vote in June 2016. Whilst GBP/USD has lost its grip on $1.32, a level it’s only been above for four days out of the past two years, it is set to record its biggest monthly gain since November and remains over 6% above its 2-year average rate of circa $1.24. The 2-year UK-US yield differential has risen to plus 244bp, from a negative 530bp at the end of May, helped mainly by dovish Fed repricing, but also the BoE’s more cautious messaging of late. This has led the latest leg higher in GBP/USD to scale 2-year peaks. A narrowing in US-UK growth differentials is also supporting. Hence the options market has turned the most bullish on sterling’s prospects over the next month since 2020. FX options implied probability also puts a near 40% chance of cable trading between $1.30-$1.35 by year-end. The biggest risks to the pound include: 1. The BoE catching up on the easing narrative and 2. A downward bias on the UK’s near-term growth prospects via fiscal tightening in the upcoming UK Budget in October.

CHF Liable to correct lower. The Swiss franc has gained versus all G10 peers except the yen this quarter, surging circa 6% versus USD and 3% versus EUR. The traditional safe haven currency saw a sharp reversal of fortunes as the carry trade unwound sharply. Traditional safe haven flows also resurfaced at the beginning of August amid the stock market turmoil and global bond rally sparked by concerns over a US recession. But the franc is vulnerable to a correction next month as its standout gains this quarter look overdone. The widening gap between rate differentials and EUR/CHF is analogous of a franc that is heavily overbought technically. Fundamentally, the case for more easing by the Swiss National Bank remains intact given these bouts of FX strength and also the downside risks to domestic inflation from weak demand conditions and the evolution of rents. Ultimately, dovish SNB guidance, either through the rates or currency market, is bound to alter the prevailing momentum of the franc. Coming up, Swiss CPI data for August is expected to fall, leaving the door wide open for further easing by the SNB.

CNY Industrial resilience amid diplomatic breakthroughs. China’s industrial profit growth shows modest expansion, defying earlier negative indicators. This economic backdrop is now complemented by significant diplomatic developments, with U.S. National Security Adviser Jake Sullivan’s visit to Beijing potentially paving the way for a Biden-Xi summit. Analysts suggest a high likelihood of such a meeting, possibly after the U.S. elections. From a market perspective, improved U.S.-China relations could boost investor confidence and support CNY. Traders should monitor both economic indicators (PMIs, manufacturing data) and diplomatic outcomes for insights into yuan performance. The interplay between economic trends and geopolitical progress will be crucial in shaping CNY’s trajectory. Any concrete advancements in bilateral relations could provide a substantial boost to the Chinese currency.

JPY Consumer sentiment stagnates, implications for BOJ policy. Japan’s consumer confidence remained unchanged in August, falling short of market expectations. While overall livelihood perceptions improved marginally, income growth sentiment weakened. The data reveals a complex picture of consumer attitudes towards the economy and inflation expectations. Technically, USD/JPY is experiencing a bearish consolidation phase. The recent rebound from key support near 140 has stalled at the first resistance zone, which includes the broken January 2023 channel trend line at 149.18. The yen has risen against 98% and 69% of its peers in July and August respectively, ending a rout that lasted six months. Traders should monitor upcoming releases on capital and household spending, as well as the au Jibun Bank Japan services PMI, for potential catalysts that could influence the pair’s direction and provide clues about future Bank of Japan policy decisions.

