- US equities are on track for their second worst week of the year, having come under pressure from both the monetary policy (Fed) and political (Trump) fronts as of late. The index is still up 23% on the year but down from its peak gain of 28%.

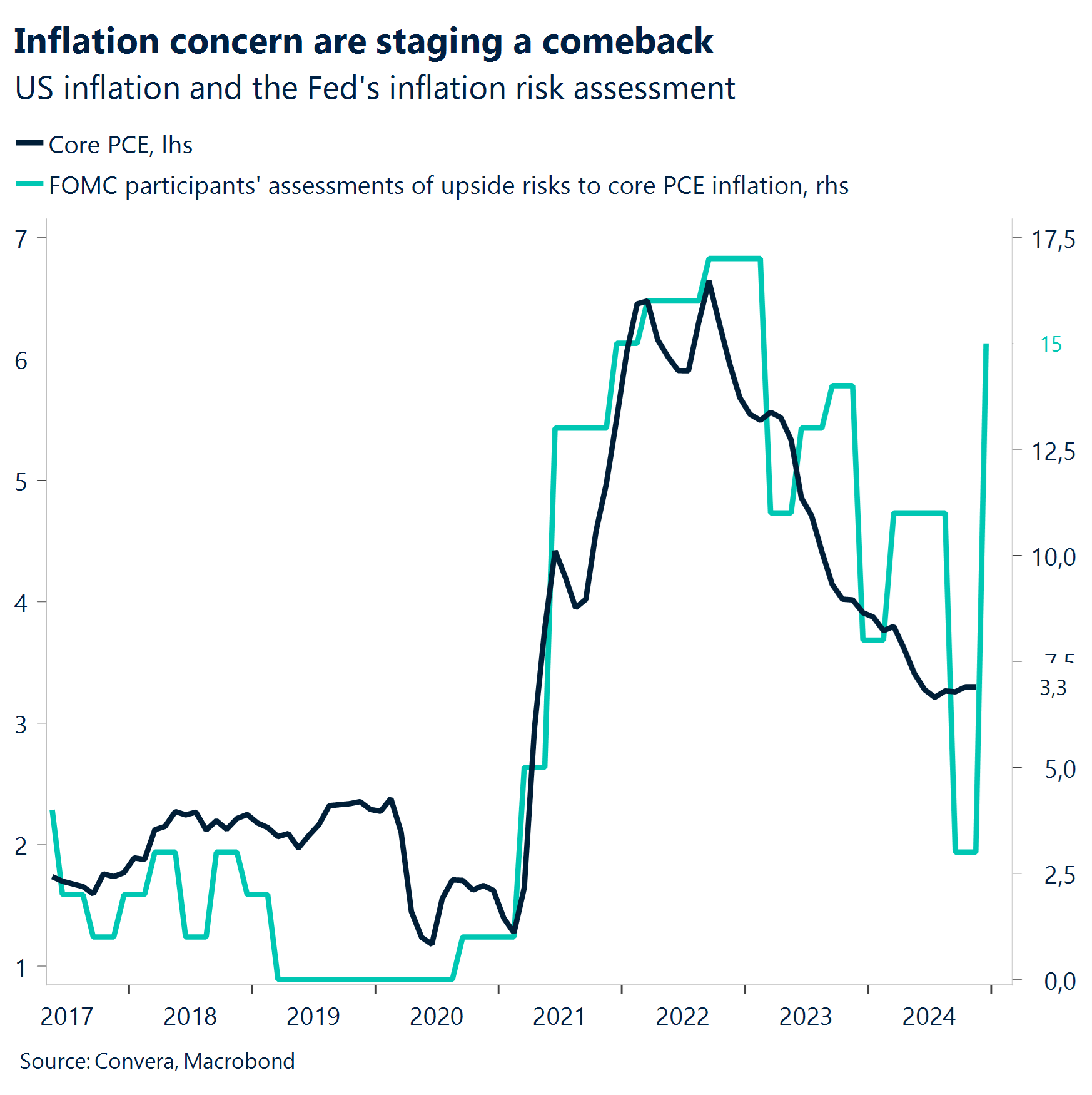

- The Fed lowered its policy rate by 25 basis points as expected. However, everything else, from the communication to the economic projections, pointed to policy makers turning more cautious on inflation and the easing cycle.

