Global Macro

Pushback against lower yields

The ongoing back-and-forth in FX markets continued this week as key US and European officials successfully pushed back against elevated policy easing expectations, driven by rebounding inflation rates and a strong US economy. Yields are on the rise again and geopolitical risks loom large. European equities logically pushed lower against this backdrop as their US peers remained somewhat resilient, supported by a strong consumer. With the Canadian and European central banks expected to hold policy rates steady next week, focus will fall on sentiment data and the US GDP and inflation print.

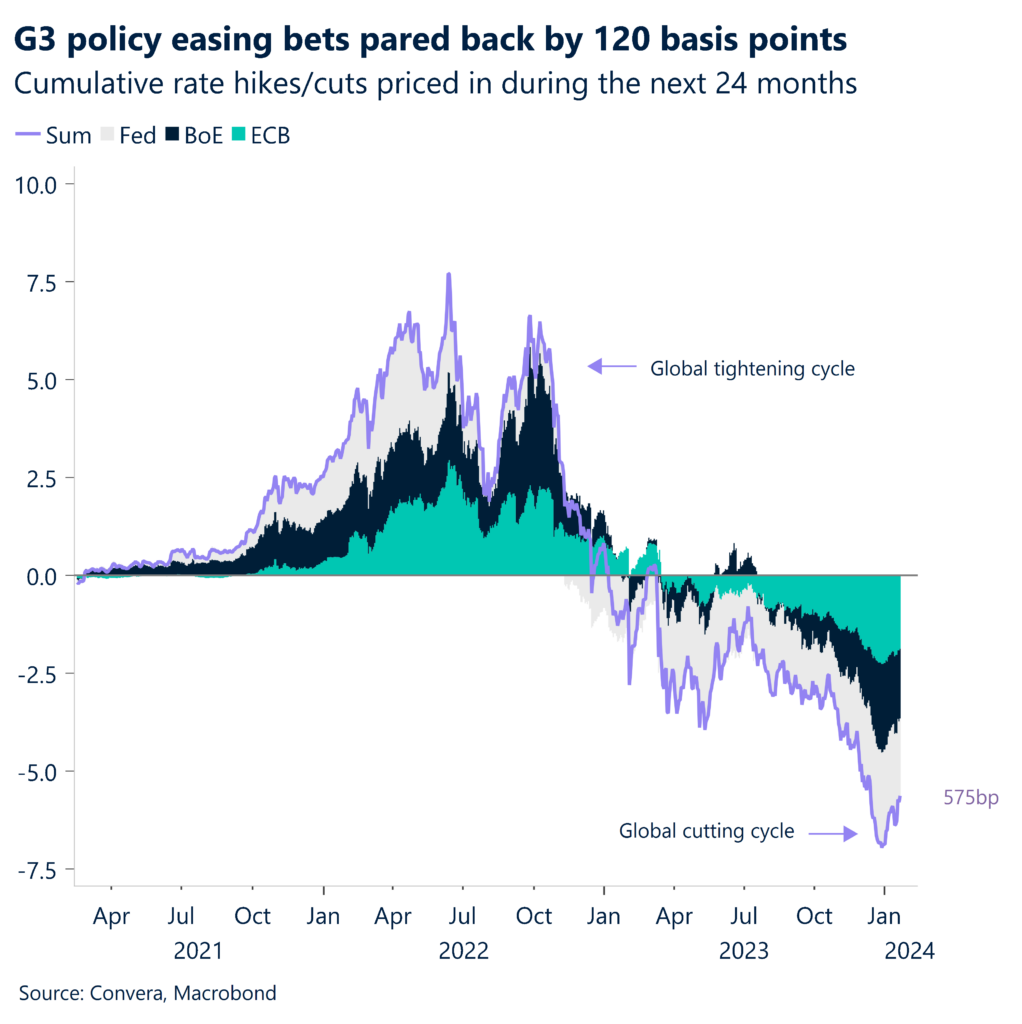

Less policy easing expected. Global markets started the week without liquidity from the United States, as trading in the country remained closed due to a public holiday. The lack of macro data and US trading volumes led to a lackluster weekly open. However, it set the scene for investors starting to pare back their expectations of policy easing from the G3 central banks for 2024. The continued resilience of the US economy, rebounding inflation rates across the world and a chorus of hawkish speeches from policy makers on both sides of the Atlantic have made an impression on markets. Investors reacted by cutting short their bets on rate cuts over the next 24 months by 120 basis points since the beginning of the year.