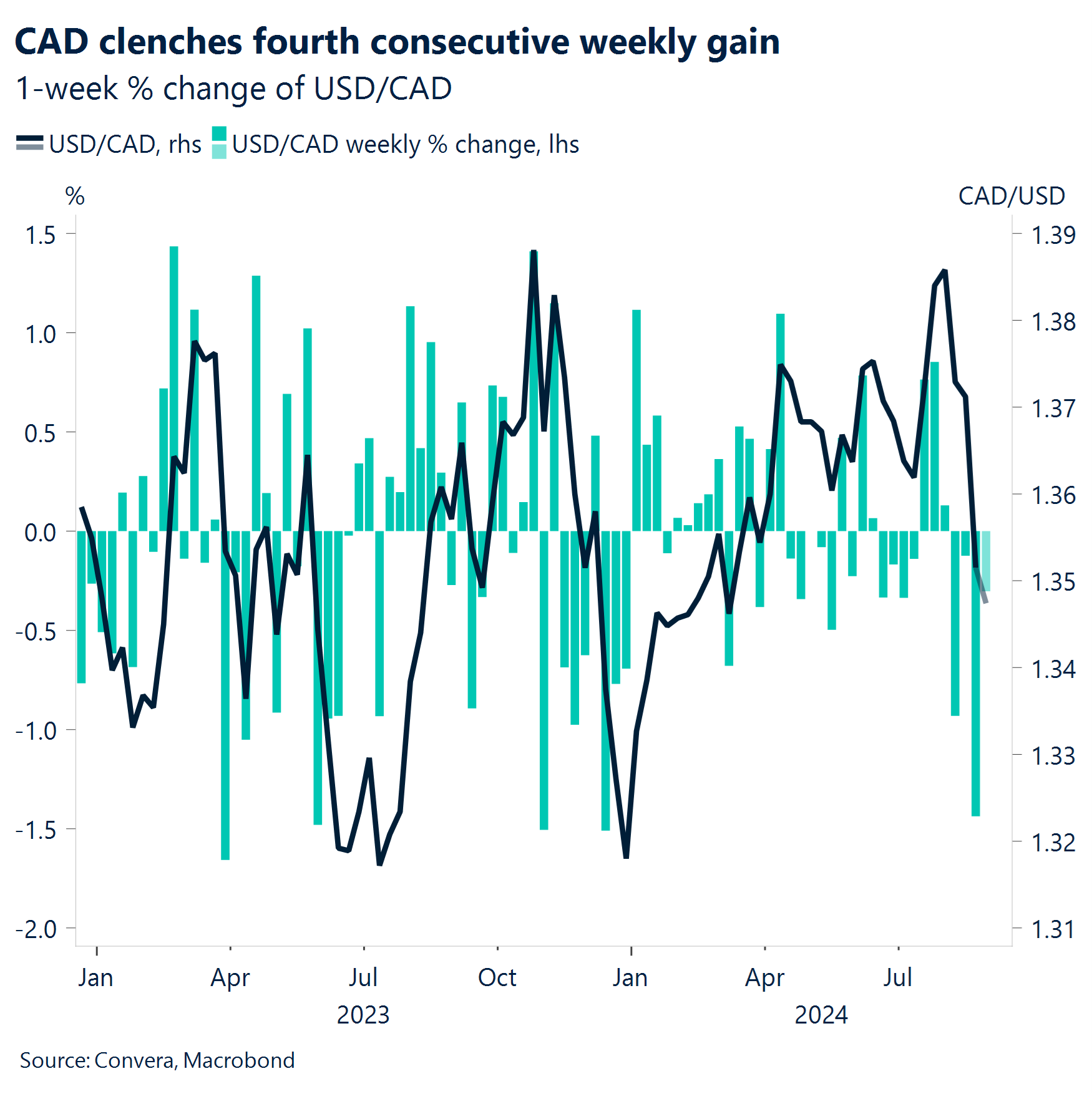

CAD Best month since June ‘23.The Canadian dollar approached a nearly seven-month high, strengthening past C$1.35 amid mounting confidence in Fed rate cuts, which continue to pressure the Greenback. A fourth consecutive week of gains led to the best monthly performance for the Loonie in the past 14, rewarding close to 2.5% month-to-date. CAD is one of the best-positioned G10 currencies to capitalise against the US dollar, given the still historically stretched positioning that investors have begun to unwind over the past three weeks. Looking ahead to the September Fed cut, further gains are possible against this backdrop, but we expect the magnitude to slow substantially, as domestic monetary policy presents a headwind for greater CAD gains. At its rate decision on September 4, the BoC is expected to cut its policy rate for the third consecutive time to 4.25%. Amid dovish signals, the market has priced in a rate cut at each of the remaining rate decisions this year, making it the most dovish G10 central bank. The options market remains CAD bullish for now on a one-week horizon, but in the presence of multiple domestic headwinds, further gains are somewhat restrained.

AUD Capex contraction signals economic headwinds. Recent data reveals an unexpected decline in Australia’s private capital expenditure for Q2, contracting 2.2% quarter-over-quarter. This development raises concerns about the broader economic outlook. The building sector showed particular weakness, while plant and machinery investments also softened. This trend could potentially impact key economic indicators like exports and employment figures. From a technical perspective, AUD/USD has rebounded to the upper bounds of its established trading range after testing support in early August. The pair may be approaching a short-term ceiling around the 0.68-0.69 resistance zone. Traders should keep an eye on upcoming economic releases, including building approvals, current account data, and GDP figures, which could influence the pair’s trajectory.

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.