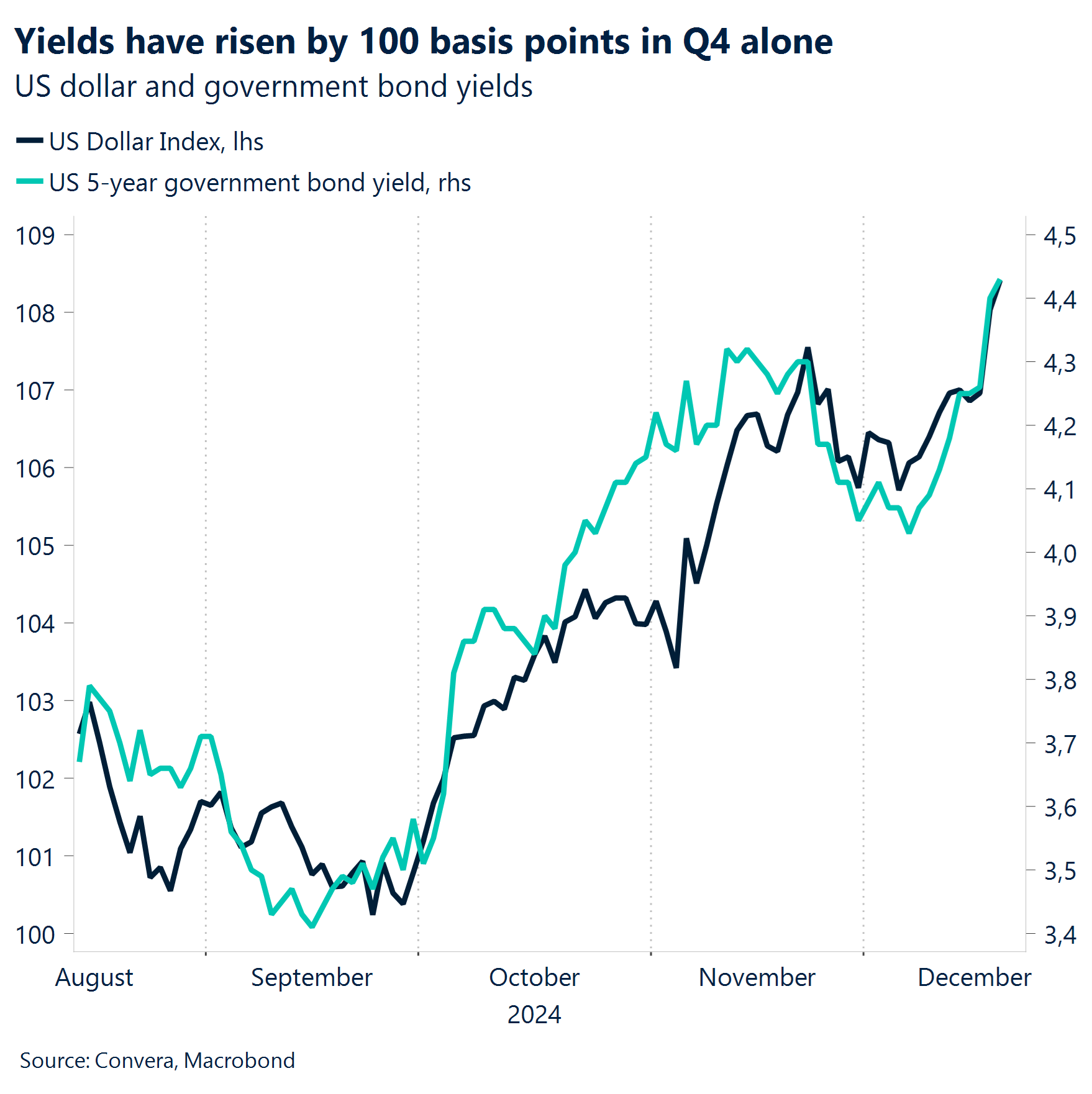

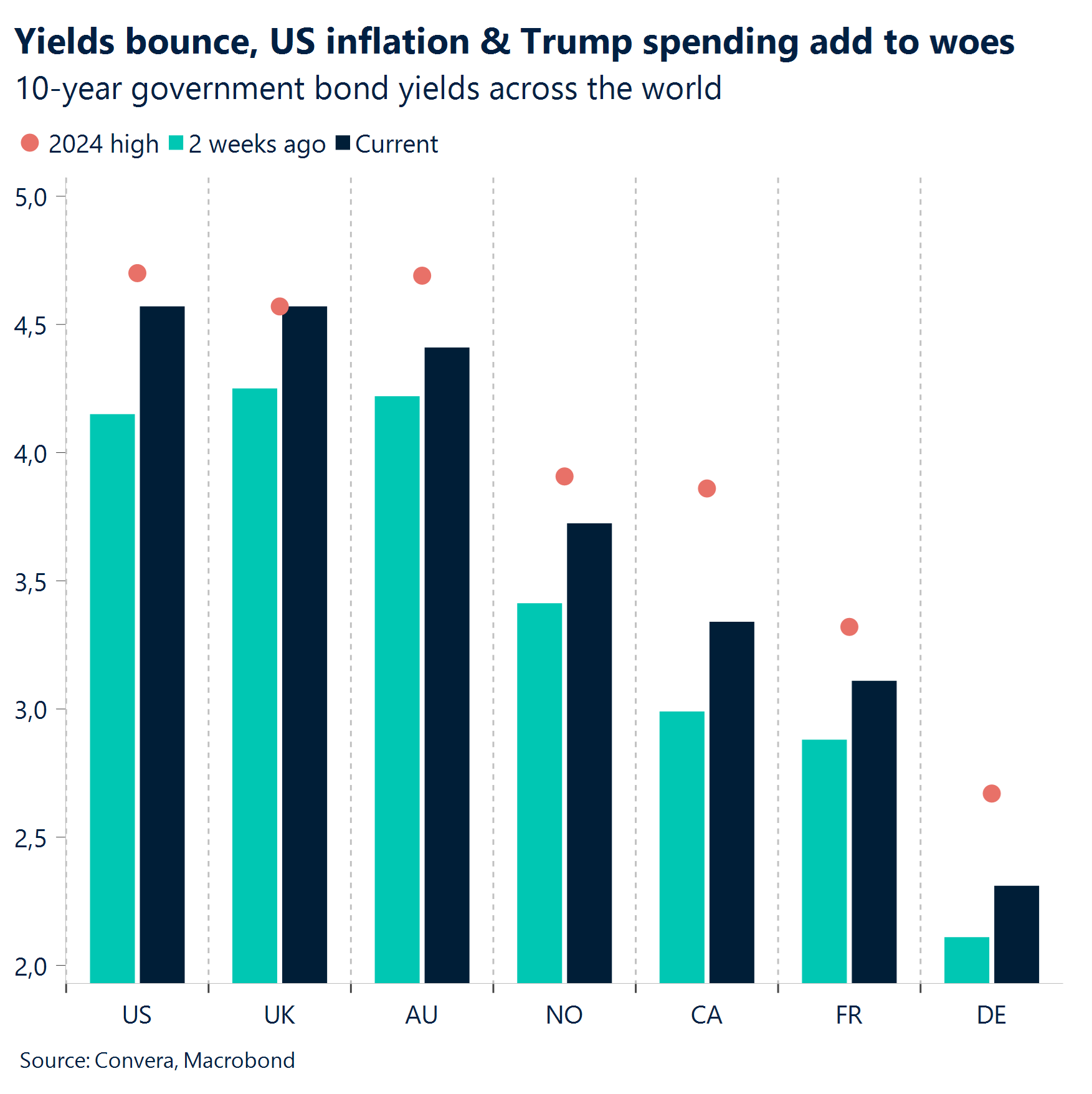

- President-elect Donald Trump’s continued push for tariffs and more spending is contributing to the rise in government bond yields. The 5-year Treasury yield is up 100 basis points since the beginning of Q4, putting pressure on risk assets.