FX volatility expected to rise. The uncertainty about the extent of policy easing from major central banks over the coming months has continued to put upward pressure on fixed income volatility. However, market pricing for the Fed, ECB, BoE and BoC had almost completely converged last week, leaving FX markets with little to no need for readjustment. FX volatility could pick up again in 2024 as geopolitical risks and diverging macro and inflation outlooks for the major economies will justify different policy paths from their respective central banks.

Global Macro

Major events. 2023 ended with the US on top

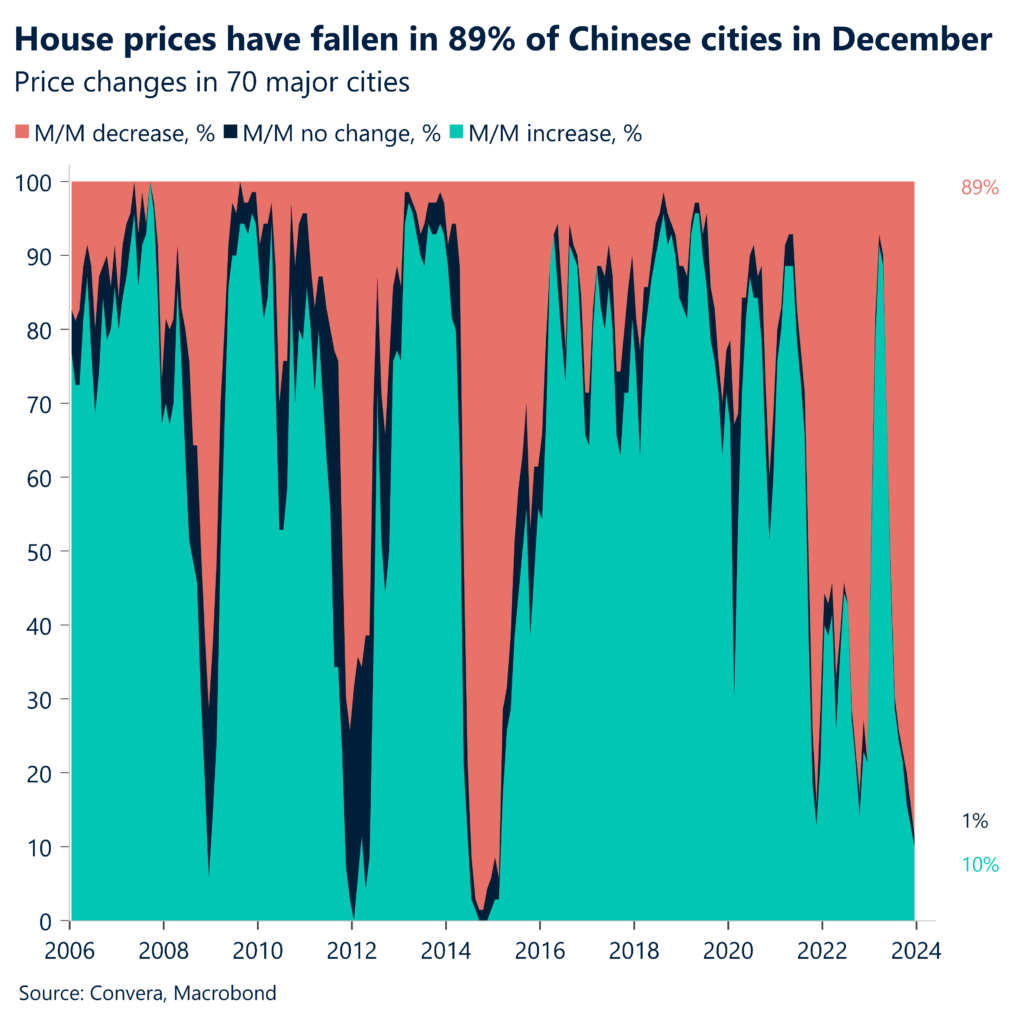

China continues to struggle. With all data points out for the month of December, it is safe to say that 2023 has been a horrendous year for the Chinese property sector. Real estate construction had its worst year since at least 2009 with both existing loan growth and planned investments turning negative for the first time since the introduction of these time series. Construction starts have fallen by 59% since early 2021 and real estate investment dropped 9.6% in 2023. Deflation was in full force at the end of last year.

Rebounding inflation. Risk assets had benefited from the broad disinflation across the developed world last year, that gave investors the room for pricing in aggressive policy easing from central banks. December saw a pickup in headline inflation rates in Europe, Canada, Japan and the United States. This poses a risk to the consensus view. However, we do think that price growth will continue to come down in the first half of 2024, supporting rate cuts by central banks in the US, Eurozone, Canada and the United Kingdom. This does not mean that the reflation in December is without consequences. It gave central bankers the confirmation they needed to push back against current market pricing. The Fed, ECB and BoE are now less likely to cut in the first quarter than a couple of weeks ago.

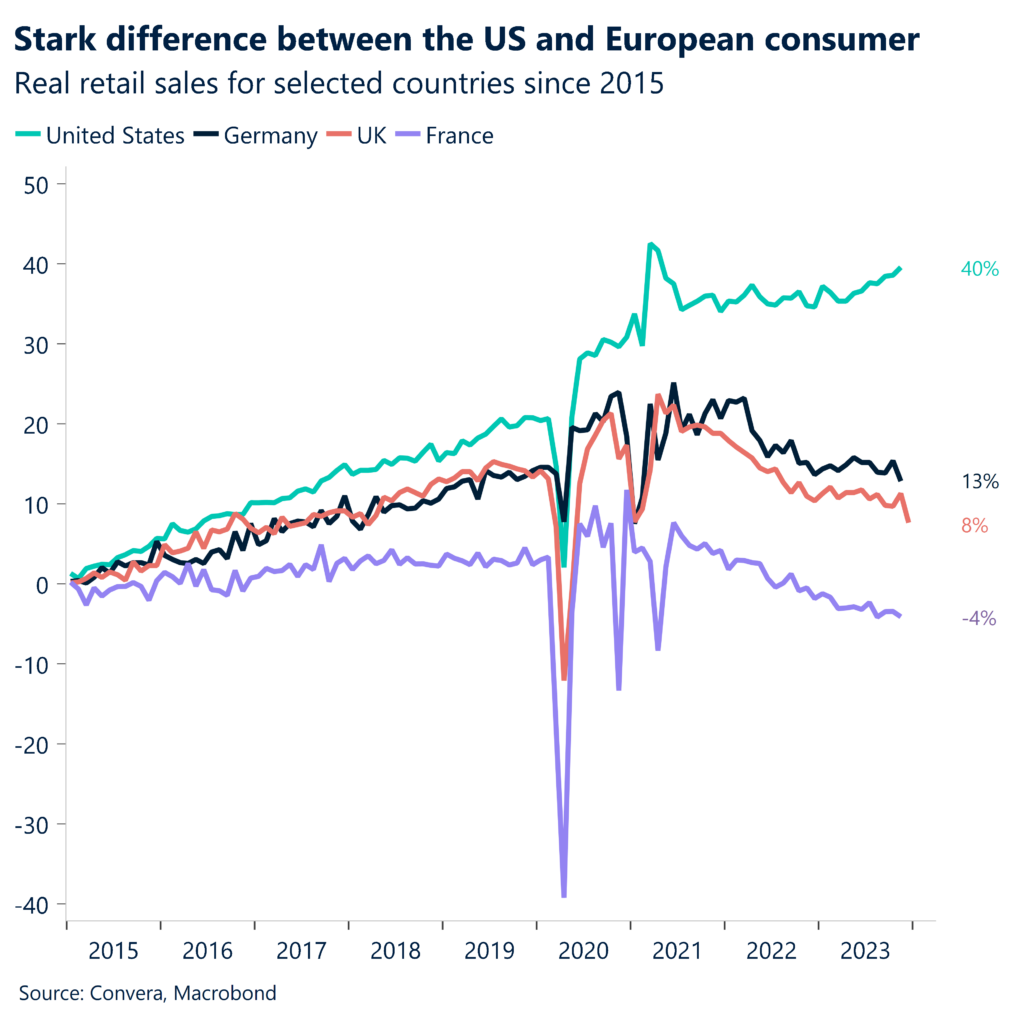

US outperforming peers. While the United Kingdom and Eurozone continue to experience a difficult growth environment, economists have slowly but surely pushed up their forecasts for 2024 US GDP. The positive macro data in the form of upside surprises of retail sales, industrial production, housing sentiment and initial jobless claims supported the view of US exceptionalism having continued in December. At the same time, retail sales in both the UK and Germany surprised to the downside at the end of 2023.