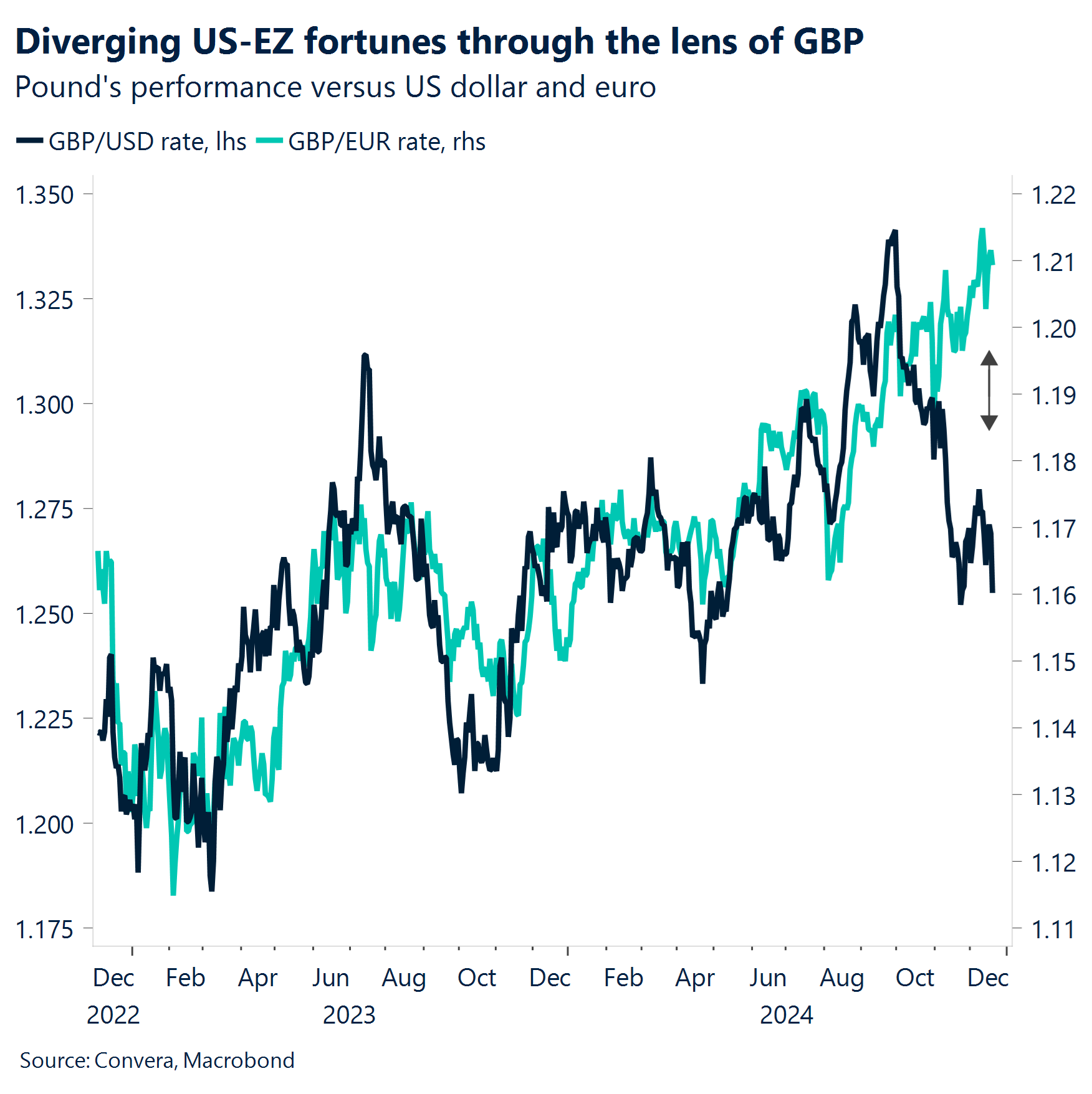

- The Bank of England went the other way and performed a dovish hold this week. However, only 57 basis points of cuts are priced in for 2025 versus the 100 basis points indicated by BoE Governor Bailey. More downside revisions are in the pipeline.