Waiting for better times. A German report showed Europe’s largest economy contracted by 0.3% in 2023 as stubbornly high inflation, along with rising interest rates, dampened activity and demand from both home and abroad. On the soft data front, German investor morale improved for the third consecutive month, surpassing expectations. The ZEW economic sentiment indicator climbed to an 11-month high in January, signaling an optimistic shift in economic expectations for Europe’s largest economy. The indicator for the Euro Area edged down, but still exceeded market forecasts. 85.5% of surveyed analysts expected stable or improving conditions.

Cautious Bank of England. UK inflation rose for the first time in ten months in December, ending a streak of continued disinflation in the United Kingdom. Consumer prices increased by 10 basis points on a year-over-year basis to 4% with the core inflation rate remaining elevated at 5.1%. The closely watched services inflation picked up from 6.2% to 6.4%, Investors pared back their expectations of Bank of England rate cuts for 2024 with the UK 2-year government bond yield rising by the most in almost a year on Wednesday. Short-term yields were up 19 basis points on the day and had risen from 4.19% to 4.38% as the hot CPI report pushed out the first rate cut by the BoE by two months. Overall, investors took out around 18 basis points out of the BoE’s 2024 easing cycle yesterday.

US data beats expectations. Labor market data concluded this week of macro surprises from the US economy with initial jobless claims showing that the number of Americans filling for unemployment benefits fell to 187 thousand last week, the lowest since September 2022. The initial cause for optimism was the stronger than expected retail sales report. Consumer spending increased by 0.6%, beating the previous gain of 0.3% and exceeding the consensus forecast of 0.4%. The data point was followed by a positive surprise in the industrial production numbers, which increased by 0.1% in December against the expectation of a flat print. The last release completed the trifecta of better-than-expected US macro data on Wednesday with the NAHB Housing Market Index. Sentiment in the property sector surged from 37 to 44, recording the best month since September.

Global Macro

The view ahead. First data and rate decisions this year

First data of the new year. Next week will bring us the first leading economic indicators of the new year in the form of the purchasing manager indices and sentiment data. Consumer surveys in the US, UK, Germany and Eurozone will be crucial to gauge how these economies started into 2024.

US inflation key. Investors are leaving last year behind and have recently priced out rate cuts from the G3 central banks based on the rebound of inflation and macro resilience. Markets therefore continue to be data dependent and sensitive to surprises. The main event on the macro side will be the US inflation print on Friday, where we expect the disinflation in core rates and rebound in headline rates to have continued in December.

Central banks to continue pushing back. In terms of events on the monetary policy side, we do expect the central banks in Canada, Norway and Eurozone to hold rates stable. Policy makers have just ended their tightening cycles and are eager to continue waiting for incoming data to make up their mind about how much easing will be needed this year.

Macro risk events.

Monday (22.01) – US leading index

Tuesday (23.01) – BoJ rate decision, Eurozone consumer confidence

Wednesday (24.01) – Global PMI’s, UK business optimism, BoC rate decision

Thursday (25.01) – Ifo business expectations, ECB rate decision, US GDP

Friday (26.01) – German and UK consumer confidence, US inflation

All dates GMT

FX Views

G3 synchronization vs. the rest

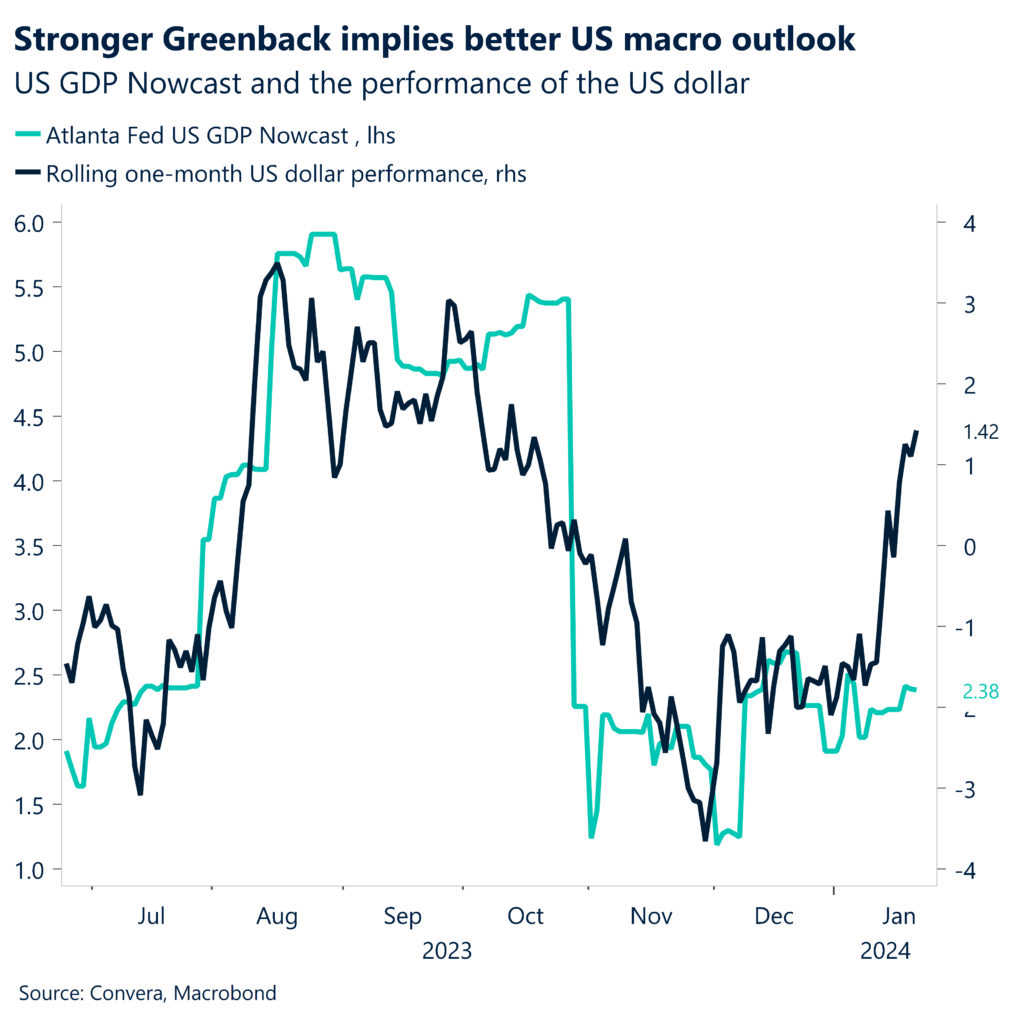

USD Well bid amid resilient economy. The US economy continues to outperform broad expectations. Most lagging data points have surprised to the upside this week, putting upward pressure on both short-term Treasury yields and the US dollar. The Greenback will most likely rise for a third consecutive week versus the Australian dollar, Canadian dollar and Japanese yen. The global reserve currency shows less strength against the euro and pound, as the future policy path pricing for the Fed, ECB and BoE have almost completely converged. Investors have lowered their expectations of the Fed cutting interest rates in March from 80% at the beginning of last week to 52% as of today. The US dollar has been a function of this shifting dynamic and has reached a one-month high earlier this week. The upcoming week will be an interesting one. While interest rate decisions in Canada and the Eurozone will dominate the news flow, US GDP and inflation numbers on Thursday and Friday will close out the week. We forecast the annual PCE inflation rate to have fallen from 3.2% to 3% in December.

EUR Rate cut optimism wavers. ECB’s clumsily coordinated hawkish pushback had an eventually desired effect – investors have scaled back their premature rate cut bets. Traders pulled back on cumulative rate cut speculations for 2024, pricing in 134bps (-11bps w/w) worth of easing by year-end. This prompted a major selloff in European equity and bond markets. Stock market indices plunged to multi-week lows and the German 10-year Bund yield is poised for a weekly gain of 17 bps, marking its most significant weekly movement since July. EUR/USD slipped to a 1-month low on the back of general dollar strength as investors scaled back bets on Fed rate cuts. EUR/GBP fell to a fresh 4-week low and is on track for its worst consecutive weekly performance in over 8 months. With attention turning to the upcoming ECB meeting next week, we expect the rate decision to be a non-event. Further pushback/reinforcement of the current rhetoric is expected, but markets will likely shrug it off as they have largely done so thus far. A slight miss on Eurozone flash PMIs could pose a downside risk for the euro, as the economy remains in a fragile condition.