- Given that we lack any meaningful data until year end, EUR/USD is likely to end 2024 overall with a loss. Furthermore, if the euro does not recover beyond $1.05 in the next 11 days, it will record the lowest yearly close since 2002.

- With the Fed, ECB, and BoE out of the way, investors will have few macro releases to go by. Central bank speak and political headlines will have the potential to shape markets going into year end.

Global Macro

Fed and Trump turn into headwinds for markets

Sentiment across financial markets has turned sour at the end of the week, as a bill to extend US government spending to March 14 fell far short of the two-thirds majority needed to pass. US Congress needs to find a deal today to keep the government open. Equities futures are in the red and the safe haven and high yielding US dollar is modestly stronger against peers.

The Bank of England (BoE) left its policy rate unchanged at 4.75%, in line with expectations. The greater impulse for markets came from the fact that three officials voted for a cut, as opposed to the previous 8-1 split in favour of a hold. This sent a moderately dovish signal to markets, weighing on short-dated gilt yields and sterling. The dovish dissent was greater than many had anticipated, but was backed-up by the committee downplaying the importance of this week’s stronger pay data stating it “has tended to be more volatile than other wage indicators”.

The Fed cut interest rates by 25 basis points as expected. Policy makers have ended the year with three rate cuts worth 1% of easing, bringing the fed funds rate to 4.25%. The Summary of Economic Projections shows a median of two cuts for next year as officials revised up their year-end inflation projection for 2025 to 2.5%.

The Ifo institutes business confidence fell more than expected in December, reaching the lowest level since May 2020. Four points stood out for us in the survey: 1) The cyclical upside bias from global manufacturing bottoming has not helped the German industry recover. 2) The divergence between the Ifo index and GDP shows a high probability of structural change and a regime change happening within the German economy. 3) German businesses have never been this pessimistic for such a long period of time. 4) The expectations and current situation sub-indicators have converged, meaning that the former will be more important to watch as a sign of a turnaround.

Fed review

Inflation back under the limelight

The Federal Reserve cut interest rates by 25 basis points as expected. Policy makers have ended the year with three rate cuts worth 1% of easing, bringing the fed funds rate to 4.25%. The Summary of Economic Projections shows a median of two cuts for next year as officials revised up their year-end inflation projection for 2025 to 2.5%.

US policy makers had gotten ahead of themselves when it comes to their lenient inflation assessment. Ever since prices started rising at the beginning of 2021, the FOMC’s inflation risk perception tracked its preferred price measure, the core PCE figure. Since 2022, policy makers have been even more cautious than inflation would have suggested or justified. This cautiousness turned in September, when only three FOMC members saw upside risks to core PCE.

As we expected, concerns over inflation are back on the rise within the FOMC. The number of members seeing upside risks to core PCE rose from 3 to 15. This was the largest meeting-by-meeting increase since at least 2017. The median inflation forecast for next year rose from 2.1% to 2.5%. The upside revision, the dissent from Cleveland Fed President Beth Hammack and the rise in inflation risk perception have laid the foundation for a pause in January. This meeting was seen by investors as hawkish as a cut can be. Equity markets recorded their largest single-day drop in about a month as investors adjust to a shallower easing cycle.

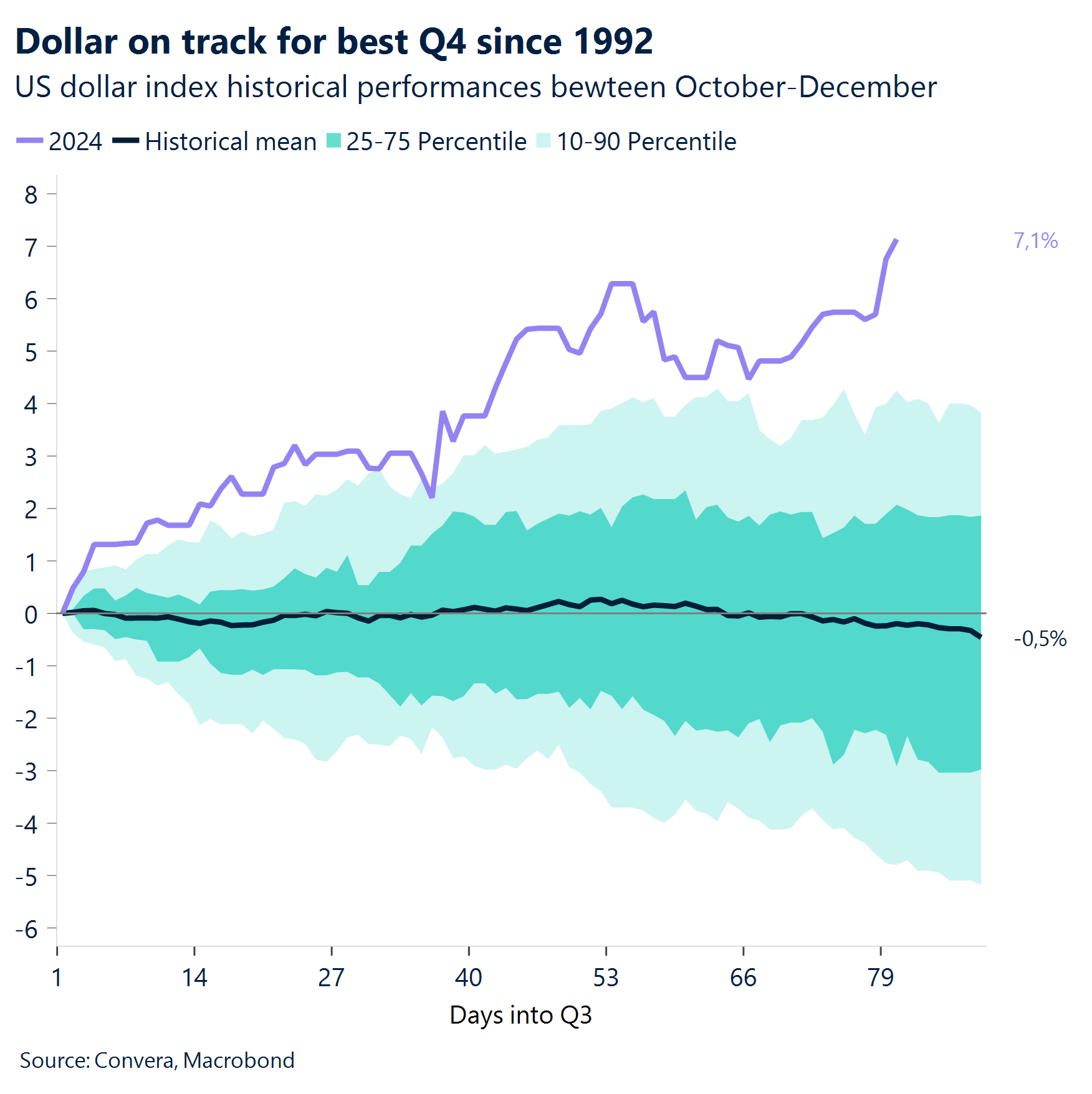

The S&P 500 dropped below the 6,000 threshold and recorded its worst Fed day since 2001. The US dollar rose to its highest level so far this year and has extended its 2024 advance to 6%. If the Greenback can hold on to these gains, the currency would leave behind the second-best year since 2015. The US Dollar Index is still 6% away from its 2022 high. However, the Fed’s broad dollar index is approaching record highs, having risen from the 85 mark after the Global Financial Crisis to 125 right now.