GBP Not enough to move the needle. The macro week in the United Kingdom ended with two data misses (retail sales and wage growth) and one upside surprise (CPI). While GBP/USD has reacted mildly to the three macro releases this week, the correlation between sterling and global risk sentiment and Fed pricing has been more important than regional data. This week’s data will not be enough to push the Bank of England into one or the other direction. This explains the muted price action of the currency pair, which traded in a tight range of 1.8% over the course of the last five weeks, staying between $1.2600 and $1.2870. Apart from the US dollar and euro, the pound has been strengthening versus other currencies, showing how high inflation, and rising short-term yields continue to offer the pound some support. GBP is expected to appreciate for a fourth consecutive week versus the Swedish krona, Australian dollar and Canadian dollar and will end the third week in a row on stronger footing against the Japanese yen, Swiss franc, and Norwegian krone.

AUD Gloomy Consumer Outlook Clouds Rate Path. AUD YTD performance stood at -3.51%. Even with reduced rate-hike fears, Australian consumers remain extremely pessimistic entering 2024. The January Westpac index fell to an 81, a multi-decade low, and missing forecasts. High costs of living and rising mortgage rates weighed on households, with finances seen worsening further. While weak consumer spending outlook may prompt the RBA to reconsider rate hikes, the state of the labor market remains crucial. With rates now at 12-year highs after the latest hike in November, the RBA has indicated more tightening may be warranted if necessary. The AUD/USD pair still needs a substantial below the 0.6600 support area to validate a collapse lower. Key data to watch includes NAB business confidence, Judo Bank Australia Manufacturing and Services PMIs.

CNY Economic Headwinds Remain. Despite starting from a low base and expanding 4.9% in Q3, China’s Q4 GDP growth of 5.2% still fell short of the 5.3% median consensus estimate. The full-year 2022 GDP grew 5.2%, meeting China’s around 5% annual growth target. However, economic headwinds persist as highlighted by disappointing December activity data. Retail sales and real estate investment underperformed forecasts. Industrial production and fixed asset investment also softened versus projections. The housing market remained weak with record declines in new home prices. Look for further gains in USD/CNY, initially targeting 7.239-7.2665 resistance. USD/CNY YTD performance stood at +1.28%. Upcoming Chinese data to watch includes loan prime rates, PBoC rate decision, industrial profits.

JPY Producer Price Deflation Deepens. Japan’s producer price index increased 0.3% month-over-month but fell 0.3% year-over-year in December. This marked the lowest reading since February 2021’s 0.9% drop, extending the deflationary trend to a 12th straight month. The data so far supports the Bank of Japan’s view that disinflationary pressure will precede any pickup in inflation going forward. The BoJ may lower its core CPI forecast for fiscal year 2023/2024 to around 2.5% from 2.8% next week per recent reports. In the short term, the USD/JPY seems ripe for a pullback if it hits 150 key level resistance. Core focus for next week include BoJ interest rate decision, BoJ outlook report, trade balance, Manufacturing PMI, and Tokyo CPI.

CAD Supported by revised BoC expectations. The Canadian dollar had the best weekly performance in 4-months across the G10 space, appreciating by an average of 0.9% (unweighted terms). Canada’s headline CPI rate rose to 3.4% y/y in December 2023 from 3.1% y/y in the previous month, in line with market expectations and Bank of Canada (BoC) predictions. The uptick saw domestic bond yields increase across the curve as markets reduced expectations for an early interest rate cut by the BoC. The market implied probability of an April rate cut slumped to 59% by the end of the week, down from around 80% a week ago. Markets have also pulled back on cumulative rate cut speculations for 2024, pricing in 98bps (-27bps w/w) worth of easing by year-end.

The repricing contributed to Loonie’s surge against most G10 currencies with CAD/NZD, CAD/NOK and CAD/SEK posting gains of 1.7%, 1.6% and 1.5% respectively. On the contrary, the Canadian dollar had the worst daily losing streak against the US dollar in 5 months and is on track to close lower for the 3rd consecutive week as weaker market sentiment and sharper repricing in Fed rate expectations favoured USD. However, the bullish USD/CAD momentum in place since 27th December is running out of steam and we expect the pair to depreciate going forward. The key event next week will be the BoC rate decision due on Wednesday (24th Jan). While the central bank is expected to maintain rates unchanged, any hawkish pushback amid a recent uptick in inflation could be CAD supportive.