Week ahead

The last week of 2024

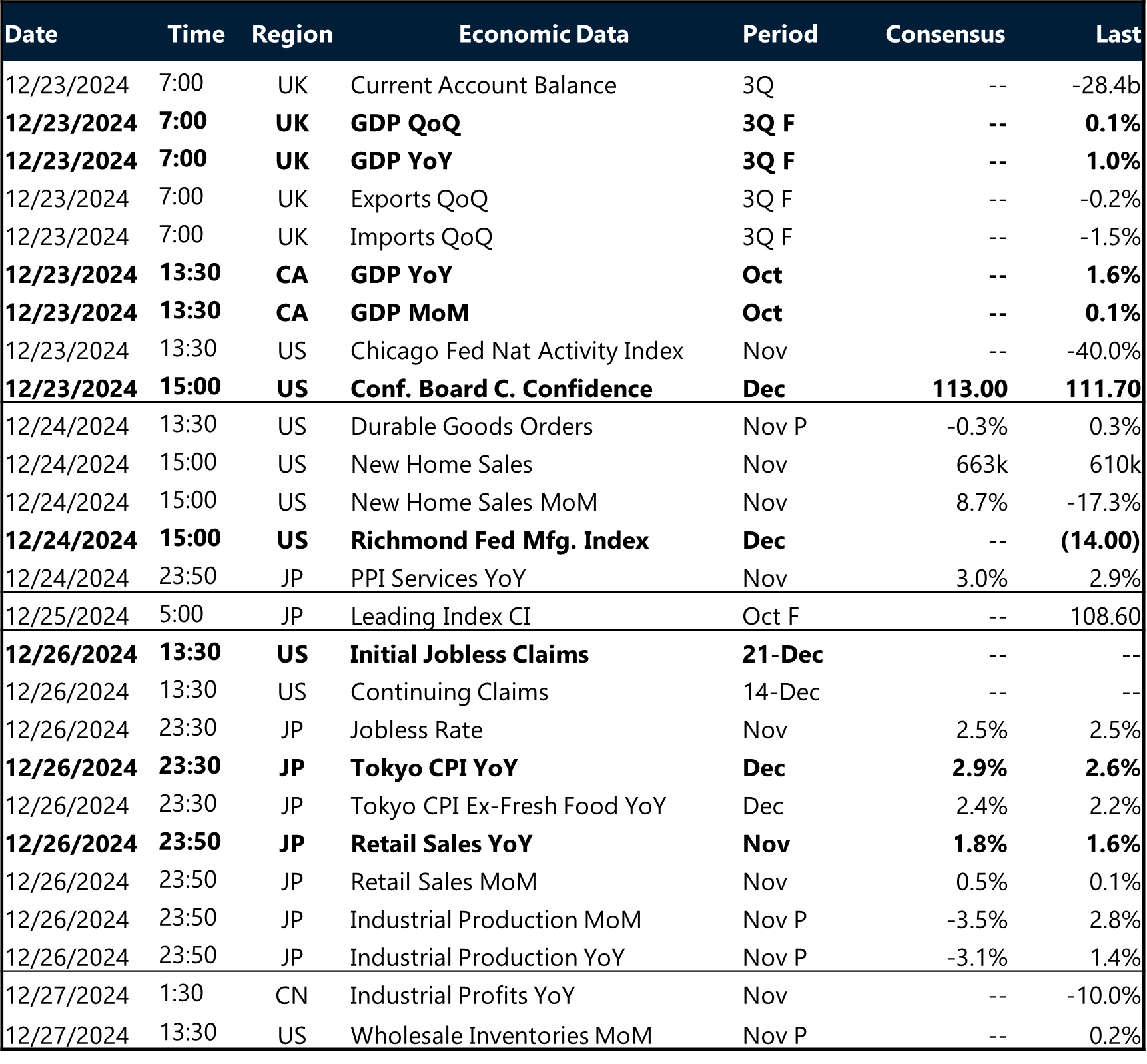

The upcoming week will be a mellow one compared to the previous ones that featured a plethora of rate decisions by major central banks.

With the Fed, ECB, and BoE out of the way, investors will have few macro releases to go by. Central bank speak and political headlines will have the potential to shape markets going into year end.

On the sentiment front, the US Conference Board index for the consumer will likely show rising confidence due to a resilient labor market and strong consumer spending.

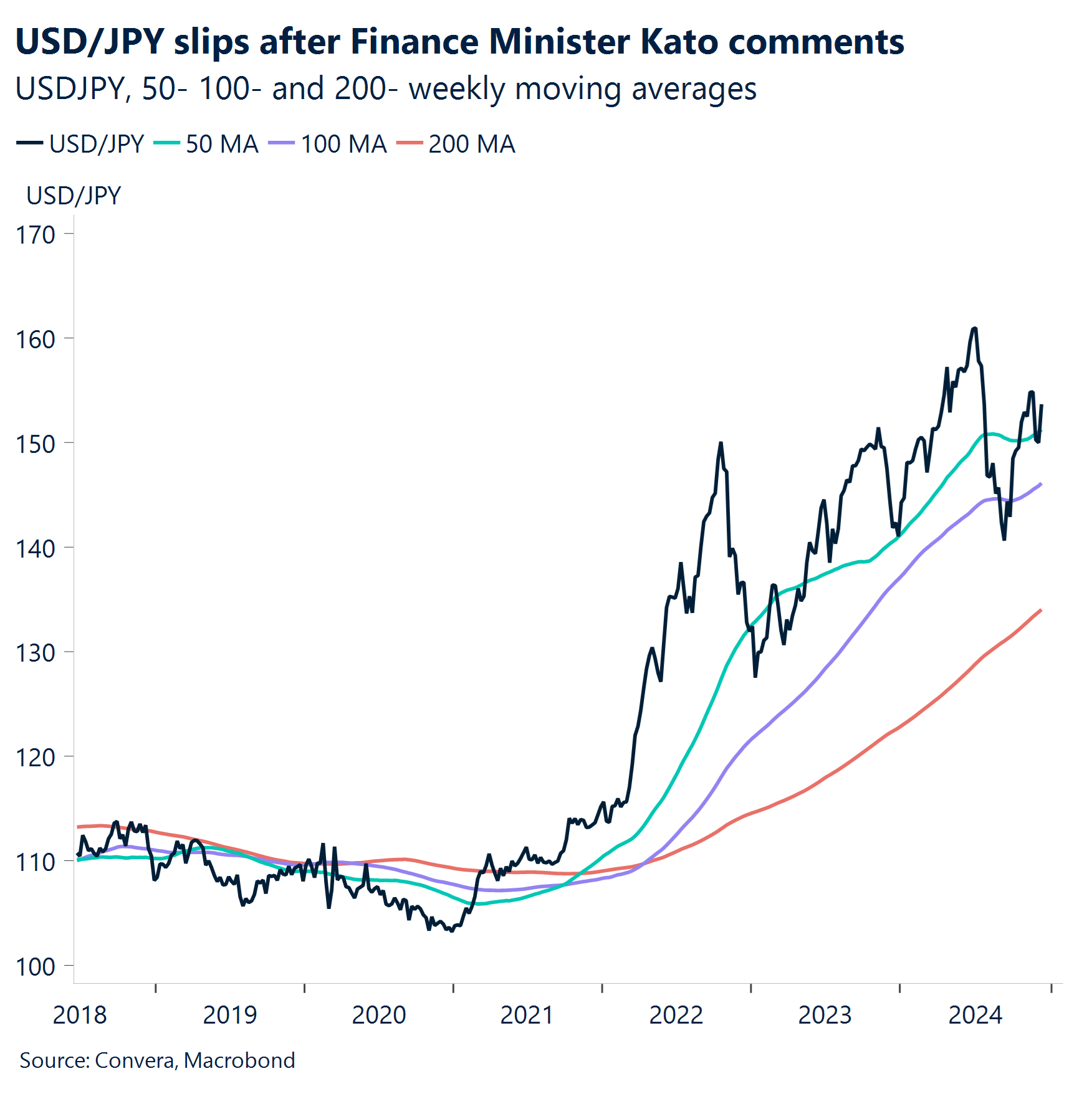

In Japan, economists expect core inflation in Tokyo to have risen from 2.2% in November 5o 2.5% in December. On a good note, the Bank of Japan has made clear that they are homing in on the services inflation figure, which is expected to have stagnated during the last month of the year.

The recent reflation trend could give the BoJ the confidence it has lacked till now to raise rates again by 25 basis points in January. We expect two tightening steps to follow, which would bring the policy rate to 1% around the middle of 2025.

All times are in GMT

FX Views

2024 will be remembered for its fourth quarter

USD Sleigh bells ring. The US dollar index flew to fresh 2-year highs this week following a hawkish Fed rate cut. Policymakers are factoring in just 50bp of additional easing in 2025, down from four and now matching market pricing. Accordingly, short-end yields jumped and the bear flattening in the US curve enabled the DXY to clinch its third biggest daily rise of the year. If the dollar can hold on to the 6.5% gains year-to-date, the currency would leave behind the second-best year since 2015. It’s also teeing up its best Q4 since 1992. The DXY is still 6% away from its 2022 high, but the Fed’s broad dollar index is approaching record highs, having risen from the 85 mark after the Global Financial Crisis to 125 right now. As it stands, there is no reason to leave the safety, liquidity and high yield of the US dollar. Plus, the hawkish re-tuning of the Fed’s message looks likely to lay the foundation for sustained dollar strengthening into the new year, despite weak seasonality patterns in the latter weeks of December.

EUR Not so festive. The euro broke through the key $1.04 support level for just the second time this year as the Fed delivered a hawkish cut. As we rightly pointed out going into the week, the euro remains mostly a function of developments in the US. But German political uncertainty reached another record high in November and thus the political news flow surrounding Germany and France will also be key catalysts for the euro in early 2025. Amidst the monetary policy divergence among the world’s major central banks and uncertainty about trade policy under the Trump administration, one-year volatility in EUR/USD closed at its highest level since April 2023 this week. The relative premium on the tenor approaches the 200 basis-point mark, the highest since 2016 when looking at year-end pricing. These are yet more signals that next year could mark the return of FX volatility. EUR/USD is down over 1.5% this month, defying seasonality patterns for now, but we note that it’s actually the last two weeks of December when the common currency exhibits strong seasonality bias. Nevertheless, a sustained break of the $1.05 level into the weekly close could spell trouble for the not-so-festive euro.

GBP Down vs. dollar, up vs. euro. The pound tumbled to fresh 6-month lows against the US dollar, briefly beyond the $1.25 handle, following the hawkish Fed cut and dovish BoE hold this week. GBP/USD is now down almost 2% month-to-date. If this sticks, it’ll be the worst December for the pair since 2015. Sterling weakness could have more to go against the dollar as the markets seem to be still underestimating the BoE’s dovishness, especially since both domestic and international drivers are adjusting to a more negative bias. So, although sterling may hold onto best 2024 G10 currency performer, maintaining the status in 2025 could prove challenging. GBP bulls may have more of a chance vs. EUR though given favourable rate differentials. The UK-German 10-year spread widened to its highest since the 1990s, allowing GBP/EUR to grind north of the €1.21 handle again. GBP/EUR is on track to close the year above €1.20 and clock a second successive yearly gain – both firsts since 2015.

CHF SNB to suppress strength. After erasing almost four weeks of losses last week, EUR/CHF is back on the defensive, pulling back from 0.94 to trade closer to 0.93 once again. Having rallied 7% through May, the pair finds itself flat on the year due to the franc’s safe haven appeal, and a huge current account surplus as a percentage of GDP, which are hard bullish factors to ignore. This may benefit the franc in 2025, particularly given the uncertain economic and political climate that looms. However, interest rate differentials may be too strong to ignore. The Swiss National Bank’s decision earlier this month to cut interest rates by half a percentage point caught many economists and traders off guard. Money markets now assign a 92% probability that the SNB cuts rates by a quarter point at each of the next two meetings and modestly price a sub-zero policy by September 2025. But even if this doesn’t happen, official FX sales may be used instead to counter lower inflation, weak growth and the strong franc, especially since, on a trade-weighted basis, CHF is just 1.7% below the record highs hit a year ago, and 5% stronger compared to the year-to-date low.

CNY Policy signals spark market optimism. Market sentiment has improved following indications of China maintaining its growth target around 5% for the upcoming year, alongside plans to expand the budget deficit to 4% of GDP. While this deficit target falls at the conservative end of expectations, it suggests potential for additional stimulus measures, particularly given recent economic data. The focus on accelerating economic initiatives and boosting domestic consumption provides additional support for market sentiment. Technical indicators suggest consolidation at current levels, with market participants closely monitoring policy implementation signals for directional cues. Technically speaking, USD/CNY price momentum looks like it may breach the strong key resistance of 7.3000 and once breached, the next key resistance will be 7.3493 (September 2023 highs). The 50-day EMA acts as strong support at 7.2163. There is no significant economic event scheduled to be out this week.

JPY Monetary policy pivot timing takes center stage. The latest policy developments suggest ongoing deliberation regarding potential adjustments to Japan’s monetary stance. Market pricing indicates measured expectations for immediate action, with March emerging as a key timeline for potential policy shifts. Wage trends remain a crucial determinant, with important data expected between January and April following the Spring wage negotiations. The careful approach to policy normalization reflects the balance between economic indicators and inflation targets. Technically, USD/JPY’s recent upward momentum appears to be losing steam, encountering significant resistance at the 157.80-157.92 zone. USD/JPY was near 158 handle before Kato’s comments. The pair’s near-term trajectory will likely be influenced by upcoming Tokyo core CPI data and industrial production figures, while broader market sentiment continues to track yield differentials. The current tactical bounce shows signs of exhaustion, suggesting potential for a reversal in the coming sessions.

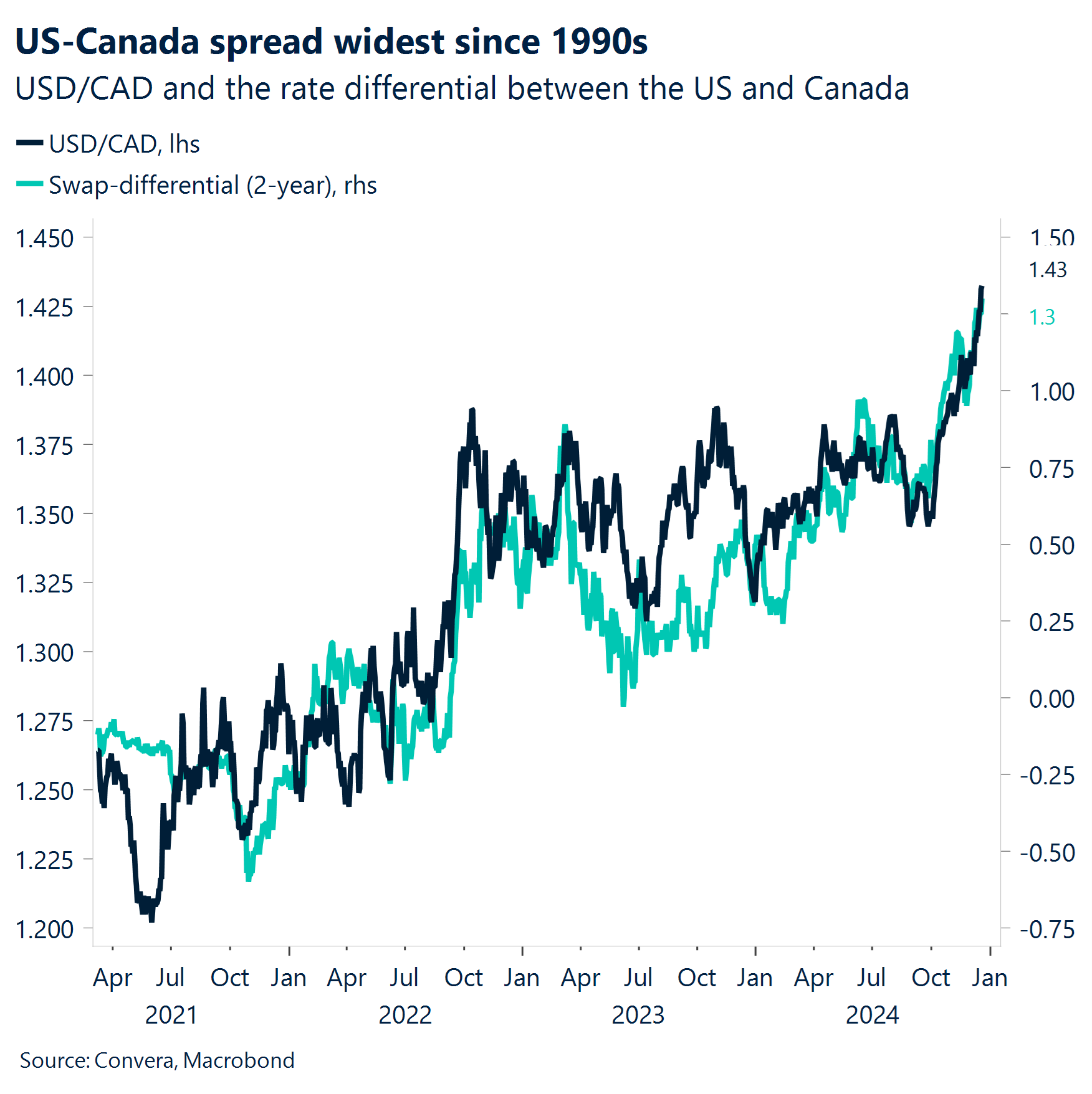

CAD Fresh reasons to stay bearish. The Canadian dollar came under renewed selling pressure this week as political risk was added to the multiple bearish factors impacting the Loonie. The surprise resignation of Canada’s Finance Minister this week over friction with Prime Minister over budget measures considering tariff risks sent USD/CAD to pandemic highs near the C$1.44 handle. The pair has climbed over 7% year-to-date as a result of exceptional widening in the short-term US-CA rate differential, driven by Fed-BoC policy divergence. Faster rate cuts by the BoC in light of lower inflation and softer growth, justifies the divergence. And since the US election, the growing risk of a fully-fledged North American trade war has added a whole new level of uncertainty, which, alongside a widening Fed-BoC policy divergence, could take the pair to the C$1.50 mark in 2025.

AUD Budget headwinds cast shadow on growth prospects. The Australian economic outlook faces mounting challenges as revised budget projections point to wider deficits in the coming years. Key pressures include softening commodity markets, China’s economic slowdown, and rising expenditure commitments. The fiscal year 2024-25 deficit forecast stands at AUD26.9 bn, with growth expectations trimmed to 1.75% for the coming year. This fiscal scenario, coupled with pre-election spending considerations, could impact the timing of potential RBA policy adjustments. From a technical perspective, AUD/USD maintains its bearish trajectory following multiple failed attempts to reverse the September-December decline. Currently trading near cycle lows, the pair requires a convincing base formation to signal stabilization. Watch the crucial resistance zone at 0.6463-0.645, with RBA minutes in focus during this week’s thin trading conditions.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.